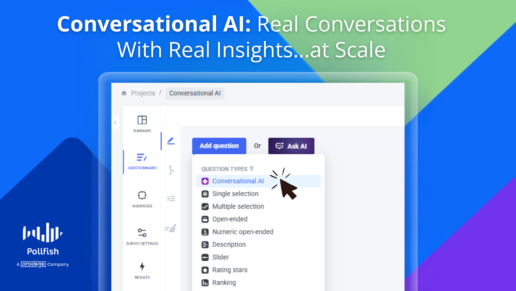

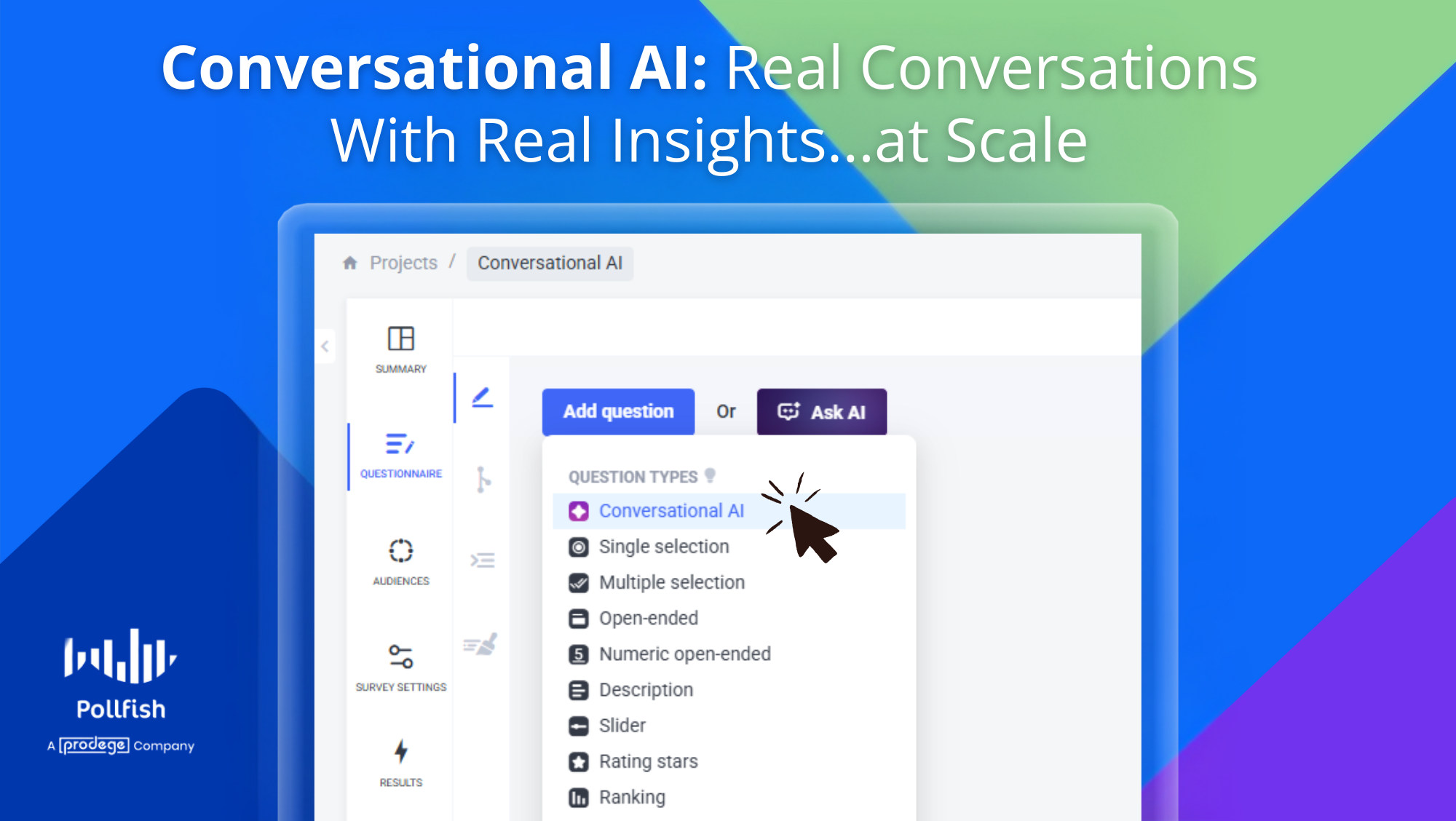

Conversational AI: How to Hold Real Conversations With Real Insights, at Scale

Surveys don’t have to feel like, well…surveys.

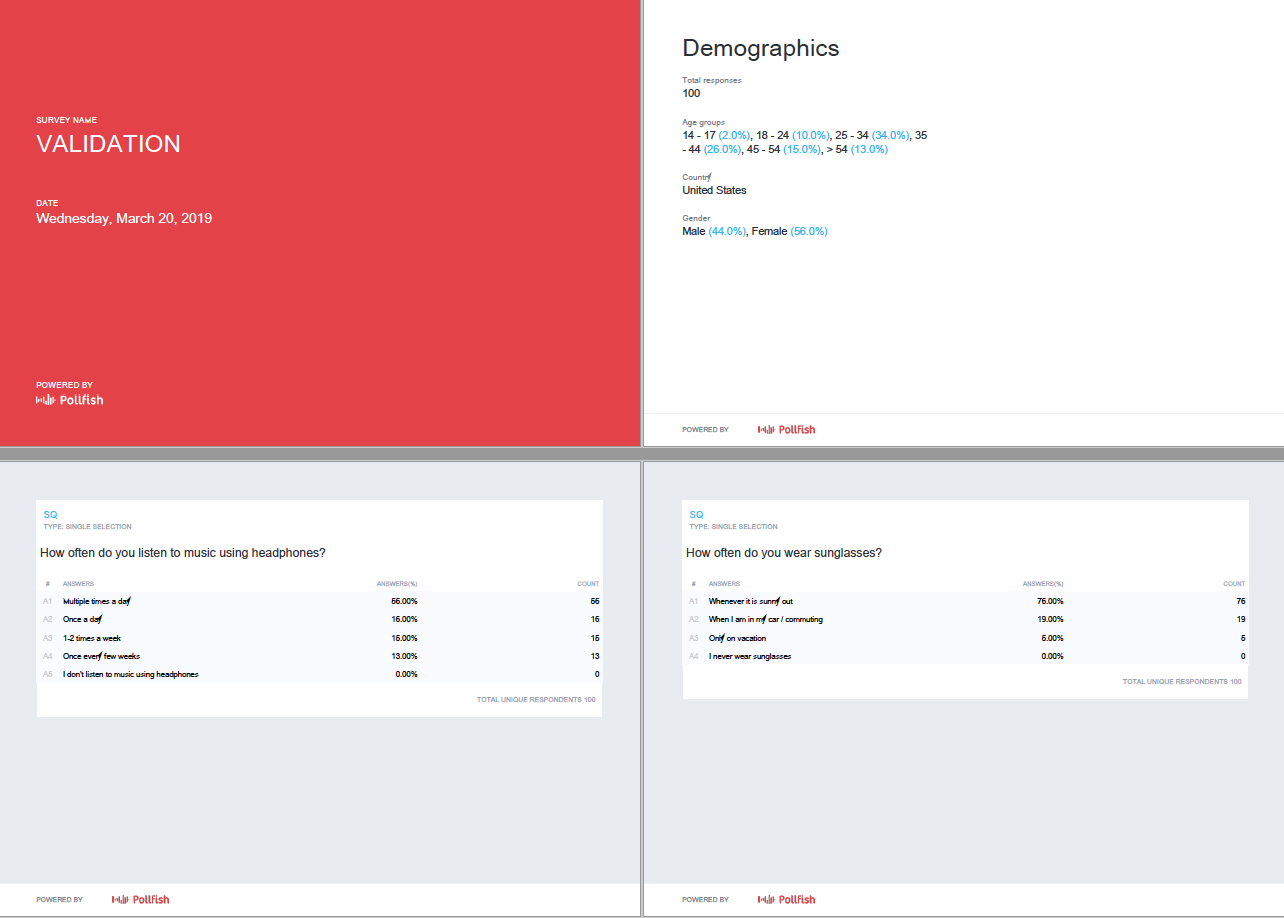

With Conversational AI, we’re bringing a whole new level of engagement to Pollfish. This powerful new question type allows you to have real-time, one-on-one conversations with respondents, powered by AI and delivered at scale.

It’s more than just a new format. It’s a smarter way to uncover the why behind consumer behavior.

What is Conversational AI?

Conversational AI is a survey question type that engages respondents in a dynamic, AI-led chat experience - just like chatting with a real person.

Unlike traditional open-ends or multiple choice questions, Conversational AI encourages richer, more thoughtful responses by replicating the feel of a real conversation. And because it’s backed by AI, it can happen in real-time with thousands of people at once.

Whether you want to go deep on a single topic or weave this format into your broader survey, Conversational AI fits seamlessly into your project. Use it as a standalone study, or mix and match with other Pollfish question types within your survey.

Why use Conversational AI?

This question type combines the best of qualitative and quantitative research in one experience. Here’s what makes it a game-changer:

✅ Real Conversations: Engage with the Pollfish Audiencel for natural, back-and-forth chats that surface tone, emotion, and nuance faster than traditional qual.

✅ Deeper, More Authentic Insights: Dynamic prompts help respondents open up, yielding more thoughtful responses.

✅ Fast, Actionable Summaries: No need to comb through raw text. We'll instantly synthesize key themes and takeaways into a clear, executive-ready summary.

✅ Flexible by Design: Use Conversational AI as part of a mixed-methods survey or as a focused deep-dive. DIY it, or get support from our expert research team.

✅ Cost-Effective: Get the depth of interviews without the heavy lifting. No scheduling, no transcription, no moderators required.

Great for Questions Like...

Whether you're testing early-stage creative or measuring emotional reactions, Conversational AI shines when tone and depth matter most.

Use it for:

Brand sentiment or perception

Post-experience feedback

Concept or creative testing

Exploring motivations, habits, or attitudes

Any question where “why” matters more than “what”

How It Works

- Create a Guide: Start by writing a short discussion guide or key goals for your question - Conversational AI uses this to lead the conversation.

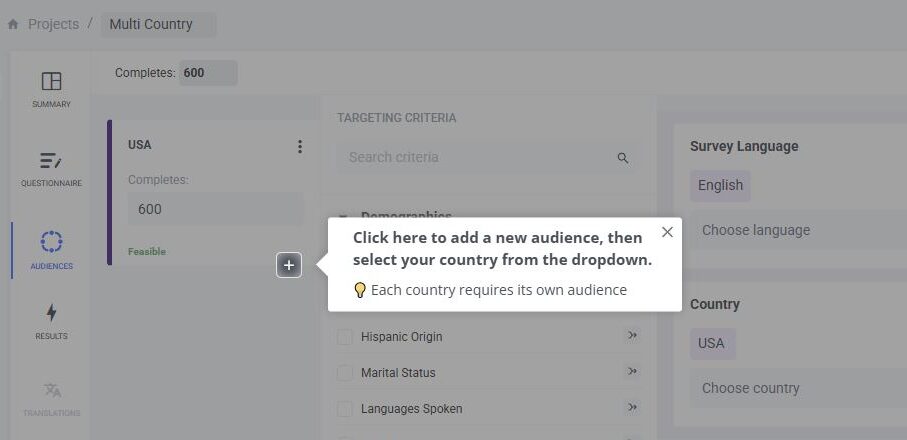

- Launch the Survey: Pollfish connects your survey to your target audience, gather qualitative feedback from hundreds (or thousands) of respondents quickly and asynchronously.

- Get Smart Summaries: When the data’s in, we compile the key themes and insights so you can act fast. On a respondent level and at a project level. There's no manual analysis required.

Want step-by-step instructions in setting up a Conversational AI question? Check out our Conversational AI Help Guide →

Ready to Start a Conversation?

You’ll find Conversational AI in the questionnaire menu when building your next survey. Create a new project → Select your audience → Add question → Select Conversational AI

Need help getting started or want to brainstorm how to use it in your research? Our team’s standing by 24/7. Use the live chat to connect with our support team anytime. Our experts can assist you with your setup.

You can also book a session directly from the chat for a live demo or personalized guidance.

Build your first Conversational AI survey now →

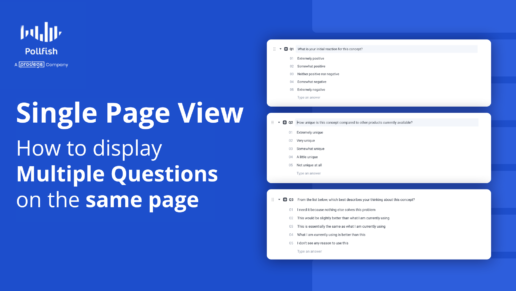

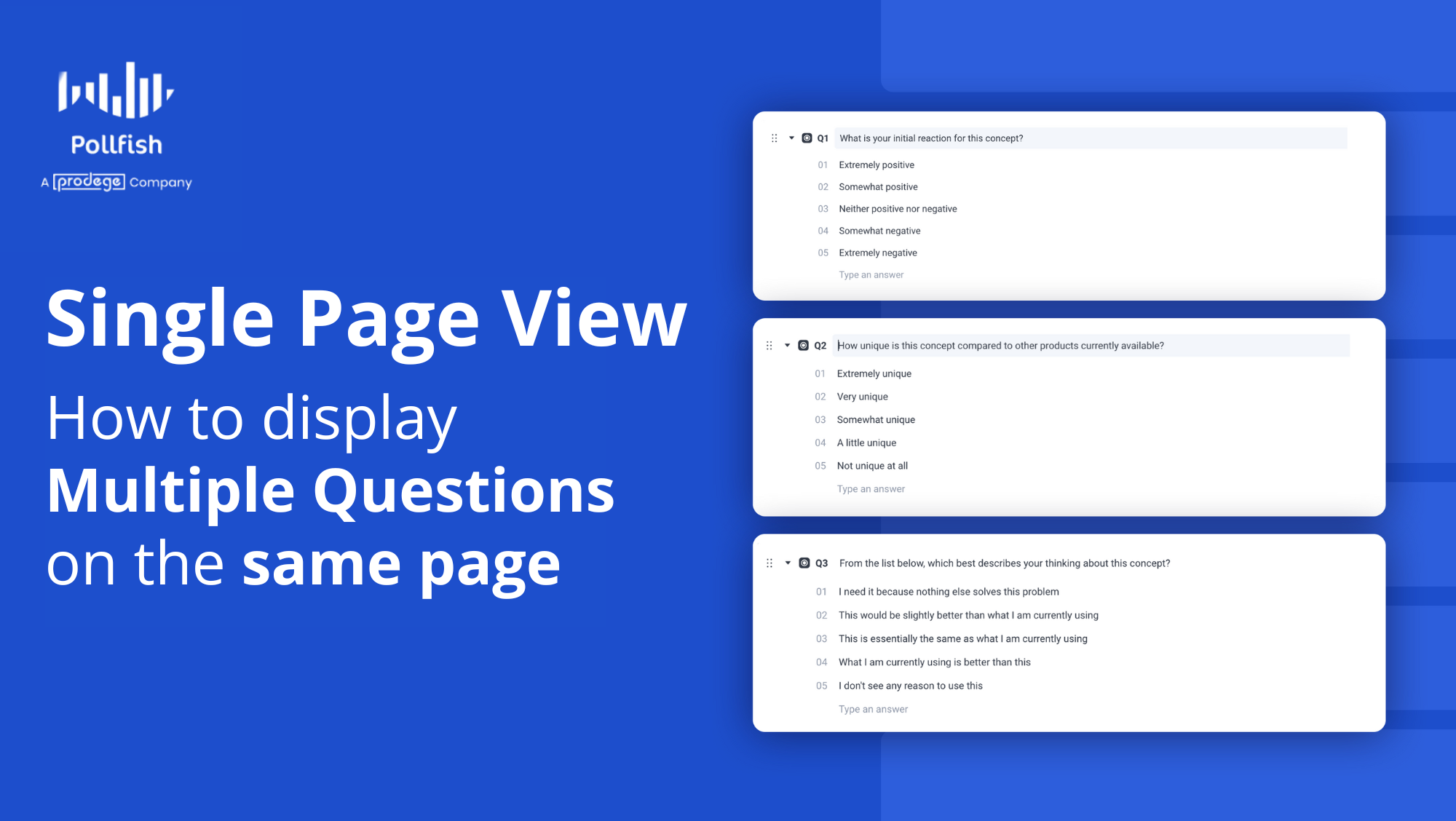

Using Single Page View to Display Multiple Questions on the Same Page

Single Page View - For Natural Topic Grouping

By default, Pollfish shows one question per page to your respondents.

But there are times when you might want to show multiple questions together in a group, say for shorter surveys or when you want respondents to answer questions in context around a topic. If that's what brought you here, then you're looking for our Single Page View feature.

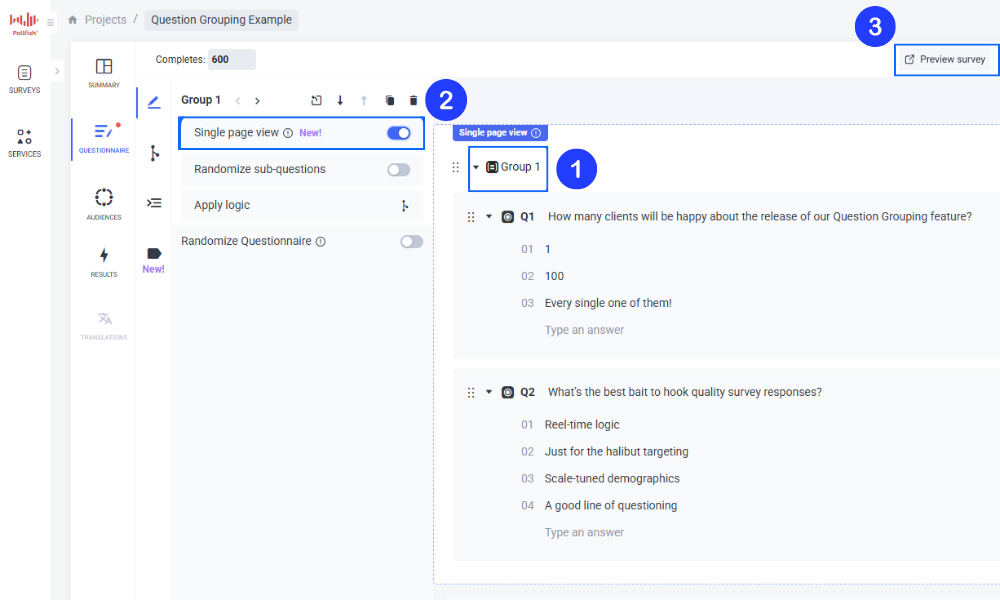

Where to Find Single Page View

Once you've loged in to your Pollfish account and created a project, or navigated to your existing survey draft...

From the Add Questions menu button, add your questions to a question group

In the group settings, toggle "Single Page View" to ON

Once enabled, the selected questions within that group will appear on the same page to respondents, and can be viewed using the Preview Survey button (in the top right of your screen)

Example Use Cases

Customers asked us for the functionality to show multiple questions on the same page for a variety of reasons. Here's just a few requests, to give you inspiration:

Customer Satisfaction Surveys: "I'd like to group multiple related CSAT questions to minimize clicks and respondent fatigue"

Product Feedback: "We'd like to ask questions about features, usability, and expectations all in one view"

Behavioral Research: "By asking similar topic questions on a single page, we'd reduce cognitive interruption between questions by grouping them logically"

Need Help?

We’re here for you! Use the live chat to connect with our support team 24/7. Our experts can walk you through question grouping and the Single Page View feature to help with your setup.

You can also book a session directly from the chat for a live demo or personalized guidance.

Answer Display Logic

A Smarter Way to Show Relevant Answers

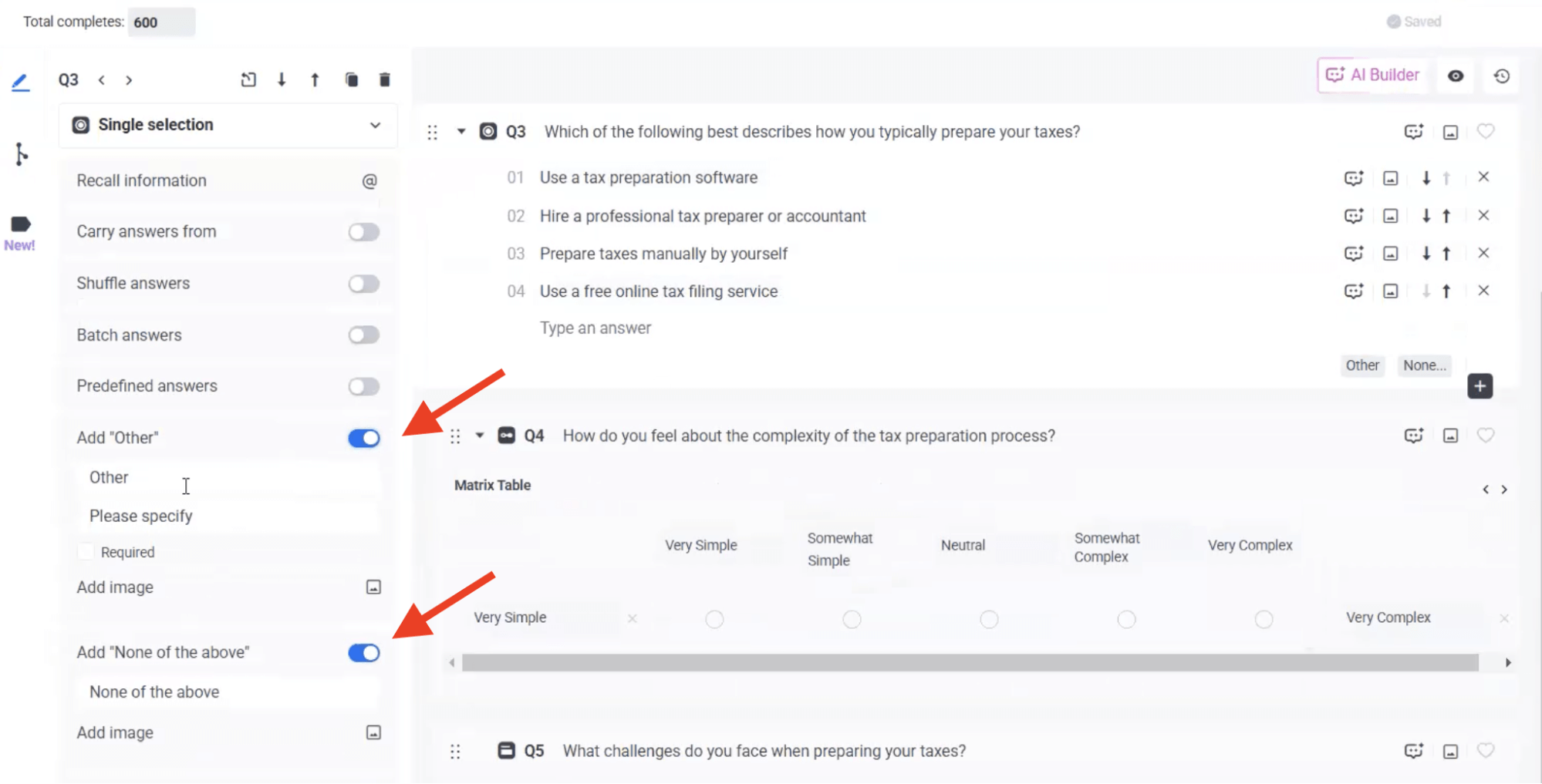

Pollfish now gives you more control over your survey flow with Answer Display Logic, a powerful feature available directly within the Questionnaire Builder. This enhancement allows you to dynamically tailor answer options based on a respondent's previous inputs—making your surveys more personalized, relevant, and efficient.

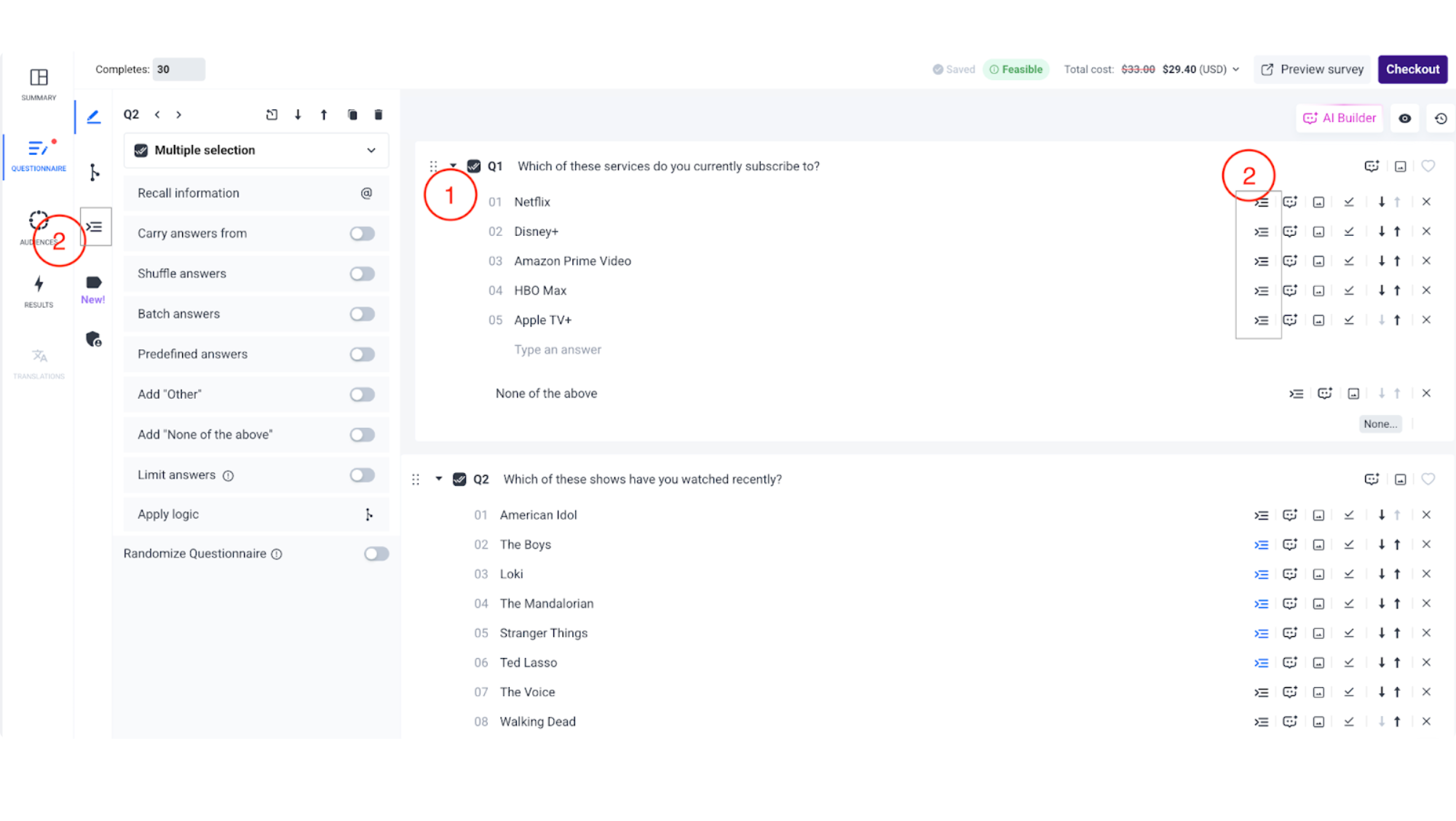

What is Answer Display Logic?

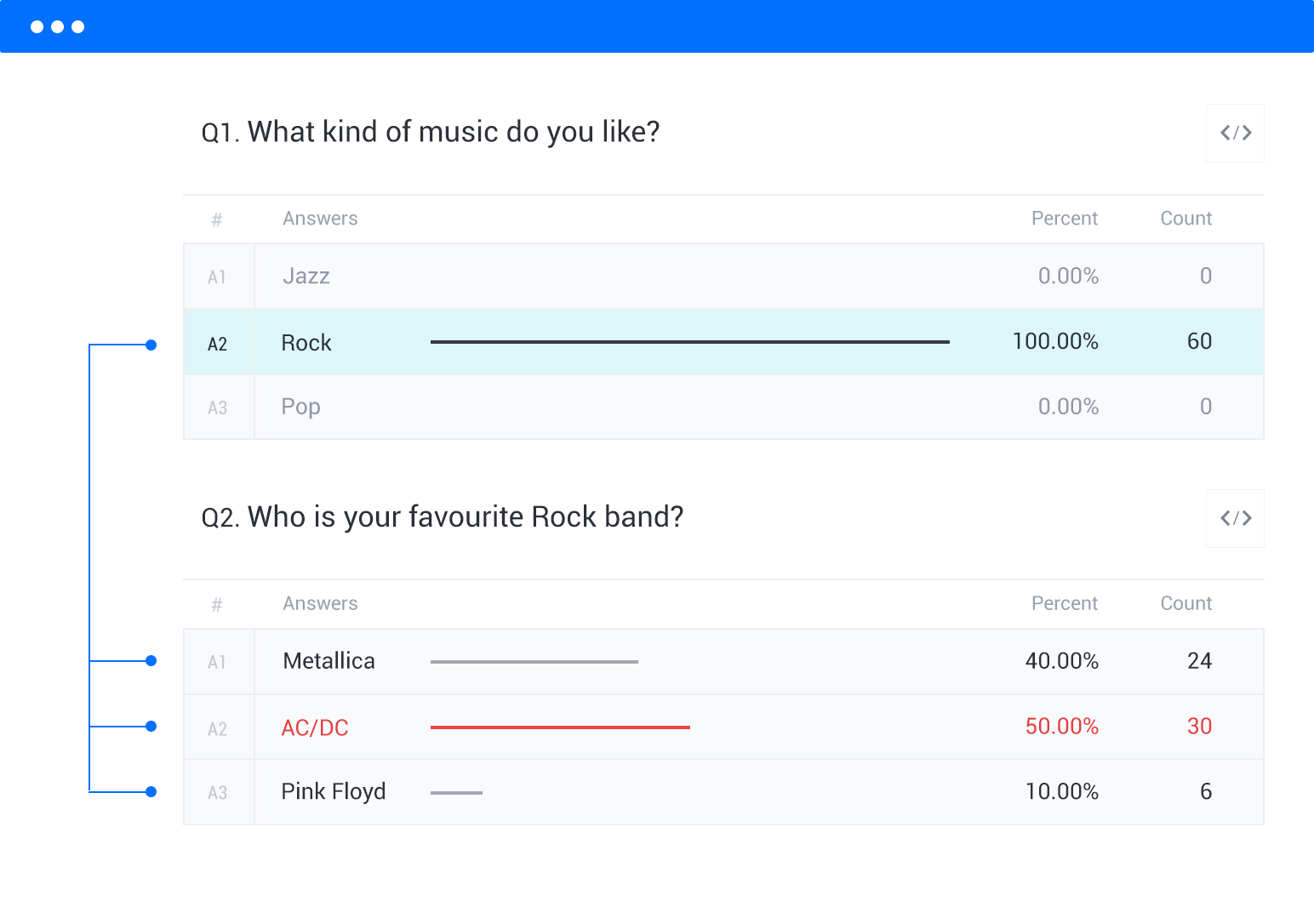

Answer Display Logic enables you to show specific answer choices only when certain conditions are met. This means you can tailor questions to the unique experiences or characteristics of each respondent, enhancing clarity and avoiding irrelevant options.

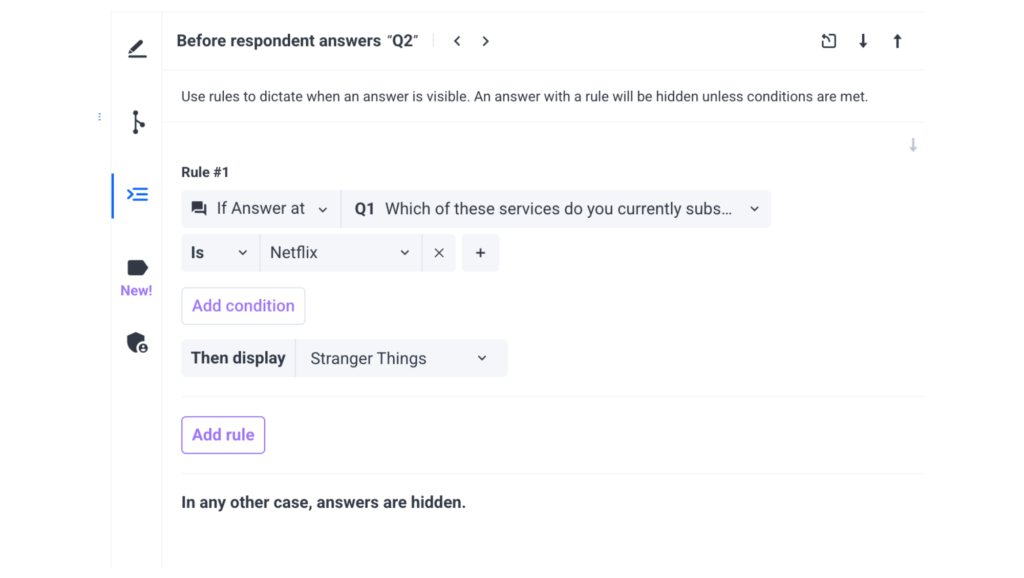

For example: If a respondent says they subscribe to Netflix in an earlier question, you can set up logic so that only "Stranger Things" appears in a follow-up question asking what shows they’ve watched recently. Respondents who did not select Netflix won’t see that option.

How to Set Answer Display Logic

Follow these steps to conditionally display an answer based on prior behavior:

- Log in and create or open your draft survey

- Select the question where you want answers to be shown conditionally.

- Click the "Edit Answers Display Logic" tab on the left-hand side (just below the "Edit Advanced Logic" section) OR click on the Answers Display Logic icon next to the specific answer you want to conditionally display.

- Set the conditions that must be met—these can be based on:

- Answers to previous questions

- Hidden variable labels

- Targeting parameters (from your audience setup)

- Answers to previous questions

- Answers with display logic will remain hidden unless the defined conditions are met.

- You can use one rule to show or hide one or more answer options within a question.

- That’s it! You’re all set to deliver a tailored, intelligent survey experience.

Compatible Question Types and Features

Answer Display Logic is currently supported on the following question types:

- Single Selection

- Multiple Selection

- Ranking

- Matrix (rows/columns, bipolar statements only)

Other features supported:

- Display logic on [Other] and [None of the Above] options

Works with "Shuffle answers" feature

Limitations and Incompatible Features

To help you avoid errors, it’s important to know what Answer Display Logic does not currently support:

- Only one rule can be applied to each answer option, but that rule can contain multiple conditions using AND/OR logic.

- Not compatible with the following question types:

- Slider

- Open-ended (including Numeric Open Ended)

- NPS

- Description

- Rating Stars

- Drill Down

- All Research methods (e.g. Conjoint, A/B Testing)

- Slider

- If a question also has Skip Logic, ‘’Answers Display Logic’’ rules will be evaluated first, followed by Skip Logic.

- Each question must include at least one answer that's always visible to all respondents—meaning it’s not carried forward and has no display logic applied. This ensures there's never a case where all options are hidden.

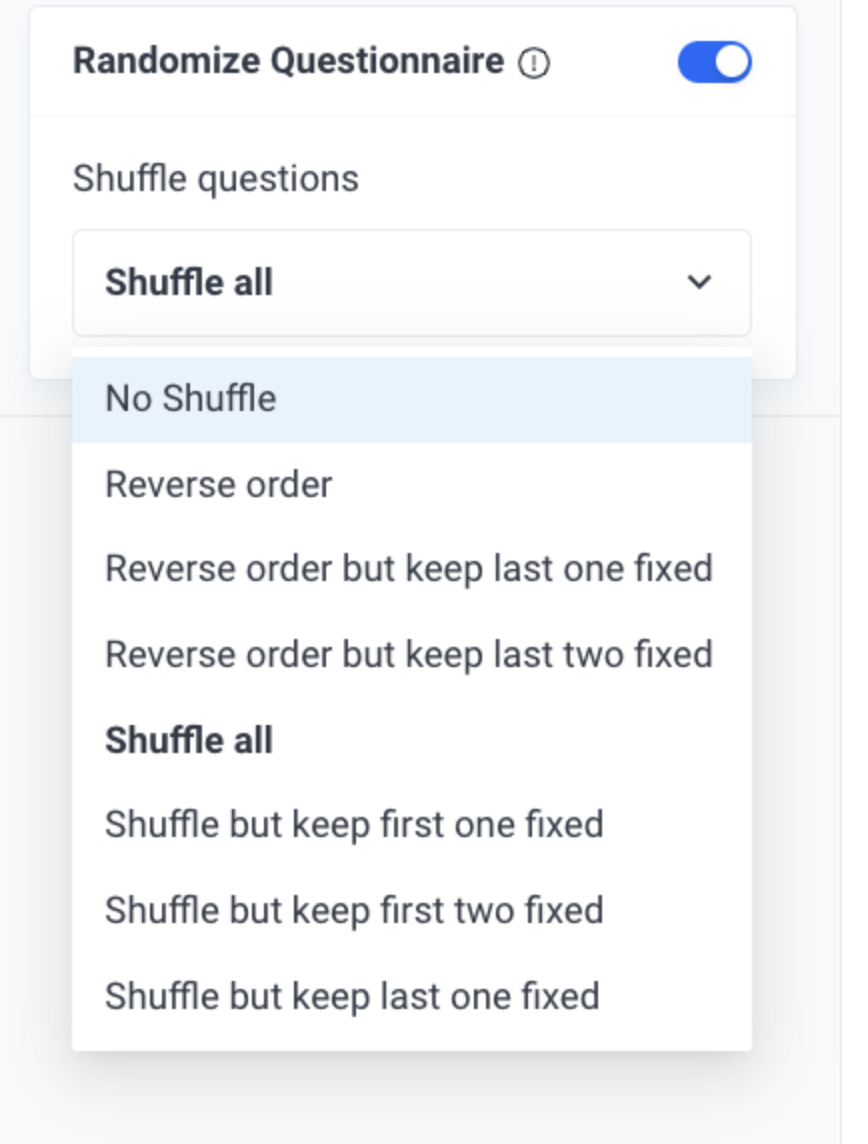

- Question shuffling (also referred to as ‘’Randomize Questionnaire’’) and Answer Display Logic cannot be used together.

Editing and Removing Answer Display Logic

Once your survey is live, you can still edit or remove Answer Display Logic rules (‘’Edit Survey’’ option) for any remaining responses.

Additional ADL Issues & Error Handling

Pollfish will flag any logic issues automatically, such as:

- Setting conditions based on a question the respondent hasn’t yet answered

However, if you create Answer Display Logig rules based on a question that may be skipped due to Skip Logic, some respondents may never encounter the conditional answer option. It's important to carefully review your survey flow to ensure all intended respondents have access to the relevant questions and answers.

Need Help?

We’re here for you! Use the live chat to connect with our support team 24/7. Our experts can walk you through the Answer Display Logic feature and help with setup.

You can also book a session directly from the chat for a live demo or personalized guidance.

5 Best DIY Market Research Tools (+ How to Pick the Right One)

5 Best DIY Market Research Tools (+ How to Pick the Right One)

For companies with complex research needs or limited bandwidth, full-service market research can be a lifesaver — but it’s expensive. That’s why many businesses are switching to DIY market research tools.

These platforms cut costs and deliver fast results, often within hours or days, rather than the weeks it takes with full-service firms.

In this post, we’ll cover:

Common pitfalls to watch for when selecting a DIY market research tool

The 5 best DIY market research tools, starting with Pollfish (our own platform)

Note: This post focuses solely on DIY survey tools. For other types of DIY research software, check out this article.

Common Pitfalls to Avoid When Picking the Best DIY Market Research Tool

Conducting your own market research surveys is easier than ever with today’s DIY platforms. The research process typically involves three steps:

Define your target audience using demographic filters

Build your survey questionnaire with intuitive tools

Analyze results through built-in reporting features

Top platforms not only offer user-friendly interfaces but also include complimentary access to expert support — market researchers who can help guide your survey design and ensure high-quality data.

However, there are a few common pitfalls with most DIY tools:

🚫 Reliance on Third-Party Respondents

Instead of nurturing their own respondent communities, many DIY survey tools (such as SurveyMonkey, Qualtrics, and others) purchase survey respondents from external third-party panel providers. These providers frequently use a payment model that exclusively rewards respondents with cash for completing surveys.

This incentive structure leads to the emergence of "professional survey takers" who quickly rush through dozens of surveys each day without carefully reading the questions in order to maximize their earnings. As a result, the quality of the data collected and the overall effectiveness of the research can be compromised.

🚫 Overpromising on Turnaround Time

Despite claiming a quick turnaround time, the process can sometimes take longer than the time-sensitive nature of your research project, potentially causing missed opportunities or delaying the launch of new products and campaigns.

🚫 Subscription-Based Pricing & Hidden Fees

Many DIY platforms utilize a subscription-based pricing model, which can lead to unused capacity and wasted budget if the tool is not consistently used.

Additionally, the true cost of using these platforms is often not transparent upfront, with potential hidden fees for access to premium features such as advanced targeting options, enhanced data visualization, and so on. These hidden fees can accumulate quickly, resulting in a significantly higher total cost than initially anticipated.

🚫 Lacking Essential Survey Design Features

Many DIY market research tools have feature limitations that can compromise the quality and relevance of your research in three areas:

Settling for broad audiences: Some platforms force you to use a broad, generic audience instead of the highly targeted, niche segments needed for your specific research objectives.

Limited questionnaire design capabilities: If you require an advanced survey flow (e.g., complex branching logic), you may have to make compromises due to limited questionnaire features.

Inadequate built-in data analysis: Many platforms lack robust data analysis tools, often requiring you to export data to Excel for manual analysis. This process is time-consuming and inefficient compared to having built-in analysis functionality.

Up next, we’ll explore how Pollfish (our DIY survey tool) addresses these limitations and lets you gather high-quality, reliable market research data without the high costs associated with agencies. Additionally, we’ll provide a brief overview of several other DIY market research tools to help you make a well-informed decision.

5 Best DIY Market Research Tools

1. Pollfish

Below, we'll cover how Pollfish (our own DIY survey platform) excels in several key areas:

Build your research on reliable responses from our first-party panel communities we directly own and nurture (rather than purchase from external third-party sources), enabling comprehensive quality controls.

Receive results within hours for broad audience segments, and typically within a few days for more niche or specialized groups. Our speed outpaces not just traditional research providers and agencies, but also most other DIY market research software.

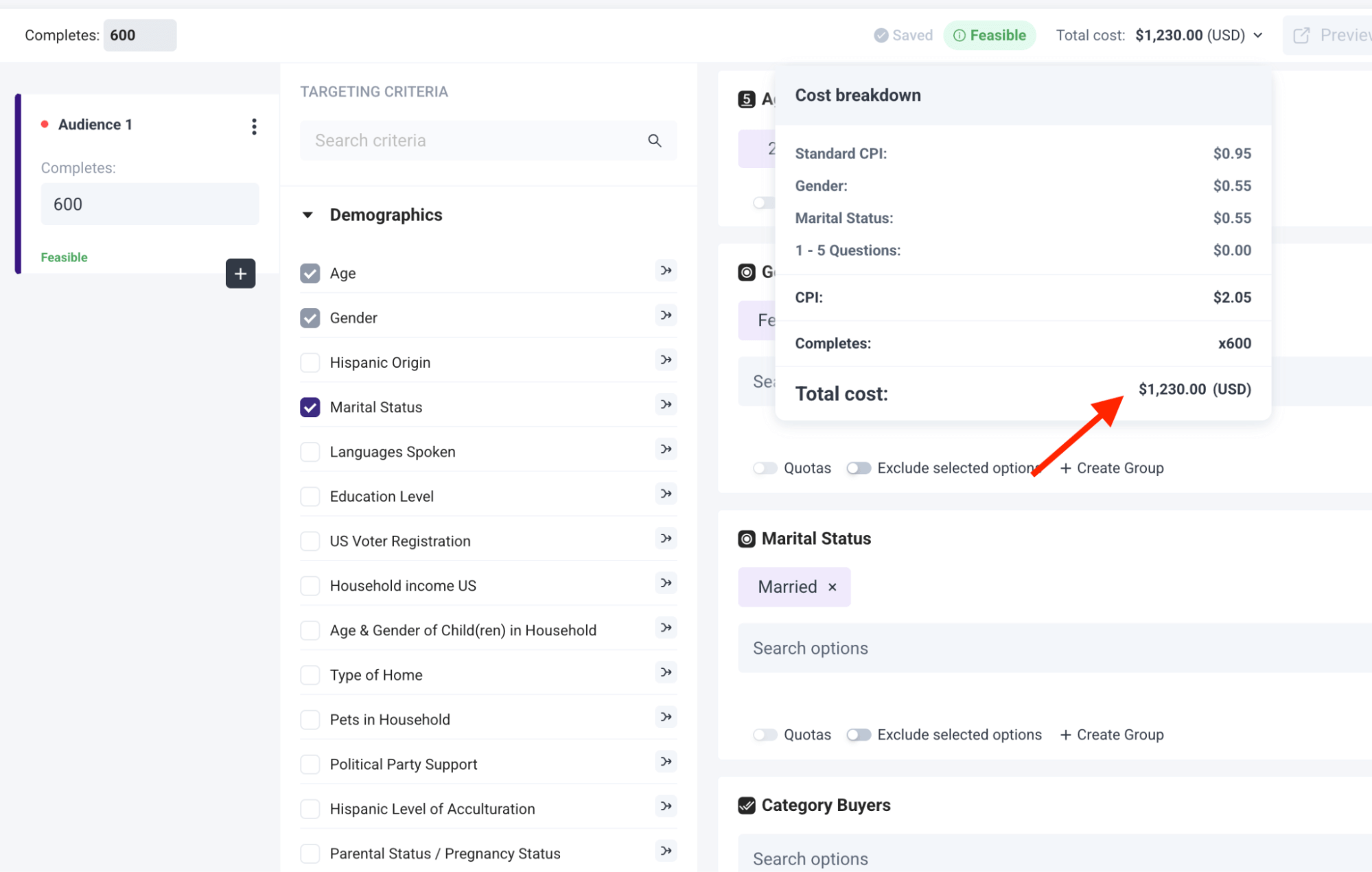

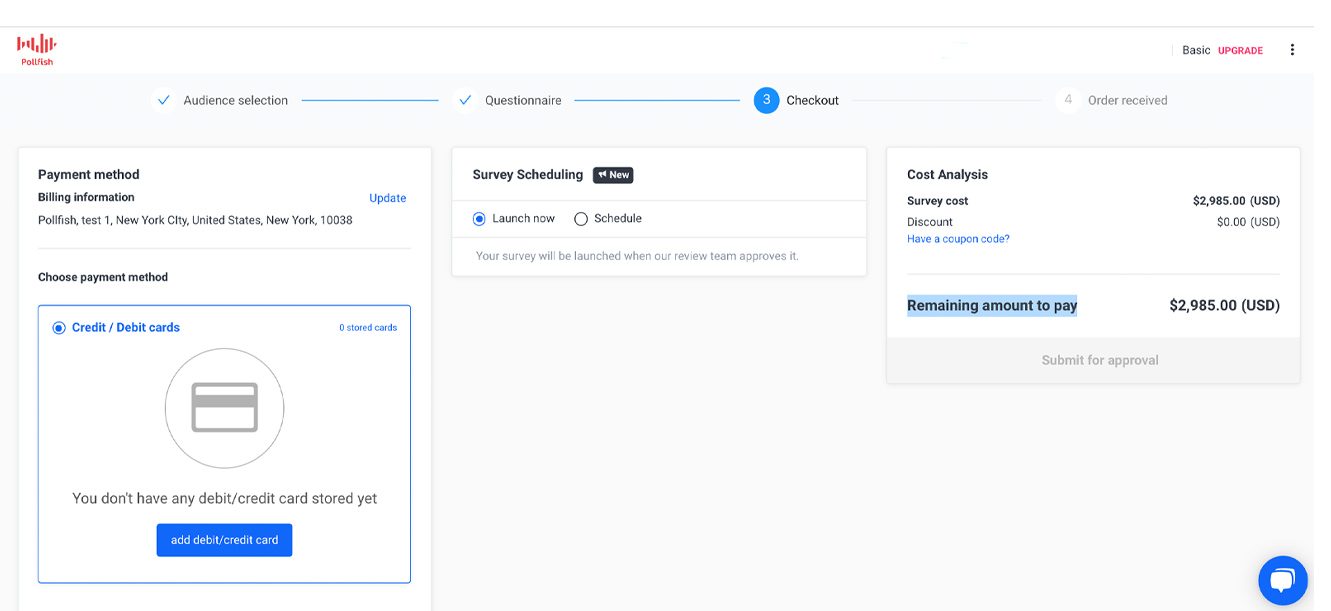

Pay only for what you use with transparent, usage-based pricing that shows your exact cost in real-time as you build your survey, eliminating subscription fees and unused capacity, and the surprise costs that plague several other platforms.

Create surveys exactly to your specifications with robust audience targeting capabilities, advanced questionnaire design, and built-in analytics tools that never force you to compromise on your research goals due to platform limitations.

Build Your Research on Reliable Responses From Our First-Party Panel Communities

At Pollfish, we own and operate our own respondent communities through our parent company Prodege. This first-party approach gives us complete control over data quality and lets us set control measures that other DIY tools relying on third-party panels cannot match:

❇️Natural Environment Engagement

Unlike traditional third-party survey panels where participants take dozens of surveys consecutively, our respondents encounter surveys organically while using apps for gaming, shopping, utility, etc. They receive meaningful in-app rewards (like extra lives in games, premium features, or discounts) that enhance their existing app experience.

This contextual approach means respondents are more engaged when answering questions, rather than rushing through surveys as their primary task. The result is more thoughtful, authentic responses that better reflect consumers' genuine opinions.

❇️ 30-Day Respondent Evaluation Period

All participants undergo a mandatory 30-day evaluation period before accessing client surveys. During this time, they may only complete internal profiling surveys, allowing us to establish baseline response patterns and verify the demographic consistency.

❇️ Receipt-Verified Targeting Accuracy

We verify purchase behavior through digital receipt uploads to ensure unmatched targeting accuracy. For instance, if a consumer uploads a receipt for Frosted Flakes cereal from the past month, you can specifically target verified Frosted Flakes buyers in your survey.

This method is far more reliable than self-reported preferences, as it's based on purchase actions rather than respondent claims.

❇️ Verified Digital Behavior Targeting

In addition to product receipts, we track respondents' verified digital activities, allowing you to target based on websites visited or services used. This enhances the relevance of your survey audience by relying on real behaviors, not self-reported preferences.

❇️ Multilayered Fraud Prevention Measures

We implement comprehensive anti-fraud measures throughout the survey process, including unique user ID tracking that prevents duplicate responses, sophisticated trap questions that challenge automated systems, advanced IP validation technology to block VPN and proxy users, and response timing analysis to identify suspicious answering patterns.

This is just the tip of the iceberg. Ensuring the highest data quality isn’t just a priority, but a core part of who we are as a company. Through our parent company, Prodege, we continually invest in cutting-edge technologies, rigorous methodologies, and top-tier talent to maintain our position as an industry leader in data quality.

Get Fast Survey Results for Both Mainstream & Niche Audiences

We pride ourselves on delivering high-quality survey results faster than many competitors:

❇️ Within hours for broad mainstream audiences

When targeting broad demographics (e.g., U.S. adults about their dining habits), you can typically collect 500+ responses within hours. This impressive speed is driven by our large, highly engaged proprietary respondent communities.

❇️ Within days for specialized niche audiences

For more specialized audiences (e.g., HR decision-makers at companies with 500+ employees), the process naturally takes more time — typically several days. However, even for niche groups, our turnaround times consistently outpace self-service market research platforms, and far exceed traditional research firms, which can take weeks or months.

Please note: Our team can provide precise turnaround estimates based on your exact targeting parameters. Reach out here for more information.

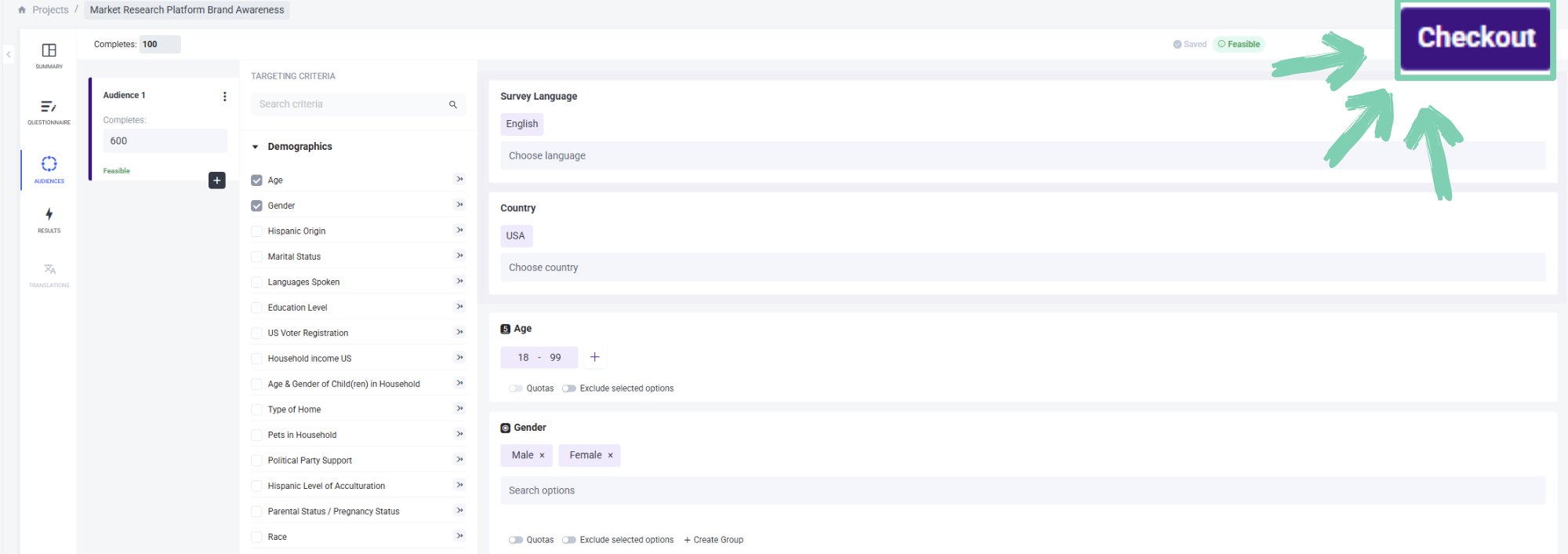

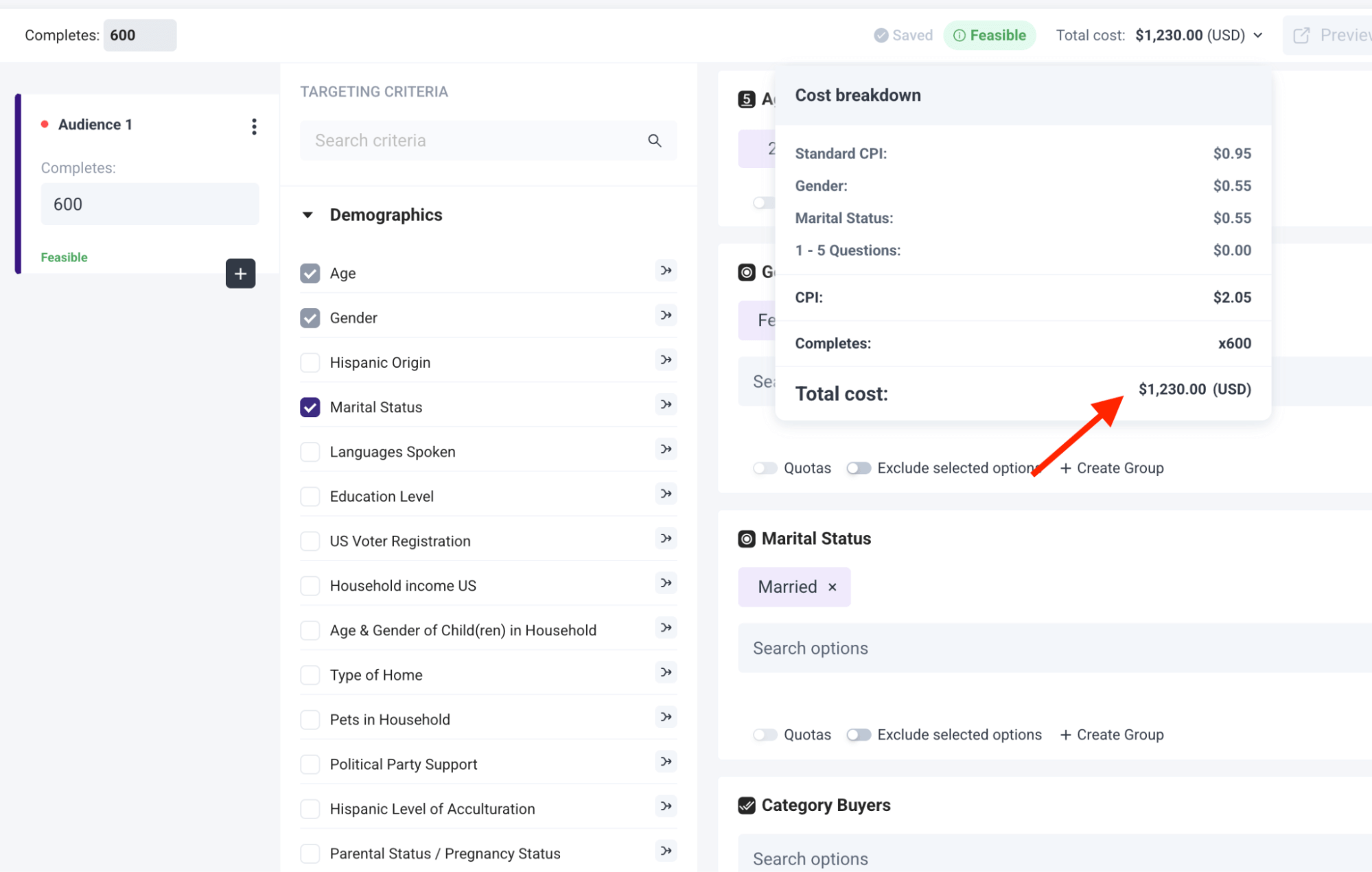

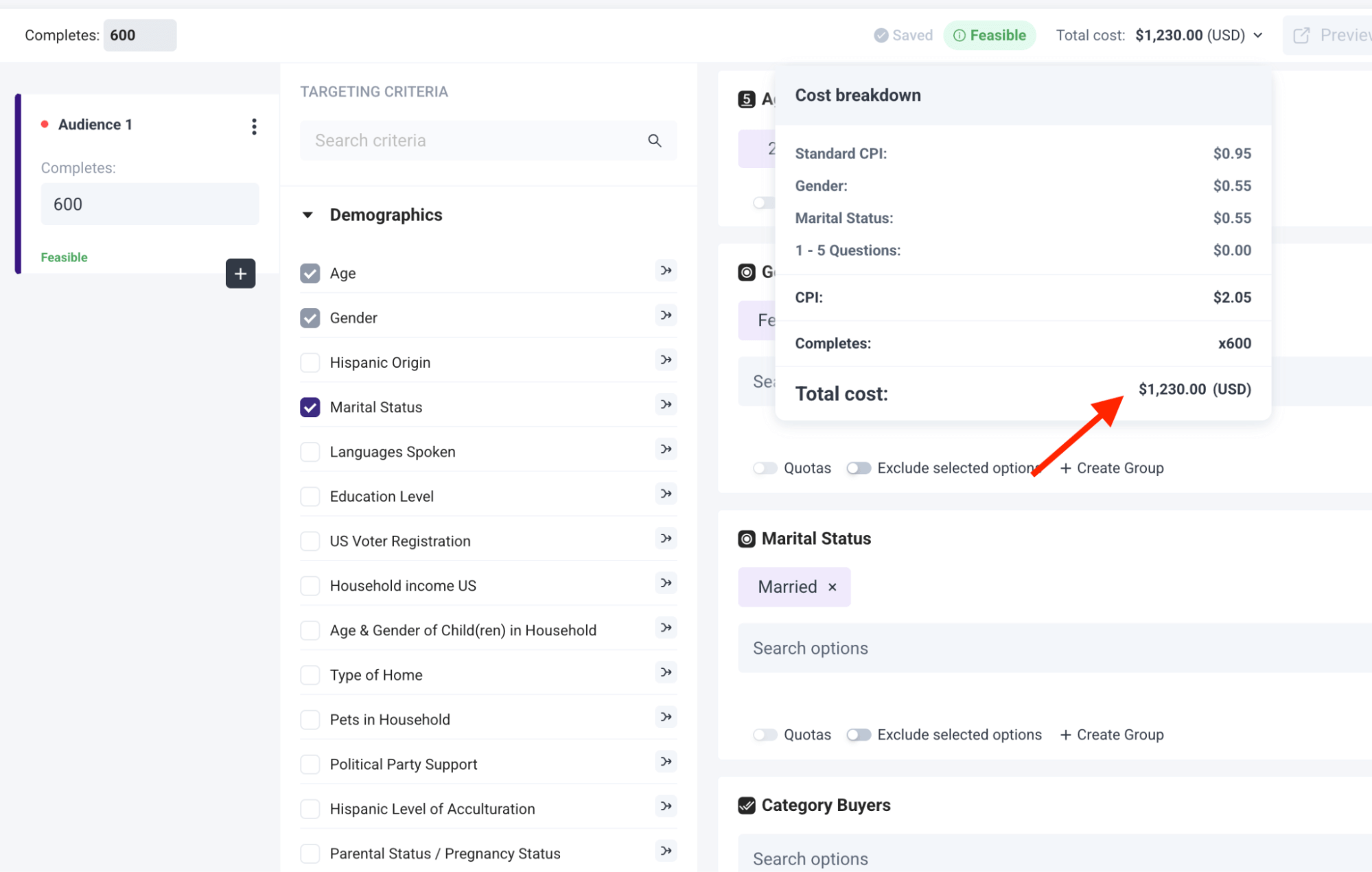

Transparent, Usage-Based Pricing: Only Pay for What You Use

We've designed our pricing structure to be straightforward, flexible, and free from the hidden costs that plague many other market research platforms:

❇️ Only pay for what you use

With our pay-as-you-go model, you're only charged for the survey responses you collect, starting at just $0.95 per response. There are no expensive monthly or annual subscriptions, and you’re never locked into paying for capacity you might not use. As your research needs fluctuate, our pricing adapts accordingly — with no minimum commitments or rollover fees.

❇️ Include your entire team at no extra cost

We offer unlimited user access across your organization, without charging per-seat license fees. Whether you have 5 team members or 50, everyone can create surveys, analyze results, and export reports with no additional charges. This stands in stark contrast to competitors who charge substantial fees for each additional user.

❇️ See your total cost for each survey before you commit

Our platform displays your complete project cost in real-time as you build your survey, showing both per-response rates and total cost.

For example, if you're creating a consumer preferences survey targeting women aged 25–45 who shop at specialty grocery stores, you'll see the base cost ($0.95), plus additional costs for each targeting parameter (perhaps +$0.55 for the gender filter and +$0.55 for the shopping behavior filter), giving you a total of $2.05 per response.

If you need 600 responses, you'll immediately see your total project cost of $1,230 before launching — no surprises, no hidden fees, and no unexpected charges appearing after your survey is complete.

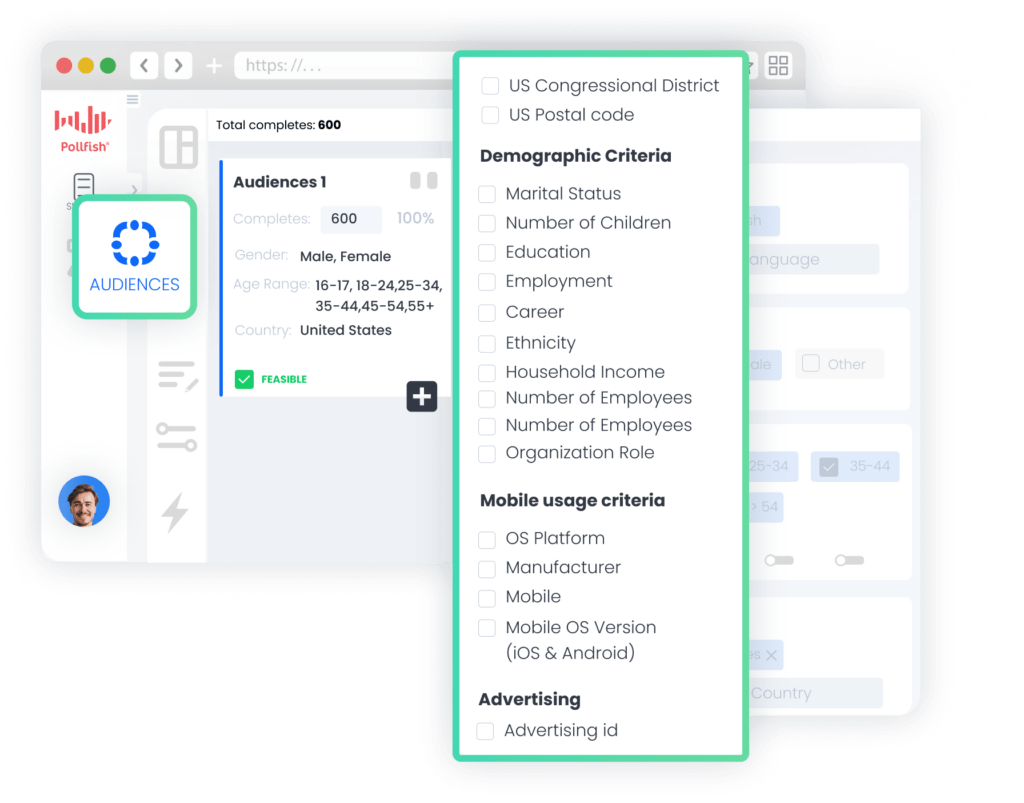

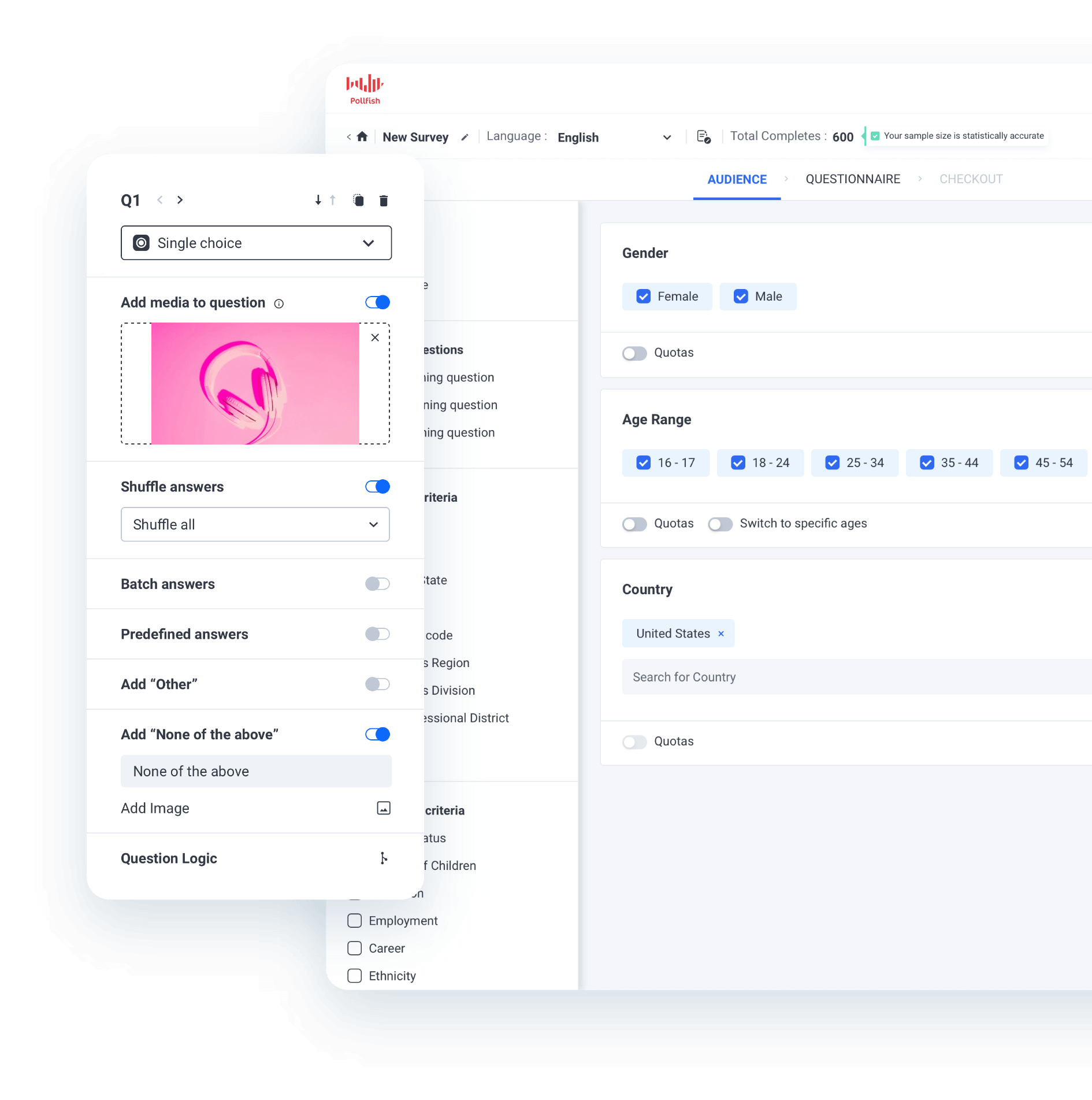

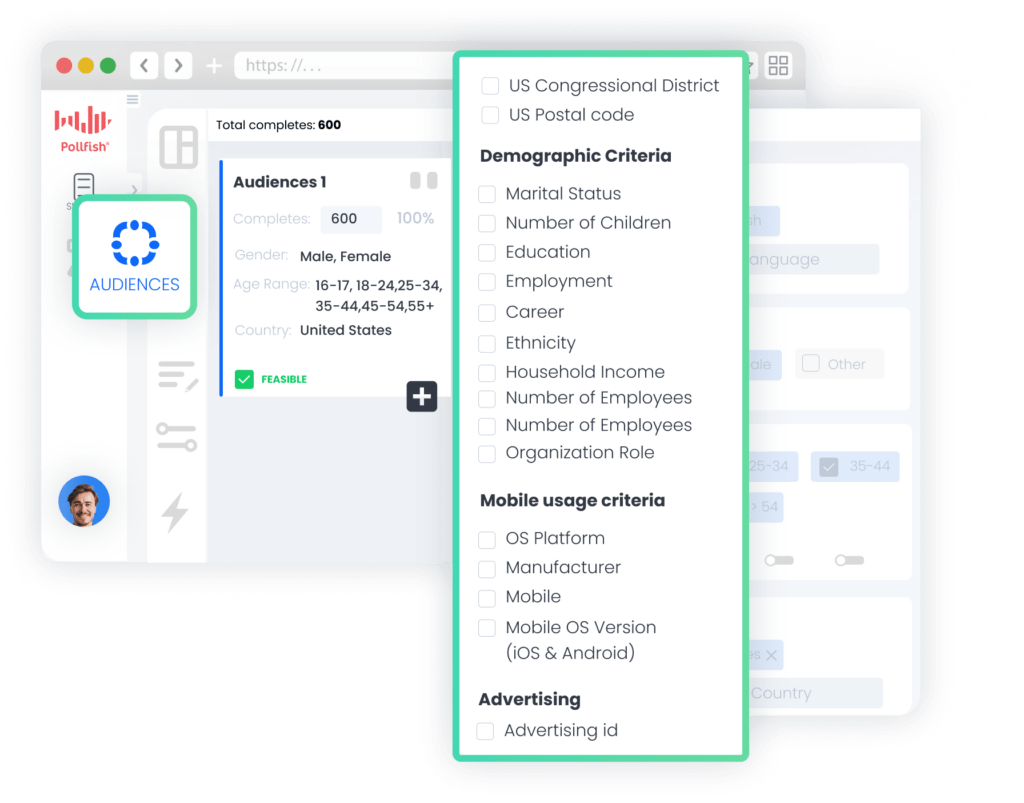

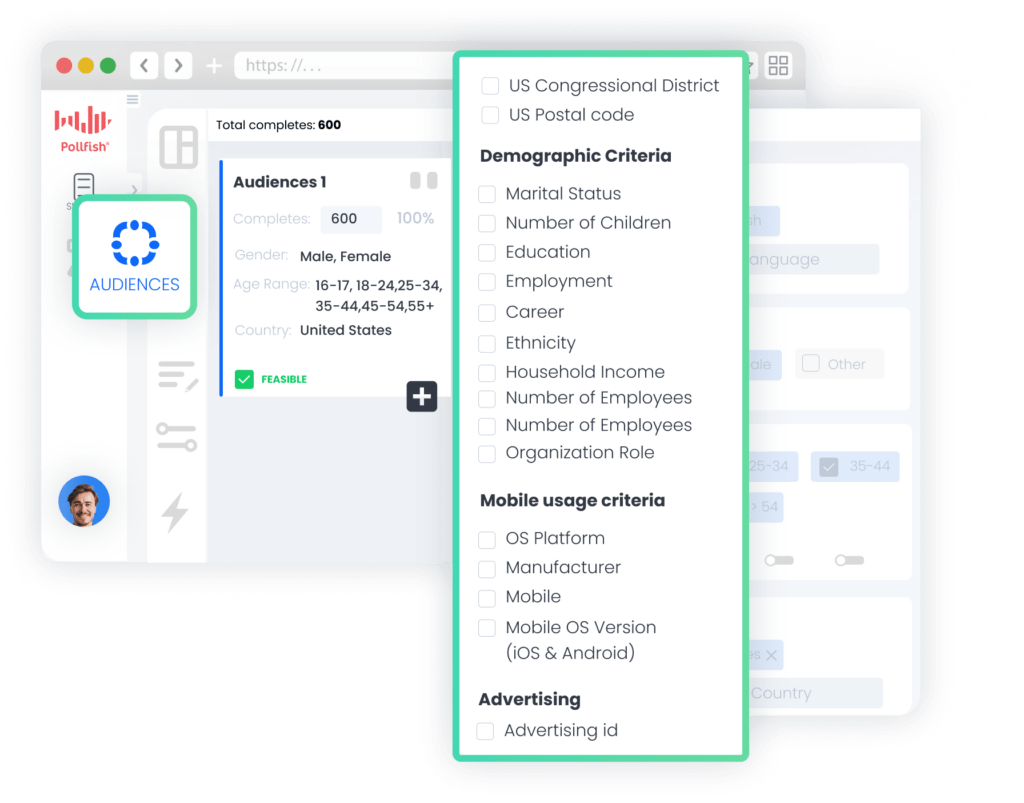

Precise Audience Targeting Capabilities

Some tools force you to settle for broad, generic audiences, limiting your ability to target the niche segments crucial for your research. With Pollfish, you never have to compromise:

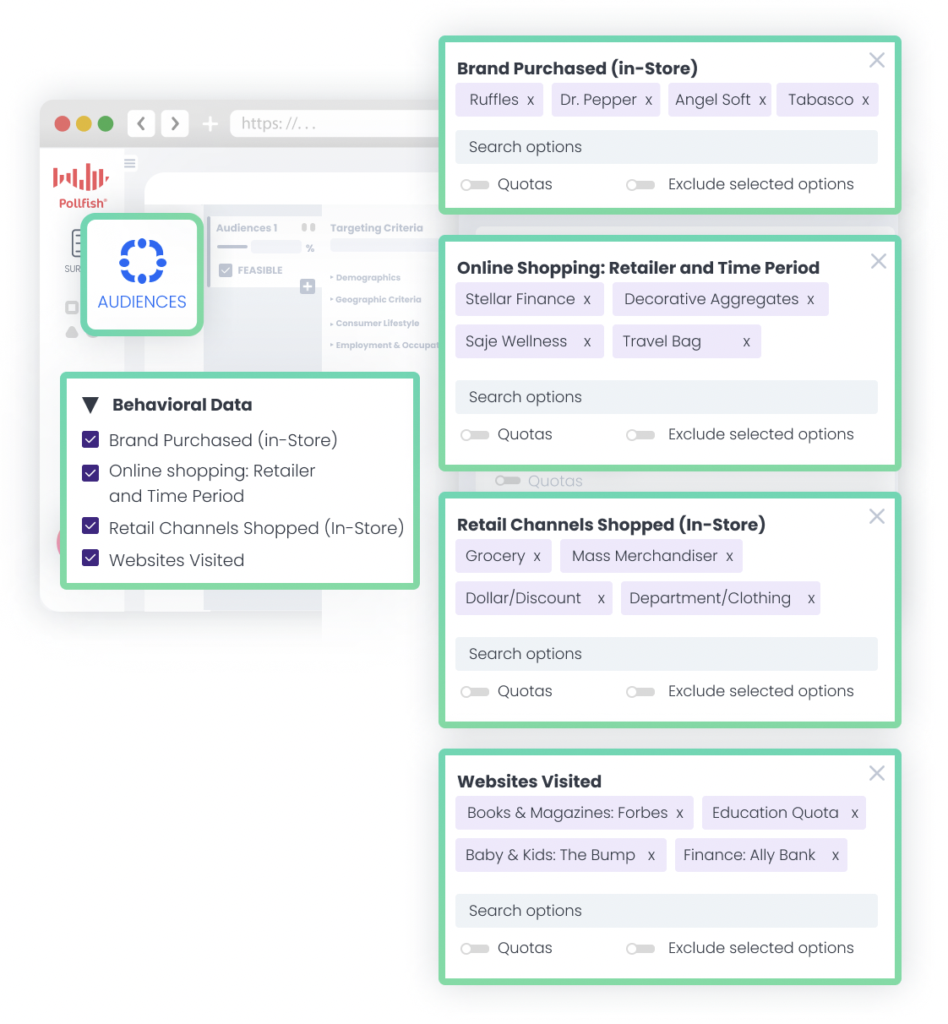

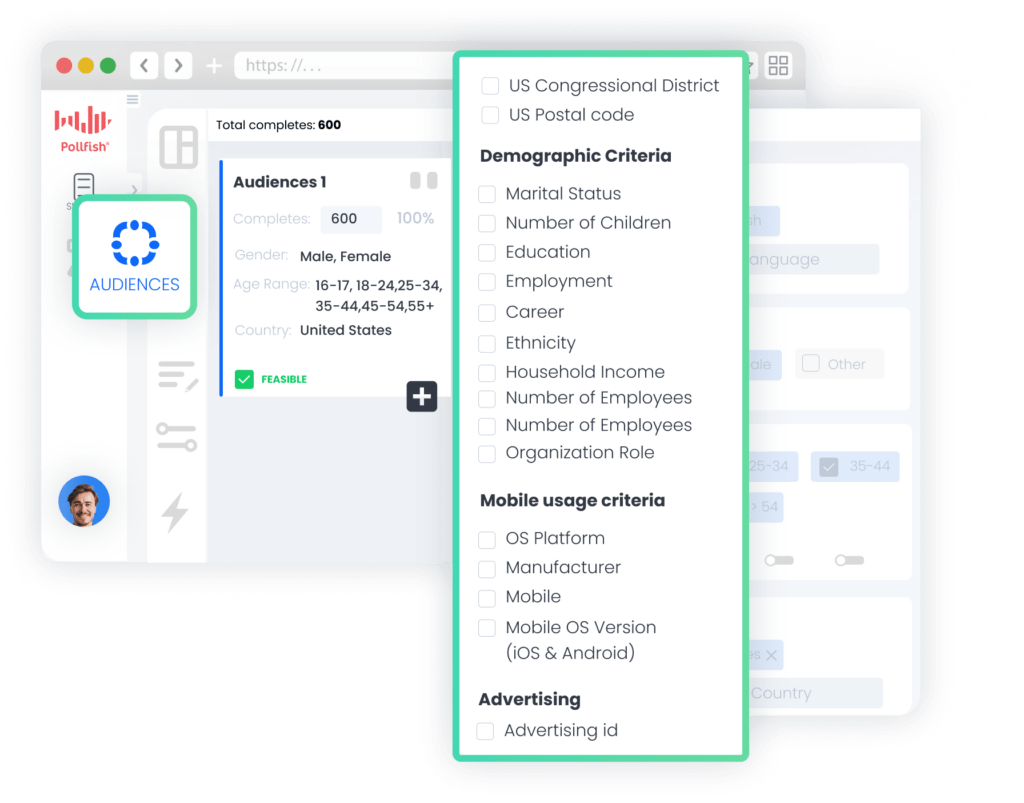

❇️ Comprehensive Targeting Parameters

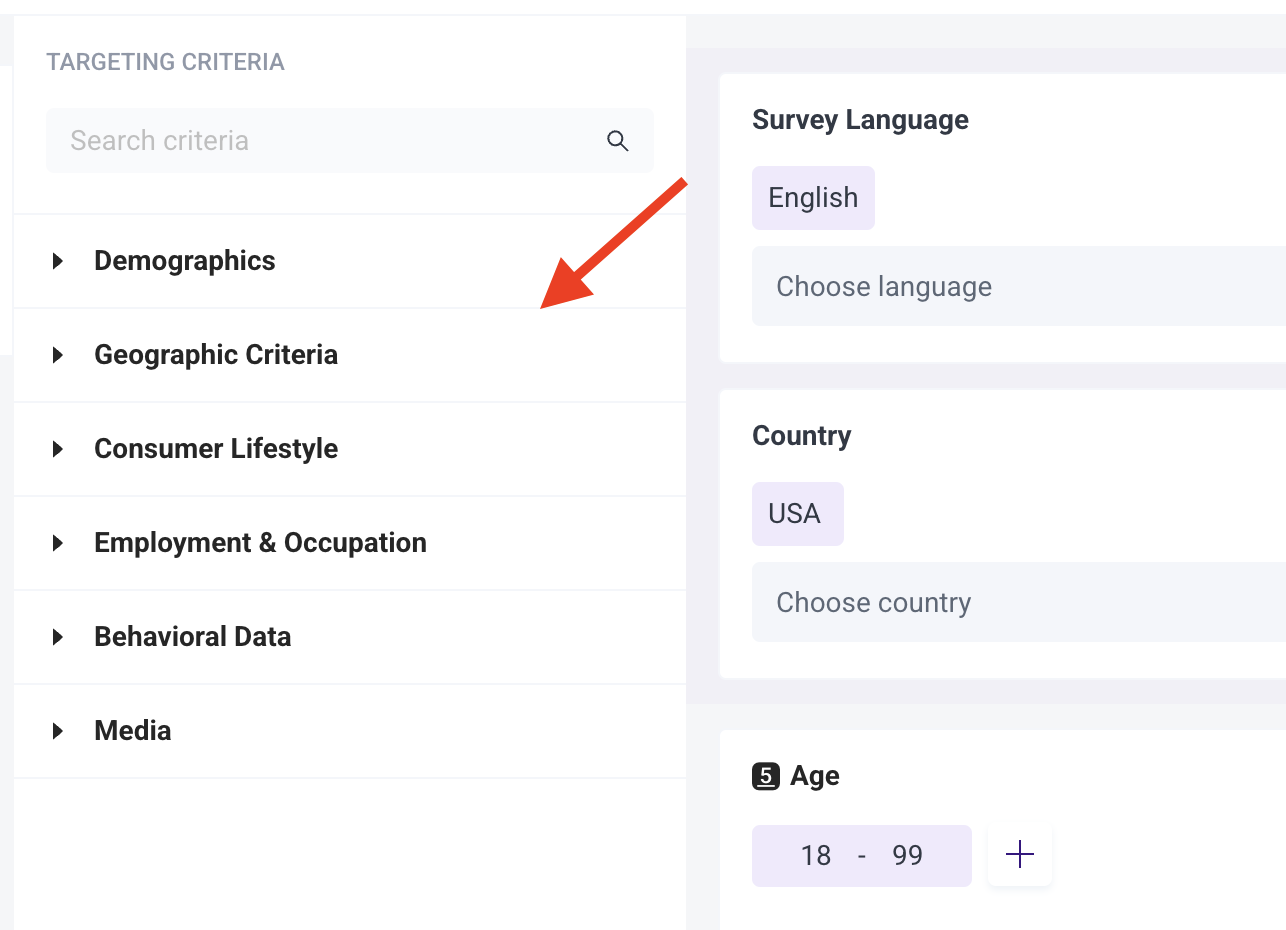

Select from over 50 distinct targeting criteria across six intuitive categories (Demographics, Geographic, Consumer Lifestyle, Employment, Behavioral Data, and Media).

For example, you can select broad parameters like "College-educated professionals" or hyper-specific segments such as "Female corporate executives ages 35–44 in the Pacific Northwest who own German luxury vehicles, have purchased organic coffee in the last month, and use financial planning apps."

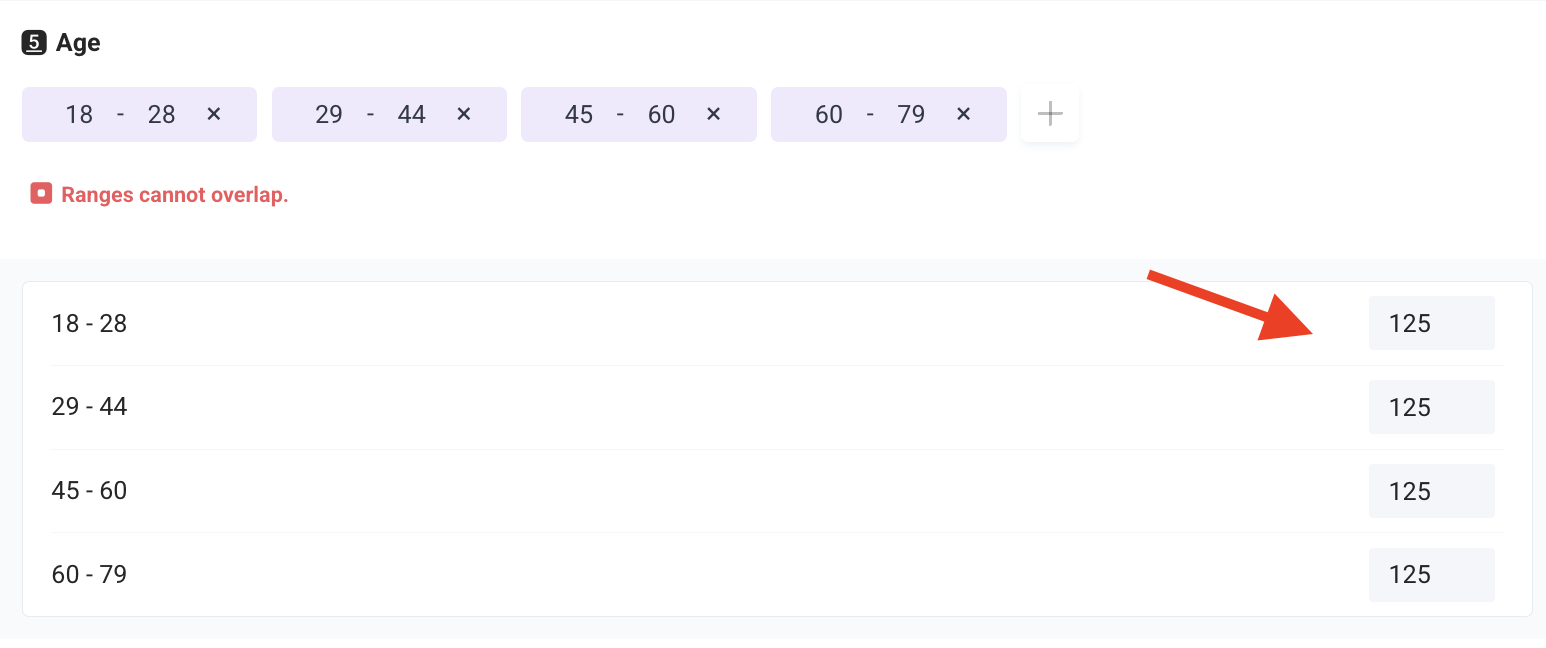

❇️ Audience Quota Management

Set precise demographic distribution requirements to ensure perfectly balanced representation across key segments. This prevents skewed results from overrepresentation while maintaining statistical validity.

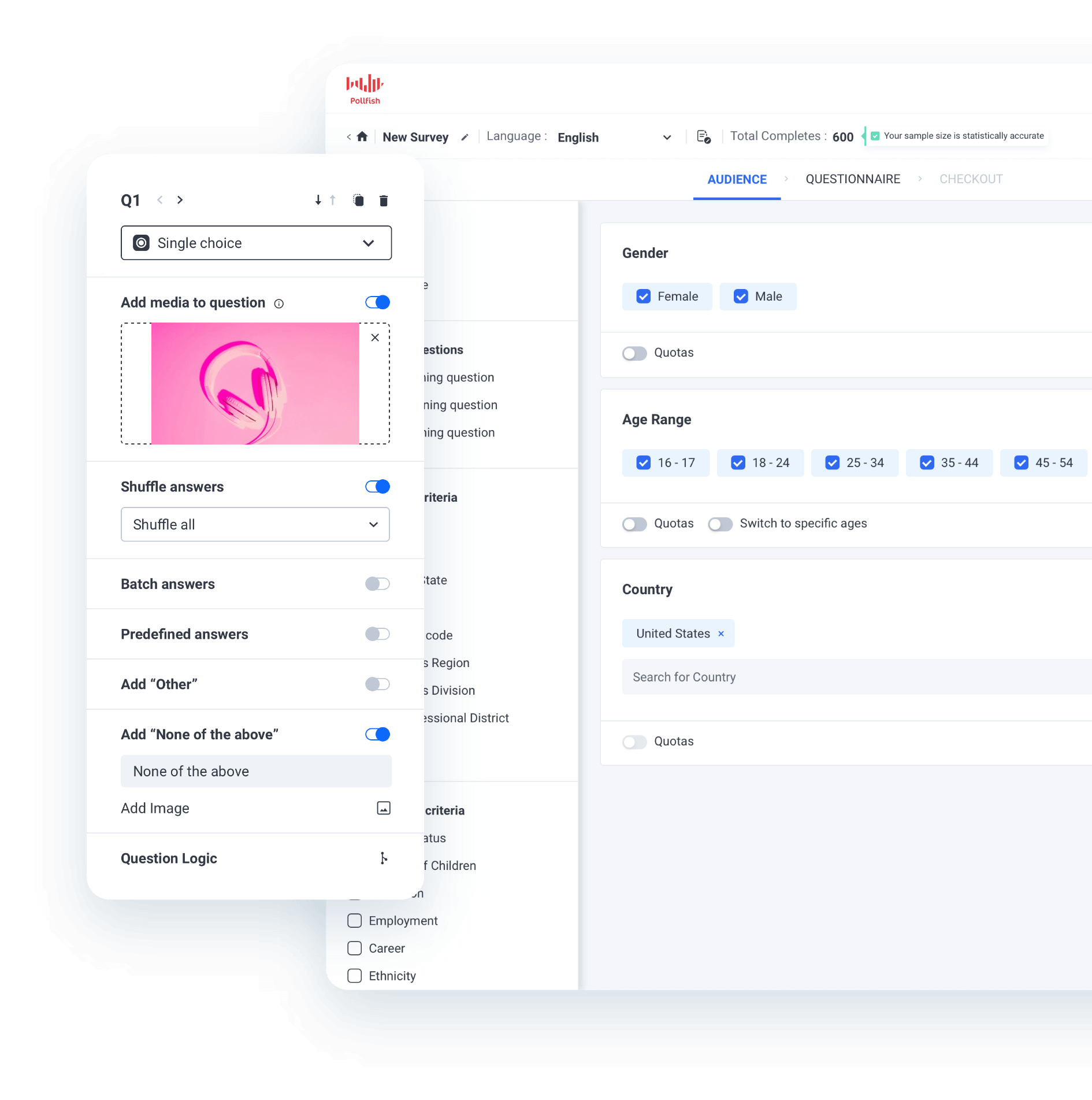

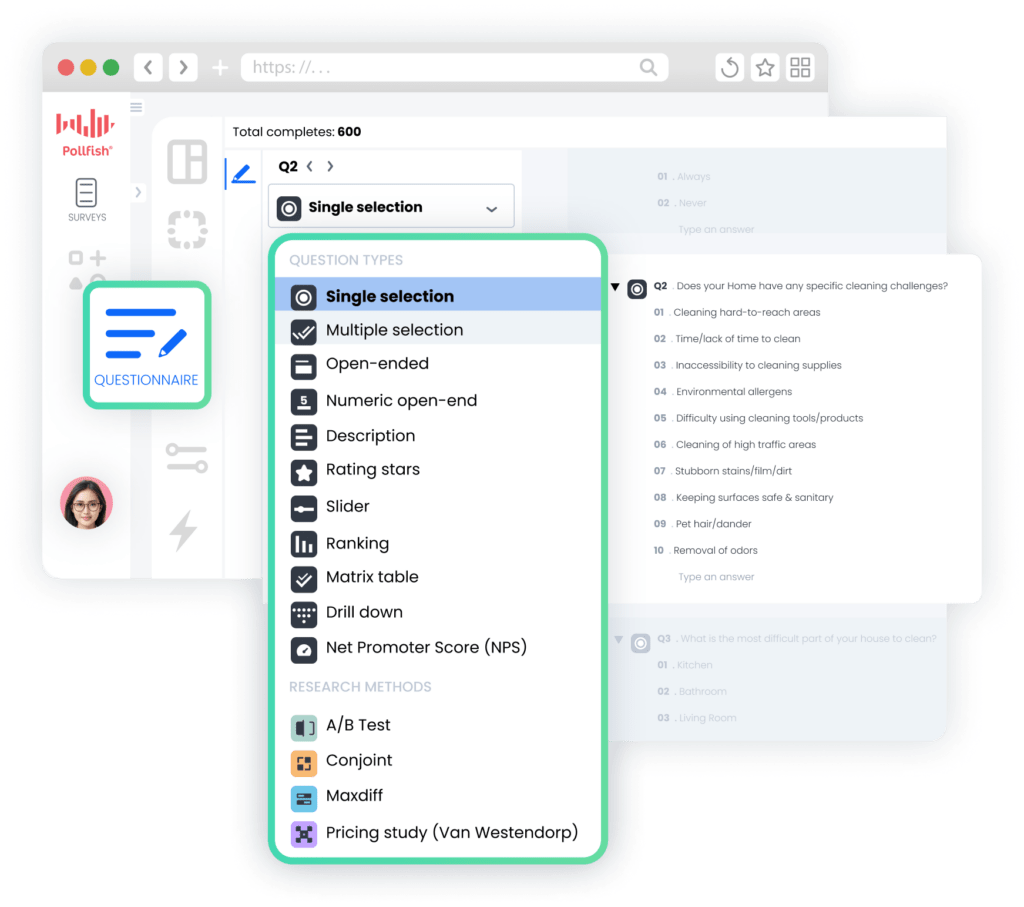

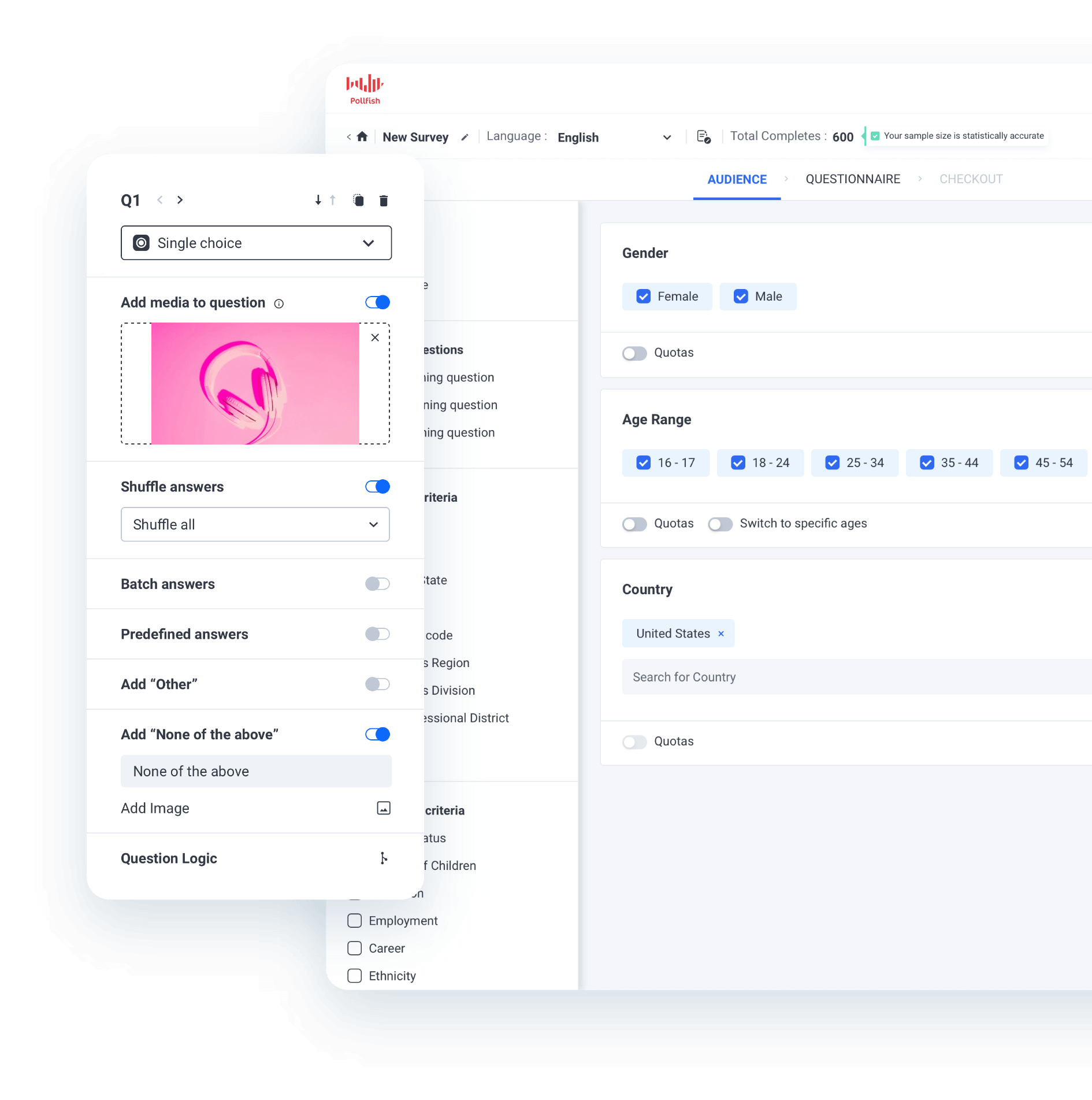

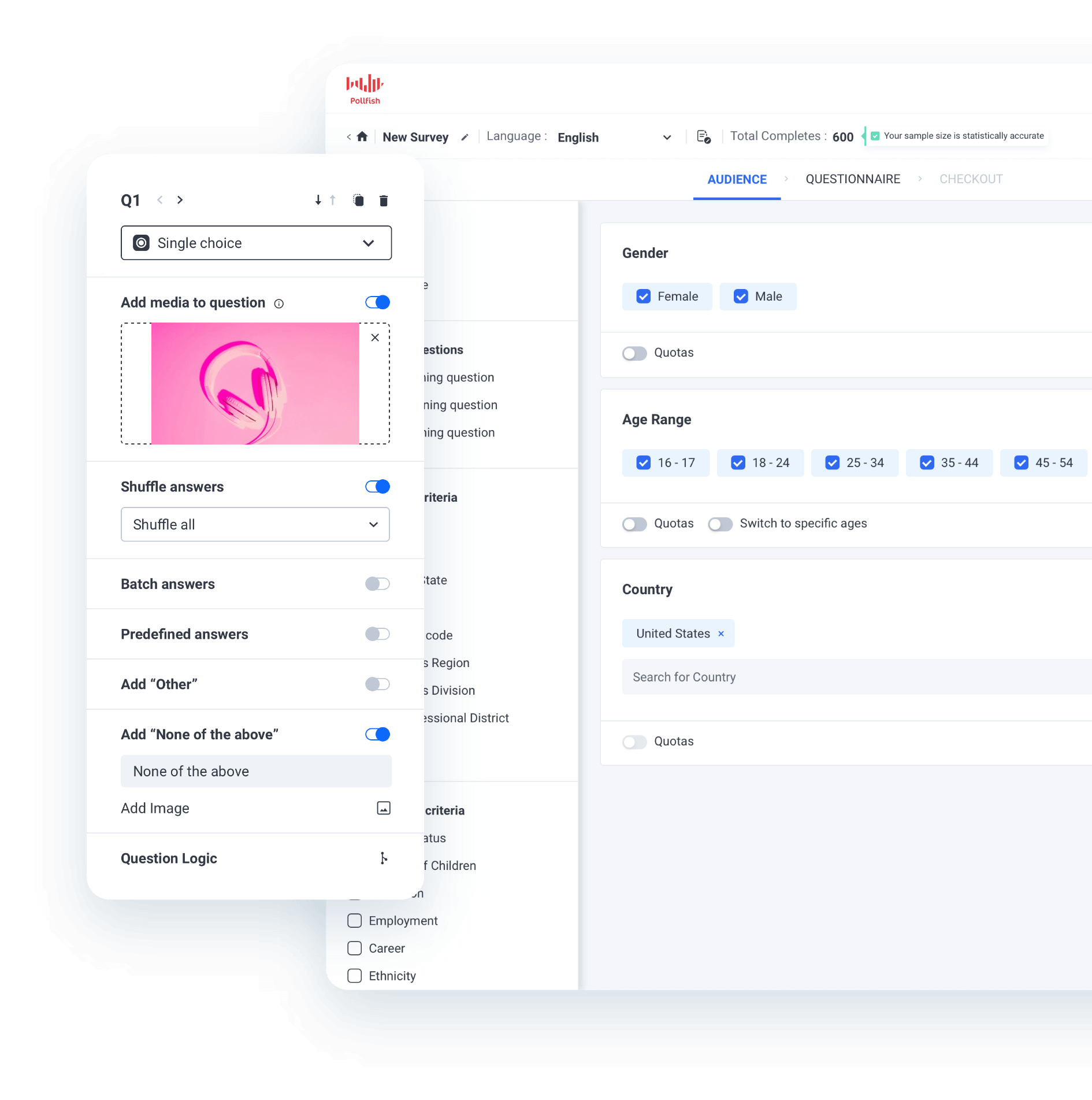

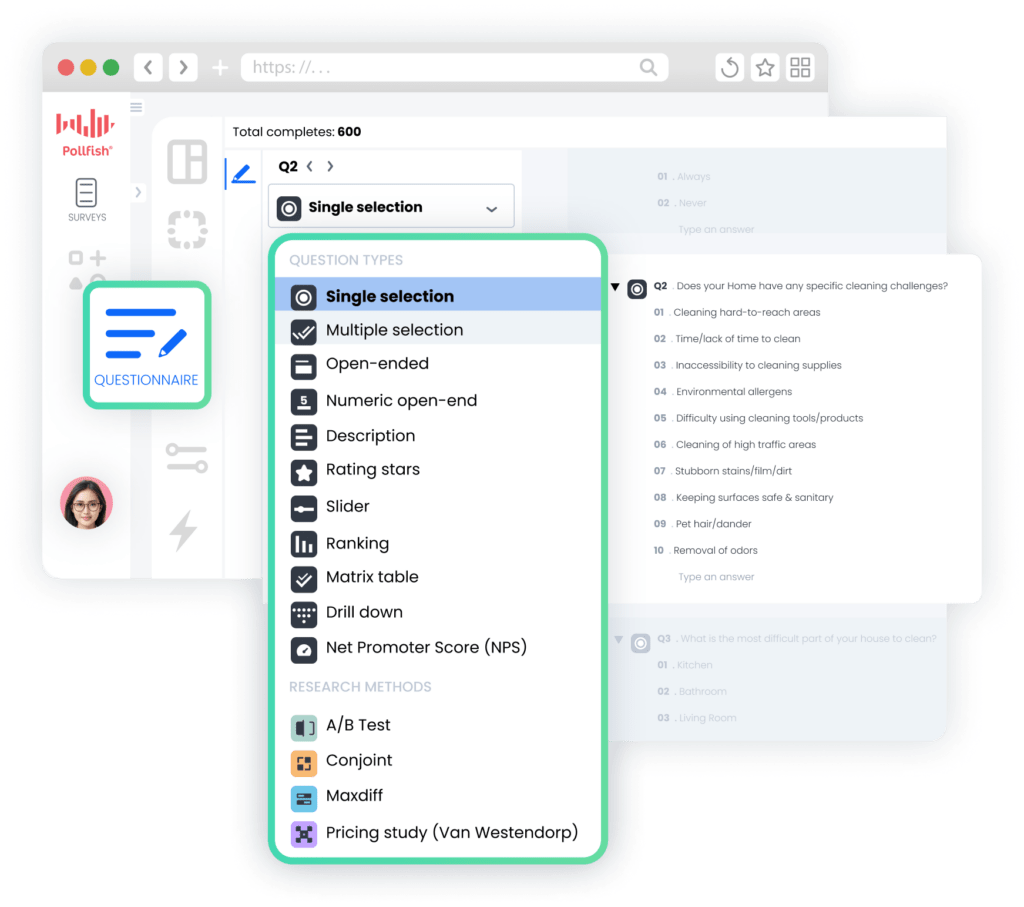

Flexible Questionnaire Design Tools

Many tools force you to compromise on survey design for advanced questionnaire functionality (e.g., complex question types, intricate branching logic).

In comparison, with Pollfish, you get:

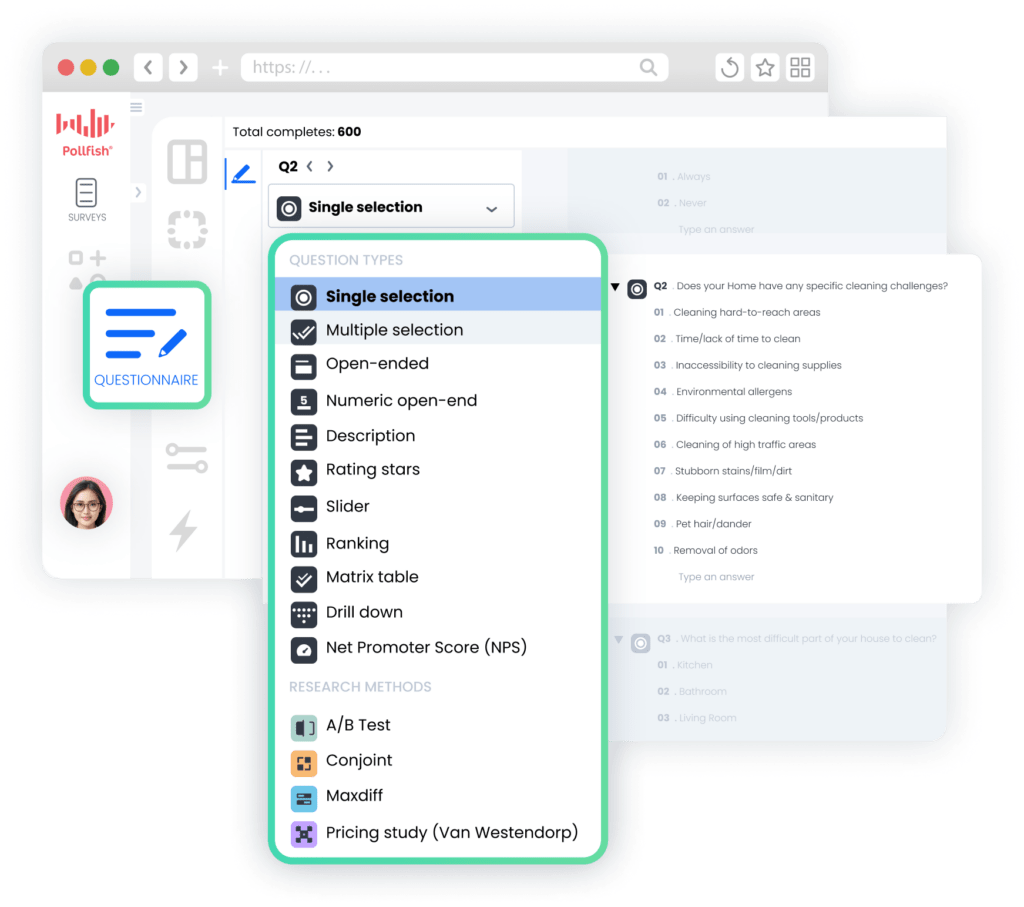

❇️ Diverse Question Type Library

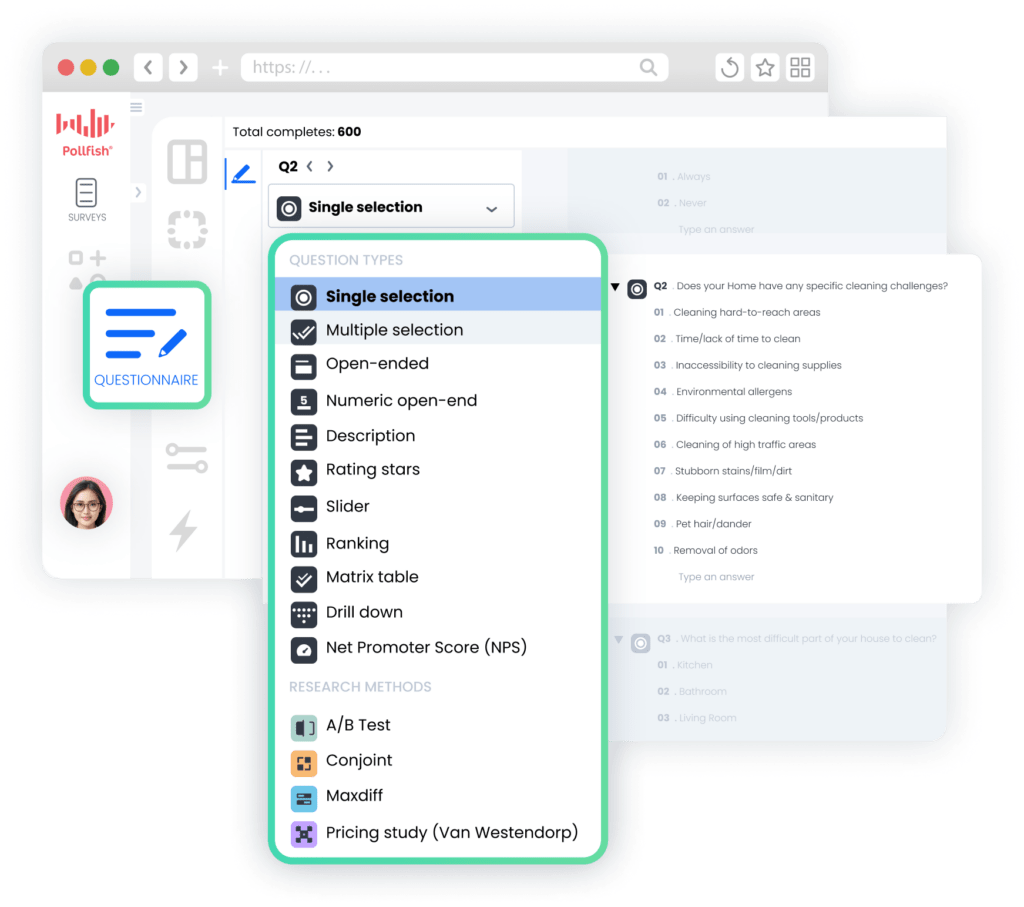

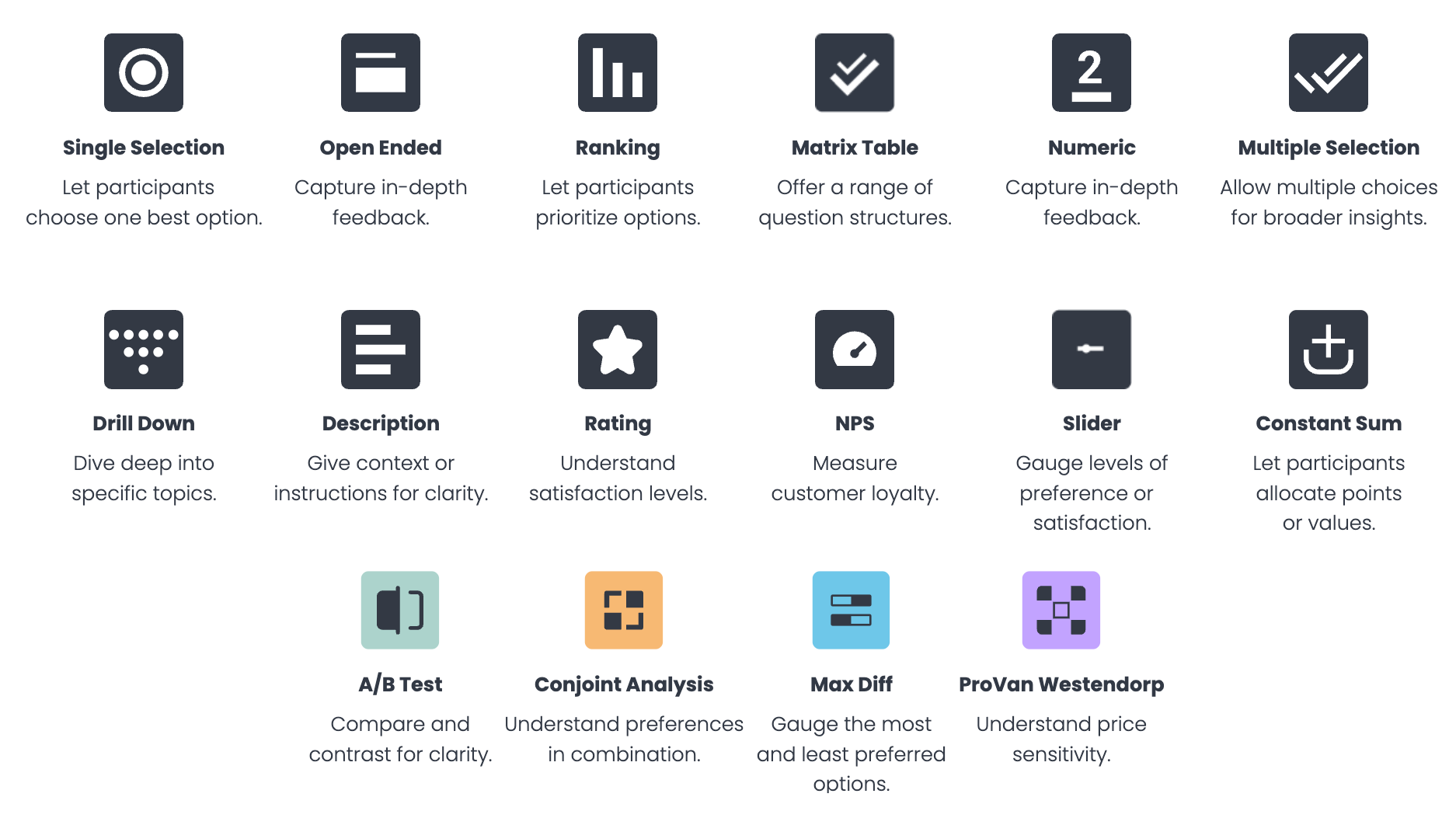

Choose from 14 question formats, from basic (single/multiple selection, open-ended questions) to advanced (matrix questions, slider scales, ranking), plus specialized research methods (conjoint analysis, MaxDiff, Van Westendorp pricing), and more.

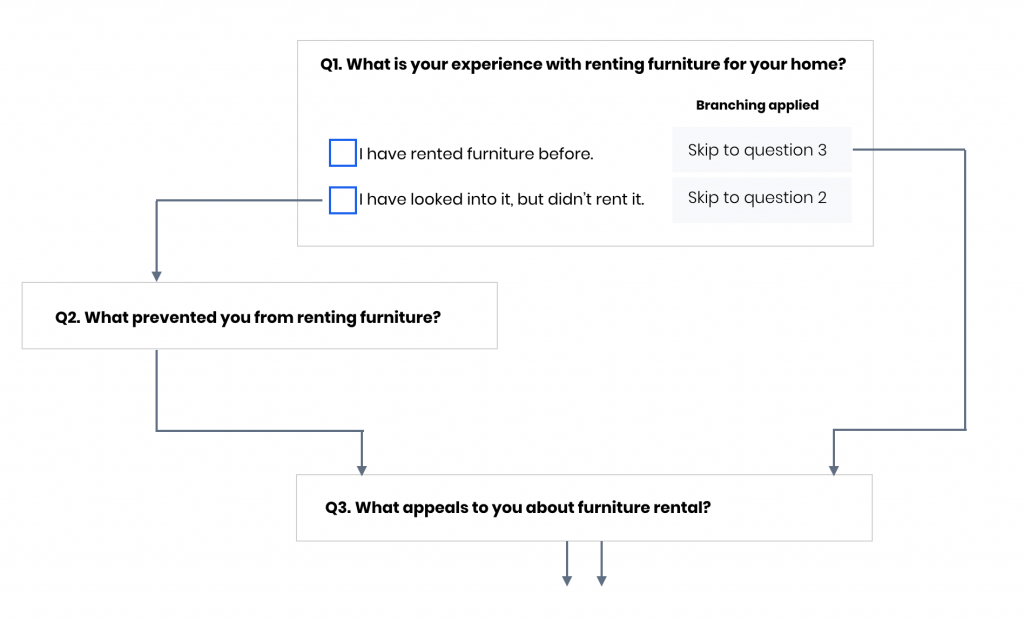

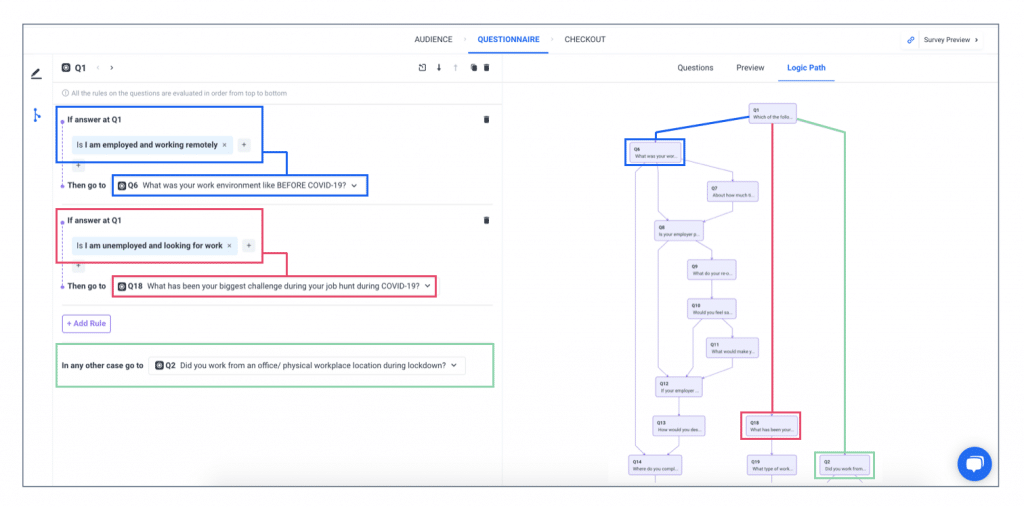

❇️ Sophisticated Skip Logic and Branching

Create personalized survey paths based on prior answers, allowing different respondent segments to view tailored question sets that maximize relevance and enhance the survey experience.

❇️ Bias-Reducing Randomization Features

Automatically shuffle question and answer choice positions to eliminate primacy and recency bias, improving data quality and preventing skewed results.

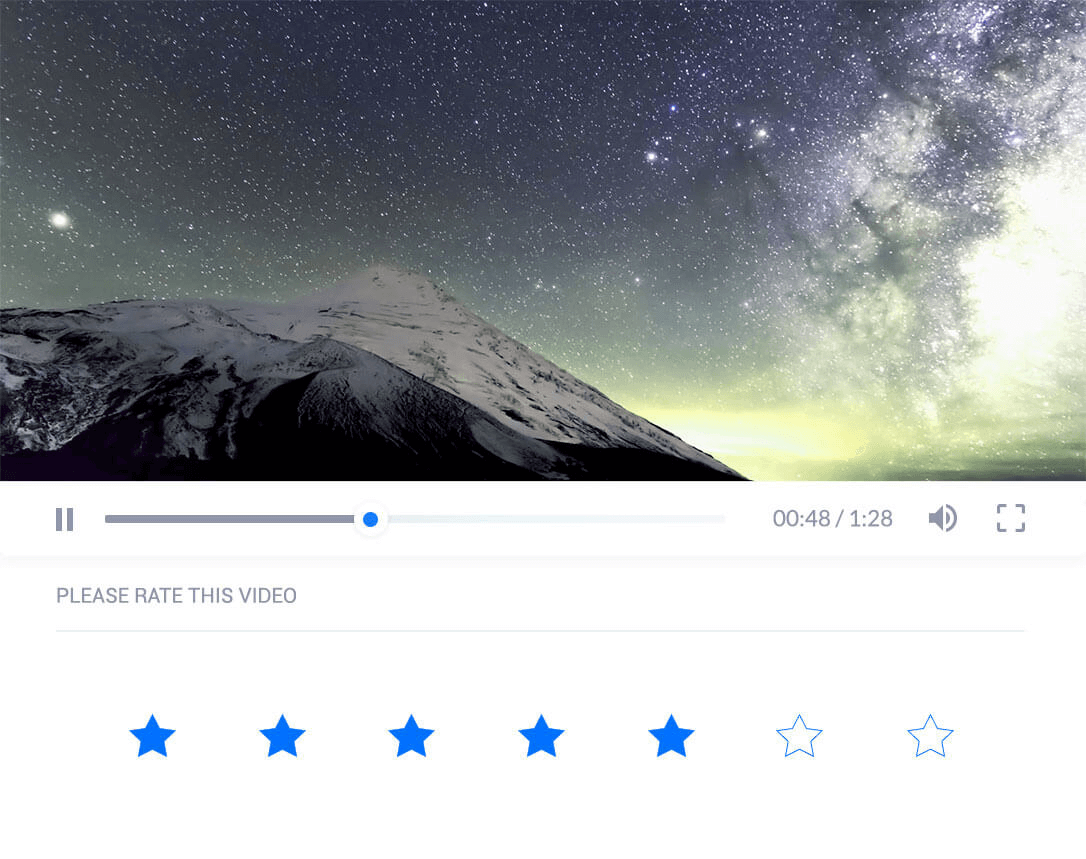

❇️ Multimedia Integration Capabilities

Easily incorporate images, videos, and audio into your survey questions, enhancing testing scenarios for concepts, advertisements, packaging designs, and more.

❇️ AI-Powered Survey Creation

Use artificial intelligence to generate professionally designed surveys from simple prompts, reducing development time and ensuring consistent application of best practices throughout your questionnaire.

❇️ Pre-Built Survey Templates

Access a library of expert-designed survey templates for common research objectives (brand tracking, customer satisfaction, concept testing, etc.), offering solid starting points that can be tailored to your needs.

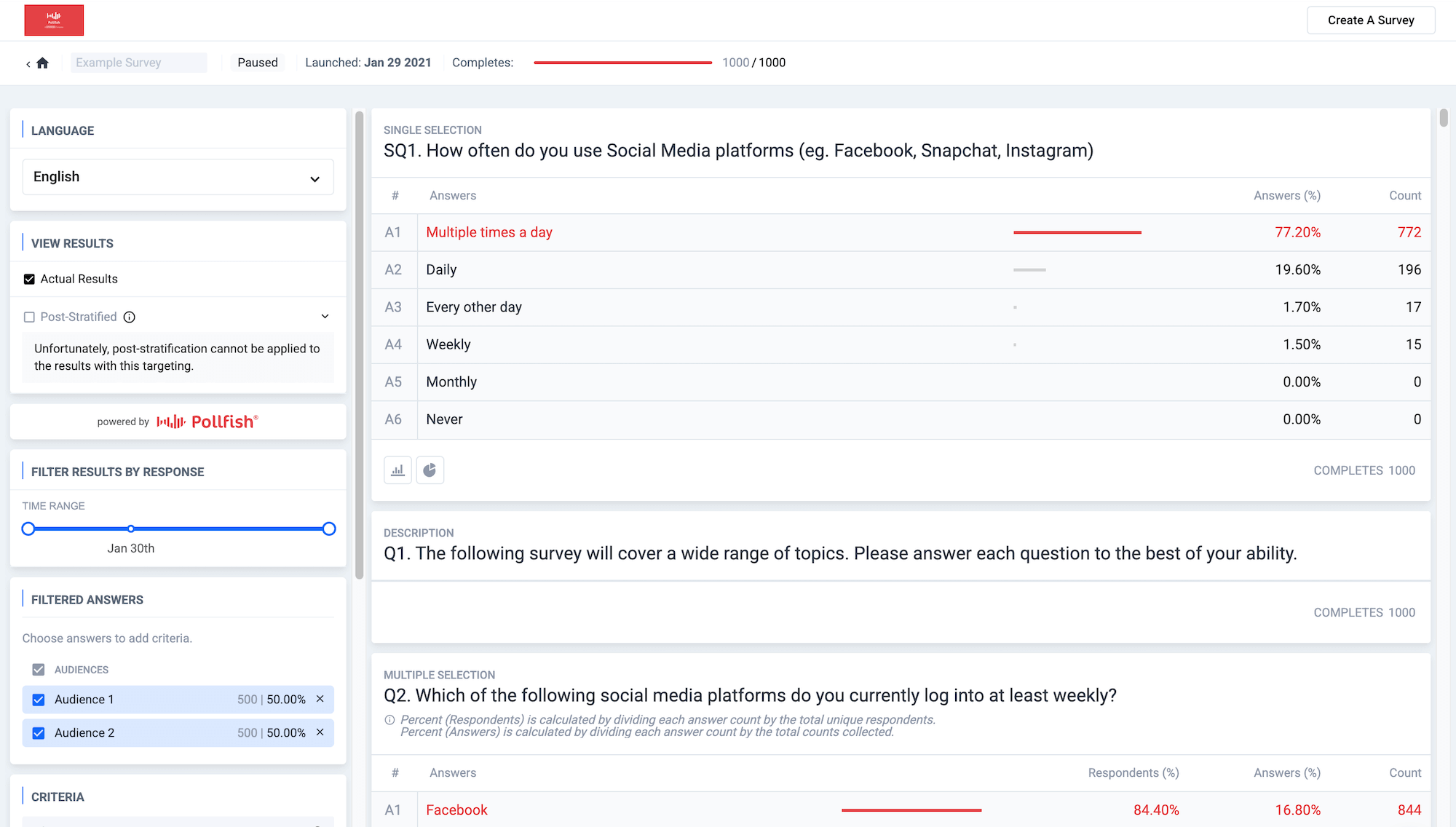

Powerful Data Analysis Capabilities

Many DIY survey tools bury insights under weak reporting features, forcing you to export to Excel and spend hours hunting for key data.

In contrast, Pollfish includes a suite of powerful reporting tools to uncover valuable insights, including:

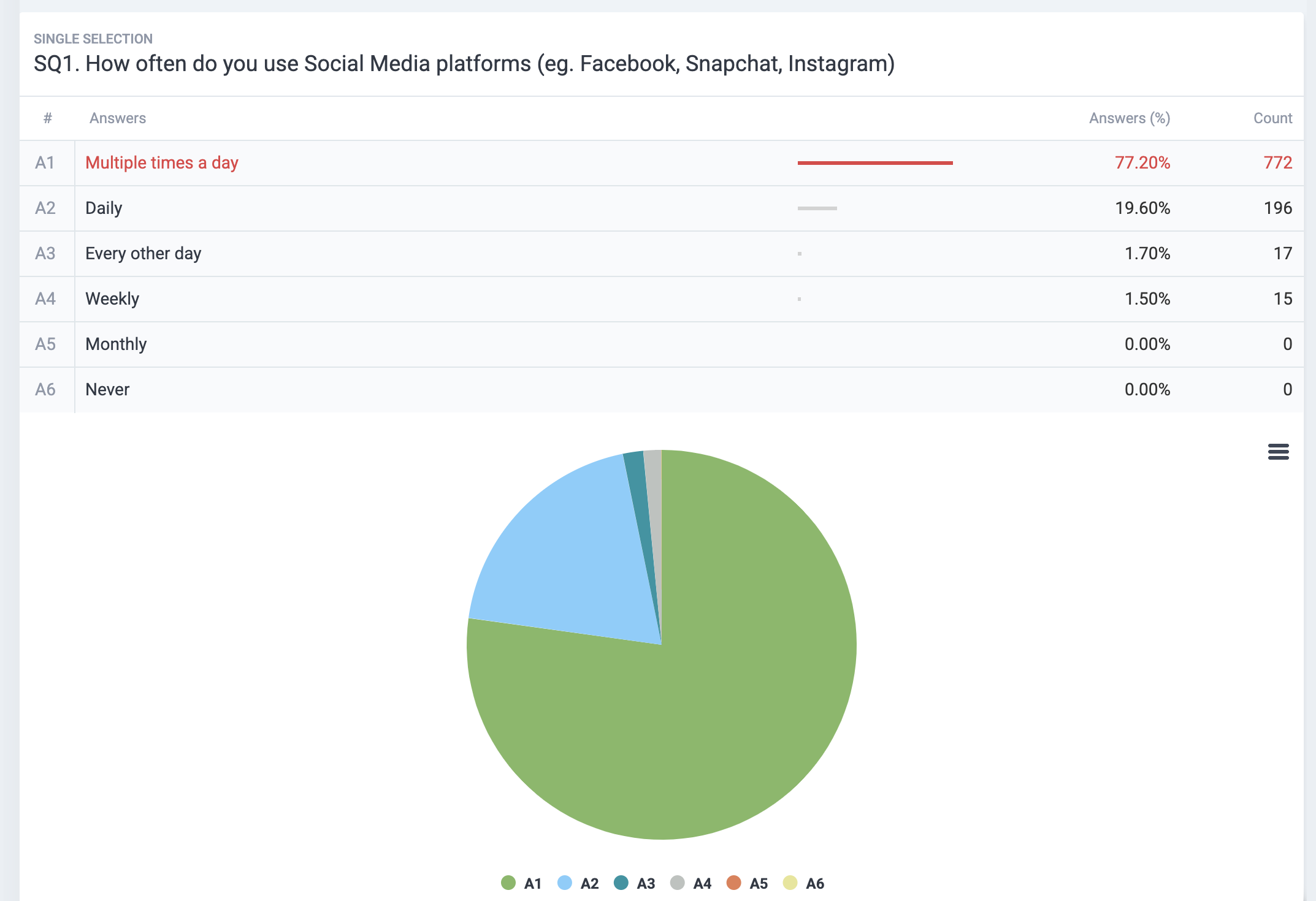

❇️ Real-Time Results Dashboard

Track responses as they roll in with dynamic visualizations. Spot trends early and adjust your strategy on the fly — no need to wait for full completion — enabling faster, smarter business decisions.

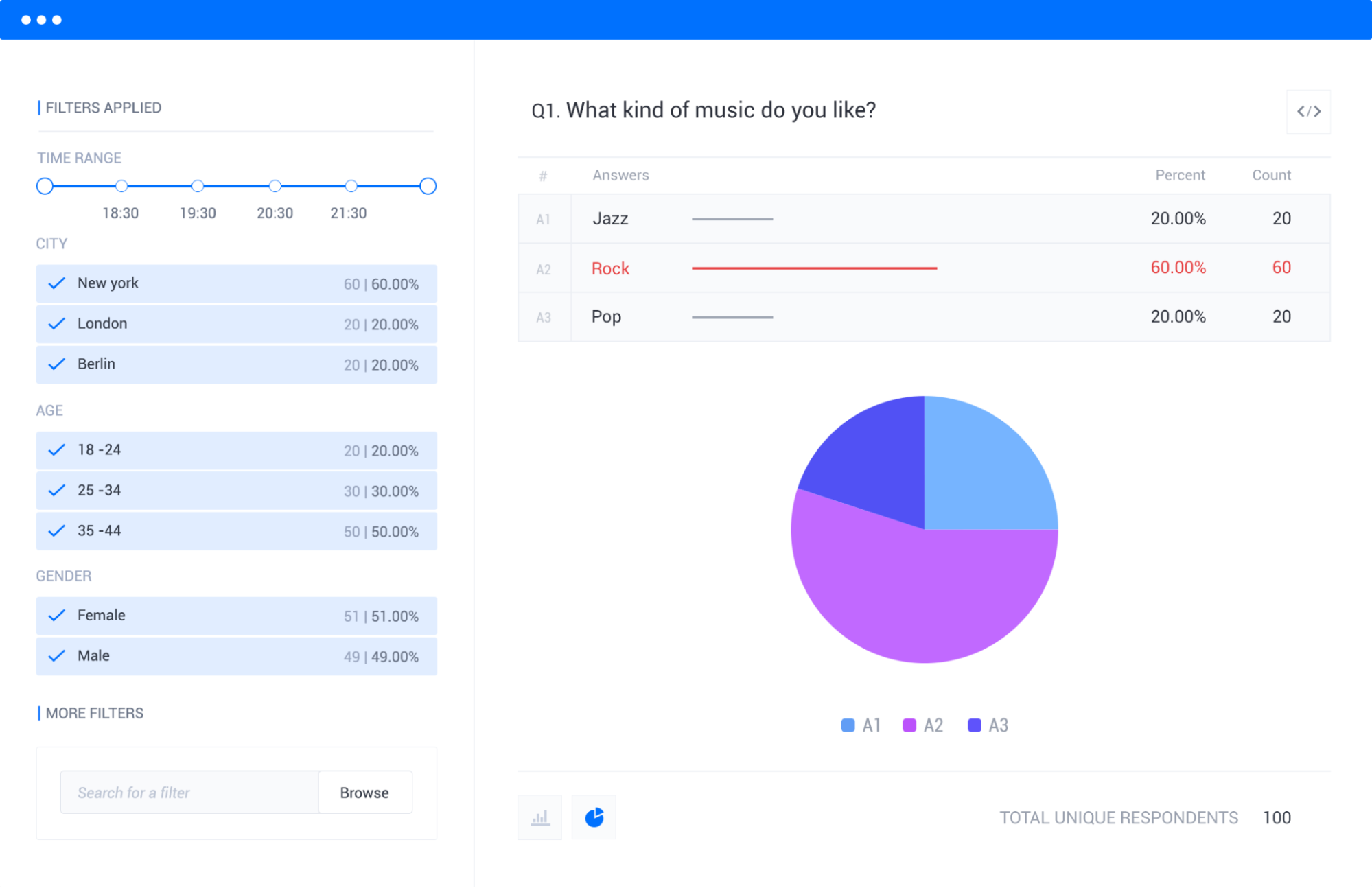

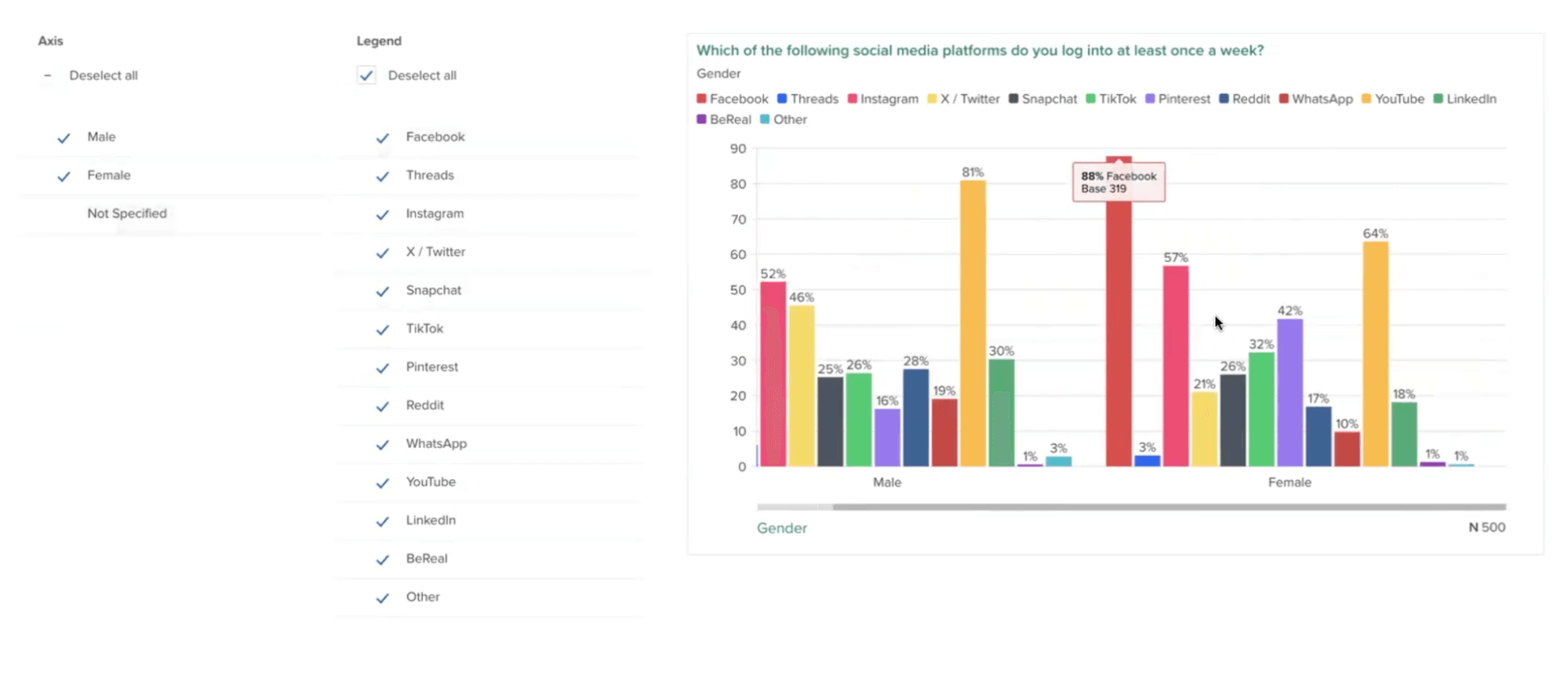

❇️ Multi-Dimensional Response Filtering

Instantly analyze results by specific demographic segments or response patterns (e.g., "show me responses only from dissatisfied customers in urban areas"), dramatically reducing the time between data collection and insight discovery.

❇️ Automated Statistical Significance Testing

See at a glance which differences between segments are statistically significant, eliminating guesswork and helping you avoid acting on random noise.

❇️ Customizable Data Visualization Options

Build the exact visualizations your report needs, from chart types to color schemes — professionally presented, aligned with your brand guidelines, and designed to make insights easy to grasp.

❇️Flexible Export Capabilities

Export research results and visualizations to multiple formats (PDF reports, Excel spreadsheets, SPSS files, PowerPoint presentations, etc.) — making it easy to share findings with stakeholders or dive deeper in specialized tools.

Get Started with a Free Pollfish Account

Sign up for a free account or schedule a one-on-one demo to explore how Pollfish can meet your specific needs and use cases.

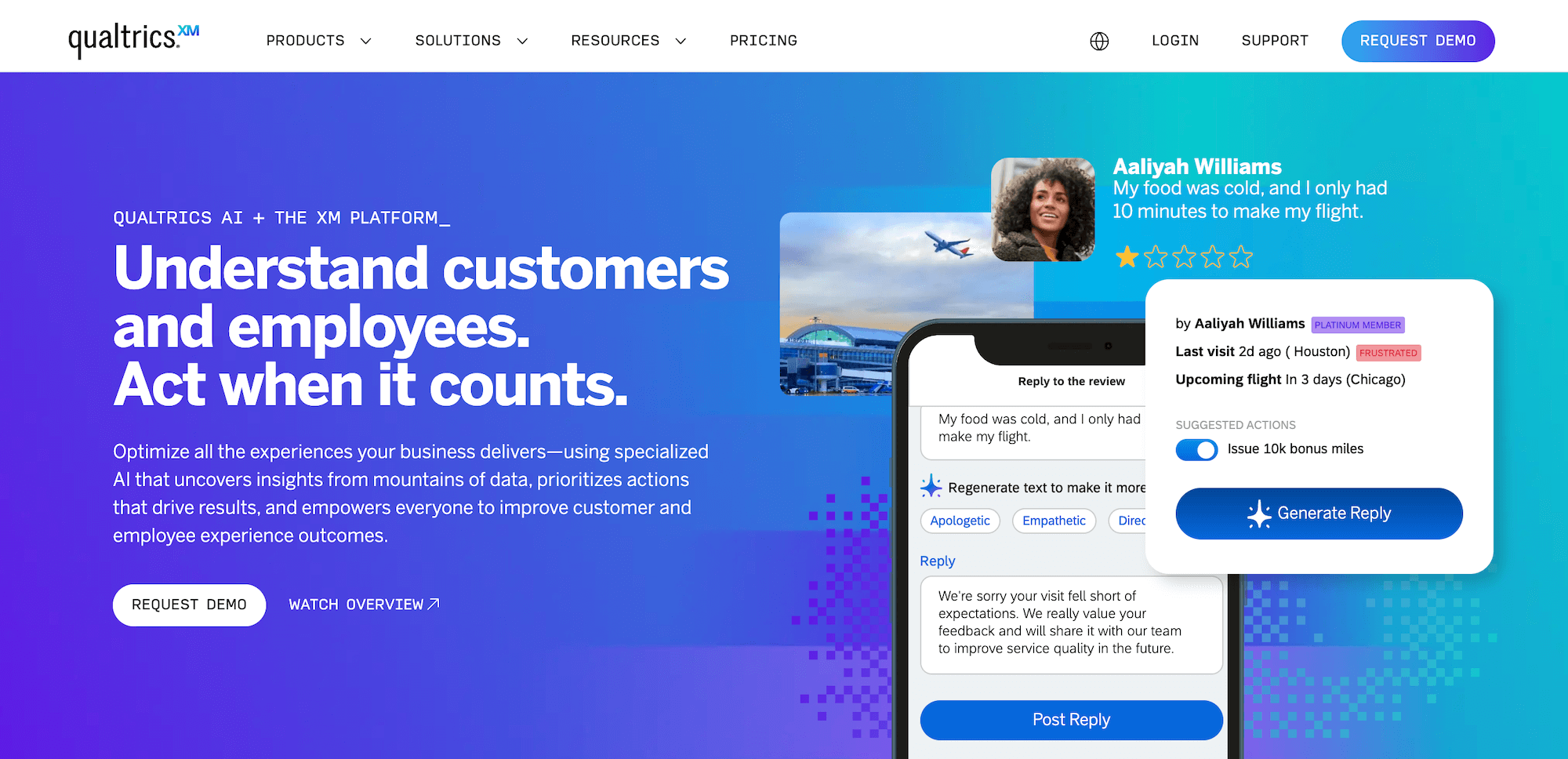

2. Qualtrics

While Qualtrics offers DIY survey functionality, its subscription pricing model with per-user license fees may be less accessible for smaller teams or occasional research.

Beyond surveys, Qualtrics positions itself as an end-to-end solution for organizations looking to manage the full spectrum of customer, employee, and market insights:

Customer Experience: Key features include Online Reputation Management, Contact Center Analytics, Agent Coaching, and Omnichannel Experience Management.

Employee Experience: Key features include Employee Retention Analytics, Continuous Employee Listening, and 360 Development Feedback.

Strategy & Research: Key features include Brand and Communication Research, User Experience Research, and Edge Audiences.

For companies focused on agile DIY market research, Pollfish’s emphasis on data quality, speed, and usage-based pricing may better align with their needs than Qualtrics’ broader offering.

3. SurveyMonkey

SurveyMonkey’s widespread brand recognition and simplicity make it a popular entry-level tool for basic DIY survey needs. However, companies looking for more robust audience targeting capabilities and stronger data quality controls may find SurveyMonkey's feature set and panel approach lacking compared to Pollfish's offering.

4. Suzy

Suzy offers do-it-yourself survey functionality, great for quantitative research.

Beyond this, they have a unique qualitative research offering called “Suzy Live,” which integrates 1-on-1 interviews, focus groups, and in-home product testing into one platform for comprehensive consumer insights. You can read more about it here.

For exact pricing, Suzy requires direct consultation, as plans are tailored to specific research volumes and use cases. Pricing may become costly for larger teams and higher volumes.

5. Google Forms

Google Forms is a simple, no-cost option for those who need a quick way to collect data from known contacts, such as their own customers, employees, or mailing lists. Its seamless integration with Google Workspace makes it convenient for collaboration and data analysis within that ecosystem.

While Google Forms doesn't provide audience targeting functionality (you'll need to find respondents yourself), this limitation may be irrelevant depending on your specific needs and existing contact base.

Get Started with Pollfish Today

Sign up for a free account or schedule a one-on-one demo to discover how Pollfish can meet your specific needs and use cases.

Getting Around Pollfish

Whether you're running a quick pulse check or a complex study, the Pollfish Platform is built with smart, intuitive features, designed to help you confidently launch the right survey to the right audience.

Let’s take a tour of the essentials.

🏠 Your Survey Dashboard

It's where all your projects live.

Drafts, under approval, running, and completed surveys

Create a new project or duplicate an old one

Track real-time performance

Download & export your results anytime

📝 Build Your Questionnaire

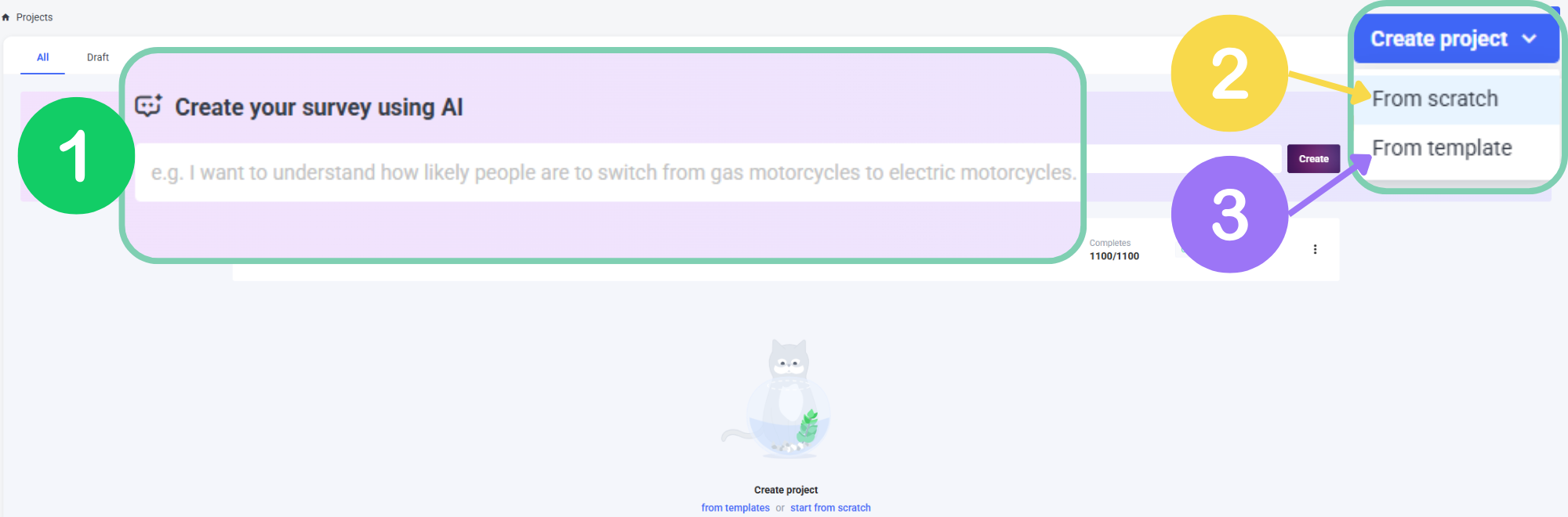

From your survey dashboard, there's 3 ways to build a survey:

With AI: Let our fully conversational research assistant help you craft high-quality surveys with expert precision and minimal effort. Or paste a pre-built survey into the prompt and let us build your survey for you. Then modify, translate, and adjust response options, all with expert guidance.

- From Scratch: Import a pre-built survey, copy/paste questions & answers or add any question type, text, images, logic jumps & more. Everything is fully customizable.

From a Template: Choose from over 20 popular and fully customizable templates to ask the right questions and save time.

🎯 Choose Your Audience

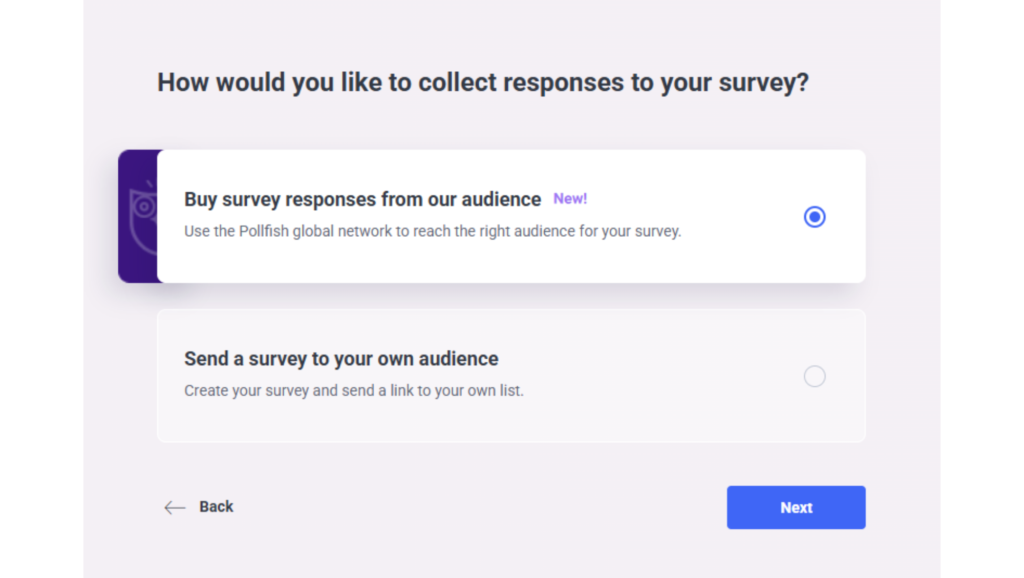

Once you've chosen how you'll build your survey, there's two flexible ways to reach the right people:

Pollfish Audience

Access millions of people with our diverse and extensive audience. Backed by Prodege’s variety of owned and operated loyalty programs.

✓ ISO-certified, ESOMAR Gold Standard Data

✓ 160+ countries

✓ 1000's of filters to contact your target persona. Including demographic, geographic, lifestyle, behavioral data points and more

✓ Cost-effective, transparent, pay-per-complete pricing

Use Your Own Audience

Survey your own database of customers for more specific insights on your brand.

✓ Build your survey and share your survey link - via email, social, or on your website

📚 How audience targeting works →

🔍 Advanced Pollfish Audience Targeting Criteria

The Pollfish audience gives you precision targeting capabilities:

Demographics: Age, gender, location, income, etc.

Behaviors: 6,979 behavioral criteria to choose from, including verified brand purchases, online shopping, retail channels shopped, websites visited and much more

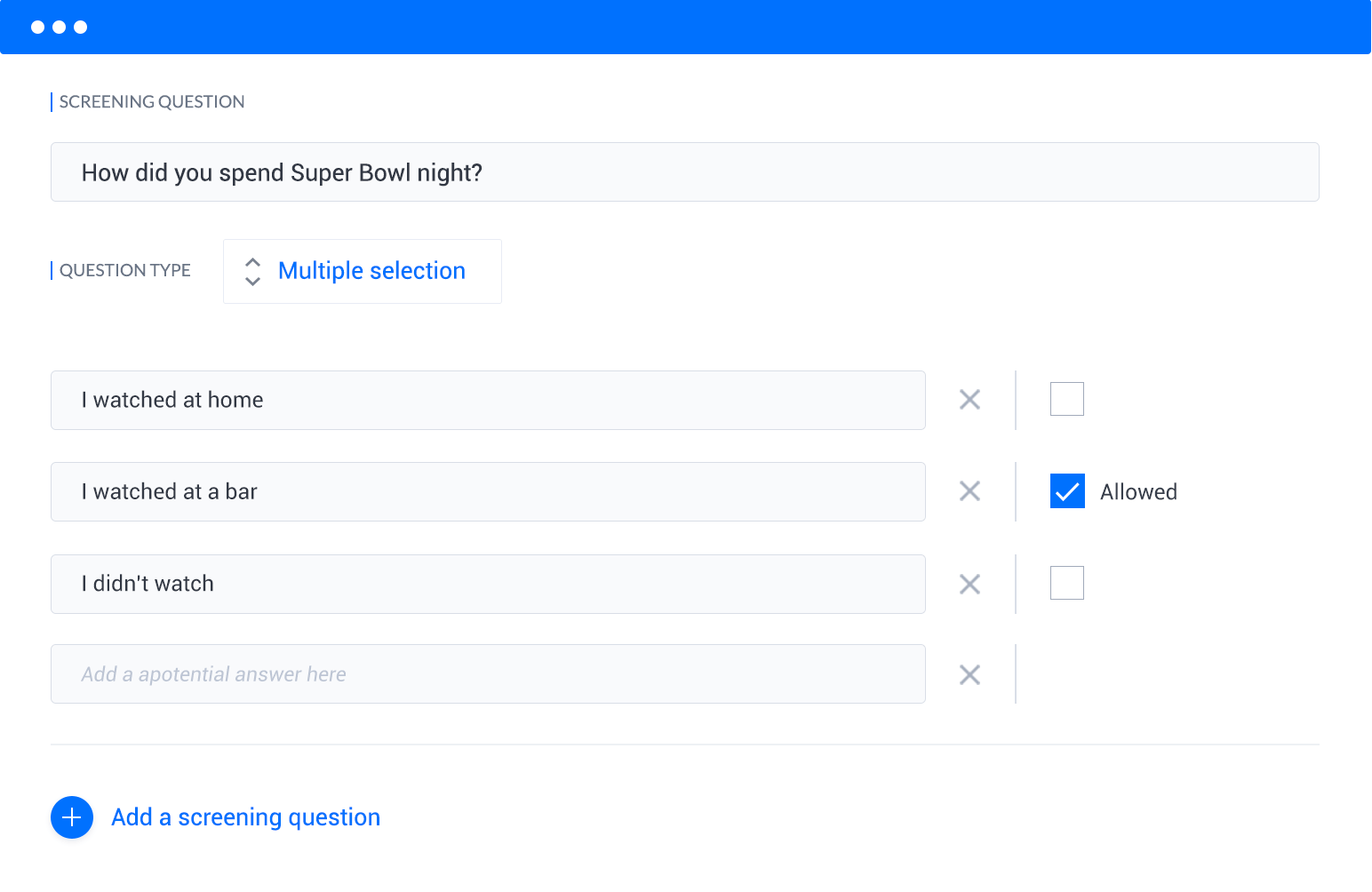

Screening questions: Include screeners (labelled SQ) with the Add question button. Ask qualifying questions upfront, to avoid responses from people who don't fit your research needs. Save time, money, and keep your insights clean.

💡 Using Pollfish Audience for your project? We'll review your survey before launch to ensure your setup gets the results you need.

Browse all targeting options →

🚀 Launch Your Survey

Quick. Reviewed. Real-time results.

Submit your survey for expert review (Pollfish audience only)

Set live once approved

View real time responses in your account - usually within minutes

Analyze insights as they come in

Responses are quality checked

Survey auto-completes and notifies you via email

Transparent pay-per-complete pricing is shown as you create your survey. No hidden fees and no nasty surprises.

Live Expert Support

Live Expert Support

Need help? Have questions? Can't find a feature?

Click the chat bubble in the bottom right of your dashboard to get live, expert support 24/7.

Real humans to support your research goals. All day, every day.

🤝 Looking for Managed Services?

Our research experts are here to support you.

Not sure where to start or simply short on time? Pollfish offers a range of professional services to take your survey from idea to insights. No stress and no guesswork.

How we can help:

Survey Design & QA: Get expert-written questions, logic flows, and formatting

Targeting Strategy: We help you reach the exact audience you need

Full Project Management: Let us handle everything - from setup to launch to analysis

Whether you’re new to survey research or managing complex studies, we’ll tailor the support to your goals.

✅ Ready to Dive In?

Head to your dashboard and start exploring Pollfish.

11 Best Qualtrics Competitors & Alternatives in 2025

11 Best Qualtrics Competitors & Alternatives in 2025

What factors should you look for when considering a Qualtrics alternative? Based on our experience helping companies of all sizes run market research surveys, we’ve identified several key elements:

- Specialized vs. broader focus: Specialized tools that focus solely on surveys tend to be more cost-effective, easier to manage, and simpler to use because they’re designed for a specific purpose. However, if you need various business functions beyond market research, you should choose a platform that provides features beyond surveys. For example, besides surveys, Qualtrics also offers Contact Center Analytics and Quality Management & Compliance tools.

- Data quality safeguards: Most survey platforms buy data from third-party panel providers, often leading to the problem of getting answers from "professional survey takers" — users who prioritize completing as many surveys as possible over providing quality responses. Instead, you should choose a software that leverages first-party data and engages respondents within the apps they already use, resulting in more authentic responses and reliable survey data.

- Turnaround time: Many survey tools have slow turnaround times, taking days to deliver results even for general audiences. The software you choose should have large, engaged respondent communities that can deliver hundreds of mainstream audience responses within hours. You should also receive accurate turnaround estimates for more niche audiences, helping you meet deadlines and get insights faster.

- Survey design flexibility: Many survey platforms have limited functionality, forcing you to compromise on your research goals. For instance, they may lack the targeting criteria needed for your specific audience, or offer only basic question types and logic that don't fully address your unique requirements. Instead, the survey software you choose should provide the flexibility and features needed to execute your research exactly as intended, ensuring you never have to settle for "close enough."

- Pricing structure & transparency: Subscription-based pricing models common among survey platforms often result in paying for unused capacity and unexpected costs for essential features or adding users. Instead, choose a software that offers a pay-as-you-go approach, allowing you to pay only for the responses you need, get unlimited user access, and show your total cost upfront as you build your survey, ensuring budget predictability.

- Market research support team: While most survey platforms offer basic technical support, their reps often lack advanced research methodology knowledge to provide guidance on more complex needs (e.g., questionnaire design, data analysis). The software you choose should have a support team staffed with seasoned market researchers available to offer expertise on these topics and more, ensuring you adhere to industry best practices.

Keep these factors in mind while we compare Qualtrics competitors, starting with an in-depth look at our survey-focused market research software, Pollfish.

11 Best Qualtrics Competitors

- Pollfish

- SurveyMonkey

- Alchemer

- Suzy

- Medallia

- Forsta

- InMoment

- Google Forms

- QuestionPro

- Microsoft Forms

- AskNicely

1. Pollfish

In a nutshell, Pollfish lets you create market research surveys that reach a highly targeted audience using precise targeting filters.

You can choose from various question formats, add screening questions, and apply advanced logic pathways to customize your survey. Survey responses are automatically organized into clear, structured reports for effortless data analysis.

(You can skip to our detailed platform overview here.)

Why choose Pollfish over Qualtrics and other survey platforms?

We'll highlight six key benefits that differentiate Pollfish as a compelling alternative for your market research needs:

- Ensure high data quality for every survey response by leveraging first-party data from our proprietary panel, along with comprehensive fraud prevention measures that include continuous respondent monitoring, a 30-day quarantine for new members, and sophisticated data cleaning techniques.

- Receive faster survey results by leveraging Pollfish's large, highly engaged respondent communities, enabling you to gather responses within hours for general audience surveys.

- Pay only for the responses you need with our flexible pay-as-you-go model, eliminating the need for subscriptions, annual fees, and commitments that may result in unused capacity.

- See complete pricing upfront with our transparent cost structure that shows your total survey cost in real-time as you build your audience, preventing surprise fees and allowing for better budget planning.

- Work with a support team that’s staffed with knowledgeable market researchers, who can help with questions ranging from advanced questionnaire design, logic and routing in surveys, data analysis and interpretation, and anything related to market research best practices.

- Build surveys tailored to your exact specifications using our robust platform capabilities for audience targeting, questionnaire design, and data analysis, ensuring you never have to compromise on your research goals.

Ensure High Data Quality for Every Survey Response

The Problem with Relying on 3rd Party Panel Suppliers

Many survey platforms, including Qualtrics, rely on third-party panel providers to supply respondents rather than owning and managing their survey panels directly. This leads to several issues that can negatively impact data quality:

🚫 "Professional Survey Takers" Problem

Third-party panels typically operate on a direct payment model where individuals specifically sign up to take surveys in exchange for cash rewards. This incentivizes people to sign up for multiple platforms to maximize earnings as "professional survey takers." As a result, they may:

- Provide rushed responses as they prioritize completing surveys quickly instead of giving thoughtful answers.

- Use strategic answering techniques to qualify for more survey opportunities rather than responding honestly.

- Generally contribute lower-quality data that fails to capture genuine consumer opinions accurately.

🚫 Lack of Transparency Regarding Data Sources

Third-party panels rarely disclose their verification methods or respondent sources. This lack of transparency creates uncertainty about data quality, a significant concern given the rise of survey fraud in recent years.

🚫 Multiple Middlemen Add Costs

Each intermediary between you and your respondents adds their markup. You pay more without improving data quality.

The Advantages of Pollfish's First-Party Data Approach

Following Pollfish's acquisition by Prodege (a market research and consumer insights giant renowned for being the largest single panel owner in the world), we leverage first-party data through a fundamentally different approach:

✅ Natural Environment Engagement

We embed surveys within apps people already use for other purposes, such as gaming or utilities. This allows us to reach respondents in their natural environment rather than relying on people who self-select into survey panels. The result is more authentic responses from real consumers, not just "professional survey takers."

✅ Comprehensive Fraud Prevention

Owning our panel gives us full control to implement comprehensive quality safeguards:

- Continuous monitoring of respondent behavior to confirm they are genuine.

- 30-day "quarantine" for new members to complete internal profiling surveys before participating in client surveys.

- Sophisticated data cleaning techniques to identify and remove low-quality responses (e.g., trap questions, speeding prevention, anti-VPN measures, etc.).

✅ Precise Behavioral Targeting

Direct panel ownership lets us gather valuable behavioral data, like purchase receipts, enabling laser-focused targeting based on verified consumer actions rather than self-reported preferences or demographic assumptions.

For example, if a consumer recently purchased premium coffee beans from specialty retailers, you can precisely target them for your high-end coffee machine campaign using verified purchase receipts rather than assumed preferences or demographic generalizations.

✅ Lower Costs with Better Quality

Building and managing our own respondent network in-house eliminates extra fees and markups from third-party panel providers. This direct approach simultaneously reduces costs while significantly increasing data quality for our clients.

Receive Faster Survey Results with Pollfish's Large, Engaged Respondent Communities

A common issue raised by users of other survey platforms is the lengthy wait time for responses. You often have to wait multiple days to get results back, even for general audience surveys.

For a general US audience survey on a broad topic with high incidence (like opinions on streaming service preferences), Pollfish can often gather 500+ responses within hours. This is extremely fast compared to other platforms, made possible due to the large, engaged respondent communities we've cultivated.

More niche, targeted audiences (e.g., pediatric oncologists with over 10 years of clinical experience) will have a longer turnaround time than broad, general population surveys. But Pollfish is still typically faster than competitors even for these niche surveys, and you can reach out to us for exact time estimates.

Pay Only for the Responses You Need Without Subscriptions or Commitments

The Problem with Qualtrics' Subscription Pricing Model

Qualtrics offers a subscription-based pricing structure that may present challenges for some businesses:

🚫 Paying for Unused Capacity

With Qualtrics, you commit to an annual subscription fee regardless of your actual platform usage. For companies with fluctuating research needs, this could result in paying for unused capacity during slower periods.

🚫 Costly Per-User Licenses

Qualtrics charges additional license fees for each team member needing platform access. This gets expensive fast, especially if you have a large team or want to provide organization-wide access.

Pollfish's Usage-Based Pricing Model

Pollfish offers a different pricing approach that’s more flexible to your fluctuating research needs:

✅ Pay Only for What You Use

With Pollfish, you only pay for the survey responses you collect. No annual fees, no subscriptions, no sunk costs. Just a simple pay-as-you-go model for the research you actually conduct.

✅ Unlimited User Access

Pollfish doesn't charge per-user license fees. You can loop in your whole team, or even allow organization-wide access, without worrying about added costs.

See Complete Pricing Upfront with No Surprise Fees

🚫The Problem: Hidden Pricing and Surprise Fees

Many market research platforms use pricing models that can be confusing and lead to unexpected expenses. Here's a common scenario:

- You sign up at what appears to be a fair monthly or yearly price.

- As you begin using the platform, you discover that certain essential features require additional payment.

- You encounter unexpected charges for things like targeting specific demographic segments, adding more users to your account, etc.

- What started as a reasonable budget item ends up being a much larger and unplanned cost.

✅ The Pollfish Advantage: Complete Pricing Transparency

With Pollfish, you always see your total cost updating in real-time as you build your target audience:

For example, let's say you're setting up a survey on consumer preferences:

- You start by choosing a base audience (starting at $0.95 per response)

- You add targeting criteria like "Female respondents only" (+$0.55)

- Include "Married" in the marital status criteria (+$0.55)

You'll immediately see the cost per completed response is $2.05. If you need 600 responses, your total is clearly displayed as $1,230. That's the final price - no unexpected fees later.

This transparent model allows you to plan more reliably and adhere to your research budget without the frustration of surprise costs popping up.

Work with Support Specialists Who Understand Advanced Research Methodology, Not Just Basic Platform Features

The Customer Service Shortcomings of Most Survey Platforms

Customer service is not a priority for most survey platforms in the market. Once customers sign their contracts, they often feel abandoned, with several specific issues that stand out:

🚫 Lack of Advanced Research Expertise

Support reps at most survey companies can only handle basic technical inquiries. They lack deep knowledge about research methodology to help with more advanced needs.

🚫 Slow Response Times

Many survey platforms have frustratingly slow response times. Customers may wait days to hear back about urgent issues, causing critical delays in research projects and missed deadlines.

🚫 Limited Support Hours

Most competitors don't offer support outside standard business hours. If you're working on a survey late at night or on a weekend, you'll likely be unable to receive assistance until regular business hours resume.

How Pollfish Solves These Problems

At Pollfish, we’ve made customer service a central part of our value proposition instead of treating it like an afterthought, unlike most survey platforms. Here’s how:

✅ Support from Knowledgeable Market Researchers

Our support team is staffed with knowledgeable market researchers, not just tech support. We can help you with questions ranging from advanced questionnaire design, logic and routing in surveys, data analysis and interpretation, and anything related to market research best practices.

✅ Rapid Response Time

Connect with our team via live chat in minutes, not days, which can help you maintain research momentum and meet tight deadlines.

✅ 24/7 Availability

Pollfish offers genuine 24/7 customer support, unlike most competitors. This round-the-clock availability ensures you can get help whenever you need it, regardless of time zone or day of the week.

Build Research Projects Exactly to Your Specifications Without Compromise

With surveys, oftentimes there will be very specific, unique requirements for your particular use case. It's crucial to ensure that your chosen software has robust functionality to fully address your precise research needs. You shouldn’t have to compromise on your research goals due to limitations of the survey platform.

Let’s consider the following examples of common limitations:

- You need to target a particular audience segment, but the platform doesn’t offer the necessary targeting criteria. You’re forced to settle for a broader audience that doesn't fully match your ideal respondent profile.

- You want to include certain question types and logic in your survey design, but the platform's options are too basic.

- You have to export the raw data and utilize external tools to truly make sense of the results because the platform only provides rudimentary reporting and analytics.

To illustrate how Pollfish provides the flexibility and functionality to avoid these types of limitations, we'll briefly cover its capabilities in 3 key areas:

- Setting your survey audience

- Designing your questionnaire

- Analyzing results via user-friendly reports

For a more comprehensive look at these areas and an overview of the entire Pollfish platform, refer to this in-depth article on getting started with Pollfish surveys. It walks through each step of the process, from survey creation to data analysis, and more.

Note: While most customers use Pollfish as a DIY (do-it-yourself) tool to build their own surveys, we also offer a full-service option where market research professionals manage your entire project from start to finish.

Set Your Survey Audience

Choose from over 50 targeting criteria across six categories:

- Demographics

- Geographic Criteria

- Consumer Lifestyle

- Employment & Occupation

- Behavioral Data

- Media.

You can keep your targeting broad by focusing on just a few key criteria, such as age and gender. However, our platform also allows you to be incredibly specific in your targeting. For example, you could target women who meet all of the following criteria:

- Aged 25–34

- Living in the Pacific Northwest

- With a bachelor's degree or higher

- Owns dogs

- Enjoys hiking and camping

- Subscribes to Netflix and Disney+

- Have visited travel websites in the past month

- Earns between $75,000 and $100,000 per year

- Works in healthcare

- Frequently shops at Target and Amazon

Most users won’t need to be this precise in their targeting criteria. Our goal is simply to illustrate the depth of customization available to you if your survey requires it.

This is just a brief overview. For more information on setting your survey audience, view this video.

Design Your Questionnaire

Design surveys using Pollfish's 14 diverse question types, from simple multiple selection to complex matrix formats and more. Then, enhance your survey quality through advanced features like skip logic for personalized respondent pathways, screening questions, answer randomization, multimedia integration, AI survey creation, and pre-built survey templates for common market research use cases.

This is just a brief overview. See this page for more information on designing your questionnaire.

Analyze Results via User-Friendly Reports

Pollfish lets you visualize each survey answer with appropriate chart formats (simple tables, color-coded column charts, or intuitive pie charts) in an easy-to-navigate dashboard.

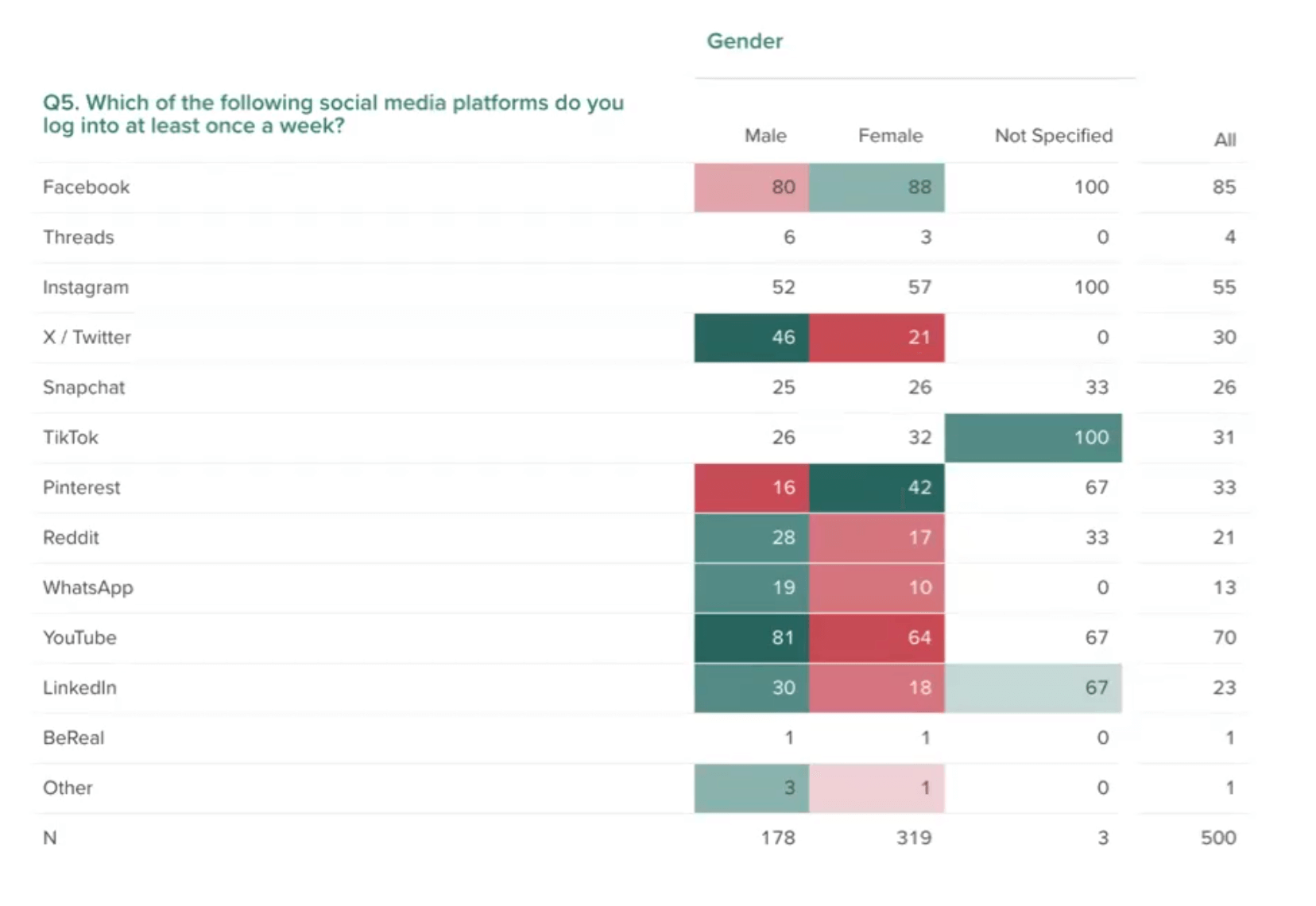

The platform also enables powerful data filtering by specific demographics or responses, such as only viewing results from female millennials in urban areas, or isolating feedback from respondents who indicated they "strongly disagree" with your product pricing.

The Insights Builder tool (available on the Elite plan) takes analysis further by enabling sophisticated data manipulation without Excel. You can create complex graphs comparing multiple variables at once, apply statistical testing to identify significant findings (like which features truly drive customer satisfaction), and customize visualizations with your brand's specific color palette.

When you're ready to share results, export options include PDF, Excel, Crosstabs, and SPSS formats, with the ability to seamlessly transfer graphs to PowerPoint presentations using your company's templates and branding elements.

This is just a brief overview. Click here for an interactive demo of our Survey Results Dashboard.

Learn More About Pollfish

For more information on Pollfish, we invite you to:

- Create a free account (no payment information required).

- Book a personalized demo to see how Pollfish works for your specific needs.

2. SurveyMonkey

SurveyMonkey is a market research platform that can help you:

- Create surveys (e.g., drag and drop survey builder, customizable templates, advanced survey design features)

- Create and customize online forms for events, applications, payments, etc.

- Analyze results via custom dashboards, charts, word clouds, and other analysis tools

- Export your data to 200+ popular apps like Mailchimp, Google Sheets, Microsoft Teams, and more

3. Alchemer

Alchemer is a survey and data collection platform that boasts several features and capabilities, which include:

- A plethora of different survey question types and advanced survey design features like logic and branching

- Real-time feedback and actionable insights from customers as they use your app or website

- Customer text sentiment analysis

- Integrations with platforms like Salesforce, HubSpot, Zendesk, Asana, Zapier, Microsoft Teams, etc.

4. Suzy

Suzy is a Qualtrics alternative and consumer insights platform that can help you:

- Conduct surveys with real-time feedback from targeted audiences

- Utilize templates, AI, and more for survey creation

- Connect with audiences through email, CRM, and social media integration

- Analyze consumer feedback with dynamic AI-powered analytics and customizable reporting

5. Medallia

Medallia is an all-around experience management software that can help you:

- Conduct agile research via surveys, online focus groups, and panel studies

- Increase contact center efficiency via conversation intelligence, agent coaching, quality management, and assurance optimization

- Improve employee experience via employee listening and activation solutions

- Implement comprehensive customer experience management programs across multiple touchpoints

6. Forsta

Forsta is another one of the best Qualtrics alternatives that can help:

- Conduct research via online surveys and focus groups

- Analyze what people say about your brand on Google, Facebook, Yelp, and more

- Receive input from customers via activity-based diary entries

- Measure and improve user experience through comprehensive journey mapping

- Centralize and analyze data from multiple sources in a single hub that connects feedback with behavioral and observed data

7. InMoment

InMoment is another Qualtrics competitor that lets you:

- Capture customer feedback across multiple channels

- Monitor, analyze, and respond to online reviews across popular platforms

- Automate the analysis of contact center conversations, chat logs, and emails to uncover customer sentiment

- Place microsurveys and interaction tracking to help you optimize customer journeys

- Analyze structured and unstructured data to detect customer intentions automatically, predict behavior, etc.

8. Google Forms

Google Forms is a free tool that can help you:

- Easily create forms via drag and drop functionality with a minimal learning curve

- Share forms via email and social media, or embed them on your site

- Customize forms using templates, flows, and quizzes, with colors that align with your company's branding

- Easily visualize responses and optionally export to Google Sheets

9. QuestionPro

QuestionPro is a Qualtrics alternative that can help you:

- Easily create surveys via drag and drop functionality, with various question types and templates

- Utilize sophisticated methodologies like conjoint analysis, MaxDiff, A/B testing, etc.

- Map the entire customer journey and collect feedback at various touchpoints

- Gather feedback throughout the employee lifecycle

10. Microsoft Forms

Microsoft Forms offers a free plan and lets you:

- Easily create simple surveys, quizzes, and polls on customizable forms without extensive technical knowledge

- Visualize response data via automatically generated reports

- Export to Excel for more customized, in-depth analysis

- Integrate with other Microsoft 365 apps

11. AskNicely

AskNicely is a customer experience software that lets you:

- Gather customer feedback through email, SMS, and embedded surveys at key touchpoints

- Run NPS and CSAT measurement programs with intuitive dashboards

- Turn happy customers into brand advocates by streamlining the review request process to generate more 5-star ratings and referrals

- Connect seamlessly with platforms like Salesforce, Microsoft Teams, Zendesk, etc. to embed feedback collection into existing workflows

Get Started with Pollfish Today

Create a free account (no payment info required) or book a personalized demo to discover how Pollfish can meet your needs.

11 Best Survey Software for Market Research in 2025

11 Best Survey Software for Market Research in 2025

When selecting the best survey software for your market research needs, these essential factors deserve careful consideration:

- Data quality: Beware of survey tools that buy respondents from third-party vendors, because this introduces significant quality control issues that compromise your research data integrity (more on this later). Instead, choose platforms that own and manage their respondent communities directly for fundamentally more accurate research results.

- Flexible survey design capabilities: Your research needs are specific and unique — never settle for "close enough" when designing your surveys, as even minor compromises can significantly distort your findings. Without precise audience targeting, you risk collecting data from irrelevant respondents who don't represent your population of interest, while platforms with limited questionnaire design tools force compromises in question structure and logic flows that yield unreliable responses, and inadequate data analysis capabilities leave critical insights buried in your survey data.

- Pricing structure & transparency: Consider the advantages of flexible pay-per-response models against expensive monthly or yearly subscriptions that might include capacity you won't use. Pay attention to the importance of upfront pricing transparency and avoid platforms with hidden fees that appear only after you've committed.

We’ll start by discussing how Pollfish (our own product) performs in these areas, and categorize the tools in this list into two groups: premium tools with advanced functionality and entry-level options.

Best Survey Software for Market Research

| Premium Tools with Advanced Functionality | Entry-Level Options |

| Pollfish | Google Forms |

| Qualtrics | Typeform |

| Suzy | SurveyPlanet |

| SurveyMonkey | Microsoft Forms |

| Alchemer | |

| SurveySparrow | |

| Forsta |

Premium Tools with Advanced Functionality

1. Pollfish

Here's a brief overview of what we'll discuss in this section:

How Pollfish leverages proprietary respondent communities instead of external third-party panels

- Competitor limitations: Rather than maintaining their own respondent communities, most survey platforms acquire survey participants from external 3rd-party panel providers. This creates serious data quality concerns through "professional survey takers," response manipulation, and a growing survey fraud epidemic.

- Pollfish’s approach: Pollfish takes a fundamentally different approach by owning and nurturing our respondent communities directly, implementing rigorous verification and anti-fraud processes, providing precise behavioral targeting based on verified actions (not just self-reported preferences), and more.

3 key feature categories that influence research quality

- Audience targeting: You may require reaching a highly specific audience segment, but find yourself constrained by limited targeting options, ultimately settling for a broader respondent group that only partially matches your target demographic.

- Questionnaire design: When crafting your survey, you might envision dynamic question formats or sophisticated branching logic, only to find the platform's survey building capabilities don't support these advanced requirements.

- Data analysis: It's disappointing when a platform provides only basic analytical tools, forcing you to export raw data and rely on external applications (like Excel) to perform the in-depth analysis essential for actionable insights.

Transparent pay-per-response pricing model (rather than being locked into a subscription)

- Competitor limitations: Many survey software charge expensive monthly or annual subscription fees that lock you into paying for capacity you may not fully utilize. Others have confusing pricing with hidden costs that only become apparent after you've committed.

- Pollfish’s approach: We offer transparent, pay-as-you-go pricing that allows you to pay only for the responses you need, with no surprise fees.

Let's explore each of these areas in more detail.

While Competitors Rely on External Third Party Panels, Pollfish Leverages Proprietary Respondent Communities

Most survey platforms don't maintain their own respondent communities. Instead, they acquire survey participants from external 3rd-party panel providers, which often employ a cash-for-completion model where participants specifically enroll to earn money through surveys.

This leads to what we call “professional survey takers”, who participate in dozens of surveys weekly across multiple platforms primarily as an income source. These respondents are motivated by speed and quantity (not thoughtful participation), and they provide answers that will qualify them for surveys, regardless of truth.

In addition, many 3rd-party panel providers operate as "black boxes," concealing their methods for combating survey fraud. This lack of transparency is concerning because survey fraud isn't just a minor data quality issue — it's a pervasive threat that can completely undermine the validity of your market research. There are now organized networks using AI-powered tools, device farms, and identity spoofing to generate convincingly human-like responses. (The survey fraud ecosystem has grown increasingly sophisticated).

When your survey results come from “professional survey takers” or fraudulent respondents, you're building business strategies on fundamentally misleading information. Imagine investing six months and significant resources developing a new product line because survey results showed strong demand, only to launch it and discover actual customers have little interest. This disconnect between research findings and market reality doesn't just waste resources — it affects your credibility with stakeholders and deflates team morale.

At Pollfish, We Have a Fundamentally Different Approach

Unlike competitors who rely on third-party panels, Pollfish (through parent company Prodege) owns and operates an extensive network of consumer communities.

This end-to-end ownership of the respondent ecosystem enables Pollfish to implement multi-layered quality controls, sophisticated targeting, and seamless in-app engagement, delivering higher quality survey responses that competitors using 3rd-party panels cannot match.

The key data quality advantages of Pollfish's owned respondent ecosystem include:

✅ Incentives through natural environmental engagement

Surveys are seamlessly integrated into apps that people already use and enjoy in their daily lives for purposes like gaming, shopping, or entertainment. Respondents can earn in-app rewards or incentives for completing surveys, such as bonus lives in a game or discounts on purchases.

By engaging users during their regular in-app activities instead of in dedicated survey environments (where respondents might be mindlessly clicking through their 20th consecutive questionnaire), Pollfish captures more genuine, thoughtful responses that better reflect people's true opinions and preferences.

✅ Authenticated purchase history via digital receipt uploads

Pollfish's ecosystem rewards respondents not just for taking surveys but also for uploading actual shopping receipts to earn cashback. This verification process serves two vital purposes:

- First, it confirms that respondents are genuine humans, not bots or fraudulent accounts.

- Second, when building your survey audience in Pollfish, you can precisely target respondents based on their documented purchase history — for example, specifically reaching people who have bought Cheerios in the last month, purchased Nike products, or shopped at Walmart. This behavioral targeting is based on proven actions verified through receipt uploads, not just what respondents claim about themselves, significantly increasing the reliability of your audience selection.

✅ Sophisticated respondent verification system

Every participant in Pollfish's ecosystem undergoes a comprehensive validation process that starts before they ever see a client survey:

- Mandatory 30-day evaluation period: New members are exempt from participating in client surveys during their first month. During this period, they can only complete internal profiling surveys that help Pollfish establish their baseline response patterns and verify the consistency of their demographic information. This allows Pollfish to identify potentially problematic respondents before they ever reach client surveys.

- Cross-platform behavior analysis: Because members engage with Pollfish's communities across various activities, Pollfish can verify consistency in behavior patterns. For example, if someone reports being a pet owner in surveys but their shopping history (as verified by receipt uploads) reveals no pet food, toy, or supply purchases that would typically be associated with pet ownership, Pollfish can flag this discrepancy for review.

✅ Comprehensive fraud prevention at every step

While traditional 3rd-party panels typically apply basic quality checks after surveys are completed, Pollfish employs more sophisticated fraud prevention methods:

- Unique User ID: Each participant receives a unique identifier that tracks their activity across our platform, preventing individuals from taking the same survey multiple times or creating duplicate accounts.

- Device-Carrier Validation: Our system cross-references the respondent's mobile carrier information with their device data to verify consistency and flag suspicious patterns that might indicate location or identity spoofing.

- Sophisticated Trap Questions: We strategically place specialized validation questions that appear simple to humans but confound automated systems. These include not just image recognition tasks, but attention verification questions that adapt based on previous responses to appear natural within the survey flow.

- Response Timing Analysis: We can detect and flag not just speeders who rush through the entire survey, but also identify suspicious patterns like inconsistent timing (fast on complex questions, slow on simple ones).

- Geolocation Authentication: We employ advanced IP validation technology that blocks responses submitted through VPNs, proxies, and other location-masking services to ensure geographic targeting accuracy.

- Progressive Trust Evaluation: Respondents receive continuously updated quality scores based on their historical response patterns.

3 Key Feature Categories That Influence Research Quality

Now that we've established the critical importance of data quality — since even the most sophisticated survey tools offer little value if they're built on flawed data — let's look at what our market research survey software can actually do.

As we’ve mentioned earlier, there are 3 essential feature categories that truly effective survey platforms must deliver to meet your precise research requirements:

- Audience targeting: You might need to reach a precisely defined audience segment, yet find yourself limited by insufficient targeting parameters, ultimately forcing you to compromise with a broader respondent pool that only partially aligns with your intended demographic.

- Questionnaire design: When developing your questionnaire, you may envision specific interactive question formats or complex conditional logic paths, only to discover the platform's survey construction tools lack these advanced features.

- Data analysis: It's frustrating when the platform's analytics capabilities offer only surface-level insights, compelling you to download your raw response data and use third-party software (e.g., Excel) just to conduct the deeper analysis necessary for meaningful decision-making.

Up next, we'll examine how Pollfish addresses each of these critical feature areas.

Define your respondent pool using granular demographic and behavioral filters

Pollfish offers an extensive range of targeting criteria to precisely define your survey's audience:

- Targeting criteria options: Choose among 50+ targeting parameters spread across 6 key categories: Demographics, Geographic Criteria, Consumer Lifestyle, Employment & Occupation, Behavioral Data, and Media.

- Example in action: Most companies won't set all of the parameters below simultaneously, but here's an example of how detailed your targeting could be:

- Demographics: Men, ages 35-49, $200,000+ income, single, never married

- Geography: Metropolitan areas across the Midwest

- Consumer Lifestyle: Regular energy drink consumers, enthusiasts of extreme sports, fishing, and camping

- Employment: Employed full-time, work in the construction industry

- Purchase Behavior: Recently bought Gatorade and 5-hour energy products

- Set audience quotas: Optionally, you can set audience quotas to ensure a balanced sample and avoid skewed results (e.g., For example, you might set survey audience quotas to ensure 30% of respondents are males aged 18-24, 40% are females aged 25-34 with children, and 30% are adults aged 55+ with household incomes above $75,000 to achieve a representative sample across key demographic segments).

Note: To learn more about Pollfish’s audience targeting capabilities, view this video.

Build questionnaires with diverse question types and advanced survey design features

Craft engaging surveys using a wide variety of question formats and advanced survey design capabilities:

- Choose from 14 question types, including single/multiple selection, open-ended, matrix, rating stars, sliders, and more. (See complete list and explanation for each question type.)

- Specialized question formats like A/B Test, Conjoint Analysis, Max Diff, and ProVan Westendorp for specific research needs.

- Screening questions: Use screening questions to ensure only relevant participants complete your survey. (e.g., Include a screening question like "Do you currently have a pet in your household?" to qualify participants for a pet food market research study).

- Skip logic: Implement skip logic and advanced branching to create personalized paths based on response. (e.g., In a healthcare survey, if a participant selects they take prescription medication, they follow a branching path with questions about medication frequency, whereas those without prescriptions are routed to questions about preventative care).

- Answer shuffling: Randomize answer order to reduce bias and improve data quality (e.g., implement answer shuffling for the question "Which factor most influences your purchasing decision?" to prevent primacy bias from skewing results toward options listed first).

- “Other” and “None of the above”: Automatically include "Other" and "None of the above" for all answer choices with a simple toggle, rather than doing it manually for each question (a common frustration for researchers who regularly create surveys).

- Multimedia elements: Incorporate multimedia elements like videos into survey questions, and optionally require video viewing completion before advancing to ensure attentiveness.

- And the list goes on, including popular survey templates for market research, an AI survey builder, and more.

Click here to learn more about designing a questionnaire with Pollfish, and the customization options at your disposal.

Leverage built-in reporting capabilities for easy data visualization and analysis

Pollfish's user-friendly reporting tools allow you to easily uncover meaningful insights from your survey data, all within our platform, without having to use Excel.

- Intuitive data visualization: Visualize every single survey answer using tables, color-coded charts, and graphs that automatically update based on filters.

- Customizable Styling: Customize graph colors and styling to align with your brand guidelines. For instance, if your company uses a specific blue (#0057B8) and orange (#FF6B00) color scheme in all marketing materials, you can easily apply these exact brand colors to your survey result visualizations.

- Flexible Data Exporting: Export results in various formats (PDF, Excel, Crosstabs, SPSS) for further analysis and presentation.

- Drill down by key audience segments:Apply audience targeting filters to analyze survey results by specific audience segments such as age, gender, location, and more.

- Example use case: Using the demographic filters on the left side of the dashboard, you could select just "Millennials (25-40)" to see their specific feedback. The results would instantly update to show only responses from this age group, revealing that millennials were twice as likely to say your proposed pricing was "very reasonable" compared to the overall sample. You could then further refine this by adding gender filters to compare male vs. female millennials' price sensitivity, discovering that female millennials were particularly enthusiastic about your pricing proposition.

- Drill down by specific responses: Utilize response-based filtering to drill down into data by individual question answers.

- Example use case: When reviewing your customer satisfaction survey results in Pollfish, you could use response-based filtering to focus on only the respondents who selected "Very Dissatisfied" to your overall satisfaction question. This would allow you to examine what these dissatisfied customers specifically disliked by seeing their responses to other questions, such as product quality, customer service interactions, or pricing concerns. You could discover that 78% of dissatisfied customers cited "slow response times" as their primary frustration, giving you a clear priority for improvement efforts.

- Advanced analysis without Excel: Our Advanced Insights Builder (available on Elite plan) enables complex data manipulation using multiple variables without needing Excel.

- Example use case: You could instantly analyze 4 variables simultaneously by creating a visualization showing how purchase intent (variable 1) for your product varies across different age groups (variable 2), income levels (variable 3), and geographic regions (variable 4). This might reveal that high-income millennials in urban areas show 87% purchase intent compared to just 43% among similar demographics in rural regions — a complex, multi-dimensional insight that would typically require extensive Excel manipulation but is available with just a few clicks on our platform.

- Built-in stat testing: Stat testing results can be clearly visualized using color-coding and traditional notation (capital and lowercase letters).

- Example use case: If you compared customer satisfaction scores across different age groups, our platform would automatically highlight statistically significant differences - showing that Gen Z customers (highlighted in dark green with capital "A" notation) rate your mobile app experience significantly higher than Baby Boomers (marked with lowercase "b").

Note: This is just a glimpse of what's possible. If you have particular reporting requirements and want to confirm that Pollfish can meet them, please contact us here.

Transparent Pay-per-Response Pricing Model (Rather Than Being Locked Into a Subscription)

Up next, we’ll examine how our usage-based pricing structure delivers exceptional value compared to alternatives.

The Downsides of Subscription-Based Pricing

- Many competitors offer inflexible subscription models that require you to commit to monthly or annual fees, regardless of your actual usage. This means that during slower periods or months when no research is conducted, you still pay the full subscription rate — essentially wasting money on unused capacity.

- Additionally, tiered pricing structures can be misleading. While some tools may advertise an attractive base rate, essential features often remain locked until you upgrade, leading to unexpected costs for targeting specific demographics, accessing comprehensive reporting tools, and more.

- Furthermore, as your team grows, paying for each additional user can significantly increase your total costs. This also creates budget unpredictability, especially when scaling teams for short-term projects or seasonal demands.

Pollfish’s Approach: Transparent, Usage-Based Pricing

- You only pay for the survey responses you collect, starting at $0.95 per response. Our straightforward cost structure scales with your actual usage, and we can apply significant volume discounts for larger research initiatives.

- You see your total cost calculated in real-time through our dynamic pricing display. As you build your survey specifications, the platform immediately shows both the per-response rate and your total complete project cost before you commit, eliminating budget surprises.

- You can add unlimited team members at no additional cost. If you're on the market research team, you can include everyone from your immediate department, plus collaborate seamlessly with stakeholders from marketing, product development, customer experience, and executive leadership without worrying about per-user fees.

Register for a Free Pollfish Account

Ready to experience Pollfish firsthand? We invite you to register for a free account (no credit card needed, no obligations) and book a demo walkthrough.

2. Qualtrics

Qualtrics is a survey software for market research that can help you:

- Create customizable surveys with advanced question types and logic.

- Combine quantitative and qualitative research methods including video feedback and interviews.

- Optionally distribute surveys through multiple channels including email, SMS, QR codes, website embeds, and more.

- Store and search all research insights using AI-powered search capabilities.

- Visualize insights through real-time analytics dashboards.

For more information on what differentiates Pollfish from Qualtrics and other competitors, visit this article.

3. Suzy

Suzy is a survey tool for market research that with several features and capabilities, some of which include:

- Custom surveys with both basic and advanced question types.

- Logic branching for personalized respondent experiences.

- Video-based qualitative research capabilities through Suzy Live.

- Retargeting of certain respondent groups for follow-up studies.

- AI-moderated conversations for conversational surveys at scale.

To learn more about what differentiates Pollfish from Suzy, visit our article on the best Suzy alternatives.

4. SurveyMonkey

SurveyMonkey is a survey platform for market research with several features and capabilities, some of which include: