Market Research Panel Definition: All You Need to Know for Meaningful Market Research

Market Research Panel Definition: All You Need to Know for Meaningful Market Research

Have you ever considered using a market research panel to lead your research campaigns? This method is typically applied to market research, which is essential to understanding and satisfying your customers.

Market research is critical for all businesses, no matter how attuned you may consider yourself to be with your customers. The importance of market research cannot be understated; it helps you keep continuous tabs on your most important customers: your target market.

There are many routes you can take in the broad field of market research, as there are many market research techniques available. This includes primary and secondary methods of obtaining the research.

A market research panel is one such technique. This research method grants researchers participants who opt into a study, typically one that is conducted through multiple rounds of research, whether it is through surveys or other tools.

The panelists that make up the research panel are not randomly selected; instead, they are recruited and pre-screened.

Panels have various nuances that you ought to know about before selecting a research method, especially one that concerns how you’ll reach your target market. You should also compare panels with organic sampling, which is a different approach to identifying and gathering respondents for your research studies.

Luckily, this exhaustive guide allows you to do just that.

This guide explores the market research panel in full depth, delving into why it matters, how it is put together, their different types and much more. In addition, this article covers their drawbacks and how organic sampling is the better research method.

Table of Contents: How To Conduct A Survey That You Can Trust In 8 Steps

- Defining the Market Research Panel

- Market Research Panels: Why Do They Matter?

- How to Put Together Market Research Panels?

- The Need to First Identify Your Segmented Target Audience

- Market Research Providers and In-House Research Teams

- Determine your panel size

- Using Online Channels to Opt-In Potential Panelists

- Vetting Your Panelists

- Incentivize Your Panelists

- Carry Out Panel Research

- Maintain and Manage Your Survey Panel

- Are There Different Types of Market Research Panels?

- What Are the Advantages of Using a Market Research Panel?

- How Does an Online Market Research Panel Benefit Brands?

- Are There Drawbacks to Using an Online Market Research Panel?

- Combat Reduced Research Quality Using Organic Probability Sampling

- The Need for a Strong Market Research Platform to Leverage Organic Sampling and More

Defining the Market Research Panel

A market research panel can be defined as a selection of research participants, chosen specifically for market research purposes. But there’s much more to this.

A market research panel is a pre-recruited group of people who have agreed to take part in market research studies. These studies can be conducted through a variety of methods and tools.

The research tools and methods used with panels can include the following:

- Online surveys

- In-depth interviews (IDIs)

- Focus groups

- In-home use tests (IHUTs)

- Mobile ethnographies

- This involves studying customers in a natural environment but with the addition of technology to document and analyze real-time customer experiences.

- For example, it may use mobile ethnography app systems to conduct these studies. This allows you to remotely research human behaviors, journeys and experiences.

- Field research

Those selected to partake in a market research panel are usually used in more than just one research survey, even if they only enlist in one survey campaign. That means they can be expected to partake in several rounds of interviews, surveys, focus groups, etc.

This is why researchers who typically opt to reach participants via a research panel use the panelists to conduct longitudinal research. Longitudinal studies involve repeatedly examining the same individuals to detect any changes that might occur over a certain period.

Longitudinal studies are a kind of correlational research; researchers gather and observe data on a variety of variables without influencing the variables in any way.

This kind of research uses longitudinal surveys and can last years.

Despite being associated with the research of change and development, a market research panel can also be used in cross-sectional research. These kinds of studies deal with collecting research about a particular population at one fixed point in time. Due to the nature of this research, it is often referred to as a snapshot of a target population.

You can use a panel for this kind of research by using cross-sectional surveys.

A market research panel helps researchers better understand the strengths and weaknesses of – or sentiments towards – a particular product, service, brand, or message. Because researchers are often fact-finding on behalf of brands, these panels also can be known as brand research panels.

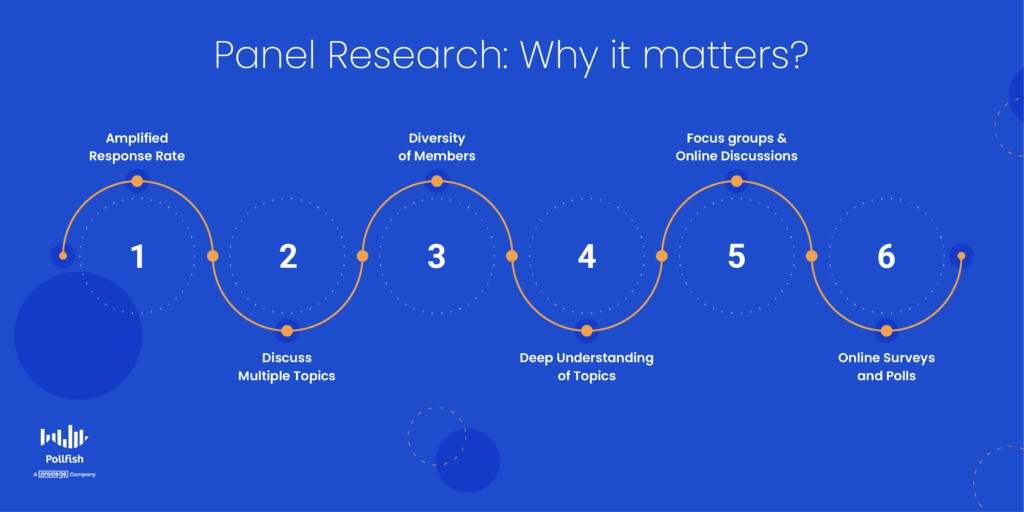

Market Research Panels: Why Do They Matter?

Market research panels matter for a variety of reasons.

First off, they provide both researchers and businesses who have no dedicated research personnel, with a go-to set of participants they can study firsthand continuously. This is critical, given that a major aspect of research is to target the correct audience in your study.

In market research, studying your target market is an absolute necessity. Panels provide easy and constant access to a target market sample, the pool of participants who represent your target market.

As such, the panelists are the research subjects, which is the crux of any research (unless you’re not studying humans). They are key to market research, as this research type is centered on understanding your customers to test the viability of any new product or service, and most importantly, sell to them.

Thus, the market research panel provides researchers et al. with a reliable group of research participants that they can turn to continuously.

This is a major convenience, given that it means researchers won’t have to scramble for research participants each time they need to conduct a research campaign. They also can rest assured that they’ll have research subjects to use in any ongoing research project, such as in longitudinal or prospective studies.

Aside from long-term research, panels can also be used in the aforementioned cross-sectional research studies as well.

In addition, panels provide businesses with a method to be more noticeable to their customers in an oversaturated market. Against the backdrop of social media and second screening, product owners, service providers and marketers are fighting tooth and nail to stand out in an increasingly crowded marketplace.

While some are becoming harder to differentiate, since many brands compete on similar price points and features, there is still one area up for grabs: a customer’s experience.

Thus, by designing a pleasant research experience and mentioning your business in the study, customers will associate their good memories during their research experience with your business.

In this scenario, the study itself serves as a marketing tactic to make your business resonate with its target market.

All in all, market research panels ensure you have constant access to your target market for your research study. They get to the heart of the matter of your area of study. The goal is to actively listen to and act upon the insights gleaned from your panelists.

Once you understand how your product or service makes your research panel feel, you can make the necessary changes to position your brand more effectively — irrespective of price or feature set.

How to Put Together Market Research Panels?

Today, market research panels are usually recruited via digital channels, as opposed to in-person scouting and interviewing. The latter is still possible, but not very common, given the ease, speed and prevalence of the Internet.

The following sections explain how to form, recruit and manage market research panels.

1. The Need to First Identify Your Segmented Target Audience

It’s important to ensure that you identify the target market segments you’ll need to include in your study before you recruit your panel. As such, we recommend conducting market segmentation first.

This way, you’ll know the distinct segments that make up your broader target market. In addition, performing segmentation allows you to identify your customer personas. These are fictional characters that represent unique members of your target market who fall under specific demographics, psychographics and the like.

You can conduct market segmentation with the help of market research software, particularly survey software. This will allow you to conduct surveys on any topic, including narrowing down your target market into segments.

Once you’ve segmented your target market and created various customer profiles, it is time to move on to determining the correct target audience.

Your survey target audience and your panel target audience specifically need to be determined before you recruit your panelists.

Your target market is not the same as your target panel audience

Keep in mind that neither your target market nor its segments are equivalent to the target audience of your panel. This is because a panel, like other research techniques, is centered on different topics.

Each topic may require different audiences.

You may have a survey campaign that relies on studying one market segment, or a few. Additionally, you may need to conduct another research campaign on another topic, one that involves different segments and customer personas.

Although you’ll be choosing from the same market segments, each segment will not satisfy or be appropriate for every panel study you conduct. Thus, your panel audience is separate from your market segments.

This is crucial and must be done before you reach out to your potential panelists.

2. Market Research Providers and In-House Research Teams

Once you’ve determined the panel audience you’ll need for your market research studies, you’ll then need to choose from one of two main options to put together your panel.

The first main option is to use market research panel providers that you have discovered and trust. Typically, this is done via the Internet. The panel provider would recruit and opt-in the panelists.

However, you and your team would still be involved in the process of targeting the panelists, as you would need to share your target market segments with the panel provider. Most importantly, you would need to inform them of your target panel audience.

As discussed in the previous section, these are not the same populations.

Alternatively, some businesses with in-house research teams find their panelists by releasing their ads and notices online. This is the second main option for creating a market research panel. You would need to enlist the panelists via your online platform of choice.

There are many options available for obtaining panelists in the digital space.

3. Determine your panel size

Before you recruit your panel, you’ll need to determine how many panelists you’ll need to participate in your research panel. To do so, you need to consider the following factors:

- Your ideal sample size,

- Your response rate

- The number of studies you intend to execute

For example, imagine you need 700 responses per survey; you have a response rate of 40%, and you’re seeking to run two studies each month. You’ll need to plug each variable into the following formula to find your panel size.

The panel size formula is:

(sample size per survey / (response rate) x (studies per month) ) x 100 = amount of panelists needed

(500 / 40% X 2 ) x 100 = 2500 panelists

Bear in mind that some people will not want to remain for the entirety of the study and will thereby leave. This is known as panel attrition. As a safety net for attrition, make sure to form a panel that consists of 10-20% more panelists than what the formula calculates as your ideal panel size.

Make sure you have all the requirements in hand before you start recruiting and aim to go 10-20% above your minimum number to cover you in case people opt out of your panel or you don’t hit your target response rate.

4. Using Online Channels to Opt-In Potential Panelists

There are a variety of online channels that you can choose from to obtain and opt-in your potential panelists.

You can invite participants to join your panel through web ads, email lists, social media, website landing pages, homepages, or third-party app partners.

They would then be asked to opt in and complete an onboarding questionnaire, which helps to organize them based on certain distinguishable traits. such as age, gender, location, profession, and personal interests.

These can be — and oftentimes are — based on the potential panelists’ demographics, psychographics, behaviors and geographical locations.

5. Vetting Your Panelists

The questionnaire you use should vet your potential panelists on a wide range of traits and their subcategories. You wouldn’t want to enroll the wrong audience in your panel. In addition, you would want your panelists to align with all the requirements you determined for your panel audience in one of the previous sections.

As such, you should vet your potential panelists, those who opted in through any of the online channels you chose, with a rigorous set of panel criteria.

The following explains the criteria for choosing the correct research panel:

- Demographics

- This involves basic groupings based on the potential panelists’ gender, age, income levels, race, ethnicity, employment type, education, salary, etc.

- You can get as granular as you wish, provided you have the right tools to do so.

- Psychographics

- This involves the attitudes, interests, lifestyles, aspirations, values and other psychological criteria you would need to group your panelists by.

- It also involves whether they engage in particular customer behavior, such as frequency of purchases, brand preferences, consumer loyalty to certain brands, etc.

- Geographical locations

- This can include macro and micro-locations.

- As such, you may need to target panelists based on their country, state, territory, city, zip code and more.

- The granularity of targeting will depend on the kind of methods your panel provider or your in-house researcher team uses.

- Firmographics

- This category applies when you seek to form a panel of business personnel, which you will need for conducting B2B research.

- As such, it requires running B2B surveys.

- Assure that the company you aim to use panelists from matches the needs of your study.

- Demographics

6. Incentivize Your Panelists

Participation in a research panel is often incentivized. Few people would devote their time and efforts for free, not least for a continuous project, which most panels often are used for.

As such, remember to offer panel members rewards in exchange for their feedback and time. You’ll need to consult with your panel provider if you don’t recruit and work with your panelists yourself and are concerned about incentivizing them.

These rewards can vary from one vendor to the next but can be monetary or non-monetary. Thus, they can include cash, gift cards, vouchers, free subscriptions to a service and free products. You can also offer a points system in which panelists can redeem for goods and services.

7. Carry Out Panel Research

Now that you have formed a market research panel, it is time to use it for your various research purposes. You’ll want to first split your panelists into different market research campaigns and studies. As mentioned earlier, each panel study will require a different audience.

Therefore, before you begin conducting your research with your panel, make sure to assign it to its designated research campaign, its sub-campaign and its particular study. Once you do this, you can conduct your studies.

To reiterate, once you have put together your panel, you can choose from various research tools and methods. You can opt for surveys, focus groups, phone interviews, mobile ethnography, in-home use tests and more.

During your research sessions, make sure you record as much information from the panelists as possible. This is why using surveys is an ideal route, as they collect all the insights your panelists share, as opposed to experiments, product testing and focus groups.

8. Maintain and Manage Your Survey Panel

Managing your survey panel is not the same as recruiting it. It takes practice and best practices to ensure you maintain your panelists and build a strong relationship with them. They are people, after all, and not solely those who take your survey once.

As such, you should attempt to form strong connections with your panel. Whenever you reach out to them, whether it's over email or phone, be friendly and use language that makes your panelists feel important and appreciated.

Avoid sounding too generic and make your outreach personable — and personalized. Ask yourself, before you send any emails, if you would open the email, read it in its entirety and respond.

It’s crucial to ensure your research is easy to partake in, yet another reason to distribute surveys, as they take less time than field research, experiments and the like.

If you’re managing a panel in-house, you should consider assigning a designated person to manage the panel. Use someone from your business to keep in touch with the panel members and serve as the head of the panel.

Always keep your research promises to avoid panel attrition. This means, that if you’ve set a specific cadence of 1 study a month or 3 interviews per month, make sure to honor that cadence. Going above or below it will frustrate your panelists and make you untrustworthy.

It will therefore cause chaos in your study, which can easily lead to attention.

Are There Different Types of Market Research Panels?

Market research panels can be split into two main groups: B2B panels and B2C panels. There are many other subgroups within each category, but it is key to know their presence and differentiating qualities.

- B2B (business-to-business) panels are made up of business owners, professionals, industry experts, advisors and decision-makers.

- Panelists often respond to business-related surveys regarding industry type, segmentation, or market demographics.

- This kind of panel would require vetting members based on firmographics.

- B2C (business-to-consumer) panels comprise customers or end-users of a brand, product, or service.

- Businesses use these panels to access feedback from their target audiences.

What Are the Advantages of Using a Market Research Panel?

Online market research panels tend to be more popular than other, more traditional research methods. Often called legacy research methods, they usually take more time and effort to complete and don’t provide the same precision as a smart online survey platform does.

Take telephone interviews, for example. These require a lot of time and expense to run, and there’s no guarantee that the person answering the phone is 1) interested and available to speak, and 2) fits within the target demographic you wish to hear from.

Research panels, on the other hand, are made up of pre-screened individuals who have already opted-in to respond to surveys. This makes panels more cost-effective (and faster) to run.

Other advantages of market research panels include:

- Higher response rates: Respondents are motivated to take part in research and are less likely to be “caught cold” by a survey. This is usually because they’ve signed up themselves via an app or website, have subject matter knowledge they wish to share, or are incentivized by rewards, such as cash, vouchers, or points.

- Diverse viewpoints: A well-run, established research panel can be made up of any number of individuals from different backgrounds, professions, age groups, or locations. This level of variety allows you to mirror your specific audience during a research project.

- Reliable panel screening: The onboarding process of a panelist means their demographics are captured and categorized from the outset. This makes market segmentation easier and allows research panels to be convened quickly to gauge opinion or test the waters with a new product or service.

How Does an Online Market Research Panel Benefit Brands?

In addition to the advantages mentioned above, research panels have specific benefits for the brands and businesses that utilize them:

- It offers quicker research turnaround: If a brand has entered the final stretch of a product development initiative or marketing campaign, and wishes to check in with their target audience, pulling together a focus group at the last minute can be challenging – and expensive. Market research panels let brands access insights and feedback faster than other research methods.

- Multimedia elements can be included: Online market research panels can seamlessly include video, photographs, and sound clips to enrich the survey experience and provide a far better level of feedback. Using multimedia elements in other forms of market research can range from difficult to impossible.

- Products/services can be tested with real end-users: Before releasing products or launching services to the wider market, brands can test them with a facsimile of their target audience. Panels allow brands to gather actionable insights quickly, gauging sentiment and performance in the process.

Are There Drawbacks to Using an Online Market Research Panel?

While market research panels do benefit both analysts and brands alike, they’re not immune from some glaring pitfalls. You should be aware of them before selecting this method for conducting research.

- Limited to those with internet access: As the name suggests, an online market research panel requires internet access. This is fine if your target audience is from a country where the internet is easily affordable and accessible, but if you wish to learn more from an older and/or remote group of people, it’s perhaps not the best research method.

- Risk of duplicate respondents: People who enjoy participating in surveys (or are motivated to do so via incentives) will likely sign up for multiple survey vendors. This can result in the duplication of responses, skewing the data in the process. While some vendors will do their best to remove duplicate respondents, it’s still important that the data is scrutinized.

- Risk of poor data quality: Speaking of data, surveys can attract a range of less desirable respondents, motivated solely by incentives and with no interest in sharing considered opinions and feedback. Speeders, straight-liners, survey professionals, fake accounts, bots, and more, these types of panelists can quickly derail a survey.

- Acquiescence bias and other biases: Also called agreement bias, acquiescence bias occurs when panelists are inclined to provide only positive or agreeable answers. With this bias, respondents feel more social pressure to answer in a particular way, as their identities are known to your business or the panel provider.

- Longer recruitment and vetting periods: It doesn’t take a few minutes to vet and recruit a panel. That’s because you would first need to target its members, have them opt-in, review their self-identifying questionnaires to confirm their qualifications and ensure you have the required panel size before you even form the panel, let alone conduct the research with it.

Combat Reduced Research Quality Using Organic Probability Sampling

Although research panels can deliver a range of benefits, the market research panel definition we shared at the start of this article only tells part of the story.

While these panels are largely comprised of motivated research participants — survey participation has been on the wane. This means the quality of research panels is fast becoming compromised as traditional companies scramble for participants from anywhere and everywhere.

At Pollfish, we avoid using conventional panels for this very reason. Instead, we’ve developed our very own market research methodology called Organic Probability Sampling. This involves sourcing our audience of real consumers via partnerships with app publishers, which allows us to conduct randomized, yet highly targeted surveys to verified respondents.

Our unique process is known as Random Device Engagement, (RDE), which uses the organic sampling approach for finding and obtaining survey participants.

This randomized method of reaching respondents ensures you avoid acquiescence bias from respondents, due to the anonymous nature of this route.

In addition, it allows you to steer clear of the sampling bias, which occurs when the respondent selection process is not conducted at random, which then leads to under or overrepresentation of a certain market segment.

A kind of organic probability sampling, RDE polling relies on advertising networks and other digital platforms to engage potential respondents wherever they visit voluntarily. This includes a variety of digital platforms and properties, such as:

- Mobile sites

- Apps

- Website

- Mobile games

With over 250 people in our network, we never have to worry about data quality, delivering only the best, most authentic, and most useful insights to our clients.

The Need for a Strong Market Research Platform to Leverage Organic Sampling and More

Our final word involves highlighting not merely the importance of organic sampling and RDE, but the need to leverage the right online survey platform to carry out your entire research campaign.

A potent online survey provider, one that offers enterprise survey software will do all the heavy lifting for your market research campaigns. That’s because such a platform doesn’t simply facilitate creating surveys.

Instead, it allows you to hyper-target your survey audience, set quotes, reach populations from far and wide and ensure your survey gathers the exact amount of respondents as you input into your audience requirements section.

It would enable you to target respondents based on screening questions, along with inputting a large swath of respondent qualifications, including the four main categories of demographic, psychographic, geographic and firmographic identifiers.

In addition, a strong survey provider grants you options aside from the Random Device Engemanet method of reaching respondents. Instead, it should also afford you the option to survey specific people, via the channels you specifically choose to deploy your surveys through.

This includes using channels such as via email, or whichever digital channel you seek to use. Fortunately, we offer the Distribution Link feature, which allows you to do just that.

All in all, a strong survey platform that offers random sampling through RDE and a variety of market research features and tools trumps market research panels.

Luckily, the Pollfish platform uses the RDE method and offers a variety of market research features such as A/B testing, conjoint analysis and much more to ensure a quality research campaign and avoid survey biases and fraud.

A market research panel is a group of individuals who have been recruited to take part in market research, which may include surveys, online panels, or in-person panels. B2B (business-to-business) panels focus on the relationship between two businesses and may consist of business owners, industry experts, and other professionals. B2C (business-to-consumer) panels focus on the relationship between the business and their target market (the consumer). B2C panels will consist of members who represent that target market. Online market research panels are more popular than their traditional counterparts for several reasons. Online market research panels are most cost-effective, faster to deploy, have higher response rates, provide better data sampling, and allow for diverse viewpoints to be heard. Online surveys can attract individuals who participate in surveys solely for the incentive or reward. These respondents are less motivated to share genuine opinions. There is also the risk that fake accounts and bots could be used to game the system. The results gathered through online market research panels can be improved by using organic probably sampling, a market research methodology developed by Pollfish. This approach sources survey respondents who are motivated to participate for genuine reasons.Frequently asked questions

What is a market research panel?

How do B2B market research panels differ from B2C panels?

What are the advantages of an online market research panel?

Why is poor data quality a risk of online market research panels?

How can you improve data quality of online market research panels?

How to Create a Customer Experience Survey to Retain Customers

How to Create a Customer Experience Survey to Retain Customers

A customer experience survey is a necessary tool to implement in your organization’s customer experience program. With CX carrying a major influence of the success of your business, it’s crucial to keep track of it.

This is because even in the competitive environment of B2C businesses, the product and cost alone are not sufficient enough to provide customer satisfaction, let alone to build loyalty.

The brands of today and the future are thriving due to the customer experience they provide.

A customer experience program refers to a methodical approach centered on improving the way a business interacts and engages with customers to improve their CX. Often this sort of program relies on a strong voice of the customer (VoC) in place.

That’s where the customer experience survey comes into play. This article explains this kind of survey in full depth so that you business can retain its customers.

Elucidating Customer Experience (CX)

Customer experience involves a variety of experiences that customers undergo in their interactions with a business. This involves all the stages in their customer journey, from viewing an advertisement to arriving at a landing page, to browsing your website, to making a purchase and all post-purchase experiences.

There are various elements that come into play with the CX; they all form a customer’s impression of a brand. These impressions are critical when it comes to maintaining customer loyalty. A bad CX incurs the risk of losing customers, as a 1 in 3 customers will leave a brand after just one poor experience.

There are more damning statistics, for example, even if a brand provides a good CX 9 out of 10 times, the one time that it fell short can lead to losing customers (even loyal ones).

As such, brands need to have a strong customer experience program as part of their business strategy. A customer experience survey is a potent tool, usually the main supplier of a customer experience program. By studying your CX with this survey, you’ll be able to improve your CX, thereby retaining customers.

Defining the Customer Experience Survey

A customer experience survey is a survey conducted to gauge various aspects of the customer experience. Brands can zero in on one component of their CX, or attempt to understand several.

Since CX involves the totality of customer interactions, behaviors and feelings, this survey can exist in a number of survey types. The following list enumerates the surveys that help you determine the state of your customer experience.

These surveys show the macro-levels, i.e., the disciplines within marketing, business, et al., that you can base around your customer research. As such, they all include their own specific types of surveys, subtypes that show you how deep and granular survey research can become.

The survey types fortifying customer experience research:

- Customer satisfaction survey

- Helps brands focus on multiple factors of customer satisfaction

- Includes the Net Promoter Score (NPS), Customer Satisfaction Score (CSAT), Customer (CES), visual ratings and custom surveys

- Product satisfaction survey

- Focuses on the product side of a business

- Includes surveys on product glitches, shipping experience and product retention

- Business survey

- Deals with key areas of business like understanding customer personas and discovering how the competition ranks against your CX.

- Measures brand awareness as it ties with several business aspects focused on the business itself

- Cross-sectional survey

- Studies a particular population at one particular point in time.

- It helps you determine your CX at a snapshot level, within a particular respondent group or market segment.

- Customer loyalty survey

- Measure the chief objective of CX: customer loyalty

- Includes surveys hinging on the Customer Lifetime Value (CVL) and the Customer Lifetime Value (CVL).

What It Helps You Study In the Customer Experience

There are multiple touchpoints in customer journeys. The customer experience survey is meant to address them all by capturing customer sentiment within each of them. These touchpoints make up the customer lifecycle; understanding how CX is relevant to them will help you form your survey, improving your experience as a result.

Mapping Out the Customer Experience in Key Stages

This is a critical phase of the customer journey, including multiple stages that a customer undergoes before making a purchase. These include:

- Early sales funnel experiences

- Online portals, billboards, physical advertisements and all else that brings awareness to your brand or a specific offering.

- Middle of the funnel interactions with customer representatives, digital journeys and social media visits.

- Late-stage experiences such as saving products for later, comparing products and using the checkout.

- Post-sales experience

- Involves ensuring that customers are happy with your products.

- Regular post-sale checkouts via surveys, emails, etc.

- This phase digs back into the previous one to collect feedback on the brand/sale discovery and ordering experiences.

- Upselling vs Returns

- Finding opportunities for upsells, cross-sells or repeat purchases, i.e., surveying customers on their future engagement or lack thereof with the company.

- Includes surveying unsatisfied customers who cancel, downgrade or return their purchases.

Creating a Customer Experience Survey

After you decide which stage of the customer experience you need to study based on the sections above, consider the following list. Many times, delivering the best customer experience involves surveying customers across all stages. Here are the steps to form an informative CX survey:

- Put together your most pressing curiosities about your CX.

- Organize them into several groups based on shared characteristics.

- Based on these groupings, filter each with a corresponding CX stage by referring to the above section.

- Find the most proper campaign within the phase you choose to study first.

- Ex: Let’s say you’re studying early sales funnel experiences. You decide you’d like to survey customers on how they found your brand and whether they enjoyed the experience. As such, you will want to study your ad campaigns, be they digital or physical (subway ads for example, in a particular city).

- Once you connect your sales funnel stage with a broader campaign, divide that campaign into several smaller, more specific survey premises.

- In reference to the above example, you may have multiple ad campaigns; base your survey on one of those campaigns, or create one that tests respondents on whether they are aware of one or multiple advertisement campaigns.

- Decide on which kind of survey best fits your particular survey campaign from the above list.

- Next, choose a specific survey from the survey types you’ve selected above.

- Put together several questions, these can begin as high-level questions and wade into those that specifically ask respondents to rate their experience. Examples:

- What was the best part about browsing our site?

- How did you feel about [example] element?

- What can we do better to improve your experience?

- Did you find it easy or difficult to [browse our site, speak with our rep, ex]?

- If you choose visual ratings questions (ratings via stars, numbers or some other visual element), consider providing open-ended follow-up questions to understand the reasoning behind their responses.

- Remember to thank your respondents at the end of the survey (or beginning) and remind them that their participation helps your brand improve the experience for consumers like them.

Making the Most of Your Customer Experience Survey

Although you are assessing your consumers’ experiences through this survey, the survey itself is another customer experience for your consumers. This is predominant in this survey type, as it doesn’t simply mention your brand.

Rather, it is based solely on the feelings and attitudes surrounding your brand’s CX, rather than general customer habits like, for example, a regular consumer survey, a longitudinal survey and others. Such surveys depend on understanding customers and external influences, whereas a customer experience survey focuses on your business.

As such, keep in mind that as yet another experience, this survey will shape your customers’ and target market’s perception about your business, so follow the above best practices, along with the many others, such as what to look for in online survey tools. In this regard, the survey platform you use is equally important to the CX of your CX survey.

Frequently asked questions

What is a customer experience survey?

A customer experience survey is a survey that collects data on different aspects of the customer experience. Brands can use customer experience surveys to narrow their focus on one component of the CX or even examine their overall CX.

Why is a customer survey experience important?

A customer experience survey is important because of the weight CX carries in influencing the success of your business. Customer experience surveys are usually the main supplier of customer experience programs. Studying them helps you improve your CX and retain customers as a result.

How do you create a customer experience survey?

To create a customer experience survey, you must first choose an area of your CX to study and select the campaign that matches this characteristic. Then, decide which survey type will fit your campaign and put together questions that require visual ratings or are open-ended. Finally, thank the respondents at the end of the survey and consider offering incentives.

How is a customer experience survey different from a regular consumer survey?

A customer experience survey revolves around your customer experience, which includes all the feelings and perceptions your brand incites in a customer journey, rather than general customer habits.

Why is the survey platform you use important to the results of customer experience (CX) survey?

Using the proper online survey platform helps streamline the survey research process. With the right platform, you can reach your intended target audience, screen them for behavioral and psychographic needs, ask of variety of question types, route them to correct questions based on previous answers and gain insights at speed.

Diving Into the Customer Satisfaction Survey

Diving Into the Customer Satisfaction Survey

Customer satisfaction. This lofty achievement is often, if not always, the main objective for businesses small and large.

It goes without saying that this concept is attributed to revenue, continued purchases, customer loyalty and brand awareness (via reviews and mentions by happy customers).

So how can your business accomplish customer satisfaction? By putting the customer satisfaction survey into practice.

This survey is specifically tailored to gauge customer satisfaction within your niche, and most importantly, within your company. This article will explore this survey type and how you can optimize it for all your business needs, including market research, marketing and more.

Defining Customer Satisfaction

This term appears to be self-evident, but for business purposes, it is best to understand it precisely before you venture out on any efforts to perfect it — or if you’re a startup — to reach it.

Customer satisfaction denotes the measurement that ascertains the degree to which customers are satisfied with a company’s products, services and experiences. In short, it reveals whether your customers are happy with your offering and by how much.

Your business can determine its own levels of customer satisfaction with the customer satisfaction survey.

The Customer Satisfaction Survey & its Applications

As its name implies, a customer satisfaction survey is a survey developed for businesses to understand what their customers think about their products, services and company at large.

As such, this kind of survey can cover all the bases of customer satisfaction, such as user experience, mobile experience, customer support and all the other facets of doing business/ interacting with your company.

The customer satisfaction survey can take the form of a questionnaire, or a ratings-based survey (think numerical values, stars and other icons used to express good or poor satisfaction).

This kind of survey can be used in a number of different campaigns, based on their macro applications. These include:

These applications may seem too broad to be used for uncovering customer satisfaction alone — and they are. These macro applications serve as the starting points of survey research, which in turn can be used to buttress them. The same applies to a customer satisfaction survey, which can be used in relation to these campaigns.

For example, you can test how satisfied customers are with a product, as it relates to an advertising campaign around it.

Or, perhaps you need to test your customer support satisfaction for branding. You may conduct a survey that asks about specific wording your representatives may have used.

There are several ways to form a customer satisfaction survey.

5 Types of Customer Satisfaction Surveys

You can design these surveys in a number of ways, but there are five main types of formats that these surveys take. Each survey type provides a different kind of angle into customer satisfaction. As such, they should be used at different points in the customer journey.

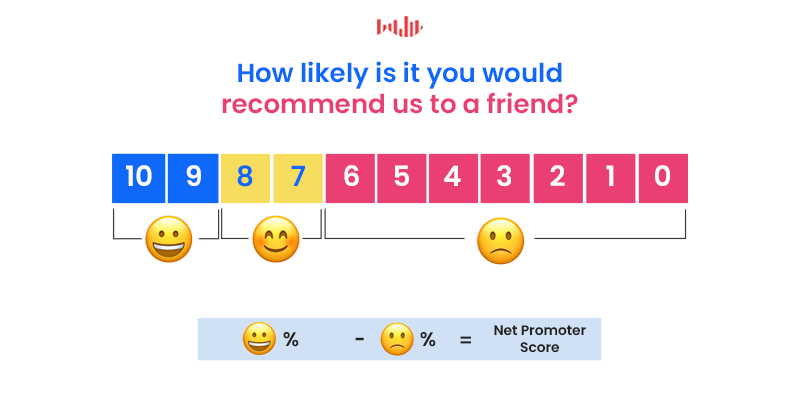

Net Promoter Score Surveys (NPS)

Conceived in 2003 by Fred Reichheld, of Bain & Company, the Net Promoter Score (NPS) survey has become prominent across industries. This score-based survey asks customers to rate the likelihood of their recommending your business, on a scale of 0-10.

The respondents who ranked their likelihood between 0-6 are known as the detractors, those who are generally unhappy with your product, service or experience.

Those who respond in the 7-8 range are called passives, as they are not impressed with your company, but aren’t dissatisfied either. They are situated in the middle of this score, despite their numbers going slightly past the mid-section.

Respondents in the 9-10 range are the most ideal, as they represent the promoters of your business; they are on the higher end of satisfaction.

To calculate your NPS, subtract the percent of detractors away from the percent of promoters. For example, if 60% of responses were Promoters and 15% were Detractors, your Net Promoter Score would be 45. (The NPS is expressed as a digit, not a percentage.

Pro tip: Always add a follow-up open-ended question, so that your customers can explain why they selected their rating.

Customer Satisfaction Score (CSAT)

The CSAT represents a customer’s fulfillment in a particular situation. This is where you can apply this survey to a wide range of applications. For example, you can assess customer happiness during an interaction with a salesperson or with a product feature.

The Customer Satisfaction Score is made up of two parts: a numerically-based question and an open-ended question. The numerically-based question is a scale representing satisfaction.

The CSAT can ask, for example, to rate satisfaction with an experience from a scale of 1 (very dissatisfied to 5 (very satisfied).

To calculate the CSAT, use the following formula: The total number of satisfied responses / total number of responses) x 100. Round the result to the nearest whole number.

Respondents who answer this with either 4 or 5 are considered to be satisfied customers.

Pro tip: Use the CSAT to understand your customer sentiment at a specific point in time. This includes after a product demo, after a technical support call, after visiting a service center or store.

Customer Effort Score (CES)

This type of survey measures the amount of effort that was required for a customer to take part in an action. This survey focuses solely on the process of achieving an end result. Also called the effort, measuring the process determines how easy or difficult the flow is in your product/service.

As such, even if the result may be enjoyable to the customer, the process itself may not be.

This service is important, as brands today must provide quality experiences; the product or service alone is not enough. To fully satisfy customers, brands must make it smooth and easy to complete any process, whether it’s signing up for a subscription or ordering a product.

To calculate the CES, use a 5-point scale to gauge the ease of the customers’ actions. For example, it is common to ask: “how easy was it to find this product on our site?” The options should range from “very difficult,” to “somewhat difficult,” to “somewhat easy” and so on.

The answers on the “disagree” side of the spectrum would be number 1 and 2. 3 would be neutral, while 4 and 5 would be on the “agree” side. The CES is centered around the “agree” answers.

As such, to find the CES add all the “agree” answers (either 4 or 5), then divide them by the total number of respondents.

For example, if 100 customers replied with a 4 or 5, but there are 200 of them who took the survey, 50% of them are in the “agree” range. That means your CES score is 50. Brands ought to aim for high CES scores, as it points to customers happy in achieving an intended outcome.

Visual Rating Surveys

Also called emoji surveys, visual rating surveys allow customers to respond with graphic, rather than with a number. All the choices they can select are composed of a graphic and there are various ones you can use.

Each answer shows a different amount of each graphic to express the level of satisfaction. For example, a question on how satisfied customers are with a service can range from 1 to 5 stars or other emojis.

Here are a few examples of the types of visual rating surveys:

- Star surveys

- Heart surveys

- Thumbs up/down surveys

- Smiley surveys

These kinds of surveys are visually appealing, easy to complete and take little to no time to finish.

Custom Surveys

Best used to understand how and why customer satisfaction was exceeded, met or failed to reach expectations, these surveys are often used as follow-ups to previous surveys.

Custom surveys include questions that delve further into customer satisfaction to discover specifics that other surveys could not make readily available.

To piggyback on previous surveys or previous responses, you can ask follow-up questions by way of advanced skip logic. This will automatically direct your respondents to different question paths, depending on the answers they provided.

You should organize your custom survey feedback into three segments: fix now, fix later and fine as is. This will allow you to see which issues and experiences are the most pressing and which can be amended later.

6 Types of Questions to Use in a Customer Satisfaction Survey

The types of questions you use will largely depend on the kind of survey type you implement into your customer satisfaction campaign.

However, since they all fall under the same research campaign and measure virtually the same thing, there is going to be a lot of overlap between the questions you use for each survey type.

The following lays out the 6 question types to use for measuring customer satisfaction.

- Multiple-choice questions: limit the number of answers a respondent can use. Little effort is required to answer (as opposed to open-ended questions).

- They can include rating scale questions, binary scale questions, nominal questions, Likert scale questions, and semantic differential questions.

- Rating scale questions: use multiple-choice questions that correspond to a scale, such as the CSAT, for customer support, or the probability of product recommendation (NPS)

- These are also called ordinal questions.

- Binary scale questions: Allow for only two answers, such as yes or no, or a thumbs up or down.

- These are used to cut back on obscure results.

An example of a binary scale question

- These are used to cut back on obscure results.

- Nominal questions: Use different categories of answers with no numbers attached.

- Likert scale questions: Questions on a 5-7-point scale to assess customer sentiment.

- 1 represents the lowest end of the view (strongly disagree) while 7 is at the highest end of the opinion (strongly agree)

- Semantic differential questions: Uses a 5-7-point scale, but goes beyond agreeing and disagreeing.

Using this Survey to Lure in New Customers

Unlike other surveys, which are used to scrutinize your target market, identify it or segment it further, the customer satisfaction survey deals solely with customers, ie, the segment that has already bought from you.

Not everyone in your target market is a customer, as this group denotes the people most likely to buy from you — not the people who already made a purchase.

Customers are every bit as important to study as prospects, as they help you discover what your company exceeds at and where there’s room for improvement. Measuring customer satisfaction will inform your business on how to better prepare your service, experiences and offerings for everyone in your target market.

As such, you’ll know how to better lure in new customers and upkeep their satisfaction. But most importantly, a customer satisfaction survey helps bridge the gap between one-time purchasers and loyal customers. Retaining your customers is key to keeping your business afloat, as they represent a continuous stream of revenue and revenue opportunities.

Frequently asked questions

What is a customer satisfaction survey?

A customer satisfaction survey is a type of survey that is designed to measure how happy or satisfied existing customers are with a product or service.

What is a Net Promoter Score survey?

A Net Promoter Score (NPS) survey is a short survey that is used to measure the likelihood that someone will recommend a product, service, or company to someone else. The survey is a good way of gauging overall customer satisfaction.

What is a CSAT?

A CSAT, or Customer Satisfaction Score, is a short survey that measures how satisfied a customer was with a specific situation. It consists of a numerical-based question and an open-ended response.

What is a Customer Effort Score?

A Customer Effort Score (CES) is a survey that measures the amount of effort required to complete a certain action. The survey consists of a single question with a 5-point scale response.

What is a binary scale question?

A binary scale question is a type of survey question that has only two possible responses (e.g. yes or no).