Everything You Can Do with Market Research Online Surveys

Everything You Can Do with Market Research Online Surveys

If you’ve ever begged the question, what can you do with market research online surveys? — we’ve got but one key response:

More like, what can’t you do with online market research surveys?

These digital tools gain you a wide range of insights into virtually anything about your target market or any target audience you intend to study.

You can apply them to any research project, as they grant you data on past campaigns (think existing ads, products or service sessions), as well as prepare you before you take any new action for your business.

Given that market research surveys have so many purposes, survey data remains important for both small and large businesses.

It is thus hardly surprising that the market research industry has grown 3.6% per year between 2017 and 2022 in the US on average. After all, it wouldn’t grow if businesses stopped relying on it.

This article gives you a deep dive into market research online surveys, what they entail, their importance and all of their applications.

Understanding Market Research Online Surveys

An online market research survey is both a major method and tool for conducting market research, which is the practice of studying your target market, the group of customers most likely to buy from your business.

Market research entails researching your target market and other customer segments in full depth, thereby understanding who they are, their needs, desires, preferences, aversions and more.

There are various forms of research, such as scientific, medical, socioeconomic, etc. A market research survey is a tool designed specifically for conducting market research, as its name suggests.

As such, it should include all the features necessary for researchers to learn what’s driving customer sentiment, market demand and a slew of other customer concerns.

An online market research survey is the modern form of a market research survey and market research at large. That’s because it is conducted online in an automated way, completes all quotas and grants you the swiftest and most accurate way to pull customer data.

Unlike other forms of conducting market research, online surveys allow you to get to the heart of the matter on virtually any topic. But there’s much more they can do, provided you use a strong survey platform.

When it comes to these surveys, the possibilities are endless.

What You Can Do with a Market Research Online Survey Platform

Most online market research surveys are conducted through an online survey platform. Such a platform allows researchers to partake in every part of the survey process.

However, keep in mind that all survey platforms are built differently, with different features and levels of respondent outreach.

The following outlines what you can do with an online survey platform:

- Target your respondents.

- Set all respondent qualifications.

- Create screening questions to further determine eligibility.

- Set quotas, the number of completed surveys and multiple audiences per survey.

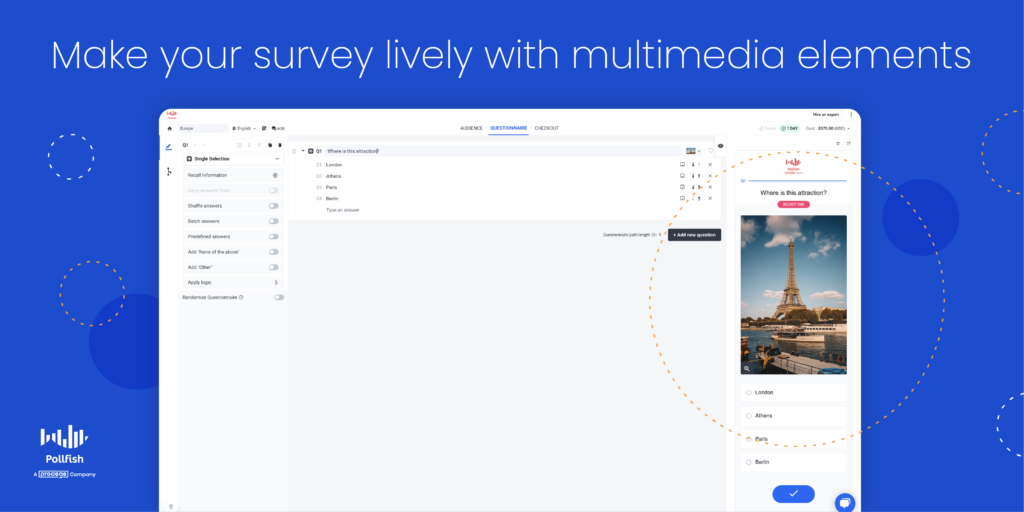

- Create the survey questions, i.e., the questionnaire.

- Offer a variety of survey templates to align with various market research campaigns.

- Create disclaimers, introductions and thank you pages.

- Allow you to use a variety of question types.

- Send your survey to a vast network of digital publishers randomly.

- Allow you to send your survey to specific digital spaces and people.

In all, an online survey platform allows you to create and administer surveys, thus also working as a survey distribution service.

A powerful survey platform enables your online survey to perform a variety of tasks, which we cover further down this article. But first, let’s learn about the importance of these surveys.

The Importance of Market Research Online Surveys

Given all that we’ve already discussed that these surveys are capable of, you’ve probably caught on to their importance.

However, there are so many other reasons why market research online surveys are a must for your business, regardless of its stage, its brand reputation and other factors.

Firstly, these surveys form a critical aspect of your business strategy. This involves strategizing all things business-related, from understanding the reception to a new product, to how a support session was perceived.

With this knowledge in tow, you’ll be informed on how to make further business decisions and run different campaigns. Thus, you’ll be less likely to make major mistakes that will affect your bottom line, while delighting your customers.

Online market research surveys allow you to remain competitive, no matter how many players are in your industry, and how big (or small) your market share is. In fact, conducting these surveys is the answer to how to increase market share, as it helps you carry out productive campaigns.

These surveys are not just tools for gathering data, instead, they are also data visualizers, presenting your data in a variety of formats. This is especially important when you need to analyze survey data and use it to create a report, a whitepaper or any other type of research asset.

As data visualization tools, they also reduce and organize large amounts of information allowing you to easily compare two or more sets of data. This will depend on the data filtering capabilities of your online survey.

In addition, these surveys also allow you to uncover things not only in relation to your customers but your own business. You’ll therefore be able to learn things you would never have otherwise without this survey type.

That’s because this survey allows you to understand exactly how your customer base views your brand, how often they think about it, what they’d like to improve, what they dislike and so much more.

By understanding your customers in great depth, you won’t simply form better marketing, advertising and other business campaigns. You’ll also build stronger relationships with your customers, which fosters consumer loyalty.

Loyalty is the bedrock of customer retention, which is more important than customer acquisition. There are many reasons behind this, including the fact that the chances of converting existing customers are 60 -70%. The probability of converting a new customer is only 5- 20%.

Thus, by studying your customers with this survey, you’ll be able to understand them well, thus better appealing and catering to customers, strengthening your relationship. In turn, you’re building loyalty, allowing you to increase your customer retention rate.

Market research online surveys don’t merely allow you to understand how customers view your business, but your competitors as well. In this way, you can obtain all the competitive research you need simply by conducting such a survey.

All in all, these surveys are extremely important for all business affairs, as they help measure the representativeness of customer views and needs. The intelligence you gain from them allows you to make crucial decisions.

What You Can Study with Market Research Online Surveys

As mentioned, there are a myriad of things you can study with these surveys. As such, you can apply them to specific areas of business, including specific campaigns and macro applications.

As such, here we lay out several main purposes of conducting online market research surveys. As you can see, these are high-level and have many sub-methods and applications.

- General Marketing: Marketing involves all the activities performed to aid a business sell its products/services, which includes educating customers, interacting with them and more. Marketing market research exists to help businesses gauge their campaign efficacy and better understand how their customers view various campaigns.

- Advertising: Used to deploy sponsored messages to grow demand and elicit purchases, advertising, you can leverage it to influence customer behavior. This involves prompting existing customers to make more purchases or to gain new customers. Surveys can be used to determine which advertising messages are the most resonant and which ads elicit the most interest. You can ask questions to compare ads and their different parts.

- Branding: This discipline involves creating a reputation, an image and a set of associations around a brand. Branding market research helps brands differentiate themselves from one another and form a style unique to a company. Businesses can tie these surveys to branding by using them to test new logos, slogans, value propositions, content ideas and more.

- Market Segmentation: Market segmentation is a macro-application that refers to dividing a target market into smaller segments and assigning certain values to each segment to better understand all your customers. That’s because a target market includes all the customers most likely to buy from a particular business and is not solely defined by one group. Researchers can create questions about their target market’s habits, lifestyles, preferences and more to distill them into several segments. From there, marketers can adopt different marketing campaigns for each segment.

- PR: Public Relations, or PR, as it is commonly referred to, aims to control the distribution and spread of information about a company (or individual) and the public. Its goal is to control the narrative of a business or organization to gain positive public perception. These surveys can help by asking questions on how well respondents know a business and their general thoughts on its operations, products, experiences, performance, etc. Researchers can also test out press release ideas and pitches through these surveys.

- Brand Tracking: Brand tracking refers to continuously measuring or tracking, as its name suggests, your brand's health. This involves analyzing how your customers buy and use your products and what they think and feel about the brand itself. These sentiments are subject to change, especially when things change at a business, whether they have a new ad campaign, have been acquired or are offering new products. You can keep watch of this with these surveys.

- Brand Awareness: This goes beyond whether or not your target market has heard of your brand. Brand awareness also deals with the extent to which customers are able to recall or recognize your brand under various conditions and circumstances. A strong brand awareness is necessary to build long-lasting relationships with existing customers, as well as draw in the interest of new and potential customers.

Specific Market Research Endeavors to Study with Market Research Online Surveys

In the previous section, we discussed several broad campaigns, macro-applications and business topics that this survey type can support. Now, let’s move on to more specific usages of these kinds of surveys.

Here are some of the more specific purposes a market research online survey campaign helps serve:

- Understand the makeup of your target market.

- You can use this survey to form a target market analysis.

- It will allow you to understand all the needs, concerns and behaviors of your target market and its segments.

- Obtain customer feedback and get a deep read of your target market.

- You can do so by centering the theme of this survey into that of a customer satisfaction survey.

- This includes forming it as the NPS, CSAT, CES, visual rating surveys & more

- Doing so allows you to understand your customers’ CLV (customer lifetime value).

- You can do so by centering the theme of this survey into that of a customer satisfaction survey.

- Excel in product campaigns.

- Use it to test product satisfaction.

- Innovate products with new features and upgrades.

- Understand how your product compares with competitors' offerings.

- Avoid negative publicity.

- Use it to perform regular checks on the opinions of your brand.

- Uncover customer aversions to avoid using in your messaging and brand image.

- Obtain employee feedback.

- Use it to run a pulse survey on your employees.

- Retain strong company morale by discovering your employees’ thoughts on their job training, roadmaps, pipelines, their boss and more.

- Improve your CX.

- Use it to learn about your customer experience (CX).

- This can involve all aspects of the customer buying journey.

- Drive Lead generation.

- Use this survey for B2B endeavors.

- This will help you learn about the specific needs and desires of your target market, specifically your B2B clients such as partners, vendors and other business entities.

- Acclimate with your niche.

- Use it to keep up with market and niche trends.

- Use it to produce a market trend analysis, so that you can analyze trends in an industry, including past and current market behavior, and dominant patterns of the market and its consumers.

- This makes it easier to change with the times.

- Complete a market analysis.

- Being able to compare your brand with others

- Getting a feel of the thoughts and attitudes in your overall space

- Understand customer behaviors.

- Use it to create a customer behavior analysis.

- Learn the motivations of customers, their lifestyles and how those affect their purchasing behavior.

- Create an RFM analysis to learn about your customers' recency and frequency of purchases, along with their monetary value.

- Understand your demographics.

- Use it to form a demographic analysis of your target market.

- This is one of the preliminary things you ought to know about your customers.

- Understand your psychographics.

- Use it to create a psychographic analysis of your target market.

- This allows you to understand your customers’ psychological characteristics, such as their values, desires, goals, interests, fears, aversions and lifestyle choices.

What You Can Set Up with Market Research Online Surveys

Now that you understand the various macro-campaigns and applications to use with these surveys, along with the specific tasks you can apply them to, let’s dive into this survey type itself.

There is plenty that you can set up with this survey type, along with key market research functions (more on the latter in the next section).

Thus, you’ll find several aspects of these surveys as you set them up. That’s because, as the previous section informed, you can use them to form specific market research survey types such as customer satisfaction surveys, etc.

Here is what you can set up within these surveys:

- The questionnaire

- This is the heart of any survey, as it contains all the questions.

- You can build sophisticated survey paths with advanced skip logic, depending on the survey platform you use. These route respondents to different follow-up questions based on their previous answers.

- Audience targeting

- This section involves adding all the respondent qualifications you seek to designate your survey audience.

- This section also contains your screener, to qualify people based on how they answer screening questions.

- Some platforms will allow you to create multiple audiences per survey.

- Distribution

- This dictates how you will distribute a survey to your target audience.

- There are two approaches to this on Pollfish:

- Random Device Engagement (RDE): A kind of organic sampling, RDE deploys surveys to a massive network of online sites, such as websites and apps. Respondents are targeted at random in their natural digital environments.

- Specific Online Channels and Respondents: You can also send surveys to the specific digital spaces you choose, such as your own website and social media with the Distribution Link feature. You can also send surveys to specific people via email with this link.

- Data visualizations

- There are various ways the survey can be presented. Within your survey results dashboard, you can view resultant data in the form of tables, graphs and charts.

- You can also view it via other visualizations, such as the kinds in imports like PDFs, Excel, CSV and Crosstabs.

- You can also view data granularly, viewing how each demographic answered questions by filtering the resulting data.

What Research Capabilities Online Market Research Surveys Include

Lastly, let’s touch upon the market research capabilities that these surveys can carry out. Not all market research surveys have these capabilities, as not all survey platforms offer them.

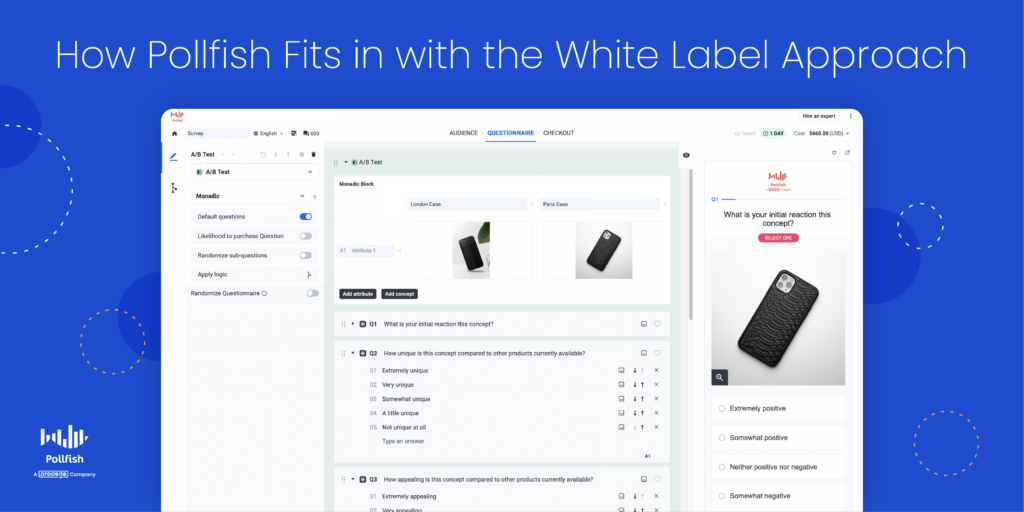

At Pollfish, we go beyond surveys.

That’s because Pollfish is not just a survey platform; it provides a full-scale market research experience. That’s because we offer a wide scope of functionalities that the average survey platform simply doesn’t have.

As such, you’ll find much more than merely survey creation on this platform.

You’ll find the following market research capabilities on the online market research survey on the Pollfish platform:

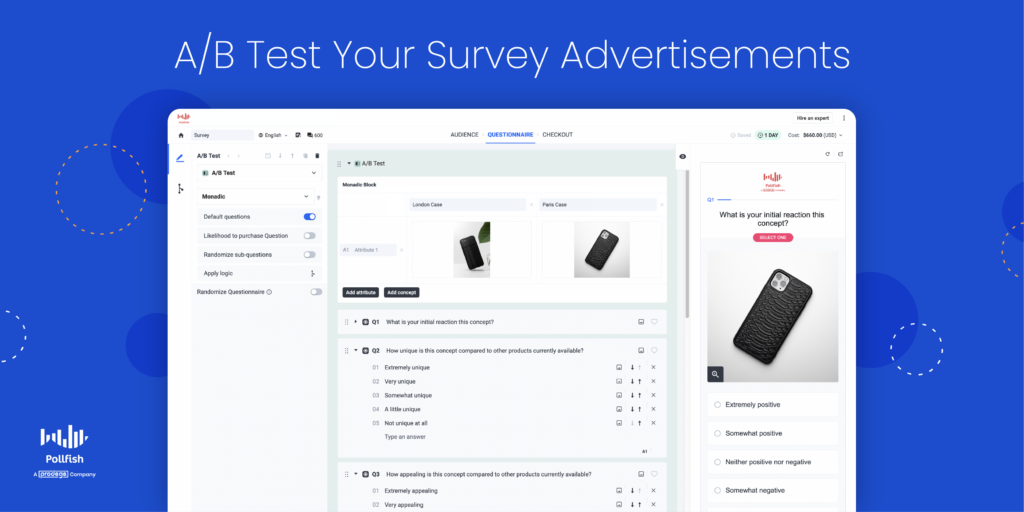

- A/B testing:

- You can conduct both Monadic A/B testing and sequential A/B testing.

- Monadic A/B testing lets respondents choose their preferences for one concept or product they randomly receive out of many. These are what the researcher wants to test and compare, exposing the respondents to one concept instead of two or more at once.

- Focusing participants’ attention on just one concept at a time grants researchers insights into making product, pricing and various marketing decisions.

- Monadic testing is commonly used for gathering independent data for each stimulus — a contrast to comparison testing, where several stimuli are tested side-by-side.

- Sequential A/B testing uses concepts with a specific distribution: all possible combinations are derived from the concepts that are selected to be shown.

- Thus, each concept is evenly distributed and presented to the respondents at equal times in the first position.

- This reduces biases that may occur from serving a concept always at the first position of a combination.

- Conjoint Analysis:

- A conjoint analysis allows researchers to gauge the value that customers place on different aspects of a product or service.

- It shows exactly how your customers perceive the makeup of your offerings.

- It unveils the distinct advantages and imperfections of your product features.

- This method breaks a product or service down by its components, called attributes and levels. Researchers can test different combinations of the components to identify consumer preferences.

- You’ll get a rich evaluation of how your customers rate the unique features of a product, rather than passing a general judgment on it.

- Maxdiff Analysis:

- Also called the Best-Worst Scale, a Maxdiff Analysis is a system for prioritizing new product ideas and customizing them to consumer preferences.

- Respondents choose the best and the worst option from a given set of options, which relate to a product and its features.

- Respondents rate a list of items by selecting only two of them — the complete opposite of each other, labeling one as the best of the list and one as the worst.

- This technique helps to identify what your target market values and what it despises.

- The Van Westendorp Pricing Model:

- The Van Westendorp Price Sensitivity Meter is a pricing framework that provides data for decision-making in regard to consumer preferences on price.

- The meter exists in the form of a graph, with ratings on price and value, presented as responses to survey questions that focus on the prices of different products and services.

- It is used to determine customers’ willingness to pay a range of prices.

- It allows businesses of different sizes and industries to set the proper prices of their offerings so that they can be in line with customer expectations.

- It helps conclude the prices that your target market deems acceptable, too high, too low and optimal.

Conducting Thorough Market Research

As you may have gathered, online market research surveys offer a vast amount of capabilities. As such, you can take on various macro-applications, specific tasks and projects by applying these kinds of surveys.

While these surveys offer a wide breadth of functionalities and insights, they are limited by the online survey platform that administers them. In essence, it is the survey platform that grants these surveys all their powers.

As aforementioned, not all survey platforms have the same features; thus, not all market research online surveys can offer all of the functionalities and features mentioned in this article.

Thus, you should select your survey platform carefully.

Pollfish survey software allows you to create a thorough survey data collection, one you can customize to your liking, view however you please and organize to the max.

In addition, with our vast array of question types, you can create virtually any type of online market research survey to support your research campaigns.

Researchers can leverage a wide range of information on their respondents by accessing a wide pool of insights in their survey results dashboard.

In addition, we also offer the advanced skip logic feature, which routes respondents to relevant follow-up questions based on their answers to a previous question.

Thanks to our advanced market research platform, you can leverage the maximum number of market research capabilities with our online surveys.

Understanding Offline Market Research and Determining if You Need It

Understanding Offline Market Research and Determining if You Need It

Have you ever considered using offline market research? Like its online counterpart, it too can be used to conduct both primary and secondary market research.

While we always tout market research online surveys, it is critical to understand all forms of market research. This way, you’ll always have various options on hand, which you can consider using when forming a major research campaign.

So how exactly is this industry faring in terms of revenue?

The market research industry has grown more than twofold since 2008, exceeding $76.4 billion in 2021 alone. Clearly, businesses are seeing the value in conducting this research for various business matters.

As such, we cannot stress the importance of market research enough. Again, studying just one facet of it is not enough. Thus, we suggest you get acclimated to offline methods of market research.

This article investigates offline market research, presenting the various methods used to carry it out, comparing it with the online variety, and ultimately, determining if you need to conduct it.

Understanding Offline Market Research

This is a kind of market research, except unlike most of the kinds of research performed in the current day, it is conducted entirely offline, as its name alludes.

Like its online counterpart, offline research has various methods that make it up. These methods can be far-ranging as well as of the subtype variety (for example, there are different types of ethnographic research or different types of surveys).

Offline research entails that the researcher has to do all the work to gather the research information, whereas, with online research, many of the tasks associated with obtaining the research are automated.

As such, offline research involves scouring through various sources and locations in order to find relevant information. This may include libraries, bookstores and newsagents. It may also require speaking with people with knowledge of particular subjects.

It, therefore, tends to be more time-consuming and may require traveling to come across the information.

Offline market research methods have been around for a long time, far exceeding the existence of online market research, for obvious reasons. Some of these methods are still in use to this day.

When used correctly, these offline methods are proven to yield results. As such, if you only use online market research methods, it may be worth considering offline strategies as well.

The Main Types and Methods of Offline Market Research

Offline research methods are a diverse mix and can thus cater to the needs and preferences of all researchers. Many of these methods are still around and can be used in tandem with online research methods.

Here are some of the most prominent offline methods for conducting market research:

In-Person Surveys

When surveys are conducted in person, they are considered to be interviews. Specifically, in market research, these are known as IDIs, or in-depth interviews. After all, when you speak with someone in person and face to face, there is a greater opportunity to collect as much information as possible.

This is due to the fact that such a setting allows for conversation, whereas written and online surveys are limited to the questions included in their questionnaire.

You can conduct in-person surveys in a twofold way: they can be preplanned or spontaneously / on the spot.

With the former approach, you would have to seek interview subjects and ask for their consent to participate in an interview. The interview would take place at a designated facility or a location most convenient for the participant.

With the latter approach, you can do so in public places that get plenty of traffic.

Many businesses prefer conducting these interviews in malls since their customers and target market members go there to browse products and shop. This method is advantageous, in that you can show your customers your products and have them form their opinions immediately.

As such, this method is especially useful for B2C businesses. However, it can also highly benefit B2B businesses, but these interviews would then be conducted at tradeshows or other events B2B companies frequent. They can also be conducted in-office or at your place of work (showrooms, stores, etc).

In IDIs specifically, a moderator spends between 30 minutes to over an hour having a comprehensive discussion with their participants one-on-one. IDIs are thus one of the most intimate and information-yielding approaches you can take with the survey route.

Snail-Mail Surveys

This is one of the oldest market research methods and though it may seem dated, it is still used in the present, especially to gain insights from older generations.

Snail-mail surveys are sent to respondents via the mail, for them to fill out the surveys and send them back to the researchers.

This approach can appease many older customers, especially if they aren’t physically capable of going to an in-person interview or aren’t adept at using computers to take an online survey.

These surveys are useful, as they show which customers are more likely to remain customers or buy from your business. Otherwise, why would they take the time to complete your survey, and then have to package it and send it back?

What’s best is that these provide you with a list of customers whose contact information you have. You can then cross-reference your list of contacts with the list of respondents who actually partook in your mailed surveys to have an understanding of those who are most serious about doing business with you.

Snail-mail surveys do have their share of downsides: they require far more time to fully conduct, as it takes more time to deliver them, have them filled out and finally, returned back. On the contrary, an online survey campaign can be completed in its entirety in a few hours.

In addition, if your survey includes open-ended questions, then your campaign is at the mercy of your respondents’ handwriting, which may not always be legible.

Phone Surveys

Yet another survey method, phone surveys are somewhere in between in-person survey interviews and snail-mail surveys, in terms of the time and effort required to complete them. They offer the same convenience as in-person surveys, as they too can become IDIs.

That’s because when you’re on the phone, you are free to ask and speak for however long you see fit (within reason). Unlike written surveys, phone surveys aren’t limited to the questions in a written survey’s questionnaire.

You can create new, follow-up questions as the phone conversation progresses. Thus, the data you extract from phone surveys is more comprehensive and may not require conducting any further primary research.

Phone surveys also have a major convenience over in-person surveys: the respondents don’t have to travel or even leave their homes to partake. This is especially critical during Covid and seasonal illnesses.

Additionally, some people prefer to stay home, and thus would much rather stay home for a survey session, rather than having to waste time getting to a certain location.

Phone surveys do have certain disadvantages. First off, not all will be willing to give up their spare time to talk with a stranger on the phone about a business or business-related manners.

Additionally, another major drawback of phone surveys is that many businesses don’t have enough contact information of their customers. They certainly don’t have the contact information for target market members who are not direct customers.

Thus, there are too many resources needed to dial respondents’ numbers and administer the surveys.

Focus Groups

A focus group is a small group of people who meet to informally discuss your topic of choice; this is usually business-related. However, it can also focus on the customers themselves, such as their lifestyles, buying patterns and more.

Focus groups are group sessions consisting of 5 to ten participants. They include a moderator, who leads the discussion using prearranged questions and topics.

A typical in-person focus group will consist of 4 to 12 participants, along with the moderator. A focus group session usually lasts a few hours and can require follow-up meetings.

The moderator leads the meeting with different topics and subtopics for roughly 60 minutes to two hours.

Aside from leading the discussion, the moderator must observe the group and take notes to record key moments in the session. Therefore, the focus group may also include using participant activity materials and audio/video recordings of the sessions.

Aside from taking part in a Q and A, a focus group can include other techniques to draw out insights from customers. These include doing role-playing exercises and more. As such, this method is more lively and interactive, as it includes more people than a one-on-one interview and more techniques aside from questioning.

Like in in-person and phone surveys, the resultant data from focus groups is more in-depth but it also tends to be more subjective. The output, therefore, involves more words, images, impressions and sentiments, rather than hard, statistical data.

In addition, some participants are more extroverted, leading them to dominate the discussion, while more demure participants remain quiet or answer fewer questions. This is where a one-on-one research method may be more useful, or easier to administer.

That’s because, technically, the discussion can be balanced, even with a mix of reserved and outspoken participants, but the moderator would have to step in so that the quieter participants can take part and the extroverted ones to allow others to speak. This would thus be more laborsome.

Observations

Like in-person interviews, observations typically occur in natural settings, that is, where people exist voluntarily.

Observations are part of ethnographic research, a qualitative research method that relies on entrenching yourself in various participant environments to extract challenges, goals, themes and more.

At times, it is best to observe customers in this way, noting where they choose to browse versus where they buy from, whether they’re looking for sales/promotions and more.

Thus, you can conduct observations to uncover real behaviors. This is a major advantage of this method, as people in surveys and focus groups may lie, as they are put on the spot (in offline surveys, that is, online surveys can be fully anonymized).

But when you discreetly observe shoppers in their natural habitats, they exist as themselves. They’ve got no one to impress or worry about judging their answers. Thus, you can learn a lot about customer buying behavior, customer motivations, needs and more, all by simply watching them covertly.

Some researchers observe shoppers and then use their findings to conduct follow-up interviews. Some research companies resort to using hidden cameras to record customers and gather information this way. Thus, some offline market research methods are also digital, even though they are not internet-based.

Like other methods, observations have some limitations as well. First off, you’ll need to find an ideal distance to observe customers discreetly, while being able to hear (and see) them. This can be difficult in crowded places, which tend to be loud and full of motion.

Most likely, in such scenarios, you won’t hear much of what your customers say to one another, unless you’re at a relatively quiet location.

In addition, while observing customers is useful, it won’t address your specific questions. Thus, observations are rarely a standalone affair.

Live Events

Using live events for market research is much like the above example of observation, except rather than observing people in basic, everyday settings, you’re going to observe them in special occurrences and planned events.

These can provide a mix of entertainment and research. The goal is to get the participants as engaged in the event as possible. This is typically a tactic of field marketing but can be applied to market research as well.

That’s because live events are a new type of market research called “engagement marketing,” which includes a mix of live elements, face-to-face discussions and even certain activities to enable customers to actively engage with your brand.

Conducting research at live events is crucial, as it can be more intimate than observations alone. Given that these are specialized events within your industry, you may set up a booth or nook with the intention of speaking with your potential customers.

With the customers’ consent, this can be treated as an interview, or at the very least, a time to pitch your product or service and get the opinions of it from your target market.

Thus, you can interview customers right then and there. This immediately transforms the event to be more than just a time for brand awareness, but to reap critical insights.

Live events have the disadvantage of the lack of time: both for you and your customers. That’s because many may attend such events without the desire to speak with businesses, let alone be interviewed by them.

As for you, you may be at the event with other tasks, such as making a presentation, pitching a product, handing out flyers, etc. Your business would need to dedicate a worker entirely for the purpose of research to actually get anything done on this front at a live event.

The Pros and Cons of Offline Market Research

As we’ve discussed in the prior sections with examples of offline research methods, we’ve alluded to both the positive and negative aspects of such methods.

You can draw your own conclusions, but to do so, it’s useful to have a concrete view of all the advantages and drawbacks of these methods.

The following does just that, listing all the pros and cons of offline market research methods:

The Advantages:

- Reaching participants who don’t have access to the internet.

- 6% of Americans don’t have adequate access to the internet at threshold speeds or with a fixed broadband service.

- Being able to reach participants who aren’t internet savvy, don’t have internet devices or simply prefer not to use the internet.

- Having wide-ranging approaches to conducting research if one doesn't garner enough data, whereas online research may only rely on one software, aka, one method.

- Not all participants spend a lot of time online; this is especially true of those with eye strain.

The Disadvantages:

- A much smaller reach to participants than in online research methods.

- Secondary online research methods are easier to come by, doing so offline requires finding and speaking with a knowledgeable source.

- They tend to all be time-consuming affairs.

- Lack of time for deep thoughts in all in-person and phone methods.

- It can be difficult to get people to answer all your questions, whether in written form or in person.

Offline Vs Online Market Research: The Verdict

Both offline and online market research methods have their advantages and pitfalls, but which is overall the best approach to take when conducting market research?

Offline market research provides many avenues that online research simply doesn’t, such as the personal touch of conducting in-person studies. That’s the major advantage of offline research over the online variety.

It is nearly impossible to create the same conversations and reap the same information digitally, or even over the phone. Thus, offline research methods are better for drawing out qualitative market research. That’s because they involve discussing thoughts, feelings and perceptions in full depth.

This can be limiting, however, as respondents may not remember or gather all of their thoughts on a subject right away, especially in an in-person setting, which puts more pressure on them. On the contrary, there is hardly any pressure in taking an online survey.

In addition, conducting offline research is much more difficult for obtaining quantitative market research. The reason behind this is twofold:

- Offline studies take much more time to conduct and complete.

- One focus group session alone can take hours.

- Mail-in surveys can take months, even years to complete, depending on the respondents.

- Calling people to ask for consent to a research project, as well as mailing them takes too long, and this is just to opt people in.

- Offline market research reaches fewer people.

- Many will ignore survey phone calls and snail mail surveys.

- There are only so many adequate observations you can make on a daily basis.

- A focus group itself only deals with 12 people at most.

Online market research solves both of these problems, as it can be deployed to the masses and completed within hours. This will, of course, depend on the market research platform you use.

Moreover, online research involves using polling software that targets the specific people you need for your research study. With offline market research, finding people who meet a variety of qualifications and who are also willing to take your survey is nearly impossible.

Online market research can also involve tactics that prevent poor-quality data and survey fraud by using AI to detect it and disqualify respondents who provide this data. This involves giving gibberish answers, skipping questions, and more. This is impossible to do in written, snail-mail surveys.

Thus, online research offers far more capabilities with survey software than does offline market research. Online market research can obtain both quantitative and qualitative research, reach the masses and do so in a timely manner.

However, it still is lacking in some regards, especially when compared with offline market research.

That’s because not all segments of the population spend much time online. Some segments do not have reliable internet access, as aforementioned, such as rural citizens. You may also have less tech-savvy, older customers.

You will therefore need to reach these segments offline.

In addition, offline market research gives you more access to primary sources of information and yields more comprehensive results.

Thus, it is often best to use both, specifically, whichever method is most suitable for your research needs. Using both will reveal different data about your target market.

Aiding All Your Market Research Projects

Although we suggested taking your market research endeavors both online and off, there’s more to this.

An online market research campaign is only as effective as the platform you use to administer it.

In essence, it is the survey platform that grants online surveys all their powers.

We therefore advise you to use a trustworthy online survey platform, one that is rich in functions and features.

Not all survey platforms have the same features; thus, not all market research online surveys can offer all of the functionalities and features mentioned in this article.

Thus, you should select your survey platform carefully.

Pollfish survey software allows you to create a thorough survey data collection, one you can customize to your liking, view however you please and organize to the max.

In addition, with our vast array of question types, you can create virtually any type of online market research survey to support your research campaigns.

Researchers can leverage a wide range of information on their respondents by accessing a wide pool of insights in their survey results dashboard.

In addition, we also offer the advanced skip logic feature, which routes respondents to relevant follow-up questions based on their answers to a previous question.

Thanks to our advanced market research platform, you can effectively pair online market research with offline market research campaigns.

How to Use Various Matrix Questions (Updated)

How to Use Various Matrix Questions (Updated)

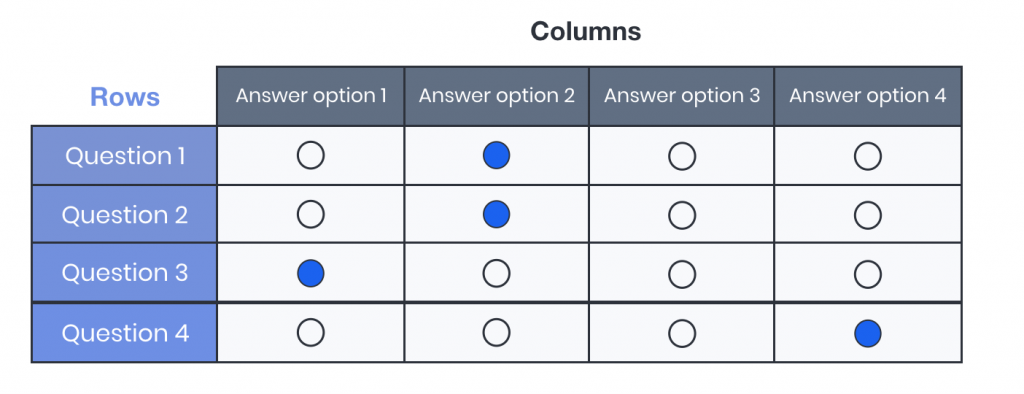

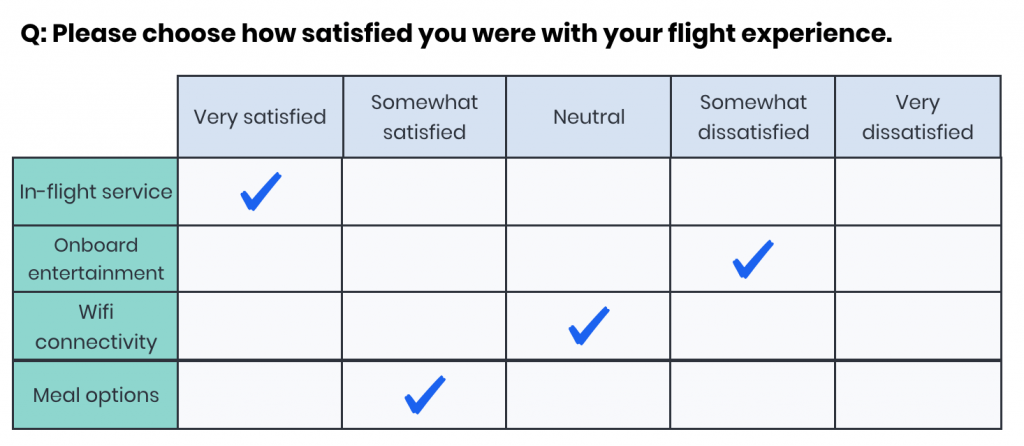

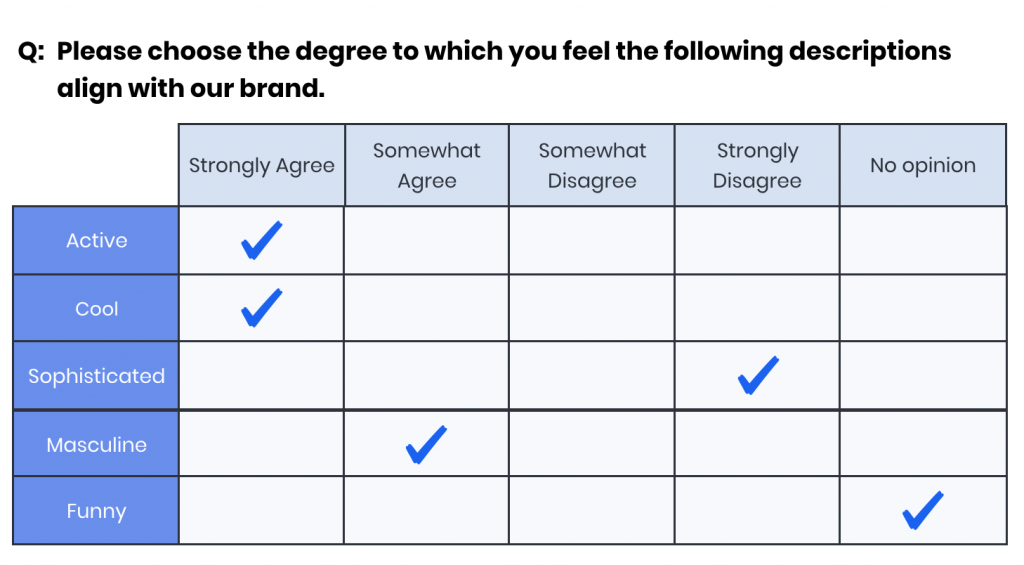

A Matrix question is a group of multiple-choice questions displayed in a grid of rows and columns. The rows present the questions to the respondents, and the columns offer a set of predefined answer choices that apply to each question in the row. Very often the answer choices are on a scale.

When to use Matrix Questions

It is best to use Matrix questions when asking several questions in a scaled format about a similar idea. They can be applied either as a mini-survey on their own or as a single-question type within a larger questionnaire. The closed-ended, predefined answers that apply to a series of questions make Matrix questions great for:

- Customer experience/satisfaction surveys.

- Questions about a subtopic in a larger questionnaire.

- Combining many rating-scale questions in a more digestible format.

Customer experience surveys

Matrix questions are commonly used in customer experience surveys. For example, to ask a respondent about their experience on a flight, the rows might ask the respondent about the service, food, or entertainment while the columns ask them to choose a rating response.

Questions about a subtopic

Oftentimes a questionnaire includes many ideas, but some of them are specific to a subtopic within that survey. Matrix questions are an effective way to cluster these ideas into a format the respondent can easily understand.

For example, in a brand awareness survey, a customer might use a matrix to get more information on brand perception.

Benefits of Matrix Questions

The format and structure of Matrix question types supply some unique benefits. Because it is a series of questions presented as a single table, it appears as a single question on the survey. This has the benefit of saving space (both on paper and in a digital survey) as well as reducing drop-offs from respondents who do not want to answer five nearly identical questions back-to-back.

The grid is easy and intuitive for respondents to follow with closed-ended, predefined answer sets, which means quick responses and a clear, easy-to-analyze dataset as the outcome.

Drawbacks of Matrix Questions

While there are many benefits, there are a few things to keep in mind when using Matrix questions.

The table formatting, while easy for respondents to answer, can also result in activities such as “straight-lining” or other pattern-making within the table.

Another issue can be the addition of too many rows or columns, which may negatively affect the data quality. If there are too many choices, respondents might lose interest (and be more likely to enter insincere answers to move quickly through it). In some cases, this can affect formatting as well, particularly in a digital survey environment such as mobile. If the Matrix question is not designed for an optimal mobile user experience, it can be confusing or frustrating for respondents.

Some survey companies will also charge for each row in the Matrix, as though they are individual questions, which may change the cost of the overall survey. Keep this in mind when building your questionnaire. (Pollfish views Matrix questions as a single question type, so pricing does not vary based on the number of rows and columns included).

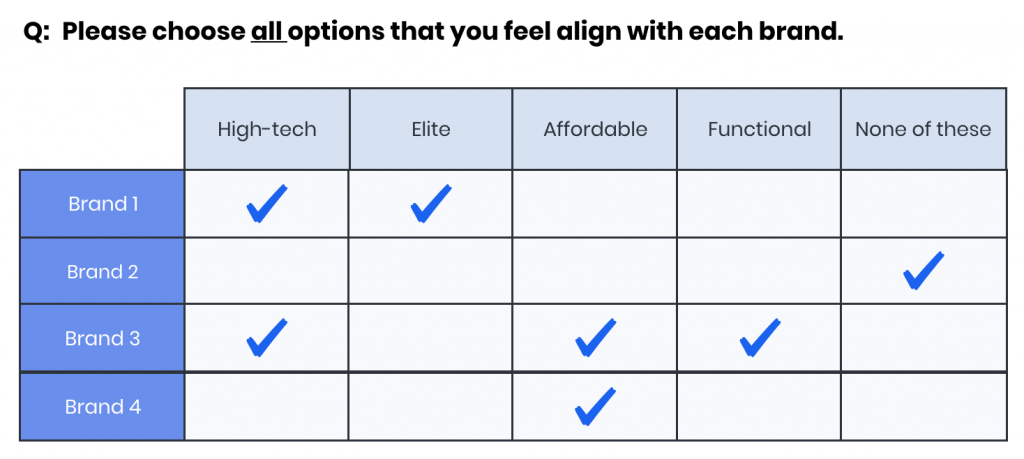

Types of Matrix Questions: Single- Selection vs Multiple-Selection & Multiple Matrices

Matrix questions, like regular multiple-choice questions, can be either single-selection or multiple-selection. This means that a respondent can choose either a single answer choice per row or they could choose multiple answer choices per row.

Competitive analysis surveys might include Matrix questions to better understand how a product or brand is measuring up against competitive offerings.

Exclusive Answers for Multiple Matrices

You can create exclusive answers from the scale points of multiple matrices.

As we realize the need to allow researchers to mark answers as exclusive in a Matrix table, you can do so by using the Multiple Selection question type.

Here's how it works: when a respondent selects a specific scale point as an answer to a statement, all the other scale points become de-selected, much like in the exclusive answers in the Multiple selection question type. Thus, the scale point marked as "exclusive" is an exclusive answer for every statement.

Keep the following in mind: after starting the survey, the respondents cannot modify any exclusive answer flag. You can make multiple scale points become exclusive.

https://www.loom.com/share/99bf9711898e495d88e9ad8da296324c

How Matrix questions differ from a Likert Scale

Many people believe that a matrix question is just a Likert scale, when in fact, it is the other way around.

A Likert Scale is a specific type of Matrix question designed to measure opinions linearly. Using a 5- or 7-point scale to collect user sentiments, a Likert Scale can be used to determine scaling attitudes such as:

- Agreement (Strongly Agree- Strongly Disagree)

- Likelihood (Very Likely- Not very likely)

- Importance (Very Important- Unimportant)

- Frequency (Always- Never)

- Quality (Excellent- Poor)

A Matrix question is a format for the question, meaning it is presented in a grid (or matrix). While Matrix questions often happen to be Likert Scales, Matrix questions can also be applied across a variety of use cases outside of attitudinal measurement, as shown above.

Best practices for writing a good Matrix question

Writing a good Matrix question follows many of the same best practices for writing good survey questions in general. However, due to the grid formatting, there are a few other things to be aware of.

- Limit the number of rows or columns. Keep it around five different options for questions and answers so as not to bore or overwhelm respondents.

- Give respondents a way to opt-out of things they are not familiar with, such as a “no opinion” or “neutral” answer choice.

- Do not make the questions too long. In the table format, long questions create a poor respondent experience.

- Try to group like-concepts. For example, if you want to know about brand perception, keep the questions related to that subtopic.

- As in any closed-ended scaling question type, keep scaling answer choices in order so as not to confuse the respondent.

Matrix question types are available in the "questionnaire" section of the Pollfish survey builder. Sign in or create an account to get started on your next survey.

Frequently asked questions

What is a Matrix question?

A matrix question is a group of multiple-choice questions displayed in a grid of rows and columns. The rows present the questions to the respondents, and the columns offer a set of predefined answer choices that apply to each question in the row. Very often the answer choices are offered in a scale.

When do you need to use Matrix questions?

Matrix questions are best used as to ask several questions about a similar idea when there is a scale involved. They can be used either as a mini-survey on their own, or as a single question type within a larger questionnaire.

What kinds of surveys and contextual questions are Matrix questions good to use for?

Matrix questions are great to use for closed-ended, predefined answers that apply to a series of questions. These are appropriate for customer experience/ satisfaction surveys, questions about a subtopic in a larger questionnaire and for making rating-scale questions more digestible.

Are Matrix questions a type of Likert scale?

It's the other way around. A Likert Scale is a type of matrix question that is designed to measure opinions in a linear fashion. Using a 5 or 7 point scale to collect user sentiments, a Likert Scale can be used to determine scaling attitudes.

What are the two types of Matrix questions?

Matrix questions can be either single-selection or multiple-selection. This means they can either be a single answer choice per row, or they could choose multiple answer choices per row. These might be used in competitive analysis surveys to understand how a product or brand is faring against competitive offerings.

Frequently asked questions

What is a Matrix question?

A matrix question is a group of multiple-choice questions displayed in a grid of rows and columns. The rows present the questions to the respondents, and the columns offer a set of predefined answer choices that apply to each question in the row. Very often the answer choices are offered in a scale.

When do you need to use Matrix questions?

Matrix questions are best used as to ask several questions about a similar idea when there is a scale involved. They can be used either as a mini-survey on their own, or as a single question type within a larger questionnaire.

What kinds of surveys and contextual questions are Matrix questions good to use for?

Matrix questions are great to use for closed-ended, predefined answers that apply to a series of questions. These are appropriate for customer experience/ satisfaction surveys, questions about a subtopic in a larger questionnaire and for making rating-scale questions more digestible.

Are Matrix questions a type of Likert scale?

It's the other way around. A Likert Scale is a type of matrix question that is designed to measure opinions in a linear fashion. Using a 5 or 7 point scale to collect user sentiments, a Likert Scale can be used to determine scaling attitudes.

What are the two types of Matrix questions?

Matrix questions can be either single-selection or multiple-selection. This means they can either be a single answer choice per row, or they could choose multiple answer choices per row. These might be used in competitive analysis surveys to understand how a product or brand is faring against competitive offerings.

How to Get Survey Responses to Complete Your Market Research Needs

How to Get Survey Responses to Complete Your Market Research Needs

When dealing with online surveys, you’ll surely ask yourself how to get survey responses, or at least, how to get more survey responses.

We hear you! Any market research campaign needs a particular amount of surveys for statistical relevance and to lessen the margin of error.

However, survey response rates still tend to be on the lower end of the scale, as the current survey response rates are at about 30%. Thus, there is clearly work that needs to be done to increase this rate so that you can reach a suitable number of survey responses.

However, despite the rather low amount of respondents that take a survey, surveys are still popular — for both researchers and their target audiences.

Online surveys in particular, are a popular route for conducting market research. Both researchers and survey respondents can attest to this.

For example, 71.6% of respondents prefer to answer a survey online. Thus, you should consider updating your market research methods by using online surveys.

This article guides you how to get survey responses so that you get an adequate amount of completed surveys to aid any research campaign.

How to Get Survey Responses Via 2 Survey Distribution Methods

Before we discuss how to increase your survey responses, please note that we are providing this advice for those who use our Distribution link feature.

This feature gives you more freedom when it comes to posting surveys online, as you get to choose where to post the link for people to take your survey, as well as who gets to take your survey, if you’re thinking of sending it to specific people.

This method is one of our major two; the other involves our Random Device Engagement (RDE) method of distributing surveys. With RDE, our platform sends surveys to a massive network of online properties, such as websites and apps.

The surveys target people randomly, given that RDE runs on organic sampling. That means there is no prerecruitment, which you would find in a survey panel. Instead, the platform targets random people who voluntarily exist in a particular digital space.

We target over 250 million people in over 160 countries to gain your respondent pool. Following agile research, this method keeps iterating surveys until the designated amount of respondents have completed their survey.

Thus, you don’t need to worry about getting survey responses via this method. However, if you send surveys your own way, that is, with the Distribution Link feature, you’ll need to have a solid plan on how to get survey responses, especially if you seek a certain number of responses within a certain time.

Fortunately, we provide several tips on how to get more survey responses.

Draw in Responses with a Strong Survey Intro

First responses matter and this applies in survey participation as well. That’s why you’ll need to reel in interest to your survey as soon as you can.

This entails compelling your potential respondents to take your survey as soon as they come upon your survey.

Everyone sets up their survey differently. Yours may exist as a pop-up, while others may position it right below a large image.

Regardless of the form of the call-out you use to grab people’s attention to take your survey, you’ll need to supply it with a strong introduction. This must be interesting, compelling and show respondents why the survey is important and why their participation matters.

As such, use short and snappy survey titles and call-outs.

To ease anyone’s dread, you may want to consider adding the time it takes to complete the survey in your title or introduction.

This is to reassure your respondents from the onset that the survey won’t take much of their time.

It’s also useful to add the purpose of the survey title and introduction, especially when it relates to helping the respondents themselves.

Example text: “Take this quick 3-minute survey to help brands serve you better!”

Create a Survey with Survey Best Practices

You should never just wing it when it comes to producing surveys; instead, apply the best practices for surveys each time you create a survey.

These will ensure you provide a good survey experience for the respondents, as well as receive the key data that you need for your market research campaigns.

While you can’t please everyone, several survey best practices are tried and true. The following provides several best practices you should consider for your surveys:

- Keep your questionnaire short.

- Many are time-poor and no one wants to waste their time.

- Keeping the questioning short will prevent respondents from leaving your survey before completing it. In this way, you’ll prevent or at the very least minimize survey attrition.

- Some respondents won’t even begin your survey if it’s too long.

- Remove any ambiguity from your questions.

- Surveys aren’t a knowledge test for school. As such, your questions should be easy to understand and answer.

- Avoid any confusion and be as direct as possible.

- When questions are difficult to answer, respondents will be bent on leaving the survey or getting bored quickly.

- Mix and match question types to retain interest throughout the survey-taking process.

- You can ward off respondents from getting bored by using a variety of question types and formats.

- Use questions such as: Likert scale questions, Matrix questions, stars and emoji scales, bipolar questions, drill-down questions and more.

- Make sure the survey platform you use allows you to do so.

- Find an adequate time to send your survey.

- This will depend on the lifestyles and habits of your target market.

- You can determine this by conducting a target market analysis to see when your target audience has more time in their day, when they go online, etc.

- Also, there are some general times and moments in the customer journey determined to be the best time to send a survey.

- Thank the respondents and follow up.

- Include a thank you page in your survey to give thanks to respondents for their time and consideration.

- You can also do so in advance by thanking respondents in the intro of the survey.

- Follow up with respondents whose contact information you have. There are many ways to go about this, including with the results of the survey, to thank them and more.

Strengthen Interest with Survey Incentives

Another strong approach to getting survey responses is to reward the respondents with survey incentives.

These incentives can be either monetary or nonmonetary and you can get creative with your incentives to stand apart from your competitors.

This is especially important when your survey states your brand or displays its logo or any other likeness. That’s because using incentives shows generosity and care, thereby positioning your brand in a good light.

After all, your respondents will know which company they are dealing with. Thus, you should consider using incentives to frame your brand in the best possible way. Survey incentives will do this, as they prove to respondents that you truly care about their participation. Otherwise, why would you reward them with incentives?

On the contrary, if respondents see your business on your survey and it doesn’t offer incentives, this will lead to a negative impression of your brand, even if the respondents are longtime customers.

That’d because no one owes you any feedback, regardless of how critical it may be. Thus, use incentives when possible, especially in instances where respondents know your business is running the survey.

Do a Favor for Your Respondents

This is especially useful if you know your respondents or have their contact information.

Doing favors closely ties in with incentives, but it is different in that favors can be anything aside from small benefits (like extra lives on a mobile game that respondents played upon encountering your survey) or gifts.

Favors can consist of doing anything favorable for your respondents. There are many routes you can take with factors, such as the following:

- Promise to give respondents a discount on your products or services.

- Offer a discount on top of an already discounted purchase.

- Enter them into a sweepstake to win a big prize.

- Raise their status if they are in a rewards program.

- Give them a preview of one of your new offerings.

As you can see, there are many kinds of favors you can offer your respondents to lure them into taking your survey.

At times, you may want to give some kind of proof of the favor you promised, such as a coupon that only goes into effect after respondents complete their survey.

Remember that what truly differentiates favors from incentives is that favors are grander and are more long-term-oriented gifts and gestures.

Use Your Content to Motivate Respondents

The content your business puts into the world has various benefits, but did you know that you can use it to encourage people to take your survey?

Not all content assets are easily accessible. That’s where you can use them to incite respondents to take your survey. This is especially true with gated content.

Content that’s gated often involves collecting users’ information in order for them to view it. In this scenario, you can require your users to take your survey to gain access to your gated content.

This is fair, given that both parties will get something in return. In addition, your site visitors won’t have to pay anything or get a membership to view the content they need, they’ll just need to take a survey.

Using gated content is especially useful for B2B matters and campaigns and therefore, B2B surveys.

Aside from granting users entry to gated text-based content, you can also gain more survey responses by giving them access to video content. Videos tend to draw in more views and engagement then text, especially in the era of Tik Tok and short attention spans.

Getting the Right Amount of Survey Participation

Getting the right amount of survey responses is never a feat with the right online survey platform. Such a platform will allow you to research all your targeted respondents in various ways, like the aforementioned RDE method and via the Distribution Link.

With the former, you won’t ever have to worry about survey responses, as the platform will keep sending surveys across the internet until your preset number of completed survey responses is fulfilled.

With the latter option, it’s best to follow our advice on how to get more survey responses. However, even in this method, our survey platform will keep iterating until the requisite number of completed surveys is reached.

Thus, your survey is in good hands regardless of the distribution route you take when you use Pollfish.

You should also consider that a strong survey platform will grant you all the functionalities necessary to build a good survey campaign, one that draws in interest and gets respondents to complete the survey.

Pollfish survey software allows you to create a thorough survey data collection, one you can customize to your liking, view however you please and organize to the max.

In addition, with our vast array of question types, you can create virtually any type of survey to aid your research campaigns.

Researchers can leverage a wide breadth of information on their respondents by accessing a wide pool of insights in their survey results dashboard.

In addition, we also offer the advanced skip logic feature, which routes respondents to relevant follow-up questions based on their answers to a previous question.

Thanks to our advanced market research platform, getting survey responses is highly attainable and easy on Pollfish.

Constant Sum Question: A New Matrix Question Type to Customize Your Survey

Constant Sum Question: A New Matrix Question Type to Customize Your Survey

We’re thrilled to offer researchers yet another new question type to power their surveys: the constant sum question.

This can exist as a Matrix question type on the Pollfish market research platform. As such, this is an addition to another Matrix question we offer: the Bipolar Matrix question type.

As you know, surveys are a great tool to conduct both qualitative market research and quantitative market research. But now, with this new question type, you can create questions with quantitative elements.

That’s because constant sum questions enable respondents to enter numeric data, wherein each numeric entry is summed up and displayed to the respondent.

You can use this question type for a consumer analysis, along with researching everyone in your target market: donors, students, employees, partners and more.

This article explains what a constant sum question is, its use cases, importance, how to create one on Pollfish and more.

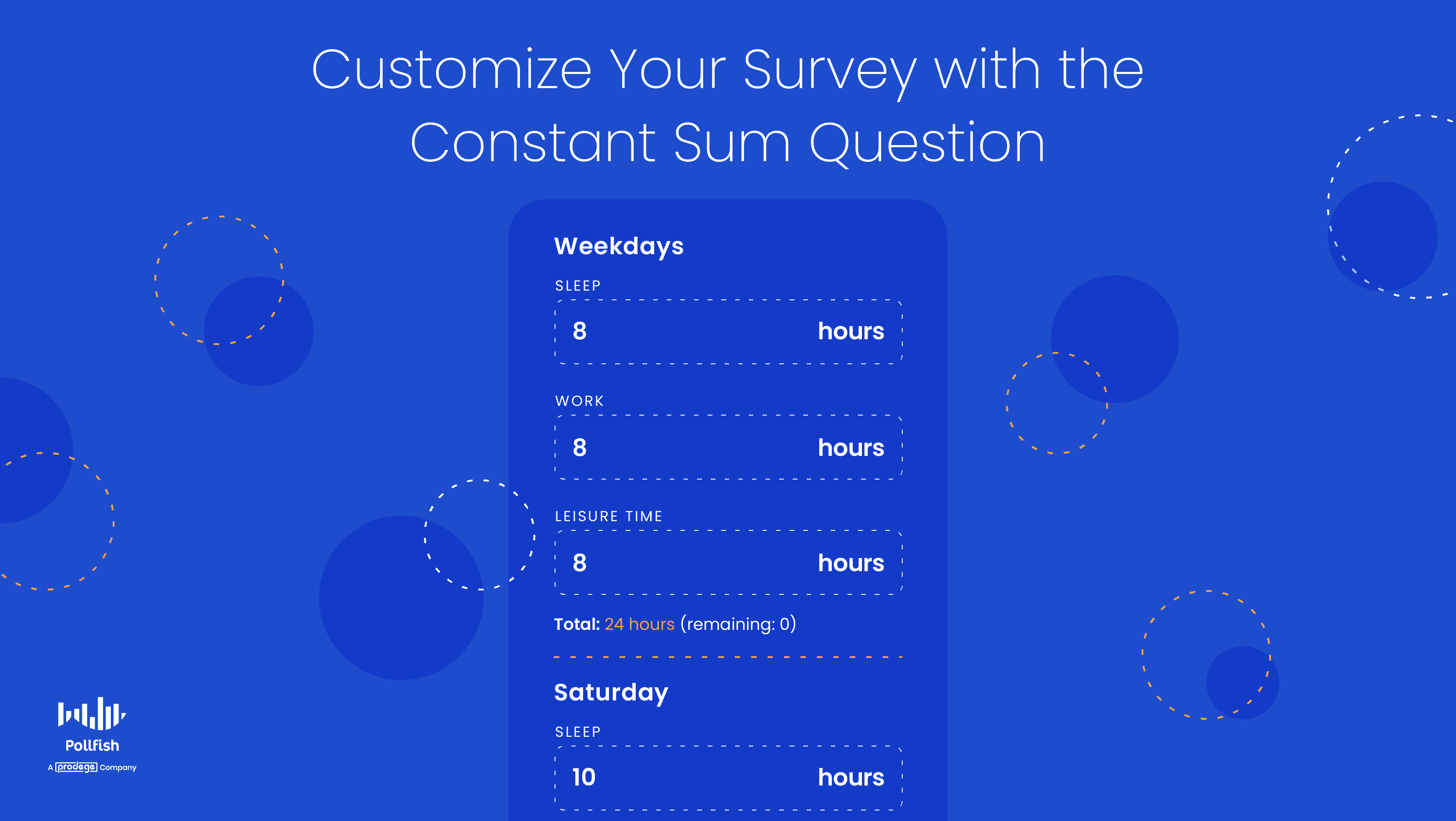

What is a Constant Sum Question?

A constant sum question is used in a market research survey; it allows respondents to assign a specific number of points to all the answer options in the question.

Thus, this is a multiple-choice question, one that requires respondents to enter a numeric value for all choices per question.

The type & total of these points can be defined by the researcher while designing the survey. When these points are defined, respondents won’t be able to answer with values that exceed the maximum points allowed.

The points can take whichever unit you wish to study, such as currency, hours, frequency, etc.

This question type allows you to calculate the numerical aspects of customers' decisions and everyday lives, allowing you to better understand their customer buying journey and virtually all else.

Let’s delve further into the usage of this question type.

Constant Sum Question Use Cases

The constant sum question type gives an understanding of how your respondents value each answer option per question.

These options revolve around a specific topic and inquiry, such as how many times within a certain time period customers buy certain products, or how they rate particular products.

Therefore, you can apply this question to a wide variety of research. The following lists key use cases of this kind of question. This is not exhaustive, as you can ask respondents to assign value to essentially all topics and issues.

- The dollar (or other currency) amount spent

- On specific items

- On certain days

- On budgets

- Amount of time

- Taking part in particular habits

- Working on a project

- Leisure time

- Taking care of responsibilities

- Percentages

- Allocating portions to various activities

- Viewpoints

- Inclinations

- Habits

- Rating systems

- Scales (1-10, etc) on products and services

- Ratings on customer service

- Easiness of a product, school or work assignments

- Ratings on overall customer satisfaction

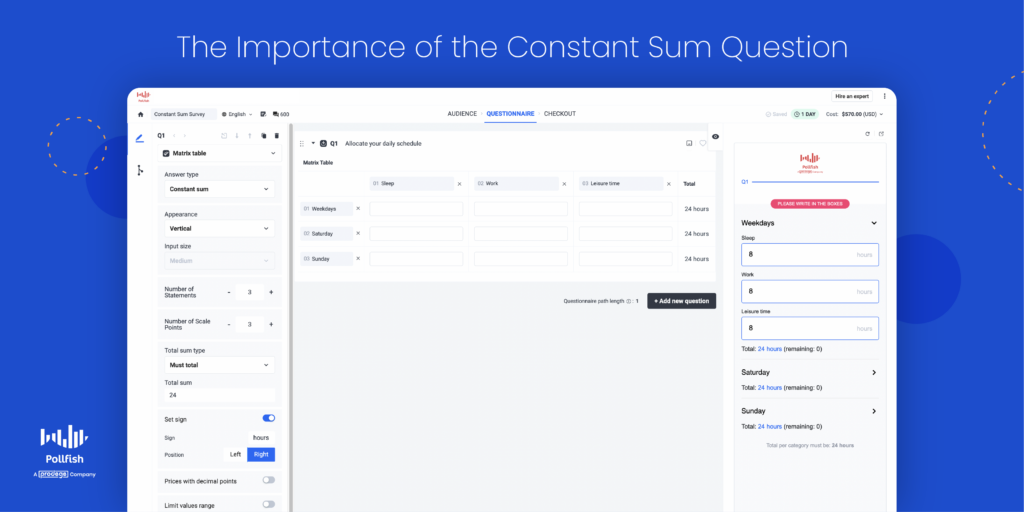

The Importance of the Constant Sum Question

This kind of question is important for various reasons.

First off, it is useful for product research. If customers feel that certain features of a product or service are more important than others, they will allot more points to those features.

Thus, researchers will get a clear indication of the products (and product features) that customers are satisfied with and not.

Using a constant sum scale is also a great way to create differentiation within a data set. It helps you determine which factors are important and which are not for your target market sample.

They are especially helpful in cases where many factors are critical and overlap in some sense. Thus, studying many factors is no longer a hindrance: you can just create an answer option for each factor.

The respondents will assign it a point or rating so you can see the nuances of each factor, especially when it comes to how your customers feel about them.

As such, this question allows you to study multiple aspects easily, as the data this question yields is straightforward and to the point.

This question is also important in a case where you seek to get purely quantitative data. Again, this is useful when dealing with larger sets of answer options. In this case, open-ended questions and other qualitative questions won’t be useful.

Additionally, this question type is especially convenient when you don’t want to form individual questions on a specific aspect.

This would require answer choices unique to the aspect in question, whereas, in a constant sum question, you can fill in various aspects per question.

You can see the sentiments on each aspect displayed in a simple numerical format. This is useful for maintaining a shorter survey, which is a common survey best practice.

In all, this type of question provides convenience for your study and a good UX for your respondents.

Examples of the Constant Sum Question

We dove into the various use cases of this question and now we’ll walk you through specific examples.

Example 1:

Ask respondents to allocate 100 points on the expenditures of their surplus goods, AKA, non-essential items. You can create your own point system or use a currency.

Provide a list of options and ask them to assign the points in order of importance.

Let’s say they spend $20 on movies, $70 on gadgets, $10 on miscellaneous expenses. With the constant sum question, you’ll find out which groceries are the most important for the respondents, as well as which they spend the most and least on.

Example 2:

Ask respondents their views on a particular digital experience with your business. Your answer options can include emails, customer service sessions, finding what they need on your site and more.

You can customize your scale to your liking. As such, you can use points via a scale of 100, or 10. You can also use percentages, especially when talking about the time spent on each.

It would be like this: rate the time you spent on the digital experiences with our company: viewing the homepage - 30%, reading a blog post - 20%, searching for products - 40%, speaking with a support rep via chat - 10%.

They can also rate how they viewed each experience; this would require a scale of 1-10, or 100, depending on researcher preferences.

Example 3:

You can discover how well your customers know and feel about certain brands, especially useful if they are your competitors.

As such, you can ask them to rate how they feel about each brand along with how much time they’ve spent engaging with it.

This can appear as such: rate how much you’ve engaged with each brand, which can include buying from them, viewing their items, reading their content, etc.: Macy’s- 30%, Old Navy -15%, Marshalls - 45%, Burlington Coat Factory - 10%.

How to Use the Constant Sum Question on Pollfish

Creating a constant sum question on the Pollfsih platform is easy and straightforward.

For respondents, it’s as simple as allocating a certain point to each answer option. See the section above with examples of how respondents can answer the question.

For researchers, it involves implementing the question in the questionnaire section, along with adding and customizing acceptance criteria.

Here is how to add it to your questionnaire:

- Go to the questionnaire section of the survey after creating a new one.

- Select a Matrix question and then the Answer type: Constant Sum.

- You can lift the Must total validation and change it to Continuous Sum.

- There are 2 appearances as well.

- You can add a sign (if you seek) and select if you accept decimals or not at responses.

Create the survey you want

Create the survey you want

The Pollfish team is constantly working to improve your survey experience, so you can expect us to continue updating and upgrading our platform with more features.

With our vast array of question types, you can form any survey and any research campaign.

Our research platform is optimized for both the respondent and the researcher. Thus, it is a win for all parties involved.

Researchers can reap a wide breadth of information on their respondents and leverage a wide pool of insights in their survey results dashboard.

Pollfish also provides artificial intelligence and machine learning to remove low-quality data and a broad range of survey and question types to customize your surveys.

In addition, there’s the advanced skip logic feature, which routes respondents to relevant follow-up questions based on their previous answers.

With a research platform containing all of these capabilities, you’ll be able to set up any survey you want, study any group based on demographics and psychographics alike and reap high-quality data.

Where Can I Post Surveys Online — and Other Concerns

Where Can I Post Surveys Online — and Other Concerns

Where can I post surveys online? We know you’ve got questions — and not just for your survey target audience. You’re probably brimming with questions on how to use an online survey platform with all of its capabilities, features and methods in the survey process.

Fortunately, we’ve got you covered on things survey and market research-related.

If you haven’t used survey research before, we suggest doing so, as online survey software industry in the US has grown 5.0% per year on average between 2017 and 2022.

And for good reason. Surveys provide an easy and quick method to obtain key insights on those who matter most to your business: your customers.

You should therefore opt for an online survey platform to learn the nitty gritty of all members of your target market — the group of people most likely to buy from your business.

While we can’t address every concern you may have in just one article, we can make certain related topics clear. When it comes to posting surveys online, you’ll need to know how this can be done, namely, the two major methods making this possible.

There are a few other related things you ought to know, which this article will cover.

This article lays out answers to key questions about conducting surveys, such as where can I post surveys online and others.

How Can I Post Surveys Online?

When it comes to posting your surveys online, there are two main methods underpinning this endeavor.

The first gives you less leeway on where your survey will appear, but is one of the most powerful ways of reaching a wide audience across the internet — and the world. That’s because it involves organic sampling, which reaches people randomly on the internet.

Depending on the survey platform you use, you may be able to cast a wide net when it comes to reaching a diverse population, across a multitude of online platforms.

The second method involves more specificity; researchers get to choose which platforms their surveys will be on. That’s because it involves posting a link to the survey in various digital channels that you as the researcher select.

Or, you can send the link to specific people via email, social media or some other means.

Not all survey platforms offer both of these capabilities of posting your survey online. We suggest leveraging a platform that powers your research with both methods.

Random Device Engagement (RDE)

Random Device Engagement is Pollfish’s signature approach to the aforementioned random sampling method. With RDE, surveys are sent to a massive network of over 250 million+ websites and apps, prompting users that exist in their natural digital environments to take the surveys.

As such, you survey will exist in different websites, mobile sites and mobile apps, where consumers are engaged and can be easily incentivized non-monetarily.

This eliminates the survey bias that can occur if you were to use a survey panel.

Professional panelists are not taking a survey in their natural environments online; instead, they are pre-recruited, which means they are not fully anonymous. They can easily feel compelled to answer surveys in a certain way, tainting the accuracy of the survey study.

They are also prone to panel fatigue from constantly having to take surveys. They may also be influenced by certain questions, which then affect how they answer future ones. This is known as panel conditioning.

On the contrary, Random Device Engagement reaches and recruits respondents in the places they naturally frequent online. This means that respondents’ participation is completely voluntary, anonymous and randomized.

As such, respondents are more likely to answer truthfully and are less prone to survey fatigue. After all, respondents’ identities are completely anonymous, since they haven’t been pre-recruited and vetted through a panel recruitment process.

Thanks to RDE, you can reach a wider scope of people and segments in your target market. This is because it is conducted across a wide network of sites and app publishers that deploy your surveys.

Specific Online Channels and Respondents

You can also send surveys to specific people and through specific digital channels, like your homepage, landing pages, emails, newsletters, etc. This requires using the Distribution link feature.

Given that it is our second major method of posting surveys online, it will not work on our network of survey publishers, as does the RDE method. That’s because, in this method, you’ll solely use the Distribution Link to connect potential respondents with your survey.

This feature allows you to create a link for respondents to be able to take your survey online. You are fully in charge of where your surveys will appear. In addition, with the Distribution Link feature, you also have the option to send your survey to specific people.

As such, this method is twofold.

Post surveys to specific channels

Send your survey via your channels of choice to reach a large number of random users, much like you would via organic sampling. The only difference is that the places you survey will exist on won’t be random, as you will choose the channels to place your link.

This method applies agile research, in that it is highly iterative; the platform will continue sending surveys across various digital spaces until a certain number of responses (completed surveys) is collected.