How to Make Your Own Survey in 3 Easy Steps

How to Make Your Own Survey in 3 Easy Steps

As a business, you’ve probably mulled over how to make your own survey for market research purposes. The power of survey research is that it allows you to extract data for a wide array of campaigns, such as marketing, advertising, branding et al., on virtually any focal subject of interest.

Surveys are unique in that they collect data from a pre-defined group of people. Online surveys take this method to the next level, as they only permit qualified respondents to enter the questionnaire portion of a survey.

As such, online survey tools allow you to define the participants allowed to take part in your survey; you can do so by selecting your desired demographics and screening questions.

There’s more to making your survey — but not much, that is, depending on the online survey tool you use.

This article will teach you how to build a survey in just 3 steps, a process that correlates with the Pollfish survey platform.

The Benefits of Using Survey Software

Aside from the above, there is an abundance of benefits to using survey software, which is why it is encouraged to make your survey.

If you are skeptical about employing survey software that allows you to build and launch your survey in just three steps, consider the following. It enumerates the various benefits of using a survey platform; the fact that you can make your survey in just 3 steps is an added benefit.

- Cost-Effective: Although the total cost depends on several factors, such as deployment methods, survey types and the stipulations of your online survey platform provider, online surveys are generally cheap. At Pollfish, they start at only $0.95 per complete.

- Versatile: Software survey often offers versatility in functionality, interface, visuals and more. As such, they allow you to create multiple types of surveys such as multiple-choice, ratings surveys and surveys that focus on different disciplines like customer satisfaction or community feedback. They also allow you to add unique features such as advanced skip logic.

- Respondent Control: A potent survey software grants surveys with the ability to identify each respondent by their IP address, so that no person can take part in the same survey twice to skew results. Therefore, if for example, you set your sampling pool to include 1,000 respondents, you can rest assured that there will be 1,000 unique individuals taking the survey, as no responder will take the survey more than once.

- Quick and Accurate: Online survey tools collect data quickly and accurately. They can gather thousands of survey submissions in a short period, one that is often no longer than a few days long. The entire sampling is accurate to the study you conduct, as screening questions and demographic quotas ensure only the targeted respondents participate in the survey.

- Ease of Analysis: Survey software facilitates the process of analyzing, by allowing you to observe the data in various formats. For example, a strong tool gives you the option of viewing your responses in spreadsheets, graphs, charts and cross-tabulation. This allows you to examine your survey results in a way that suits your preferences best, as some campaigns require specific data formats.

- Easily administered and completed: Online survey tools offer the convenience of administration ease and completion. That is because these tools deploy the surveys for you, meaning that you don’t have to worry about reaching your intended target audience and amount of respondents. The Pollfish platform distributes your survey to a sweeping network of over 140,000 of the most popular websites and apps. It doesn’t finish the process until all respondent quotas are filled.

- Flexible and amendable: Online survey platforms ought to make it easy to control all survey content; that involves adding different media files to questions, skipping questions (skip logic), using a blend of open and close-ended questions and much more. In short, survey software makes survey-building easy to tailor and change.

Make Your Own Survey With a 3-Step Process

Now that we’ve covered the bases of online survey advantages, it’s time to put survey building into action. The following elucidates the three steps, or stages, to make your survey using an online survey platform.

These steps parallel the steps required to take on the Pollfish platform dashboard; they make it easy to jumpstart your survey research campaigns.

Beginning a New Survey Project

When you begin a new survey project, you now have three options. You must select the type most appropriate for your needs. To do so, on your survey dashboard, hover over to "Create project," the big blue button on the upper right side of the screen. Click on it to reveal the two-option dropdown menu. These two options form the basis of your survey campaign type. The two options for creating a new survey project are:

- From Scratch: entails building your survey entirely on your own for custom needs.

- From templates: gives you various templates for building your questionnaire, which you can edit (from moving around the questions, editing the question content, adding new ones, adding media files, etc).

After choosing how you will use the Pollfish platform for your survey project, you will be prompted with the following message:

How would you like to collect responses to your survey?

Here you can choose between buying your responses and sending your survey your way. The latter refers to sending your survey across our vast network of publishers, which includes a bevy of websites, apps and mobile sites. This is part of our random device engagement, a kind of organic sampling in which surveys are distributed randomly to users of different digital spaces. This method allows respondents to take the surveys while they are in their organic environments — cutting back on survey bias.

The latter refers to the Distribution Link feature, in which you can send surveys to specific respondents, rather than through a massive network. Out of the many survey sampling methods, this is a non-probability sampling method. This means it is not random and designed to target people you either know, such as in the case of B2B surveys, or, consumers and other web users who have given you their contact information.

This feature also offers convenience sampling, in that it generates a link you can use at various digital properties to send people to your surveys. Willing respondents can then partake in your survey after coming upon your link on social media, landing pages, site pages, your homepage, etc.

Step 1: Enter all your audience qualifications

The specifics of the audience enable you to dictate the kind of respondents to take your survey. These specifications certify that the respondents who answer the survey qualify to take it.

The audience section is twofold: it features the demographics section and the screener. The demographics section features various demographic categories. You should tick off all the boxes of categories and subcategories that you would like to study in the survey.

These categories include everything from geolocation — from country to postal code — to employment type, marital status and many other demographic categories. You can assign quotas to each category and subcategory. Or you can set each subcategory to receive an equivalent number of responses.

If this wasn’t granular enough, the screener portion allows you to ratchet up your audience requirements even further. For example, you can ask behavioral questions, such as: how many times a year do you go shopping on [vertical] sites?

Or you can ask more hyper-targeted demographics questions, such as: how many children do you have? This allows you to choose the answer(s) that allow the respondents to take the survey.

You can also place preset quotas on the screening questions.

Pollfish offers the addition of multiple audiences for your screener. This way, you can create separate audiences in one survey and achieve any targeting combination you desire. It expands the number of quotas you can employ per survey. Essentially, it allows you to widen your audience in one survey, eliminating the need to create several.

After you’ve applied all of your audience qualifications in the demographics section and the screener, it’s time to move to Step 2.

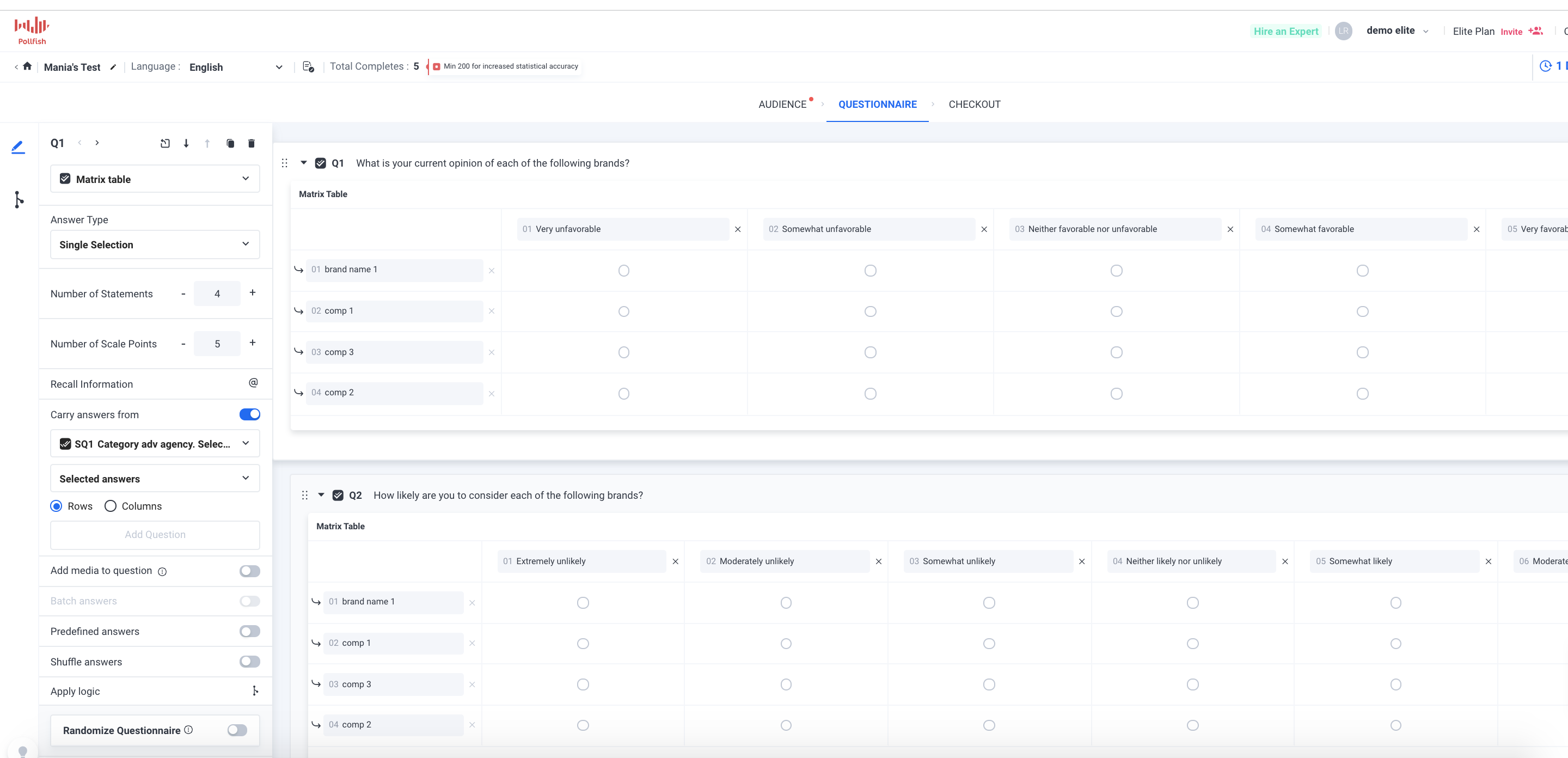

Step 2: Establish all the questionnaire content

The questionnaire stage is the heart of the survey. This stage allows you to add all the questions that you would like qualified participants to answer. It is the content of this step that will grant you market research data.

The survey platform you choose should allow you to choose from a variety of question types to add to your questionnaire. These are important as they control the type of survey you can create.

For example, in some surveys, such as Net Promoter Score surveys, you’ll need to include a numeric scale, as it is the basis for NPS surveys. In Visual Ratings surveys, emojis are required as part of the answer options.

The following lists some of the question types crucial to have in your online survey tool:

- Single selection

- Multiple-selection

- Open-ended

- Numeric open-ended

- Rating stars

- Likert scale

- Matrix questions

The question types should allow for multiple functionalities, such as:

- Adding media files to questions (images, GIFs, videos, etc.)

- Shuffling answers

- Using batch or predefined answers

- Adding “none of the above”

- Applying logic so users can go on custom question paths depending on their answers

You should be able to regroup questions and answers at the click of a button or two for a flexible survey research experience. This section should also allow you to add in the exact size of your sampling pool, i.e., the total number of respondents.

Additionally, this stage of the survey-making process should provide you with an estimated survey completion time, so that you will have a sense of how long it will take you to yield the number of responses that you preset.

Review all of your questions, answers, question paths and any other elements you have applied to your questionnaire. Make sure you’re not missing any questions you feel would be pertinent to your survey study.

Also, keep an eye out for spelling and grammar — these are going to go live as they appear on your dashboard. If you’re satisfied with it, then move on to Step 3.

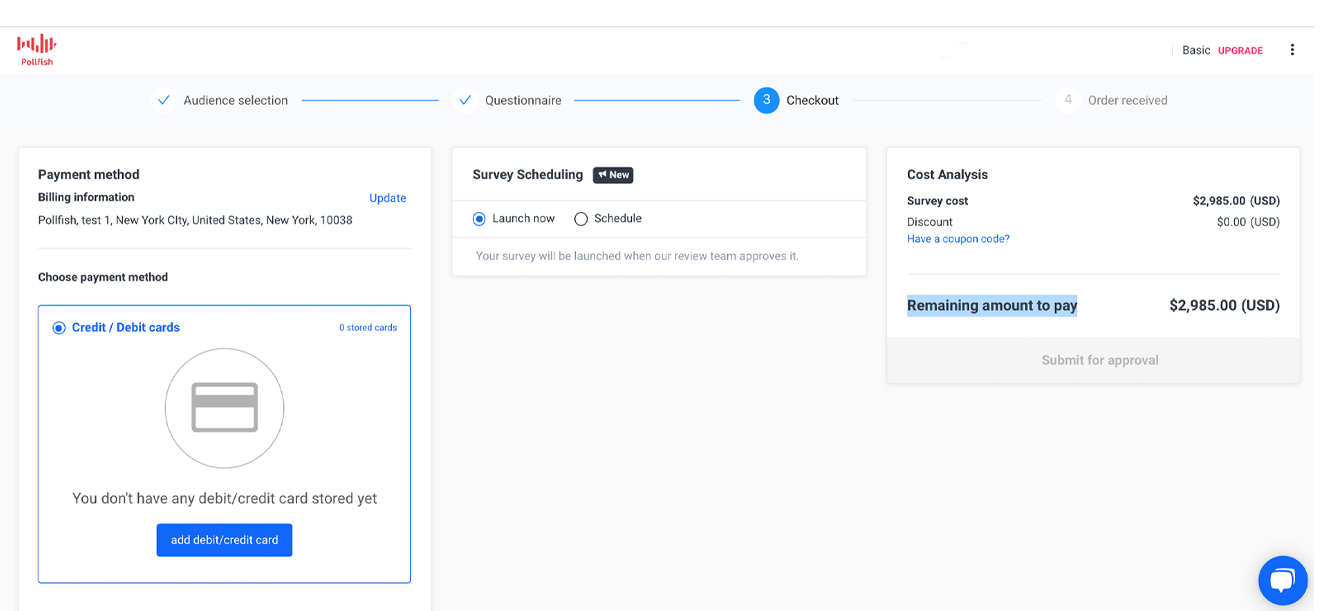

Step 3: Set off the Survey Launch at the Check Out

The final step of the survey-making process is essentially the simplest one, as it doesn’t require ideating or tweaking any in-survey content. Instead, all it requires is to fill in 3 quick requirements and your survey is almost as good as live.

Here are the requirements in 3 small sections making up this final step:

- Enter your billing information, such as your address and credit or debit card number.

- Choose from 2 options on survey scheduling: either to launch your survey then and there or to schedule it.

- Review your payment information in the Cost Analysis; here you can add a discount code if you have one.

- After you’ve reviewed the survey cost, hit the big button that reads “Submit for approval” and your survey is about to go live into the vast ecosystem of partner websites and apps that will deploy it.

Some online survey platforms (like the Pollfish one) will include a review stage from experts before your survey officially launches. This will ensure all your content is set up to run smoothly, with no glitches, eros, or logical issues.

There you have it; that’s all you need to do to make your survey and have it distributed to the masses.

Please note that this process is not universal to online survey tools; rather it is used in the Pollfish platform and meant to illustrate how convenient survey software programs can be when it comes to helping you make your survey.

Reaping the Most out of Your Online Survey Tool

Online survey tools are exceedingly important for market research, however, there’s more to them than just survey campaigns.

Your business ought to use secondary sources and perhaps other primary sources to bolster your survey research. This will ensure you are conducting a holistic market research campaign.

Keep in mind that while the survey-building process delineated in this article may seem simple, all survey tools are not the same. Some will demand a much more intricate process to create your survey. Others may not even contain the function of distributing your survey.

As such, you should invest in an online survey platform that provides the most gainful survey research experience. You should opt for survey software that offers a wide range of capabilities and functions (such as the ones mentioned in this article), along with the kind that makes it easy to configure your survey and launch it.

Frequently asked questions

What are some benefits of using survey software to make your own survey?

Survey software offers many benefits to those who wish to make their own surveys. Creating surveys in this way is cost-effective, versatile, flexible, easy to use, allows for easy data analysis, provides a simple way to control respondents, allows for a variety of applications and can be administered from anywhere.

Which three steps are required to make your own survey?

In general, this simple process can be followed: 1) target your audience by defining demographics and screener questions; 2) create the survey questionnaire; 3) launch your survey.

Why is it important to define your survey audience?

In order to ensure high-quality data, you want only qualified respondents to complete your survey. By establishing the correct demographics and presetting the screener to permit only the respondents that answered in a specific way, you are set to receive the respondents that belong to your target population only.

What types of responses do survey platforms typically offer?

A good survey platform will offer a variety of question responses including single-selection, multiple-choice, text entry field, numeric, scaled and visual rating systems.

What other features should you look for when choosing a survey platform to make your own survey?

Advanced features allow you to create better questions and can result in higher quality data. The types of features you should look for include the ability to add media to questions, random shuffling of survey responses, provision of predefined answers to simplify the question writing process and skip logic.

The History of Survey Platforms & Technology

The History of Survey Platforms & Technology

In the time since the first survey was conducted, surveys have evolved to become one of the most common methods of researching groups of people. Survey platforms have further revolutionized the way we collect and analyze data, making it easier for researchers to identify trends and draw conclusions more quickly and accurately.

Interestingly, the need to conduct surveys and manage the resulting data was one of the driving factors in the development of early computing technology. While survey platforms are a relatively recent concept, the development of computing technology to support survey data has been around much longer.

This article presents the history of survey platforms to show just how online survey tools have morphed into the market-research powerhouses of the digital age.

Well-Known Early Surveys

Surveys have not always been a standard component of research, in fact, they have been in use for less than 200 years. The earliest known survey was conducted in 1834, by the Statistical Society of London. It was a simple, door-to-door survey that sought to understand the occupations of people living in Manchester, England.

The American Community Survey (aka, the US Census), conducted every 10 years, is likely the most well-known American public survey. This massive undertaking seeks to obtain demographic data about every household in the United States via a survey. The manner in which it has been conducted has changed dramatically since its conception in 1790.

During the very first census, the count was performed via a physical visit to every household in the United States, but this gave way to phone, mail, and eventually online data collection.

Nielsen ratings are another example of prominent public surveys. Conducted every year since 1947, this survey collects information about how Americans of various demographics consume media. Media outlets, businesses and marketers rely upon these surveys to make decisions about how to evolve their products, choose the proper media advertising channel and run effective marketing campaigns.

You may wonder how these massive amounts of data were collected and analyzed before the existence of computers. Interestingly, it was the need to collect and organize exactly this type of data that led to the development of computing power.

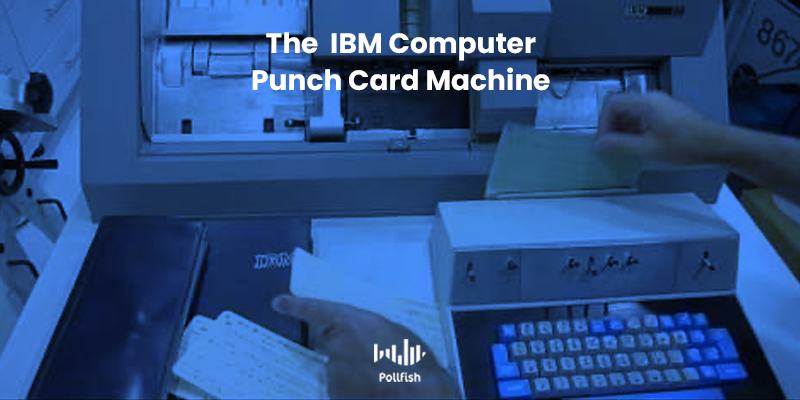

The Punched Card Tabulator

The development of the punched card tabulator marked the first major breakthrough in the way we collect survey data. In the late 1800s, the United States experienced unprecedented population growth, due to the large number of immigrants migrating to the country. When it came time to conduct the 1890 census, government officials noted that it would take over 8 years to count the resulting data from the census.

An enterprising young engineer of the time, Herman Hollerith proposed a solution. He designed a system whereby a paper card with a series of punched holes would represent each individual’s census information. While the collection of this data was manual, the processing of the information could now be automated.

Thanks to Hollerith’s creation, the census count took just two years and saved the US government $5 million. Hollerith turned his machine into a business, which he named the Tabulating Machine Company.

His machine soon became commonplace in the back offices of a wide variety of industries throughout the world, including railroads, oil companies, drug manufacturers, utility companies, and large department stores.

His machine was later sold to the Computing-Tabulating-Recording company (C-T-R), which evolved into IBM in the 1920s. His design transformed data processing in nearly every industry in the world and paved the way for the development of the computing giant, IBM.

Punched Card Statistical Analysis & the Rise of IBM

The creation and subsequent development of IBM into a computing super-giant had its very roots in survey data collection.

In 1928, IBM introduced an evolution of Hollerith’s punched card tabulator and named it the “IBM Computer Card,” which was commonly referred to as the IBM card. Remarkably, this seemingly simple invention was one of IBM’s most important technological advances and was responsible for the rise of IBM as the data processing giant in the early 1900s.

Today, with the proliferation of data and computing systems, it seems hard to believe that IBM’s cards held nearly all of the world’s data for almost half a century. Not only did the cards advance data processing, but they created a steady profit stream that allowed IBM to develop into the company it is today.

The IBM card allowed customers to store a large amount of data, thanks to its 80-column format and character codes. The challenge then was to develop a system that could make sense of the huge amounts of data that were stored on these cards. The device used to process this information was known as a tabulator.

During World War II, IBM developed the earliest type of supercomputers in order to process data that was stored on these cards. While these computers looked and acted nothing like computers today, the concepts used to convert and process data stored on physical cards into a digital format set the foundation for the later development of modern computers.

Computer-Assisted Survey Information Collection (CASIC)

From the 1950s, the use of computers to assist in the collection and analysis of survey data became more frequent. The use of computers in any aspect of survey creation, distribution, or analysis, is referred to as computer-assisted survey information collection (CASIC).

CASIC made it easier and faster to compile, store, and analyze data, which increased both the popularity and reliability of surveys. Computers helped lower the cost of survey research, reduced errors during data entry, and improved data quality by eliminating interviewer bias.

Before the existence of the Internet, computers were utilized in various ways to support survey research.

Applications of the CASIC

Here are some of the many ways that computers were used to collect survey data:

- During phone or in-person interviews, the interviewer reads from a computerized questionnaire and enters the respondent’s answers.

- An individual sits at a portable computer to read and answer survey questions.

- Surveys are distributed to respondents via a floppy or optical disk, which is returned by mail.

- Touch-tone data entry (TDE) allows the respondents to answer questions by phone by pressing numeric keys.

- Respondents answer questions by phone, which are then recorded and automatically transcribed into text.

In each of these modes of collecting survey data, the information is digitized, making it easier to store, analyze, and update the data with subsequent survey iterations.

The Development of Online Survey Platforms

While surveys have been in existence for nearly 200 years, the relatively recent development of online survey platforms marked the most dramatic evolution in how surveys are conducted and analyzed. The ability to oversee the entire lifecycle of a survey from a computer represented a fundamental change in the world of market research.

Before the advent of online survey platforms, the process of creating a survey, distributing it, and then analyzing survey data was a cumbersome and time-consuming process, even with CASIC technology. With the development of online surveys, survey research has become a critical tool for a wider range of research fields, such as marketing, social studies, and official statistics.

Online survey research offers distinct advantages in comparison to pre-Internet CASIC methods. These include:

- More cost-effective

- Easier to design and develop

- Faster data collection and processing

- Option to include advanced skip logic

- Ability to provide inline support to respondents as needed

- Ability to respond to the survey on any device

Online Surveys for Businesses, Banks Government Entities & More

Today it is hard to fathom how surveys were conducted before online methods were available. It required a staggering amount of manpower and determination to collect data from populations and then make sense of that data.

Thanks to online survey platforms, surveys are widely used to collect information about any number of topics. Whether they contain one question or hundreds, surveys have become commonplace in our study of the world around us.

Surveys can be deployed in a matter of minutes, giving businesses an easy way to understand their customers in order to improve their products, services, and interactions.

Frequently asked questions

How did the punched card tabulator advance the process of survey data collection?

The punched card tabulator made it possible to automate the process of counting survey results. This greatly reduced the amount of time and manpower required to compile survey data.

Who developed the punched card tabulator?

Herman Hollerith developed the punched card tabulator, which was later sold to the Computer-Tabulating-Recording company.

What was the IBM Computer Card?

Also known as the IBM card, the IBM Computer Card was a standardized card format that was used to store data via character codes in an 80-column format.

What is Computer-Assisted Survey Information Collection (CASIC)?

Computer-Assisted Survey Information Collection (CASIC) refers to any use of computers to help in the collection and/or analysis of survey data.

What is an online survey platform?

An online survey platform is a tool that allows surveys to be created, distributed, and analyzed from a centralized, remotely-accessed, digital platform.

Diving into the Business Survey for Building Success

Diving into the Business Survey for Building Success

If you own or operate a business, you need a business survey. Although you might know plenty about the intricacies of how your business operates from the inside, that knowledge alone might not be enough to propel your company into its next round of success.

Customer feedback, customer satisfaction, employee morale, upcoming market trends — knowing all this separates thriving companies from businesses that are just one bad decision away from a crisis.

And a business survey is a shortcut to this knowledge.

In this article, we cover how companies use business surveys to operate effectively and without hesitation, and how said surveys inform critical business decisions in today’s fast-paced and uncertain environment.

Defining a Business Survey

A business survey is a survey that allows you to gather data and insights that can be used to enhance various aspects of your business.

Using business surveys, companies can either acquire new knowledge about markets and target audiences while exploring fresh opportunities for growth. At the same, time business surveys can be used to fill the gaps in the existing knowledge of company operations, boost employee performance, and optimize expenses.

Although the data gathered during such research can be used in myriad ways, we recommend setting a specific goal for every business survey to keep your insights focused and actionable.

Applications Of Business Surveys

Due to the high level of customization that surveys provide, business surveys offer a wide range of applications and can be optimized for producing all kinds of value for businesses.

Here are some of the common applications for business surveys:

- Enhancing customer personas. Business surveys allow you to learn more about your customers, their habits, and what they think about your company and products. Studies show that 82% of marketers improved their value proposition using well-developed customer personas.

- Learning more about the new markets. Expanding into new markets and platforms is one of the surest ways to grow your business, but it comes with lots of uncertainty. Business surveys help step into the new territory with more confidence and hard-proof data.

- Increasing customer retention levels. Knowing when your customers are happy with your product is as important as knowing when they are not. Use business surveys to keep track of what your customers think about your products and brand before they start turning to your competition. In addition to that, the mere act of conducting surveys may increase customer retention levels as clients feel more taken care of.

- Improve employee performance. Business surveys can be used to inspect the state of your workforce on several levels via employee feedback: employee motivation, team trust, and management efficiency. With business surveys, you can reveal issues that certain departments experience and address them before the problems affect the rest of the company.

5 Types Of Business Surveys

You can use the following types of business surveys to gain a 360-view of your business, inform your growth strategy, and enhance customer satisfaction levels.

Customer Satisfaction Survey

There are five types of customer satisfaction surveys that allow you to gauge customers’ opinions about your products and company. One of the most commonly used is the Net Promoter Score (NPS) survey, which that checks measures how much your audience is willing to recommend your products to their inner circle.

The NPS survey allows you to segment your audience into three major groups known as detractors, passives, and promoters. The more promoters your business has, the higher will be your organic growth. It’s the other way around with detractors.

Regular customer satisfaction surveys are extremely important in case your business relies on organic growth as they allow you to keep track of how happy your customers are over time and correct your course in case recent decisions stagnated your expansion.

Example question: On a scale of 0-10, how likely are you to recommend our product to a friend or colleague?

Market Research Survey

Market research surveys are a wide group of surveys designed to learn more about the market you currently operate in or gain additional knowledge in case you want to expand into new niches.

These surveys may include demographic surveys designed to gather more data about your current and potential customers, platform-specific surveys such as e-commerce market research, technology market research, market trends research, and surveys designed to enhance various marketing-related activities, e.g. advertising market research

Example question: What are your main social media channels that you use to learn about new products?

Employee Satisfaction Survey

Employee satisfaction surveys are designed to collect information about the general feelings of your employees, their level of motivation, and any roadblocks that might be preventing them from doing their job more effectively.

These types of business surveys are often conducted in companies that want to enhance the performance of their employees or address issues during a transitional period (e.g. company-wide switch to remote work, company buy-out, or a new HR policy).

One of the variations of these surveys is an employee exit survey that aims to determine employee’s reasons for applying for a job or their reasons for leaving the company.

Example question: Are there any roadblocks that currently prevent you from operating at your maximum level of efficiency?

Brand Awareness Survey

Brand awareness surveys aim to elicit customer’s opinions and feelings about your brand.

Brand perception is an encompassing term and may be affected by many factors such as PR-relationships of your company, public stance on local and global issues, and the general representation of your brand in media.

Brand surveys help companies to reveal the current brand perception by their customers and track whether it has been recently affected.

A brand awareness survey can also reveal whether your target market is able to identify your brand, i.e., know of its existence. This is especially important when it comes to differentiating your brand from competitors.

Example question: Which of the following brands have you heard of? (Include your business)

A well-established branding policy has many benefits such as a higher number of positive online reviews, an increase in customers’ trust, and revenue growth.

Example question: Where have you seen or heard about our brand in the last several months?

Product Satisfaction Survey

The product satisfaction survey is closely related to customer satisfaction surveys, but with a focus on your product.

Business surveys that are focused on your product may help you to check whether customers know about your product, if they find your product appealing, discover how your product compares to the competition, and gather quality insights on how it can be improved in the future.

Example question: How long have you used [your product]? Or

What would you like to be improved in [your product]

The Role of Business Surveys In Growing Your Company

There’s no lack of data in our digital age, and often companies are confused and disoriented with the amount of information they gather through various analytical tools and 3rd party data providers.

But business surveys don’t add to this chaos. Instead, they allow businesses to gain a birds-eye view of their whole organization while referring to the most relevant and reliable source of truth: their customers and employees.

Insights gathered through business surveys often allow organizations to organize and enliven previously disjointed sources of data into more coherent and actionable formats.

If you want to see for yourself how business surveys can fuel your company’s growth and obtain trustful and impartial data directly from your target audience, try our market research platform, which makes it easy to create and deploy all kinds of surveys, along with analyzing them in different formats.

Frequently asked questions

What is a business survey?

A business survey is any type of survey that is conducted in order to improve or enhance certain aspects of a business.

What are some reasons for conducting a business survey?

Business surveys may be conducted in order to gain new knowledge about target markets, better understand company operations, improve employee morale and performance, and/or improve a company’s profitability.

What are some examples of business surveys?

There are many different types of business surveys, including customer satisfaction surveys, market research surveys, employee satisfaction surveys, brand awareness surveys, and product satisfaction survey

How can a business survey help a business better understand its target market?

A business survey can provide an in-depth view into customer habits, feelings, and attitudes, which can then be used to develop customer personas. Customer personas allow businesses to understand their customers so they can develop better products, services, features, and market campaigns.

How can a business survey improve customer retention?

Studies have shown that the simple act of conducting a business survey may help improve customer retention rates since customers feel that the business genuinely cares about their needs and concerns.