What is a Focus Group and How to Use it in Your Market Research

What is a Focus Group and How to Use it in Your Market Research

Chances are, you’ve come across focus groups if you’ve looked into market research or other forms of research.

The term focus group is often used as one of the key methods to gather qualitative research, in the market research sphere. Although not quite an interview, this hands-on approach spurs discussions between research participants, which have the potential to go into great depth on a subject of study.

As such, using this technique allows businesses to gain critical insights into their target market, along with all of its segments.

These insights help you hone in on your marketing, branding, advertising and other business processes.

Focus groups can be conducted with other research methods, such as survey research and more.

That’s why you ought to familiarize yourself with this type of research technique. Luckily, this lengthy guide goes into the weeds of this form of research, allowing you to gain an exhaustive understanding and decide whether you should carry out this kind of research method.

This thorough guide explains what a focus group is, how to use it, how it works, its advantages and shortcomings, how it ranks against survey research and more.

Table of Contents: What is a Focus Group and How to Use it in Your Market Research

- Defining Focus Groups

- Post-Focus Group Research

- How Focus Groups Work

- The Pros and Cons of Focus Groups

- The Types of Questions Used in Focus Groups

- When to Use a Focus Group

- Focus Groups Vs Online Surveys

- Focus Groups vs. an Online Survey Platform: The Verdict

Defining Focus Groups

Let's begin with the heart of the matter: what is a focus group? A focus group is a small group of people selected based on their specific shared characteristics, to take part in a discussion for market research, or other types of research.

Focus groups are a kind of primary research. Unlike market research software, which is one of the most popular tools for conducting research in the present day, a focus group does not take place digitally—not before Covid, that is. Now, many events, whether they are research-related or otherwise, take place via online meetings.

At any rate, focus groups occur with all members in one conjoint session, whether it’s in-person or over the internet. Researchers can opt to include a single or multiple focus group sessions, should they require further studies on the same topic or group of participants.

Focus groups are one of the main techniques of qualitative research, which delves into a wide variety of phenomena. These include:

- Motivations

- Attitudes

- Reasoning behind actions

- Opinions

- Sentiments

- Beliefs

All of these aspects and topics of discussion can focus on the participants about various stimuli, such as current events, past events, plans, fears, culture, etc.

Unlike quantitative data, which works to find the “what” and generate statistics, qualitative data aims at understanding a topic in greater depth.

Focus groups are composed of a small number of people who take part in a studied conversation alongside a moderator. The moderator is one of the main researchers assigned to this kind of study.

The Role of the Moderator

The role of the moderator is to ask questions, manage the discussion, make sure everyone speaks up and take notes on the discourse, which are later used to analyze it. Essentially, the moderator is a kind of host in this scenario.

Their role is multi-pronged, as they wear different hats in the study. The degree of their involvement in the study may depend on the other actors involved, typically other researchers who are part of the focus group or the larger research study.

In addition, their roles may differ based on the other market research techniques their organization uses, whether it includes survey research, concept testing, experimental research, or others.

The following lists the different aspects of the role of the focus group moderator:

- Observer

- Recorder

- Discussion driver

- Interviewer

- Post-session and on-site analyst

Focus Group Size

The typical size of a focus group ranges between 5-10 people. 5-7 is the ideal amount of focus group participants, as these groups are purposely kept small.

That’s because when there are more than seven people present, it is difficult for every member to speak about a topic, or issue, and especially, to answer a specific question. It would also be difficult for the moderator to control a larger group and ensure everyone provides their insights. Additionally, some topics become irrelevant to continue discussing after the seventh person weighs in.

The Focus Group Approach

This method provides an interactive approach for research participants to share their viewpoints and experiences and for researchers to collect critical data on their subjects.

In direct opposition to quantitative market research, focus groups do not involve crunching large numbers or making assumptions based on large quantities. Instead, they focus on a small group of participants who represent different market segments and customer personas.

In keeping with the qualitative research approach, the moderator uses open-ended questions. The moderator may also use multiple-choice questions, but those are almost always followed up with questions to explain the reasoning behind choosing a particular answer.

Thus, these discussions are typically filled with questions that delve into the “why” and “how,” as they seek to uncover context and motivations.

Participant Discussions

The purpose of this qualitative research methodology is to gain a wealth of insights into customer behavior, customer preferences, attitudes, beliefs and more, by way of a hands-on approach.

As such, the focus group method is intended to reap key insights from the discussion generated among participants. During the discussion, the participants are not solely encouraged to respond to questions the moderator asks but to engage in conversations with other participants.

In doing so, participants are prompted to reflect on their memories and draw from their own experiences.

The discussion of the focus is based on a pre-selected topic. This is usually tied to a larger market research campaign, which may be part of another business campaign, such as the strategic planning process, a marketing objective, a consumer insights campaign and more.

Focus Group Participants

In market research specifically, the participants of a focus group are members of a business’s or in broader studies, an industry’s target market. This is the broad range of customers who are most likely to buy from a business and are typically the targets of marketing campaigns.

The shared characteristics of the study can be based on demographics, psychographics, geographic location and firmographics. Firmographics characteristics are those that involve business, as such, they would be included in a B2B focus group. This is a study on other businesses, typically those who are clients of a business.

Demographic factors include characteristics such as gender, age range, ethnicity, income, education level, marital status, number of children and other such factors. These can include geographic locations, although geographical factors are considered a separate category in market segmentation.

Post-Focus Group Research

After the interview or set of interviews in this study, the moderator gathers the research and summarizes it. They may conduct their analysis or consult with other researchers on their team.

It is usually the other researchers who are better suited to understand and explain certain communication styles, and body language as well as to conduct further descriptive research. As such, there may be several rounds of analyses on the data from the focus group

Thus, in post-focus group research, which refers to post-interview research, there is usually a team of researchers involved in analyzing the group’s discussion and the data it produced.

Post-Research Document of Findings

After conducting an analysis, the researchers, including the moderator, will consult with one another to turn the raw data and analyzed research into a presentable document. This document should include the following:

- The purpose of the focus group study

- The participants’ profiles

- This should include the characteristics of all major segments of a population, such as:

- Demographics

- Psychographics

- Geographies

- Firmographics (if business personnel were studied)

- This should include the characteristics of all major segments of a population, such as:

- A summary

- Key findings

- Explanations of key beliefs, sentiments, opinions, or thoughts

- Comparisons and contrasts between different members

- This should include comparing them on a higher level, as each participant can represent a different segment of a target market.

- Statistics (although not very common)

- These can include statistics drawn from other market research methods, such as using an online survey tool, other non-focus group interviews and even sources of secondary research.

- Plan of action

- This should include what the researchers plan to do next with the data, especially about other team members.

- After all, most data and research campaigns should be actionable. You wouldn’t want your efforts and highly-coveted data to sit idly and gather dust.

- A conclusion

- This should be concise and round off the study.

- It should include a few of the most important findings, along with the plan of action and next steps.

They would then share it with other members of their organization. This often depends on the purpose of the focus group study.

For example, if it was for marketing purposes, the research would be primarily shared with the marketing team. If it was for customer development, it would be shared with the product team and so on.

Data Democratization in Post-Focus Group Research

There are going to be some cases in which the topic scrutinized in this kind of study doesn’t neatly correlate with a single department. This is perfectly fine, as certain business practices can be conducted cross-departmentally, or for the business at large.

This is where the democratization of data comes in. This concept refers to the practice and condition in which everybody in an organization has access to data. In such an environment there are no team members hindering access to the data. As such, there should be no bottlenecks preventing people from either using the data or understanding it.

This points to the need for the data to be both highly accessible and understandable. This underscores the importance of creating the post-research document mentioned in the previous section.

It is this document that serves as the go-to source for examining a business’s focus group study, and most importantly, putting the study to good use. This means the actions the focus group yields will go beyond those outlined in the plan of action section in the study’s main document.

Instead, in a democratized data environment, other team members, those who aren’t researchers or analysts, can analyze the data as well. This ability allows them to partake in the data for the decision-making process.

This is important for all companies, as data goes unused in too many businesses. Even though more companies are investing in customer data, up to 80% of all data goes unused. You wouldn’t want to waste your money and efforts on churning out data that goes unused.

As such, data democratization is a must in all market research campaigns, including docs groups.

How Focus Groups Work

Focus groups use a specific methodology to clear away any ambiguity. As aforementioned, the small group that makes up a focus group comprises 5-7 people.

The participants are pre-recruited, similar to the mechanism for gaining research participants used in survey panels. They are enlisted based on shared characteristics, which are considered the subject of market research.

To reiterate, these characteristics include demographics, psychographics, purchase history, shopping behaviors, and other factors.

The qualifications that researchers use to recruit participants often bind the participants to a brand’s target market. However, brands can also study people outside their target market to learn how other consumers think and possibly gain them as customers.

Focus group discussions vary; they can involve feedback on a product, experience, or marketing campaign. They can also be used to discuss consumers’ opinions on different matters, such as pop culture, news and politics, especially if they relate to a brand’s industry.

The discussions are led by a moderator, who prompts questions and talking points. The moderator sets the conversation in motion, along with acting as the researcher. As such, the moderator also notes their observations.

How long does a focus group last?

The length, both in terms of questions and the discussion of the interviews themselves will vary. It is up to the moderator to decide whether they’ve gleaned enough information from the participants or not before moving on to another question or topic or ending the session.

Typically, these discussions involve using 10-12 questions to draw out responses on key topics that underpin the overall market research campaign. The discussion takes about 30 to 90 minutes.

The environment of the study

A focus group environment should be open-minded as participants can have varying and even oppositional opinions. No one should be made to feel threatened or silenced, as every insight matters.

Focus groups are NOT to be conducted in the same way as interviews. They are far more interactive, but most importantly, they are not carried out on a one-on-one basis. Instead, they are group-focused activities, in which participants speak with each other instead of solely with an interviewer.

As such, the participants may influence each other, possibly swaying the minds of some members, or reinforcing someone’s opinions. Some participants will draw opposition or even aversion to their responses from others, possibly from the moderators themselves.

This is because they’re in the same broader target market, they are all individuals who hold their own opinions and convictions.

Regardless, the moderator should not input any of their opinions or beliefs into the discussion and be as neutral as possible. They should assume this neutrality even if they severely disagree with any of the participants.

Since focus groups are small, researchers often conduct several (3-4) of them, which includes hosting several interviews per focus group, across different geographic locations. This way they can reap the maximum amount of insights and satisfy all of their research campaigns.

The Pros and Cons of Focus Groups

This market research method offers several advantages. These will help propel you to understand your customer base or subject matter much better. They will also help carry your research to completion. But, they have a few drawbacks as well. Researchers and businesses ought to consider both before choosing this research method.

The Pros

- Researchers can probe the deep feelings, perceptions and beliefs of their intended subjects.

- When members are engaged, they provide invaluable information that removes any obscurities surrounding a topic.

- They generate results fairly quickly, as each session lasts no more than 90 minutes.

- Researchers can study body language, facial expressions and other non-verbal signs.

- Not all questions need to be premeditated, as they can be produced based on the direction of the conversation.

- Given that this is a discussion, you may discover even more insights than you had originally planned, including on other adjacent topics.

The Cons

- The thoughts of a small group that fits a target market are useful but are not representative of a larger population.

- Recruitment will take a significant portion of the time.

- Traversing different geographic areas, if need be, is also time-consuming.

- Some members will be dominant while others will contribute less to the discussion.

- Certain participants can sway the discussion, even making it veer towards irrelevant territories.

- They can’t be used for quantitative research.

- Given that this is often done face-to-face, or at the very least, with everyone’s identity known (at least to the researcher), some participants may shy away from expressing their true thoughts.

- They are therefore subject to social pressures and acquiescence bias, in which respondents tend to select positive responses or those with positive connotations.

- As such, there is a lack of accuracy, as these groups are not anonymous.

The Types of Questions Used in Focus Groups

The moderator of a focus group should ask specialized questions to reap as much intelligence as possible. While this format is generally flexible, there are still certain question types that you should incorporate. These will help you hatch the questions you’ll need.

Here are the four types of questions that are most applicable to a focus group, along with question examples:

- Engagement questions

- These questions are designed to ease participants into the discussion by introducing themselves,

- These are easy questions posed early on to introduce the participants to each other, to make them more at ease, and to acquaint them with the main topic at hand.

- Questions include:

- Tell us a bit about yourself.

- What do you generally think about ads in this industry?

- What do you think of this ad campaign?

- Exploration questions

- These questions probe deeper into the topic to get a feel of the participants’ feelings about it.

- These questions are to be asked after participants begin to ease into the conversation and become more active in it.

- Questions include:

- Why do you feel that way?

- Have you seen better examples of this type of ad campaign?

- What would be a better way to go about it?

- Why do you feel this way about this [social] issue?

- Follow-up questions

- These are used to gain a better understanding of a previous question answered, or a previous topic addressed.

- These allow the moderator to get into the nitty-gritty of participants’ feelings and motivations.

- Questions include:

- How do you go about this issue?

- Why do you feel this way?

- Is there anything that would change your mind about [this issue, method, way, etc]?

- How can this brand improve on serving [you, releasing a campaign, etc]?

- Exit questions

- These questions help conclude the session and should be asked when the moderator is certain that the group has expressed everything they can on the topic.

- They should be used to get confirmation on certain notions.

- Questions include:

- Are you sure these are the best approaches?

- Is there anything else on this topic you’d like to add?

When to Use a Focus Group

Do you need a focus group? If you do, you’ll need to know when to use them, which is rooted in the reason behind conducting them in the first place. As such, the when is closely tied to the why and how.

In short, knowing when to use a focus group depends on what you need it for. This will require you to turn to your research campaigns and needs. The following presents a few key moments and reasonings for when you should use this kind of research technique:

- To better understand the results of primary quantitative research or secondary quantitative data about qualitative aspects.

- Whenever you need to gain an explanation of something, whether it’s a phenomenon, a thing of the past, something current, something you still don’t understand.

- When you seek a more interactive research method as opposed to a textual or digitally-based one.

- When you require information about behaviors, motivations and other phenomena that are too complex for a questionnaire alone to reveal.

- To understand the thoughts and opinions of people who are already in your orbit, you don’t need to conduct a deep recruitment process. For example:

- You’d like to know how the members of a senior center feel about its programs, hours and service.

- In this case, the senior center already has a batch of possible participants to choose from, being the members of the center.

- A college club seeks to learn how students feel about their classes, workloads and schedules.

- In this case, the club can choose from a wide range of students at the college. They can promote their group via signs, a booth, email, etc.

- You’d like to know how the members of a senior center feel about its programs, hours and service.

Focus Groups Vs Online Surveys

Now that you’ve learned about the ins and outs of focus groups, it’s time to see how they stack up with another research method: online surveys. It’s key to compare them closely when you decide on the best research method you wish to conduct.

A focus group is a suitable method to garner qualitative research. It is far more interactive than seeking and providing written responses. So how do focus groups measure up against online surveys?

This method is useful for finding deep insights into a topic. It allows researchers to get as granular as possible, since they are speaking with the research subjects themselves and can ask anything that they didn’t include in a survey.

How Online Surveys Are Superior

The following expounds on why online surveys provide researchers with more meaningful results and a more comprehensive market research experience. Use these insights to compare with the benefits of focus groups to determine the better option for your research needs.

Benefits that are second to none

An online survey platform, however, offers benefits that are second to no other market research method. That is because surveys offer more definitive results about a population since they are not limited to 10 or fewer research participants.

Reach the Masses and Conduct Quantitative Research

A potent online survey tool allows you to reach thousands of people — in just one survey alone.

This means surveys are the most apt tool for conducting quantitative research, something that a focus group cannot do.

Quantitative + Qualitative Data = A Complete Market Research Experience

What’s more, is that surveys can include open-ended questions and follow-up questions (depending on the online survey platform you use). This proves that surveys can also forge qualitative market research.

Thus, online survey platforms grant you the power to conduct both quantitative and qualitative research, giving you the most holistic research experience possible.

No need to worry about recruitment

Additionally, there is no recruitment element. The survey platform is the recruiter in this case, as it allows only qualified respondents to take part in a survey.

Granular respondent targeting

You can create respondent requirements that are as granular as you wish, covering every minute detail of a customer profile and reaching any population.

This is because a strong online survey platform enables researchers to select precise respondent criteria, the kind that goes far beyond demographic selections alone.

That is because the screener portion of an online survey allows you to ask specific questions and only permits respondents who chose particular answers to take the survey.

Anonymity, privacy and no social pressures

When taking an online survey, respondents cannot be swayed by other participants as they would in a focus group as surveys are lone activities. Therefore, respondents take them in privacy.

Most importantly, survey software grants responders anonymity. There is no anonymity in a focus group, so more reserved members will feel less inclined to speak about certain things.

Additionally, when domineering respondents are present, it adds another layer of difficulty to the reticent participants, especially when it comes to speaking about views that are contrary to those of a dominant member.

However, with the anonymity of a survey, respondents are free to speak their minds. As such, surveys too can provide qualitative details — so long as researchers include open-ended questions.

Focus Groups vs. an Online Survey Platform: The Verdict

So which is the better research technique? The answer is, it depends on your needs. Most often a focus group is used in tandem with other market research methods. As such, we recommend using both online surveys and focus groups for your research campaigns.

Here’s why:

Researchers can use a focus group to their advantage when they seek deeper insights into the perceptions and thoughts of various business matters.

Whether you’re testing out a new product idea, seeking the sentiment on an ad campaign, trying out new messaging, or seeking insights for any other purpose, a focus group is a useful method. However, they are but one market research method; as such they can and often are used with other market research techniques.

However, survey research is one of the most powerful forms of research, in that it empowers researchers to probe into anything and reach relatively anyone (should the survey platform allow it).

A strong online survey tool will deploy your survey to the most popular websites and apps, and take no more than 2 days to gather the number of respondents you input. In addition, it can send your survey to specific individuals through specific online channels, such as social media, email, or landing pages. Your survey platform would need to offer the Distribution Link feature to do this.

In addition, the online survey platform you choose should allow you to create logic in your survey, that is, to route respondents to appropriate follow-up questions based on the answer they provide to a question. Choose a platform that offers advanced skip logic to do this.

All in all, researchers who are serious about conducting market research campaigns should use surveys alongside any other research method, including that of a focus group. It provides quantitative data, which focus groups do not, along with a wide breadth of key features and capabilities to complete any market research campaign.

A focus group is a small group of survey research subjects, typically composed of 6-10 participants who take part in a moderated discussion about a particular topic. The participants are chosen based upon similar characteristics. The moderator of a focus group leads the discussion by asking questions, proposing talking points, studying the responses and taking notes on the findings. The moderator keeps the conversion flowing and ensures that the discussion remains amicable, even when discussing sensitive topics or opposing opinions. Focus groups are used in qualitative research to help gain a deeper understanding of the motivations behind the behavior, attitudes, or feelings of a group of people. By directly addressing a portion of the sample population, researchers can delve into the “why” or “how” behind data that has already been collected. Focus groups allow for the exploration of deep feelings and opinions, can provoke thoughtful insights, provide quick results, allow researchers to study non-verbal signals that accompany the discussion, and can result in unexpected information. Focus groups are conducted with a smaller group of people, therefore the recruitment phase can take longer and the thoughts of the group may not represent the larger population. In addition, it is possible that stronger voices can dominate the conversation and influence or obscure the findings.Frequently asked questions

What is a focus group?

What is the moderator’s role in a focus group?

How can focus groups support a qualitative research project?

What are some of the benefits of a focus group?What are some of the disadvantages of focus groups? Focus groups are conducted with a smaller group of people, therefore the recruitment phase can take longer and the thoughts of the group may not represent the larger population. In addition, it is possible that stronger voices can dominate the conversation and influence or obscure the findings.

What are some of the disadvantages of focus groups?

The Complete Guide to Market Research Techniques

The Complete Guide to Market Research Techniques

If you intend to conduct market research, you'll need to be well versed in market research techniques. These methods will help you carry out a sufficient market research campaign, allowing you to better serve your customers and steer your business toward.

But when you are facing a concept as broad as market research, it is rather challenging to know where to begin and how to conduct the various forms of research.

This complete guide to market research techniques will help lessen this challenge so that you can stride confidently into all your research needs.

Defining Market Research

Like several aspects of business, market research is not bound by one concept; rather it is an umbrella term that encompasses a wide array of practices.

Market research is the process of gathering information about your target market (the people most willing and likely to buy from a business), segmenting your buyer personas (market segmentation) and amassing knowledge on your competitors.

This category of research allows businesses to gain insights into the quantifiable aspects of their industry, along with the opinions and attitudes of past, current, potential and churned customers.

The ultimate end goal of market research is to learn how successful your product or service is and/or will be within your industry, niche and most importantly, within your target market.

Primary Vs Secondary Research Research

The chief divider of market research involves the method of researcher participation, aka, the way the research is conducted.

Primary research denotes an active form of research, in that researchers conduct the research themselves. This signifies that the information they are seeking has not yet been collected, or, that the research they need has been gathered, but they seek to gain their own, firsthand data.

As such, primary research involves using primary data, that is, the data that a researcher would extract themselves.

On the contrary, secondary research entails research that has already been conducted and (usually) has been made available. With this research category, the researchers aren’t required to amass their own intelligence; rather it involves aggregating knowledge that has already been collected and passed on by others.

As such, this kind of research largely involves summarizing, synthesizing and scrutinizing data and other forms of intelligence. Secondary research often involves studying the primary research that others have already conducted and packaged in their chosen form.

It is important to incorporate both styles of research for a comprehensive market research campaign. This is because there are going to be subjects that you cannot study simply through one form of research. For example, your competitors aren’t going to publish the primary studies that depict them in a negative light, no matter how accurate they are.

Another example is your own set of customers; secondary research alone is not going to provide an adequate amount of data on them. There may not even be any data on your particular customer segment.

Primary Market Research Techniques

Here are a few techniques for completing primary market research. Researchers need not attempt all of these techniques, as some will be more useful and easier to execute than others. It all depends on your preferences and goals.

- Interviews: One of the more intimate methods, interviews can be managed over the phone or in person.

- Focus Groups: A more interactive form of interviews, this technique gathers data from a group of about 6-10 participants. Focus groups study subject matter experts. Using a moderator, these groups aim to incite discussion among the participants. This is a good method to perform to learn about a specific segment of your target market. Focus groups rely on open-ended, broad and qualitative research questions.

- Field Research: This is an observational method on subjects in their natural environment. To use this method, researchers do not interfere with the outcome or behavior of a situation. This technique grants direct observation of people and their interactions. Ex: An electronics brand seeks to observe how customers interact with a new line of products. They may do field research on in-store customers to study this.

- Surveys: Online surveys are the best distribution method and allow you to study any topic. A strong online survey tool will enable you to set granular demographics requirements, ask a wide style of questions (multiple-selection, single selection, ratings, etc), add advanced skip logic, add media files and use multiple audiences per survey. Surveys can take many forms; business and consumer surveys alone form macro surveys that include their own survey types.

- Test Marketing: This technique involves testing the usage and opinions of a new product by selling it to a small segment of one’s target market. For example, software brands test-market by using the “beta” versions of new features/products on a small group of likely customers. This method helps predict how a new product will fare in a larger market.

Secondary Market Research Techniques

Secondary market research techniques require using sources specific to your industry and niche. While some sources may be general, you’ll need to gather intelligence most pertinent to your target market — or at least your industry. Here are a few citations to use for secondary research.

- Government Resources: The government collates massive data on citizens; this data is free and can be found on a number of government websites.

- The Census Bureau: Provides a portrait of the American economy, market sizes, populations, demographics and more. It includes the American FactFinder tool, which finds demographic, economic, social, household, and other data on geographic regions.

- The U.S. Small Business Administration: Captures statistics on economic matters such as employment, salary, income, sales and more. The SizeUp tool allows businesses to compare themselves against competitors.

- The U.S Department of Commerce: With offices scattered across the US, the U.S. Department of Commerce generates data on industries and their products and services.

- The Bureau of Economic Analysis, which is a part of this department, creates economic reports on income, expenditures, and even savings data on a quarterly basis. This site shows the trends in product/service demand based on spending.

- Enterprise Sources: These resources are not free, but offer invaluable insight into particular trades and subsectors.

- Trade Associations: Perfect for studying your industry, they’re made up of groups of businesses that cater to specific subsectors. Use the following to find your industry association.

- Research Associations: Composed of research analysts, these associations to be independent, although some are affiliated with trade associations. These organizations provide businesses with granular reports on specific subsectors of an industry. They include:

- Forrester: Research in the consumer business and tech sectors.

- Statista: Statistics, reports, infographics & more on 170 industries and 150+ countries.

- Gartner: Research for senior leaders with business insights, advice and tools.

- IBISWorld: Industry reports by sector and country.

- Mintel: Market intelligence across industries and countries.

- Dun & Bradstreet: Data, analytics, and commercial insights for businesses with 120 million business records on over 1,000 industries.

- Industry Blogs and Content-Oriented Websites: Each industry has online publications dedicated to reporting on them. These are useful for the latest updates, trends and breaking news, the kind that a major report or downloadable asset may not provide. Here are a few examples across different industries.

- Ars Technica: A website covering news and commentary on the technology, science and politics space.

- The Business of Fashion: News and intelligence on the fashion industry.

- Grocery Drive: News that focuses on the grocery and ecommerce spaces.

- Premium Beauty News: Markets, trends, laws, new products and other news within the cosmetics industry worldwide.

- Realtor Magazine: News surrounding the real estate industry.

- Educational Institutions: Colleges and universities have research departments that study a wide range of business data. These insights are not free but involve heavy-duty market research from faculty and students. They include:

- Graduate student projects

- Faculty-based projects

- SEO and SEM Reporting: SEO is critical to growing your business online, as your target market won’t purchase from your business if they don’t find it. SEO/SEM sites help you gather keyword research to learn the most relevant to your niche.

- SEMrush: For SEO, PPC, content, social media and competitive research.

- Moz: For rankings, keywords and link testing.

- ahrefs: For rankings, site audits and keywords.

- Google Keyword Planner: For finding keywords, tied with Google Ads.

- Screaming Frog: A site crawler for technical SEO site audits.

Quantitative Research vs Qualitative Research

Another crucial market research division is that of quantitative and qualitative research. Unlike primary and secondary research, which can exist without one another, quantitative and qualitative research are used in complementation.

Another crucial market research division is that of quantitative and qualitative research. Unlike primary and secondary research, which can exist without one another, quantitative and qualitative research are used in complementation.

This means you would often use both in your research campaigns.

Quantitative research is marked by measurable data that quantifies the opinions, attitudes and experiences that respondents report. It collects numerical data for producing statistics, finding prevalence and identifying patterns.

The goal of quantitative research is to test a theory or hypothesis. Another common objective is to measure opinions in regards to a particular research topic. Quantitative research is also used to find causal relationships between variables, predict outcomes and create generalizations on broad populations.

Computing an instance or phenomenon takes precedence in this form of research, rather than gathering the reasons and motivations behind it. This kind of research works out the “who” and “what,” of a research subject.

Qualitative research stands in contrast with quantitative research, as a descriptive form of research. This form of research inquires into the depths of an attitude, opinion or phenomenon. Instead of delving into the statistical aspects around a research subject, which is known as the “what,” it works to find the reasoning behind it.

As such, this research doesn’t seek to describe a situation, opinion or occurrence; rather it focuses on establishing the “why” behind it.

Qualitative research was designed to take place in natural environments, i.e., places in which research participants can provide thorough answers. This environment can take place on or offline.

This form of research relies on using psychological, ethnographic and sociological approaches to study a target market. The design of a qualitative study evolves (along with the participants it studies).

In this form of research, there is no such thing as a single reality; rather it is changeable and subjective. It is highly interpretive, as it doesn't involve simply adding or crunching numbers.

Quantitative Market Research Techniques

Quantitative research involves using methods that collate measurable data that can be encapsulated in graphs, charts, tables and other visualizations. Here are a few techniques for gathering this kind of data:

- Experiments: Researchers can conduct experiments on products, such as producing beta versions, as tech companies do. They can also do A/B testing on digital experiences such as digital ads, emails and even on-site experiences. Additionally, researchers can run experiments in-store to test customer satisfaction with employee service and product layouts.

- Observations: Part of field research (as mentioned under primary research), researchers can observe customer behavior and occurrences in natural environments such as in-store behaviors. Observations can also exist online, for example, by using session replay tools found in analytics software.

- Statistics and other Published Resources: Researchers can garner quantitative data by studying secondary research. The technique involves looking at statistics websites, along with other data sources such as infographics and reports. This is a good starting point when dealing with quantitative data; it can also be used to compare findings between past and present data.

- Surveys: Perfect for discovering the “what” with multiple choice and multiple selection questions. Matrix questions help find the intensity of a phenomenon. There are swaths of different survey types you can implement, including macro ones like business surveys and consumer surveys, along with specific surveys such as the Net Promoter Score (NPS) survey or the Employee Satisfaction Survey.

Qualitative Market Research Techniques

Quantitative research techniques necessitate being able to understand opinions in more depth to uncover motivations, reasonings and consumers’ general psyche. These methods do not require quantifying any findings. Instead, they require using exploratory and open-ended questions; the kind that fully reveal the bedrock of consumers’ attitudes.

Here are a few techniques:

- Focus groups: These spur natural discussions by incorporating a small group of people with a moderator who prompts various conversations. Focus groups consist of people who share demographic attributes to study a target market or a segment of it. Unlike interviews, which are one-on-one, focus groups allow multiple people to speak, mimicking natural discourse and therefore having the participants influence each other.

- Unstructured interviews: Unstructured interviews are in-depth interviews in which there are no premeditated questions. Instead, the interviewer asks open-ended questions that relate to the research topic. This way, the conversation runs like a natural exchange. The interviewer would keep questions relevant to both the research topic and the participant’s experiences.

- Textual and visual analyses: A form of secondary research, researchers can draw analyses from qualitative research documents already available. This including looking at trade publications or research publications that focus on various consumers and other demographics.

- Case Studies: This technique uses thorough investigations on a participant, a group, an event or a community. It merges various sources such as interviews, observations and surveys. Researchers analyze the data from these sources and put together the case study document. This is used in clinical medicine, but can be applied to numerous other industries, including the general business vertical. This method uses both information from the past (retrospective) along with present and everyday manners.

- Surveys: Surveys can be every bit as qualitative as they are quantitative. In a qualitative survey, you would use open-ended questions. These often dovetail to quantitative questions by going more in-depth on them. Thus, you would need to use skip logic, so that if a respondent replies in one way, they would get rerouted to the appropriate follow-up question. Like with quantitative surveys, qualitative surveys can be applied to macro concepts like in cross-sectional surveys or for more specific ones, such as with community feedback surveys.

Other Forms of Market Research Techniques

Aside from the above two major types of market research classifications, there are several other major kinds of research techniques. Here are a few vital examples:

Retrospective Research

This research studies past events to see if or how they contributed to a current topic of interest. Also called historical research, this study inspects historical data. It falls under cohort studies, which follow a group of participants bound by a similar trait. This research uses observational studies that determine how often a phenomenon occurs within a targeted population. Techniques include:

- Survey panels

- Longitudinal surveys

- Interviews

Cross-Sectional Research

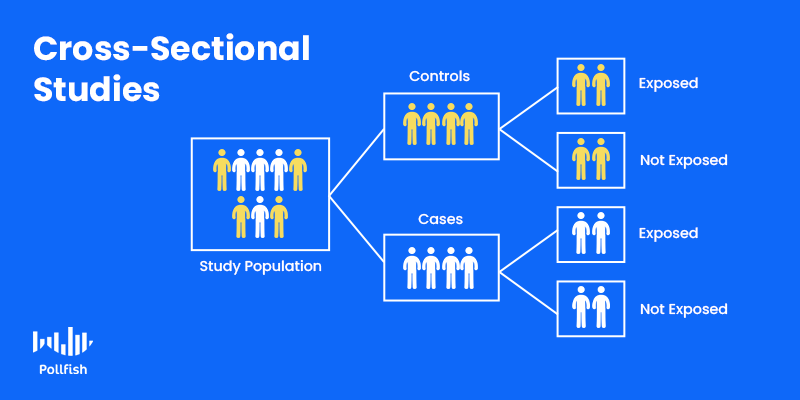

A cross-sectional study collects research on a particular population at one fixed point in time, essentially serving as a snapshot (aka cross-section) of a studied population. This type of survey does not require using a survey panel as this method follows a panel over several points in time. It is contrary to longitudinal studies, since they study participants at ongoing frequencies. Instead, it seeks to gain an overall portrait of a phenomenon during its time of study. Techniques include:

- Field research (especially recent studies)

- Interviews

- Surveys (Ex: community feedback surveys)

Prospective Research

Prospective research aims to predict the likelihood of a future event or issue. It is focused on outcomes and can also determine relationships between variables. A prospective study usually involves investigating a cohort of subjects over a long period. This research tends to be experimental in nature, as it seeks to uncover relationships between variables. Techniques include:

- Experiments

- Trials

- Longitudinal Surveys

- Focus groups

- Survey panels

Wading the Waters of Market Research

While this guide covers the most pertinent and useful forms of market research technique, there are still more to explore. That is because certain techniques, such as survey research methods have many forms and subsets of methods that brands can apply to their campaigns. A strong research campaign will guide you deeper into the many techniques available, some are tried and true, while others are newer.

When you fortify your secondary research with a strong primary research tool, your campaign will be on the right track towards unique insights for all your business and market research needs.