Buy a Survey Audience and Survey Respondents Straight from the Source

Buy a Survey Audience and Survey Respondents Straight from the Source

As market research professionals, we urge you to buy a survey audience to access a wealth of survey respondents at your fingertips.

While it may be tempting to opt for a market research panel, buying survey respondents straight from the source is a much more effective method for conducting research and having constant access to the correct survey respondents.

You wouldn't want to survey the wrong audience; it should be precise to both your target market segments, along with to the respondent qualifications of a particular research campaign or survey.

Both the former and the latter are going to vary; as such, there is no such thing as a single survey target audience.

Thus, the makeup of your survey audience will differ based on the shifts in your target market and the different subjects and objectives of distinct research campaigns.

As such, you’ll need to reach out to several populations based on your various research campaigns and needs. To do so, you’ll need to identify, target and buy the correct survey audience.

This article explores how to buy a survey audience, the importance of reaching the right survey respondents, how the Pollfish platform does so with random organic sampling and much more.

Table of Contents: Buy a Survey Audience and Survey Respondents Straight from the Source

- Target the right survey audience

- Removing fraud incentives

- Our audience operates differently

- Audience size and source matter

- Selecting the right consumer

- The right audience makeup

- Our expansive reach means we can do what no other market research provider can

- The Importance of Buying a Survey Audience

- The Proper Target Survey Audience is Not the Same as Market Segments

- Identifying and Reaching the Poper Respondents

- Studying Your Target Audience in Greater Depth

- Being Able to Detect and Observe a Bad Customer Experience

- Having Constant Access to the Correct Survey Audience Population

- Using Random Device Engagement and Organic Sampling

- Market research panels are flawed

- How to Buy a Survey Audience

- Buying a Survey Audience as Part of the Survey Process

- The Two Pollfish Plans

- Accessing Market Research Data to Buy Survey Audience

- Two Main Ways to Buy a Survey Audience

- How to Buy Survey Respondents

- The Pollfish Platform Has Your Back

Target the right survey audience

You ought to target the right survey audience without being bogged down by survey fraud and a host of other issues that non-organic probability sampling methods bring.

We identified data-quality issues - such as panel fatigue and unconsciously biased responses that are unavoidable with career panelists early on. To stamp out low-quality data, our platform is designed to avoid career panelists with narrow targeting and a system of quality checks.

We’ve also created our own distributed audience network to be the first wholly-owned and operated network made up of real consumers around the world.

Whether it’s cracking down on low-quality survey data or accessing real customers, the Pollfish organic sampling method (see the section called Using Random Device Engagement and Organic Sampling) executes a meaningful market research campaign.

Our platform targets the correct survey audience, one that can be exclusively defined and hyper-targeted to ensure that only the most relevant respondents partake in your survey campaigns.

Removing fraud incentives

Most traditional market research panelists are survey respondents who sign up in exchange for cash or airline points.

Because these incentives are static and cumulative, they often become “professional survey-takers” — they understand how, and are motivated to bypass screening questions to ensure they can take as many surveys as possible, without providing quality responses.

Our platform mandates a screening section, which you can customize to be as granular as possible, thereby allowing you to avoid poor-quality respondents. Just use our screener to qualify respondents on a wide range of demographics and psychographic qualities.

We even offer screening questions in addition to inputting survey respondent qualifications in the screener section.

Our audience operates differently

Because we partner directly with app developers, the developer defines appropriate and specific non-cash survey incentives in exchange for completed surveys. These incentives benefit real consumers without motivating them to become career panelists.

Instead, respondents are motivated to complete a survey truthfully and are rewarded with a pleasant survey experience (and an incentive after they complete the survey).

With so many mobile apps in existence, there is a wide breadth of non-monetary survey incentives to reward your respondents, draw them to your survey and provide accurate data.

For example, in the case of a news app, the survey incentive might be a premium article, or in a fitness app, access to a free yoga lesson.

In a mobile game, the incentive can take the form of in-game tokens, lives, access to higher levels and more. You can get creative with how you offer these incentives, and our app partners always are.

Audience size and source matter

Since we operate the largest global audience of survey takers, our vast network enables us to reach very narrow consumer segments, meaning we can reach very specific target audiences, the kinds you wouldn’t be able to target otherwise.

That’s because our survey audiences are hyper-targeted.

The screening questions we mentioned earlier (Removing fraud incentives section), allow you to do just that.

With the screening questions, you can permit or disqualify potential respondents based on how they answer your screening questions. In other words, it allows you to fine-tune your survey audience targeting even more distinctly.

However, what truly makes us stand out against the crowd of other survey sample providers is our relationships with our partner apps that ensure high-quality responses from those targeted segments.

Because of this relationship, our surveys and incentives are never boring or lackluster. Instead, the respondents have an engaging survey environment where they’re prompted to complete entire surveys. Thus, it’s a win-win situation for researchers and survey respondents alike.

Selecting the right consumer

Our more than 120K+ app partners are manually vetted and only get paid when they deliver a response from a qualified individual that fits the targeting criteria request and meets our strict quality controls.

This differs from the traditional approach that requires “impaneling” respondents, making it prohibitively expensive to throw out questionable responses.

But on the Pollfish platform, our AI-powered system automatically disqualifies respondents who don’t fit the entire targeting criteria, along with those who provide faulty answers and low-quality data.

That’s because our wide range of quality checks weed out gibberish answers, respondents who don’t pay attention, VPN users who would otherwise taint geographic targeting and other sources of low-quality data.

The right audience makeup

New respondents are joining our consumer network every day. Our network of app providers and survey respondents is now in over 160+ countries - and growing - as our app-based partnerships give us a fast and efficient way to reach and expand our market research audience.

We use a rolling profiling model to keep our audience information up-to-date and collect a wealth of data upfront including demographic, location, gender, carrier and mobile usage data (a first in the space).

This makes it easy for you to create surveys using already-collected demographic data and spend time seeking answers for your business, not drafting questions to define your audience makeup.

Our expansive reach means we can do what no other market research provider can

We narrowly target consumer populations and send surveys to the exact respondents you want to reach, apply AI fraud detection to remove responses that don’t meet our quality standards and still have plenty of responses to satisfy your targeting quotas — all while they are organically engaged in mobile apps on their devices.

We call this revolutionary methodology organic sampling, specifically Random Device Engagement on the Pollfish platform. We’ve used it to accurately predict some of the most confounding political events of recent decades — where traditional methods fell short.

Learn more about the Pollfish methodology.

The Importance of Buying a Survey Audience

Buying a survey audience is essential to your studies. Many reasons support this claim. Let’s explore some of the major arguments as to why buying a survey audience is an absolute must for your market research campaigns.

The Proper Target Survey Audience is Not the Same as Market Segments

The reason that upholds the importance of buying a survey audience ties in with the need to use the proper survey target audience. You wouldn’t want to reach out to irrelevant population segments, as they are not part of your target market.

In addition, even if you have identified the distinct market segments and customer personas in your target market, they are not equivalent to your target survey audience.

This is because the market segments and customer profiles that you’ll need to survey will vary from study to study and from one survey campaign to the next.

As such, your survey audience is not the same as your market segments and broader target market.

Instead, your survey target audience is a far more narrow and specified group contingent on a particular survey campaign. Sometimes, it’ll be even more limited, as it will be exclusive to a particular survey part of a larger campaign.

Identifying and Reaching the Poper Respondents

To reach this distinct group of respondents, you’ll need to have them in your sampling pool. To do so, you’ll need to identify them first, before you buy them. That’s something you can achieve with a market research platform, particularly an online survey platform.

Such a platform would handle identifying and reaching your correct survey audience. But you would need to buy your survey audience first.

Buying this audience is also important for several other reasons.

Studying Your Target Audience in Greater Depth

Having access to the correct survey audience is essential for market research. As aforementioned, you wouldn't want to study the wrong populations. Having your survey audience within easy reach allows you to study your customers in great depth.

This is important for a variety of reasons, from delighting your customers, to retaining them. Customer retention is more important than customer acquisition, yet studying the proper survey audience allows you to achieve both: retaining your customers and gaining new ones.

To study them, they’ll need to be accessible to you and your market research efforts. As such, it’s crucial to buy your survey respondents.

Being Able to Detect and Observe a Bad Customer Experience

Did you know that almost half of all customers stop doing business with a company due to a bad CX? In fact, 47% of customers stop buying from businesses after a negative experience.

But having a bad experience with a brand doesn’t always compel customers to make light of it. As such, not all of your customers will complain, thereby you won’t have awareness of the poor customer experience your brand provided.

91% of unhappy customers will leave a business without complaining. Thus, while many brands place a lot of effort into forging customer happiness, they can’t avoid all kinds of customer dissatisfaction and frustrations.

Fortunately, with survey research and access to the correct survey audience, you’ll never have to be kept in the dark about poor customer experiences. Instead, you can deploy regular consumer surveys and brand trackers to be in the constant know regarding your customers' wants, needs, sentiments, opinions, aversions, and more.

Once more, this all depends on having access to the correct survey audience, which is why you’ll need to buy your survey audience through a reliable online survey platform.

Having Constant Access to the Correct Survey Audience Population

When you buy a survey audience, you can also rest assured that you always have access to the correct audience. That’s because a strong online survey platform will allow you to hyper-target your target survey audience as narrowly as you’d like.

It will even allow you to use multiple audiences in a single survey. This provides a holistic survey audience access. It’s objectively important to have this option within constant reach in your online survey platform.

But having access to the correct survey audience once or for one survey isn’t enough. As aforementioned, it is key to keep constant tabs on your customers and your brand experience. Avoiding a bad CX is a must, but you won’t be able to do it via a one-and-done approach.

Thus, while using syndicated research may give you access to your target survey audience, it won’t give you continued access to your customers — unless you’re willing to break the bank. This form of research involves using a market research firm to carry out and own all research data.

This approach is therefore not ideal, as it is expensive and won’t allow you to have a constant grasp of your data. Instead, when you buy a survey audience with Pollfish, you are the sole owner of your data and have constant access to our 250+ network of consumers ready to take your surveys.

Using Random Device Engagement and Organic Sampling

Equally important as buying a survey audience is using the proper mechanism for reaching it. Did you know that the way you reach your survey respondents dictates the nature of their responses?

That’s because some respondents will be more inclined to take it than others, while some will be more prone to biases (especially if they are pre-recruited via panels).

As such, the method for reaching an audience goes hand in hand with buying a survey audience; both are critical to your studies, as both factor into its quality.

To avoid as many survey biases as possible, keep respondents engaged in your study and forgo survey fraud, you ought to use a platform that runs on organic probability sampling.

As such, you should use a potent market research platform that leverages this mechanism and allows you to easily access your audience.

Below we’ll delve into what organic probability sampling is, along with the RDE method.

Market research panels are flawed

Research panels are one of the most common techniques used to identify and reach survey panelists and other market research participants. While they are a popular option, they do not provide you with the quality that organic sampling does.

At Pollfish, we avoid using conventional panels for this very reason.

Instead, we’ve developed our very own market research methodology called organic probability sampling. This involves sourcing our audience of real consumers via partnerships with app publishers, which allows us to conduct randomized, yet highly targeted surveys to verified respondents.

Our unique process is known as Random Device Engagement, (RDE), which uses the organic sampling approach for finding and obtaining survey participants.

A kind of organic probability sampling, RDE polling relies on advertising networks and other digital platforms to engage potential respondents wherever they visit voluntarily.

Thus, RDE catches users where they choose to be, as opposed to being in unnatural environments, where they’ll be less likely to pay attention, let alone take part in a survey.

That’s because, in unnatural environments, the thought processes of respondents can deviate from those in more natural environments, which results in artificial considerations that can influence their responses. Thus, RDE is the better approach to reaching respondents and getting honest, attentive responses.

Random Device Engagement / Organic Sampling includes a variety of digital platforms and properties to survey respondents, such as:

- Mobile sites

- Apps

- Websites

- Mobile games

This randomized method of reaching respondents ensures you avoid acquiescence bias from your respondents, due to the anonymous nature of this route. This means you’ll avoid respondents who respond with answers that have positive associations.

This is because these surveys are completely anonymized and therefore don’t have the same pressures as a panel.

In addition, RDE allows you to steer clear of the sampling bias, which occurs when the respondent selection process is not conducted at random, which then leads to the under or overrepresentation of a certain market segment.

With over 250 people in our network, we never have to worry about data quality, delivering only the best, most authentic, and most useful insights to our clients.

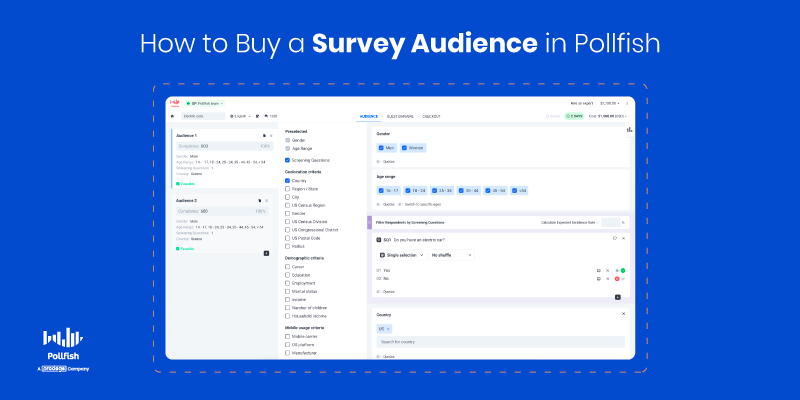

How to Buy a Survey Audience

Now that you understand why it’s important to buy a survey audience, along with how the Pollfish platform provides the supreme respondent-reaching mechanism and quality survey data, it’s time to learn how you can buy a survey audience yourself.

Fortunately, the Pollfish platform values user-friendliness and ease of use, making it a quick and easy process.

On our platform, buying a survey audience is deeply tied to the entire survey creation process.

Buying a Survey Audience as Part of the Survey Process

So what does it mean when the survey creation process is deeply connected to buying a survey audience?

In Pollfish, it means that as you create your questionnaire, you can also seamlessly switch to the “audience” tab and edit your survey target audience.

This section of your survey project is where you input ALL of your respondent criteria. In market research, this is typically referred to as the screener, or the screening section. This section includes all the demographic, psychographic and geographic criteria you can use to target specific survey target audiences.

You’ll need to register with Pollfish to view the screening section, dashboard, and the rest of the platform. You can do this by signing up for either a Basic Plan or an Elite Plan.

The Two Pollfish Plans

Determine the best Pollfish plan for your business, organization or personal need. When you register for an account, you’ll have access to the platform to understand how to buy a survey audience firsthand.

Our market research SaaS offers two plans. Read through the nuances, offerings and possible limitations of both before you sign up.

- The Basic Plan

- Part of our Freemium model

- Includes basic features

- Allows you to pay as you go, meaning there is no minimum or maximum deposit.

- Each completed survey costs $0.95.

- Survey prices are uncapped.

- This is accessible to 10 people in your team.

- Which features it includes:

- A/B testing (Monadic)

- Advanced question types

- An account budget

- Data Exports (SPSS, CSV, PDF, Crosstabs)

- Demographic information on results

- White-labeled reports

- Open-ended grouping

- Full survey review and edits

- 24/7 support

- Which features it excludes:

- Conjoint analysis

- 4-6 Screening Questions

- Van Westendorp Price Sensitivity Meter (for pricing studies)

- BigQuery Export

- Crosstab Reports Designer

- Survey Results Translation

- Single Sign-On (SSO)

- At last, this plan offers the Distribution Link feature.

- This grants you more options for deploying your survey, those that go beyond using our Random Device Engagement method.

- Instead, it grants you full control of how and to whom you send your surveys.

- Now available with both plans, learn more about it under Elite Plan, below.

- The Elite Plan

- This plan also prices each completed survey at $0.95.

- It includes capped pricing.

- The plan requires an account deposit.

- This deposit works in the manner of credits. Each dollar amount is equivalent to 1 credit.

- These credits are what you use to pay off each survey complete and other survey costs.

- This plan is suited for all business types and organizations with larger market research goals and needs.

- As such, it includes more advanced features, along with all those that the Basic Plan includes.

- For example, it includes the Distribution Link feature.

- This nifty feature allows you to send your survey your way.

- That means, you can send your surveys to either:

- Specific individuals. This usually includes targeted respondents to whom you have contact information.

- This can include their email address or their social media accounts.

- This kind of information may come from paying customers, or those who signed up for marketing collateral, such as newsletters, thereby giving you their contact info.

- You may also get this information by interacting with your followers on different social media channels.

- Through specific online channels, such as social media, the homepage, a static page or landing pages.

- This is especially useful if you seek to send your surveys through your own digital channels and properties, as opposed to others, such as those in our RDE network of website and app publishers.

- Specific individuals. This usually includes targeted respondents to whom you have contact information.

- Which features it includes: (that the former plan lacks)

- Conjoint analysis

- 4-6 Screening Questions

- Van Westendorp Price Sensitivity Meter

- BigQuery Export

- Crosstab Reports Designer

- Survey Results Translation

- Single Sign-On (SSO)

If you’re interested in learning more, or are ready to sign up with Pollfish to start cranking out all the market research projects you desire, visit our page: Pollfish Plan Pricing.

Accessing Market Research Data to Buy Survey Audience

Once you register with Pollfish, sign in to your account. Once signed in, you’ll be able to access all of your market research data — including the screener where you select your desired survey audience. The Pollfish platform includes the following interfaces:

- The Dashboard

- New project creation

- Here, you can create new survey campaigns

- List of ongoing surveys; this includes

- Running surveys

- Paused surveys

- You can include each survey under different folders

- New project creation

In your dashboard, you can choose what you want to do with your survey campaigns, such as combing through ongoing surveys, paused surveys or those that have already reached completion. The latter refers to surveys that have received the amount of completes you originally added as part of your quotas.

Two Main Ways to Buy a Survey Audience

You can also choose to create an entirely new project. For this purpose, you’ll find the large blue button on the top right corner of the Dashboard, called “Create Project.”

As such, there are two main ways to buy a survey audience in Pollfish and edit it to your liking.

The first way to buy a survey audience is by creating an entirely new project. This grants you three options, which you can learn about in the next section. Essentially, these options provide the way you build out your survey.

The second way to buy survey respondents is by editing a survey that’s already in progress, AKA, a survey that is already running. In this second method, you can choose respondents by pausing a running survey.

Remember, in both ways, you’ll need to buy your survey audience by accessing the last section (or step) of the survey process, which is the checkout.

For more information on how to make your own survey in just three easy steps, read the article in the hyperlink.

How to Buy Survey Respondents

Now that you understand how buying survey respondents works on Pollfish, including the fact that it is innately tied to forming surveys themselves, let’s delve further. Here, we’ll teach you how to make that knowledge more actionable.

The following provides step-by-step instructions on how to buy a survey audience on Pollfish:

- Register or log in to the Polish platform.

- Choose how you want to buy your respondents based on the two main ways explained above.

- If you seek to edit an ongoing survey (or a lauded survey), go to your dashboard.

- In your list of surveys, choose from the following surveys:

- All

- Draft

- Under approval

- Approved

- Running

- Paused

- Completed

- Under Edit

- In this list, click on the one you wish to edit.

- Edit your survey audience.

- You can change anything on the audience page, such as applying /removing filters, adding/changing quotas, etc.

- You cannot edit the screening questions.

- Go to the Checkout and pay for your new survey audience.

- In your list of surveys, choose from the following surveys:

- If you seek to create a new project, click on the big blue button labeled: “Create project.”

- You’ll have three options for creating a new survey project. These include:

- From scratch

- From template

- Link 3rd party

- Next, you’ll be asked the following: "How would you like to collect responses to your survey?”

- Choose from the following options:

- Buy a survey from the Pollfish audience (The RDE method)

- Send a survey to your own audience or another survey panel

- Next, you’ll be brought to the 3-section survey creation interface.

- Choose your precise survey audience in the “Audience” section.

- Here, you can input as many demographic/ location/ psychographic features.

- You can add screening questions if you have the Elite Plan.

- After you’re done choosing all your respondent criteria, move on to the next section, the Questionnaire and create your survey.

- Go to the last section, the Checkout. Here you can:

- Choose a payment method.

- Choose to schedule your survey or launch it immediately.

- View your cost analysis.

- Pay and complete your survey. Congratulations, you’ve bought a survey audience!

- You’ll have three options for creating a new survey project. These include:

The Pollfish Platform Has Your Back

Regardless of the kind of market research project you seek to build out, Pollfish always has your back. Our dedicated team of market research experts is here to help you 24/7. Our platform is second to none when it comes to working on any topic that requires research.

Whether you seek to run a product satisfaction campaign, measure your consumer loyalty, run a brand tracker, understand your brand reputation or improve your customer service, we’ve got you covered.

That’s because you can create any type of survey — and if you’re ever stumped on how to get started creating yours, you can choose from various survey templates and edit them to your liking. We currently offer 19 templates for a distinct range of topics.

Just remember to study the correct survey target audience, as it differs from your broader target market and its various segments and customer personas. Luckily, you can filter your survey audience as granularly as you need to on our platform. Happy researching.

Buy Survey Responses With a DIY Market Research Platform

Buy Survey Responses With a DIY Market Research Platform

Rather than relying on survey panels or syndicated research, you can buy survey responses and access highly sought insights yourself when you use a DIY market research platform.

Such a platform evades many issues present within the aforementioned research methods, such as panel fatigue, which is found in survey panels and exerting less control over a research project, which occurs in syndicated research.

Additionally, in keeping with the idea that any team member can perform quality market research — very much in tune with data democratization — you can buy a set amount of survey responses for your market research needs. You can do so without breaking your budget.

On the contrary, research firms and various market research platforms don’t offer the ease of performing and sharing market research as does a DIY market research platform. What’s more is that many research projects are expensive and time-consuming. As a matter of fact, brands spend $60,000 and more on market research, with an estimated 6 weeks or more to complete a market research project.

With a DIY research tool, you can buy responses, which is far more cost-effective and quicker.

This article explains what it means to buy survey responses and how to do so on the Pollfish online survey platform.

What it Means to Buy Survey Responses

Relatively speaking, buying survey responses is much like buying a survey sample, which is an exclusive pool of all the respondents that make up your survey. As such, it does not mean you’ll need to reach out to individual respondents or send your survey via an online portal yourself.

So what does buying survey respondents entail? In the context of a DIY market research platform, it means you buy the participation of your target audience based on a particular number of individuals.

Given that you and your team are at the helm of market research study, it is up to your team to decide the number of respondents you would like to partake in your survey. It is key to note that you are not buying for participation in an entire campaign. Rather, you pay for individual respondents’ participation in a specific survey.

By buying survey respondents, you’re allocating all the data you need for any survey; at times, one survey is all you’ll need for a market research campaign, unless you’re seeking out other market research techniques.

Thus, when you pay for individual survey respondents, you’re building the entirety of the subjects that make up a DIY survey.

As such, when you buy responses in a DIY market research platform, you’re hastening the speed to insights and reducing the span of the research project. This is one of the many benefits of buying your responses.

Benefits of Buying Survey Responses

When you buy survey responses on a DIY market research platform, you’re doing more than just opting in research participants. A strong DIY market research platform offers various benefits. These include the following:

- Reaching the exact number of respondents you need

- Obtaining respondents where they naturally exist online

- via RDE sampling or random device engagement

- Market segmentation and targetting

- Quicker insights

- Reaching your particular target market

- Dictating the demographics, psychographics and geolocation of respondents

- All the data you reap is proprietary to you (not the DIY survey platform)

- Being equipped with key data for decision making

- Insights for business decisions

- Steering the direction of a research campaign

How to Buy Survey Responses on Pollfish

Buying respondents is easy and hassle-free — with the right DIY research platform. You can buy individual survey responses on Pollfish.

All respondents are pre-screened and pre-qualified to take part in a survey study. This means, only the respondents you target can take your survey. They will need to tick off all your requirements, from location to demographics and more, depending on how you set up your screener.

To buy responses on Pollfish, you’ll first need to choose a pricing plan. On this page, you have the option of choosing a basic or elite plan. In the basic plan, you can buy survey responses at an individual basis.

Each completed survey, aka, individual survey respondents starts at $0.95. Prices range from $0.95 to $1.25 based on the number of questions in your survey.

Once you choose a pricing plan best suited for you, you can then begin your market research endeavors. The Pollfish dashboard is easy to access and allows you to make your own survey in just 3 steps.

Then, commence targeting your respondents by setting up various qualifications in the screener section of your survey. In Pollfish, this interface is referred to as the Audience section. Here you can also set the exact number of survey completes in your survey. Each complete is done by an individual survey respondent. As such, a survey with 800 survey completes = 800 survey respondents.

You can also create custom quotas to narrow down specific people and see how different groups answer questions. For example, you can create quotas such as: 300 middle-aged men with a salary between $100,000-$250,000.

Constant Access to Any Target Population

All business and non-business entities can conduct their own research via a potent DIY market research platform. Even individuals who seek data on a specific target population can do so at speed when they buy survey respondents.

You should opt for an online research platform that makes buying survey respondents a quick and simple process. This way, you’ll collect all your necessary data from the right respondents in a short space of time.

Opt for a platform that features artificial intelligence and machine learning to remove low-quality data and offer a broad range of survey and question types.

It should include advanced skip logic to route respondents to relevant follow-up questions based on their previous answers.

Most importantly, it should allow you to survey anyone. As such, you’ll need a platform with a reach to millions of individuals, along with one that offers the Distribution Link feature.

This feature will allow you to send your survey to specific customers, instead of just deploying them across a network.

With all of these capabilities, you’ll be able to reach any target audience and run quality research campaigns.

The Complete Survey Response Rate Guide

The Complete Survey Response Rate Guide

In a survey, the survey response rate is a unit used to measure the accuracy of the data that you collected, making it an important factor to consider when interpreting survey results. After taking the time to plan and create a survey, a low response rate can be very disappointing.

Even worse, a low response rate may result in the incorrect interpretation of survey data, leading to a major misstep in business planning.

When planning and creating a survey, you should aim to maximize the survey response rate by paying attention to factors that may hinder respondents from starting or completing your survey.

This guide will help you understand why the survey response rate matters and what you can do to improve the response rate of the surveys you create.

Understanding the survey response rate

Also referred to as the completion rate, return rate, or simply the response rate, this unit is crucial to survey research. The survey response rate and its affiliated monikers are used to indicate the percentage of people who completed a survey compared to the total sample size (people who received the survey).

For example, if you sent out 1,000 surveys and received 150 completed surveys, your response rate would be 15%. When looking at the response rate for a survey you conducted, you will need to assess whether the response rate is poor, average, or good.

There is not a standard “good” survey response rate because it varies greatly based on several components, such as the industry, survey type, and the method of distribution (e.g. phone, in-person, email, live site or app).

Why the survey response rate matters

Calculating the survey response rate is straightforward, but interpreting its effect on survey data is more nuanced. As such, it is vital that you carefully consider this metric when analyzing survey data.

A low response rate usually increases the likelihood of sampling bias. Sampling bias is the term used when the results of a survey do not return random results. The lower your response rate, the more likely it is that you will experience sampling bias.

An example of potential sampling bias due to a low response rate:

Let’s say that a company wants to know what incentives are most appealing to their employees. They decide to focus on softer incentives like free lunches, happy hours, and other team-building activities. They send the survey out to 200 employees and receive 32 responses, giving them a 16% response rate.

When examining the data, the HR team noted that 94% of these respondents expressed great satisfaction with the team-building incentives. With such a positive response, the team could be tempted to assume that these incentives are a valuable asset to current and prospective employees.

Fortunately, knowing that the survey had a low response rate that could result in sampling bias, the team decides to look closer at the results before drawing conclusions.

While reviewing the data, the HR team sees that most respondents were in the 22 – 28 age group, leaving them with new questions. Were younger people more likely to respond because they like these activities and want them to continue? Does this age group have more interest in voicing their opinions?

With more questions than answers, the HR team decides to revisit their survey and try to improve the response rate before making changes to their incentive program.

5 ways to improve your survey response rate

Here is the most important part of this guide. Since the response rate is an indication of survey quality and can improve the accuracy of results, you should do everything you can to promote a higher response rate.

Here are our top tips for creating a survey to improve your response rate:

#1: Understand and state the purpose of your survey

Before you create screening criteria or questions, think deeply about the purpose of your survey. What do you hope to learn by conducting this survey? What are the top questions you want to answer for your business? Revisit your purpose before, during, and after your survey development to ensure you stay on target.

For even better results, share some of this information with your respondents. Instead of asking someone to “answer a few questions,” you may get a better response when your respondents understand why they are being asked to participate.

#2: Design your survey well

A well-designed survey offers a better user experience (UX) for respondents and increases the likelihood that they will complete the survey. Survey design covers both the physical aspect of the survey as well as the questions within the survey.

Some best practices for survey design include:

- Create a visually appealing survey. Questions should be laid out nicely and responses should be easy to select. Include images if necessary.

- Make sure the language of the survey appeals to your target audience. Use language that is clear and appropriate for the audience. The questions should be easy to understand with responses that make sense within the contact of the question.

- Since many people will complete an online survey on a mobile device, verify that the survey works as well on phones and tablets as it does on a computer.

- Personalize your survey to your target market. Further audience segmentation will help organize your user base.

- Add advanced skip logic so that respondents are routed only to relevant questions based on their answers.

- Use a variety of question types. Varying your question types between multiple-choice, rating, and open-ended can help increase your survey response rate.

#3: Keep it short

Long surveys are less likely to be completed, making survey length one of the primary factors in survey response rate. Ideally, you will keep your survey short and focused – a survey that takes longer than 5 minutes to complete will not perform as well as one that takes 3 minutes.

Of equal importance, let your respondents know how long it will take them to complete the survey – and make sure your estimate is accurate or you may notice that respondents start the survey and do not finish it.

#4: Reach the right audience

In order to increase the number of people who complete your survey, you need to reach them and offer them a survey that they can complete on their own terms. A professional survey platform can help you reach a bigger, more relevant audience, thereby increasing the odds you will find the right people to complete your survey.

With a larger number of prospects, it is also important to carefully consider your screening questions to filter out those who are not in your target market, area of study or are less likely to complete the survey. A good survey platform will make it easy for you to screen users before they begin taking your survey.

#5: Choose the right incentive

While some people truly enjoy filling out a survey, the vast majority of respondents are reluctant to spend valuable time answering a survey without some type of incentive. There is no “one size fits all incentive” – the type of incentive you offer must be attractive to your specific survey group.

B2B customers are more likely to be motivated by intrinsic incentives, such as eventually receiving the results of your research or understanding that their response will help you improve their experience.

Other survey audiences are better motivated by extrinsic rewards, such as discounts and coupons. If you have an online shop, offering a 10% discount on a subsequent purchase can help dramatically improve your survey response rate.

An appealing introduction:

In our scenario above, the HR team could encourage responses from a wider demographic if someone explains the importance of the survey during a company-wide meeting and again when distributing the survey.

Here is an example of an introduction that could improve the survey’s response rate:

“Hi Sam. We know that incentives are a powerful tool to retain employees and attract the best talent to join our team. We want to understand if the incentives we currently offer are appealing to all of our employees.

The survey will only take 3 minutes to complete. Your responses will help us update our incentive program to ensure that our incentives are relevant to all of our employees.”

Improve your survey rate, improve your market research

In many cases, using a survey platform will make it easier to maximize your survey response rate. For example, the platform should make it easy to add an attractive visual design that works well on any device.

It should also come with a call-out (a button or banner that prompts users to take the survey). Additionally, the platform should give you advanced tools to select your desired target audience by way of demographics options.

Another important benefit of a professional survey platform is that you can understand your survey’s response rate in real time, allowing you to respond quickly to correct a survey with a low response rate. The ability to course correct can save you time, money, and provide higher accuracy of results, so you can be confident about making business changes based on the outcome of your survey.

Frequently asked questions

What is the survey response rate?

The survey response rate is a term used to describe the percentage of people who completed a survey compared to the total number of people who received the survey.

Why is the survey response rate important?

It is important to understand the survey response rate to ensure that your conclusions are not a result of sampling bias. Sampling bias can occur when the response rate is low.

How does length affect the survey response rate?

Respondents are less likely to complete longer surveys, which can result in a lower response rate.

How does targeting the right audience improve response rate?

When you target the appropriate audience for your survey, the questions are more likely to be interesting and engaging for that audience. An engaged audience is more likely to complete a survey, thus improving the response rate.

How can the mobile survey experience improve the response rate?

When a survey is well-designed for a mobile device, respondents will be able to complete the survey at any time and place, and from any device. You can expect a higher response rate when you allow respondents to complete the survey when it suits them best.

5 Types of Survey Respondents to Keep an Eye On

5 Types of Survey Respondents to Keep an Eye On

When conducting a survey, it is essential to understand that, no matter how sophisticated the platform you use is, not all survey responders are keen on taking it the way you’d like.

That is to say that there will be some respondents who speed through a survey to be done with it as soon as they can, while others will take it more diligently.

These different kinds of survey respondents are not necessarily bound by a demographic; rather their style and behavior when taking surveys gives rise to their labels. Oftentimes, this is something that you can’t narrow down on a survey’s screener. You can, however, question responders on their survey-taking behaviors.

There are five types of survey respondents worth noting in your market research endeavors. They are personas — survey respondent personas to be exact — in their own right. Learn about the five respondent personas so that you can understand how your survey will be received.

The Survey Aficionados

To start this roster on a positive note, we begin by introducing the survey aficionado. Usually categorized as one of the good kinds of survey takers, survey aficionados make it their business to take surveys — they treat it as their job, or at least a source of supplemental income.

They manifest their devotion to survey-taking by taking them frequently and consuming them across websites and mobile apps. This is usually a positive behavior for marketers and market researchers, as aficionados provide sought-after participation.

However, survey aficionados can also hurt surveys, in that constant participation can yield biased results. This is especially true if they take part in surveys that deal with similar subjects.

How to attract and avoid this persona:

To attract survey aficionado respondents, offer an incentive in exchange for taking your survey. This is usually the draw of taking so many surveys for this persona, as there’s something in it for their gain.

To avoid survey aficionado respondents, screen them by asking if they’ve taken part in a recent survey on a related topic.

If you can’t do this in the screening stage of your survey, choose a platform that allows you to apply skip logic in your questionnaire.

This mechanism allows you to move a respondent to your question of choice based on their answer to a question. This way, you will avoid asking them certain questions or end the survey right then and there if they’re a bad fit.

The Flatliners

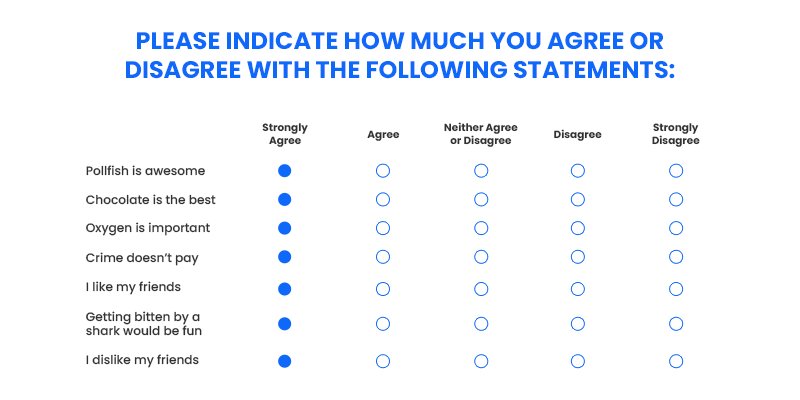

Also called straightliners, these responders engage in negative behavior when taking a survey. Flatliners tend to regularly respond as either extreme on a Likert scale survey (a survey that measures the magnitude of attitudes, opinions, or beliefs on a scale of answers, such as “highly likely” to “highly unlikely”).

As such, it is in their nature to habitually respond either on the positive end of the scale (with “strongly agree”) or on the negative side (with “strongly disagree”). Or they may respond with another answer type — continuously.

The motivation for behaving in such a way is often to complete a survey as soon as possible, making this persona a predominant kind of speeder.

Another underlying motivation for flatliners is an innate bias, such as acquiescence bias or dissent bias.

How to avoid flatliners:

Lay off of grid or matrix questions, as they are the most likely to knuckle under the behaviors of this persona.

Use one question per page (or find a platform that does this).

If you use a platform that applies multiple questions per page, make sure they are similar.

Implement more open-ended questions that deal with the matter. Additionally, use skip logic to lead respondents to answer why they chose a particular answer to a Likert Scale question.

The Fakers

These respondents’ behavior is self-evidently negative. This persona deals with responders who do not provide genuine answers, only fake ones, hence the name. The motivation is usually to reap the reward for taking a survey.

The Fakers operate in three ways:

They create multiple accounts on a website to repeatedly take the same survey.

They use one account to take the same survey multiple times.

The most technically savvy and malicious fakers create bots to take surveys without doing the work of a survey.

Weeding out fakers has become increasingly easier, as both survey panels and platforms rely on advanced restriction functionalities.

How to avoid the fakers:

Use a platform with built-in anti-bot technology.

Use a platform that bars responders with the same IP address from taking the same survey more than once.

Ask more open-ended questions. These will easily spot fakers, as they require longer, more thought-out answers, which are much more laborious than selecting an option.

The Rule-Breakers

Much like the cheaters, and as their name implies, rule-breakers don’t adhere to the directions of a survey. While some are just looking to cause trouble and some want to finish the survey quickly, other responders may be breaking the rules unintentionally.

This is usually the result of not fully understanding a question or completely misconstruing it. Rule-breakers are a nuisance, but like the other personas, they too can be avoided.

How to avoid the rule-breakers:

Use several screening questions to prohibit the wrong kinds of respondents.

Discard respondents who manifest their lack of attention in open-ended questions.

Use skip logic to avoid possible rule-breakers, by moving responders to relevant questions only.

The Posers

Not to be confused with the fakers, posers also provide false feedback, but not because they are bots or manage multiple accounts to take the same survey more than once.

Rather, they provide dishonest responses because of a social desirability bias, a kind of inclination to answer questions in a way they believe will be viewed more favorably. This means their feedback can over-report “good responses” while downplaying the “bad responses.”

Posers do not necessarily act as their moniker in every situation, instead, they may only behave as such when answering questions on certain topics. Due to this, posters can be hard to pinpoint, but they can still be avoided.

How to avoid the posers:

When dealing with particularly sensitive topics, assuage your respondents by telling them that they are not being judged (especially in the beginning).

Assure your responders that their answers are anonymous.

Remind your responders of the importance of the accuracy of their answers.

Handling Survey Respondent Personas

With surveys becoming ever so dominant in market research, there have been evaluations on how respondents behave during their participation. Thus, the birth of five unique survey respondent personas was born.

You may discover other names for similar behaviors when reading up about these personas. Regardless of what they are called, they each present unique challenges to your market research study.

These personas may not all relate to your pool of respondents; that is why it is important to assess your surveys and look for behavioral patterns.

This is not as tedious as it appears, as some behaviors may be more obvious than others. It’s also important to rise to the challenge of understanding your customer base. You can do so by conducting the right surveys. If you can’t spot any of these personas, it is still worth sticking to the aforementioned best practices as they can prevent the “bad” types of respondents from influencing your study.

Frequently asked questions

What is a survey?

A survey is a research method that is used to gather information from a group of people in order to gain insights about a particular topic.

What are survey respondents?

In survey research, the term “survey respondents” refers to the people who take part in a survey. They make up the sampling pool.

Why is it important to be aware of certain survey personas?

In order to gain accurate and valuable insights from a survey, a company depends upon survey respondents providing truthful, unbiased information. When a large number of poor-quality responses are received, it can affect the accuracy of survey results.

What are survey aficionados?

Also known as professional survey respondents, survey aficionados are individuals who take surveys in order to make money. They are motivated to complete surveys quickly so they can respond to a large volume of surveys.

How can a company improve the quality of survey responses?

A company can increase the likelihood of gathering genuine responses by using strong screening questions and creating a well-designed survey with a good mix of survey questions.