Attaining All Research Goals with Online Market Research

Attaining All Research Goals with Online Market Research

Online market research is the foremost method of modern market research, owing to its speed, accuracy of execution, ability to reach millions and plenty more.

You shouldn't, however, mistake this kind of research for one subtype (such as keyword research or internet database research). That’s because this kind of research is an umbrella term that encompasses many methods and approaches.

You may be wondering, is online market research relevant to your business?

Well, 81% of customers conduct online research before they make a purchase. Thus, if you aren’t already conducting this kind of research, your customers already are to judge your business.

Thus, you’d be remiss not to conduct it. You wouldn’t want to miss out on sales opportunities.

After all, 68% of companies increased sales with market research. And online market research is the dominant form, for a variety of reasons.

This article expounds on online market research, its various types and its importance, along with how and which campaigns you can apply it to.

Understanding Online Market Research

As its name implies, this is a form of research conducted entirely online, utilizing a variety of means to gather critical customer insights.

As such, it is the direct opposite of offline market research, which is predicated on using various non-digital, and non-internet-related sources to conduct research on customers.

The reason that online market research is used specifically to collect customer insights is that it is a form of market research, which involves all the activities used to study your target market — the group of customers most likely to buy from you.

As such, market research is a kind of research driven by the study of the following topics, as they relate to your customers and industry:

- Customer preferences

- Customer behavior

- Needs

- Desires

- Aversions

- The customer buying journey

- Demographics

- Psychographics

- Lifestyles

- Sentiments and attitudes, especially in relation to your business.

Online market research involves using a variety of methods to facilitate research campaigns. Because of this, it is not bent on using just one method. Instead, it involves all the activities and tools available to study your customers and the industry at large.

You can use several forms (or subtypes) of this research, or you can use this research to accompany other forms, such as real-time market research and offline market research. But you don’t necessarily have to.

That’s because this kind of research includes many different kinds of methods and tools, allowing you to reap all the customer intelligence you need.

The Types of Online Market Research

Given that this research is largely an umbrella term for a range of online activities for researching your customers, you ought to know what kinds it includes.

As the market research industry evolves, the following list will change, as some methods will die out and more will be added. This is because this kind of research is reliant on technology, specifically, the internet, which is constantly progressing.

The following lists the names of various forms of this kind of research:

- Internet research

- A secondary research method that typically involves searches on search engines.

- Keyword research

- This is especially used for understanding the demand of products and services.

- Market research software

- These are platforms designed to automate the research process and are typically used in agile research.

- DIY market research

- This is a kind of research that businesses and researchers can conduct on their own through a variety of tools.

- Syndicated research

- This is virtually the opposite of DIY research, as researchers use a research firm to conduct the entirety of their research campaigns. In this context, they do so digitally.

- Real-time results research

- Closely tied with real-time research (a kind of ethnographic research), it involves using a platform that offers customer data in real-time.

- This is its own category, as not all market research software offers this.

- Competitor research

- This involves paying close attention to your competitors’ digital properties to observe how they carry out their offerings and how their customers engage with it.

- Survey panels

- Much like syndicated research, this too is external, as a company amasses a research panel to partake in research campaigns.

The Importance of Online Market Research

If the above sections, which delve into the many capabilities of online market research didn’t convince you of its importance, the following will.

First and foremost, this kind of research allows you to understand your customers in great depth, the kind you wouldn’t have access to in other forms of research. That’s because it’s far easier to reach people online, rather than via mailed surveys or interviews.

Secondly, it enables you to understand how viable a product is in your industry before you launch it, to avoid low sales. In addition, it can help you innovate and improve upon already existing products.

That’s because there are various ways to conduct product research, such as via general internet research. Or, you can do this through a market research tool that you would only get from a market research platform. For example, the Van Westendorp Price Sensitivity Meter is a pricing model that provides data for consumer price preferences.

You can also use this kind of research to improve your entire customer experience, from the first impressions of your business, to browsing your digital properties to finally making a purchase and beyond.

With a good CX, you’ll be able to delight your customers across all touchpoints, building a strong relationship with them, in turn. This itself has a wide variety of benefits for your business.

A good relationship with your customers fosters consumer loyalty, which you’ll need in order for customers to come back to your business time and again. You wouldn’t want to have a “one and done” customer.

Thus, by conducting this research and pleasing your customers, you’ll be able to increase your customer retention rate. Retention is paramount, as it is both more profitable and attainable.

For example, increasing customer retention by just 5% can increase profits from 25-95%. In addition, acquiring a new customer costs five times more than retaining an existing one.

Thus, it’s crucial to maintain adequate customer retention. By running online market research, you can also maintain or even increase your customer lifetime value, the quality of your customers in relation to the length of their patronage of your business.

This metric also ties in with retention and is a must to keep your business competitive.

What Campaigns and Macro-applications Online Market Research Can Support

One of the strongest abilities of conducting online research is that it can support a wide variety of business campaigns. This includes aspects of all areas of your business, as your customers affect it beyond the scope of marketing and selling.

While there are too many to list, here are some of the major campaigns and macro-applications this kind of research supports:

- Concept testing

- This is ideal to do before you introduce any new products into the market.

- You can test a variety of concepts to see which resonates the most and which has the highest demand.

- This is also used to ask customers themselves to pitch concept ideas for products and services.

- Customer development

- Conceived by an entrepreneur, this is the mid-portion of the lean startup model, which is designed to tackle the problems in product development.

- It requires first fully evaluating the product opportunity and then proving that the solution proposed will meet market demand and customer needs.

- Writing a business plan

- Before you embark on any new business, you’ll need to know whether your idea would be viable.

- Thus, you will need to create a business plan as a framework for all your new business undertakings. Learn how to do market research for a business plan,

- Advertising research

- There are a variety of ways to use this form of research to test ad campaigns.

- You can conduct A/B tests of ads, run surveys, view existing ads in a similar business and more.

- Brand tracking

- These campaigns involve measuring all your brand-building efforts, such as brand reputation, awareness and perception against key metrics.

- There are various methods to keep track of your brand health, but using the brand tracking survey is one of the simplest and most accurate sources of this campaign.

- Consumer analysis

- Analyzing your customers is the core of market research.

- There are various online approaches to conducting this research, including secondary and primary sources, which you can use to build your analysis.

- Purchase frequency

- Create specialized analyses, such as the RFM analysis to learn about customer buying patterns and behaviors.

- Conducting online research can also help you increase your purchase frequency.

- Customer satisfaction

- Satisfying your customers involves using a variety of avenues to get them hooked on your products/services, engaged in your social and other posts and keeping your business top of mind.

- Use research to test your customer support and engagement sessions.

- Business relationships

- Learn more about how your business customers, vendors and partners feel about working with you, or what they seek from the industry at large.

- You can do so via B2B surveys

- Learning how to lower bounce rate

- One of the many metrics you’ll contend with on your site, your bounce rate is one you’ll ideally want to lower.

- This involves testing your site’s UX and user-friendliness.

- Conducting global studies

- You’ll need to appeal to global customers beyond the ability to serve them. Conducting research will help you understand their cultures and norms to better market to them.

- The right platform will make it easy to conduct global market research.

Forming Strong Business Campaigns

Online market research guides and supports a vast variety of business matters. As such, you should never forgo conducting this research, as it reveals much about your customers and industry, and most importantly, informs you on the actions you need to take.

You should therefore select your market research platform carefully. A strong market research company will allow you to fulfill all of your online market research activities.

We suggest using a survey platform that offers a wide range of capabilities and functionalities. This will ensure valuable campaigns that are rich in insights, that also provide you with ease of survey deployment and analysis.

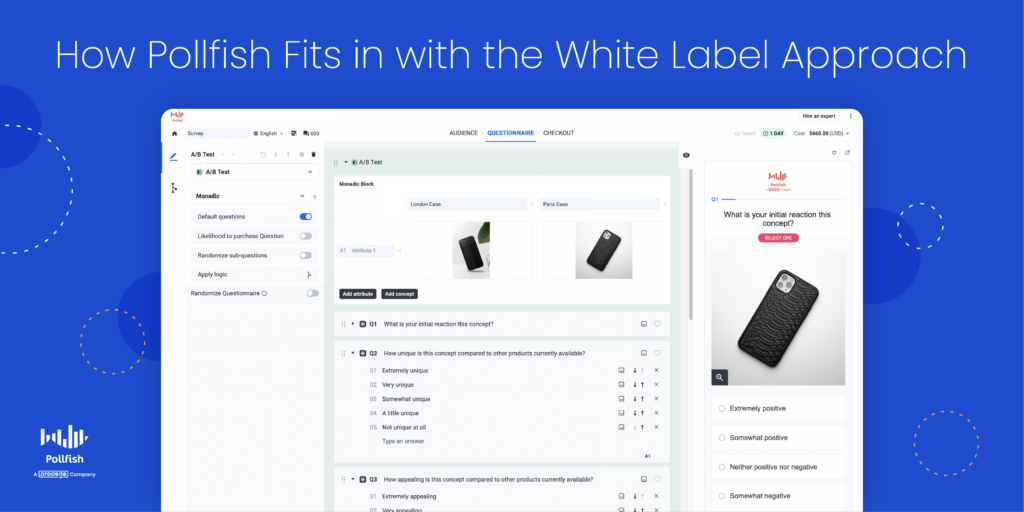

Pollfish survey software allows you to create a thorough survey data collection, one you can customize to your liking, view however you choose and organize it to the max.

In addition, with our vast array of question types, you can create any type of online market research survey to support your research campaigns.

Researchers can leverage a wide pool of information on their respondents by accessing the data in their survey results dashboard.

When you have the support of such a platform, you can tackle all your research needs.

Complete Your Real-Time Market Research with a Survey Platform

Complete Your Real-Time Market Research with a Survey Platform

You may have come across real-time market research, a modern version of what essentially is ethnographic research.

That’s because businesses are constantly being swamped with different types of data collection methods — and software companies making all sorts of promises on the capabilities of their data.

This results in a kind of data overload: In 2022, 97.2% of businesses are investing in big data and AI. Despite this seemingly omnipresent investment, only 32% of businesses are able to realize tangible and measurable value from their data.

This rings true in market research as well, which provides a groundswell of data on customers and market trends. Among them is the said real-time market research.

Real-time market research is often part of the data advertised as necessary to businesses so that they can understand their customers. But this is not the same as real-time results data, despite the similarity in name.

Neither is it the same as survey research and other forms of agile market research.

However, it can be used in tandem with agile market research. The key is to do so correctly and to fully understand what real-time research entails.

This article lays out real-time research, how it's conducted, its importance and how it can be used alongside agile market research, specifically survey studies campaigns.

Understanding Real-Time Market Research

As its name suggests, real-time market research is a kind of data collection method that garners information on customers in real time. This is to say that it involves collecting insights on customers’ experiences as they occur.

This may appear to be much like an ethnographic approach, which is a traditional market research method.

Ethnographic research is a kind of qualitative market research method for collecting data. In this method, data is collected through firsthand observations, which are then used to draw conclusions about customers.

Customers are thus observed in their natural environments rather than being interviewed after the fact.

These natural environments that customers frequent include:

- Malls

- Stores

- On the street

- Watching an advertisement

- While speaking or interacting with them

- Customer support sessions

- Digital environments (more on this in the real-time results research section below)

While it may seem to be outdated, it has been modernized in the form of real-time research, with different software companies offering tools for businesses to monitor their customers in the here and now.

Real-Time Market Research Vs Other Forms of Research

As you know, there is a plethora of research methods you can leverage for your studies.

Real-time is a form of research that should not be confused with other kinds, regardless of how similar in name they may sound, or how similar in function they may appear to one another.

There are a variety of legacy market research methods, such as snail mail surveys, telephone calls, in-person interviews and research panels.

However, for the purpose of this article, we’ll discuss how the real-time research approach differs from two major kinds of research: agile and real-time results research.

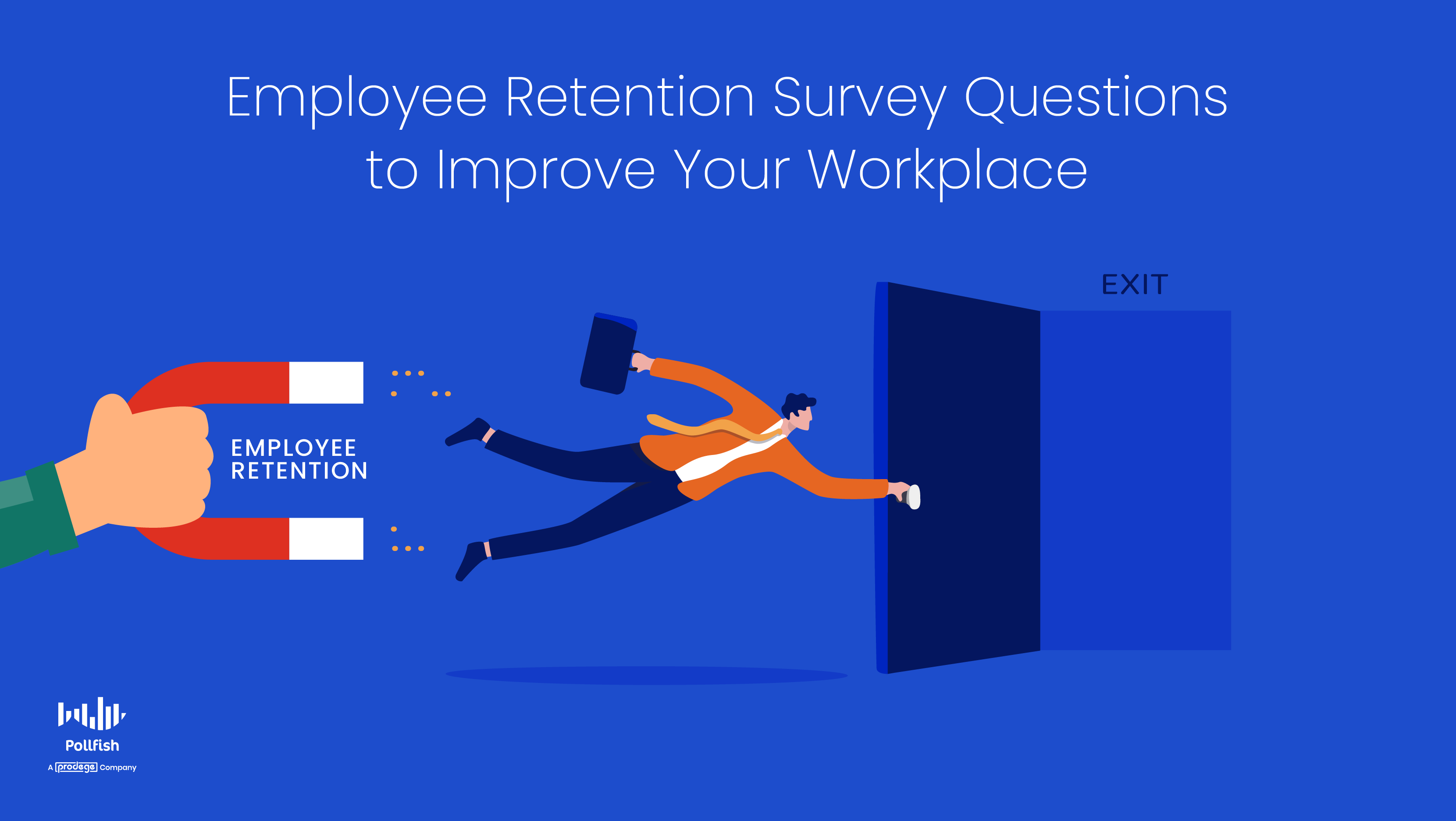

How Real-Time Differs from Agile Research

Real-time market research differs from agile research in that real-time is a method of collecting information by way of drawing data on a customer’s experience as it is happening.

As such, it is centered on customer experience and is therefore used to gain a clear understanding of customer reflections and their behaviors, as they’re manifesting them.

Agile market research, on the other hand, is a kind of research driven by iterative and incremental software development processes. It is predicated on getting insights on customer behaviors and sentiments, after they have occurred.

It is also different, in that it is also bent on rapid and flexible responses from respondents — these are often automated via software such as automated surveys. This agile method gives way to many benefits, such as faster time-to-market, low costs and improved quality of outputs.

Like many other kinds of market research, agile market research methods are primarily focused on forming statistics, while real-time research is based on data science.

As opposed to the reality of customer experience, the agile approach deals with the reflections of customers.

The biggest difference between these two forms of research is that in agile research, you would explicitly ask your respondents questions, while you wouldn’t in the real-time research method.

How Real-Time Differs from Real-Time Results Research

While they sound similar, these two forms of market research differ considerably. Interestingly enough though, real-time research can be a form of real-time results research.

First, let’s understand the core of real-time results research.

Real-time results research is a kind of research method in which customer data is collected in real-time.

However, unlike in real-time research, the real-time results method is based on data. Thus, the real-time results approach is focused on observing customers in the digital space, not in physical places.

The data becomes available as different data visualizations, which researchers can see being updated in real-time.

On the contrary, real-time research is driven by observing customer actions in the physical realm. It is therefore a modern version of ethnographic research since it also obtains information from consumers without explicitly asking them questions.

However, it too can apply to observing customer data in real-time. Thus, in this way, it is a form of real-time results research.

As such, it is easy to see why these two methods are often used hand in hand.

How to Conduct Real-Time Market Research

Real-time market research has evolved along with the broader market research industry. Gone are the days when the only way to conduct it was by watching customers in person or interacting with them (however, you can still use these methods as well).

The following is a list of the ways you can conduct this form of research:

- Social media listening

- Session replay tools

- Predictive analytics

- Field marketing

- Speaking and interacting with customers at trade shows, grand openings, etc

- Viewing how social media posts are engaged with

- Viewing how advertisements are engaged with

All in all, you can use any method of collecting data, as long as it gives you a firsthand glimpse into a customer’s experience as it is happening.

The Importance of Real-Time Market Research

This kind of research method is important on several accounts.

First off, it provides an alternative to agile methods of data for decision-making. This is important to researchers who seek to gather information on customer behavior as it exists at the moment rather than studying it retroactively.

This is also important, as it can be used as a comparison method to compare current behaviors and sentiments as they exist, with those of the past. In this way, it can be used for comparing the data from longitudinal studies.

In addition, this kind of research approach is critical to satisfying the need for a sharper understanding of customer reflections and behaviors. That’s because agile data can’t always capture everything, as some respondents forget things while others fall victim to selective memory.

Real-time research is also a must for client-side marketers who are in demand of immediate data, the kind they can access at any time of the day.

What’s more is that you can use it as a kind of real-time results research, by evaluating the performance of customers’ digital activities. They can do so via the tools mentioned in the prior section.

The greatest benefit of this kind of research is that it can be used in conjunction with agile market research, such as the kind you get from software such as survey platforms.

Using Survey Research with Real-Time Market Research

The ultimate verdict on real-time research is that it should never be a lone market research effort. Instead, it should be used in tandem with other forms of research, such as the aforementioned agile research.

Why? It’s simple. The insights you derive via the real-time method are far from sufficient.

They become truly invaluable, however, when you pair them with agile data. With both types of research in tow, you will be able to conduct an exhaustive research campaign.

That’s because these two forms of research complement each other. When you don’t have enough information from one, you can conduct the other type to make up for the gaps in insights.

For example, say you begin with real-time research. While the observations you made were interesting, they are likely to set off a bunch of questions in relation to the activities you watched. Thus, you would follow up with agile research, specifically via a survey campaign.

In this dual approach, you’ll get ethnographic research, coupled with answers to the questions that stemmed from it. Thus, you’ll have a full-picture understanding of the subjects you’re studying.

You can also compare real-time research with historical data or market trends. Much of this data can be conducted via the agile method as well, especially when it comes to longitudinal research.

In addition, you can also combine the agile and real-time methods via brand trackers.

These are ideal for uncovering seasonal and ongoing trends, unlike real-time, which shows you what’s occurring in the present.

Thus, you can compare the data from both for a strong understanding of your customers and how they feel about your business.

The final key takeaway is that real-time market research provides a key aspect of research on your consumers. But it should never be used on its own; it is best to use it to complement agile research, as automated surveys help fill the void in what a real-time campaign lacks.

Perfecting Your Research Needs

The real-time approach to market research can come in handy whenever you seek to study customer activities and behaviors as they are happening. This kind of research adds another facet to your survey studies.

You should always use it with agile research, particularly surveys, as surveys can uncover virtually anything, depending on the questions you use with it.

You should therefore select your platform carefully. A strong market research company will allow you to carry out and fulfill all of your market research activities.

We suggest using a survey platform that offers a wide range of capabilities and functionalities. This will ensure a valuable campaign that is rich in insights, as well as granting you ease of deployment and analysis.

Pollfish survey software allows you to create a thorough survey data collection, one you can customize to your liking, view however you choose and organize it to the max.

In addition, with our vast array of question types, you can create any type of online market research survey to support your research campaigns.

Researchers can leverage a wide pool of information on their respondents by accessing the data in their survey results dashboard.

When you have the support of such a market research platform, you can truly create multifaceted research experiences to inform all of your curiosities about your customers.

What is Product-Market Fit and How You Can Earn it Via Market Research

What is Product-Market Fit and How You Can Earn it Via Market Research

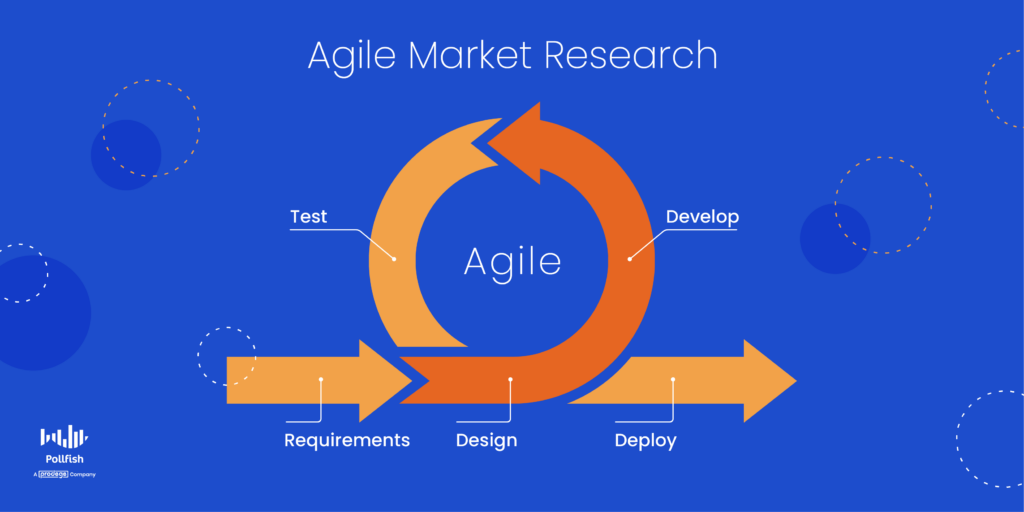

In an ever-competitive startup world, you need to be able to identify your product-market fit. This concept dictates how well a particular market will respond to your product or service, thus predicting its success.

After all, it would be costly and useless for businesses to launch a product that doesn’t align with current market dynamics and demands.

Marc Andreessen, co-founder and general partner of Andreessen Horowitz, who popularized product-market fit, described the term as “being in a good market with a product that can satisfy that market.”

Moreover, this concept is important to measure and achieve, as a lack of a product-market fit is one of the top reasons why businesses fail. In fact, 35% of new businesses fail due to the lack of product-market fit. On the contrary, a strong fit leads to a high-performing product among its target market.

However, a hefty 80% of SaaS companies never make product-market fit. As such, reaching and measuring this concept for your business can be challenging, but market research helps you both gauge and earn it.

This article examines the concept of product-market fit, its importance, how to measure it and how to obtain and increase it for your business.

What is Product-Market Fit?

Product-market fit, also known as product/market fit, denotes the extent to which a product satisfies a strong market demand. It is typically used to describe startup companies, as long-established businesses have some degree of it — otherwise, they wouldn’t be in business.

In laymen’s terms, product/market fit means being in a good market with a product that can satisfy that market.

This concept describes the stage of a startup company in which it has successfully identified a target market — it therefore also involves the process of first finding a market that will become consumers of your product. This way, the company can serve its members with the right product or service.

When brands achieve a strong product-market fit, they can then work towards scaling; they do so by attracting more customers, usually through market research techniques.

There may be multiple market segments in your product-market fit. It’s important to ascertain at least one when establishing a business or creating a new product.

If you don’t ensure that the product you’re developing aligns with the needs of customer personas, scaling will be difficult.

This concept is also used to depict a scenario in which a company’s target market members are not solely desiring the company’s product or service, but are buying, using, and telling others about the company’s offerings. This phenomenon involves the customers doing this in large numbers, the kind that sustains a product’s growth and profitability.

As such, product-market fit is designed, intended for and is often manifested as something that critically affects customer behavior, mainly in a way that benefits a company.

The occurrence (and maintenance) of a product-market fit exists as a conjunction of three critical aspects:

- Customers recognize your product’s value.

- They tell others about their great customer experience with your product.

- Your business continues to provide an excellent customer experience for new customers.

Although this concept is usually associated with marketing and product management, achieving it is a shared responsibility across the company. This means that sales, business development, support, finance and all other departments can help a company reach this important milestone.

The Importance of Product-Market Fit

Product-market fit is important on several counts.

First off, before you create a product that you confirm enough consumers are willing to use and pay for, your business cannot afford to plan or work on any other strategic objectives. This is because it is impossible to focus on growth if you do not have a customer base or a product deemed viable by your would-be target market.

After all, how can a business cross or upsell if they haven’t sold anything to begin with? Or, even if you had sold some products early on, if you failed to sustain a product-market fit, your chances of sustaining both a customer retention rate and customer acquisition are slim.

As such, any initiatives you take before establishing a product-market fit are counterproductive, as you don’t have enough demand to generate a profit. As such, if you continue working on something with a low product-market fit, or one you haven’t measured, you’re essentially risking investing in something with no commercial value.

In addition, you won’t be able to raise enough seed money, let alone further funding rounds without a sound product-market fit.

Venture capitalists and other debt lenders take a risk on the companies they fund; they will not invest in a company with a low product-market fit. This is because they expect a return on the investment they input into a business. Evidently, there will be no such return if your products don’t yield high enough demand.

When fledgling businesses struggle to raise venture capital, they end up in a startup graveyard, unable to launch their business, all due to the market for a product not being big enough, also known as a low product-market fit. Even the “good” entrepreneurs can wind up on this graveyard when they unintentionally chose to create products for small, crowded, or shrinking markets.

A product-market fit is especially important for B2B SaaS startups, as there is much they contend with, such as educating their markets on the benefits of their products — which takes time and money. They also face the pressure of accelerating their sales from venture capitalists.

It is therefore par for the course that startups need 2-3 times longer to validate their product-market fit than their founders expect.

How to Measure Product-Market Fit

You can determine your product-market fit in a number of ways. Determining your product-market fit involves the process of adjusting the product in your market based on consumer feedback, and using that feedback to evaluate its profitability.

This process verifies that you have established a group of potential customers that react positively to your service or product. This ensures that it is auspicious enough for you to sell it.

As such, product-market fit is less concerned with crunching numbers and more focused on understanding who your customers are in-depth and how they feel about you and your offerings.

Measuring product-market fit therefore involves gauging the following:

- The need for your product or service

- The level of satisfaction of your customers (and those of competitors)

- The level of engagement with your products and services

- How often your customers use your product and services

- How many new users (or customers) you get through word of mouth

- The purchase frequency of your products or those in your niche

In all of these cases, market research can provide accurate answers from your target market or your market under study.

To measure your product-market fit, use the 40% rule, made popular by Sean Ellis. This is a conventional metric for making sense of product-market fit survey results.

This rule dictates that a business holds an adequate amount of product-market fit if at least 40% of customers surveyed say they would be “very disappointed” if they no longer had access to a product or service — or if 40% consider the product/service a “must-have,” meaning, they wouldn’t use an alternative.

You can also apply this rule to the above aspects of measuring product-market fit (in the numbered list). To measure these aspects, you’ll need to conduct primary market research, also through conducting surveys. You can begin by analyzing secondary market research, but the most relevant and up-to-date information you’ll be able to extract on your product-market fit is by surveying potential (and current ) customers yourself.

Do not run this test on just any suspected member of your target market. According to Sean Ellis, the participants of this product-market test must have the following qualifications:

- Consumers who have experienced the core product or the service.

- Consumers who have experienced the product or the service at least twice.

- Consumers who have experienced the product or the service in the past two weeks.

How to Obtain a Product-Market Fit with Market Research

As the previous section explained, the core aspects of a product-market fit can be measured via using surveys and analyzing the responses via the 40% rule. You can also aid your market research with secondary sources.

However, to gain demand and increase your product-market fit, you must constantly listen to the needs, desires, problems and aversions of your target market.

This way, you’ll understand the kinds of products that solve their issues and adapt to their needs, thereby reeling in a high product-market fit.

With this information in tow, you can then confidently and successfully launch your product(s) and even base your business around them.

Surveys allow you to question your target market on virtually anything, along with segmenting it via market segmentation and developing customer personas.

As such, using surveys is a solid market research strategy, giving you speedy insights you can use to make informed decisions. Surveys allow you to not merely gain in-depth data on your consumers, but also allow you to monitor your customers over time — this enables you to measure whether your product-market fit can withstand the test of time.

You can also use survey results to justify your product-market fit to venture capitalists and other lenders. These results provide the definitive proof they would need on the viability of your product.

By regularly conducting survey research on your target market, you’ll be able to better innovate on your products so that they continue driving demand, therefore increasing your product-market fit.

By understanding your target market at a deep level with market research, you’ll also be able to serve it better, therefore pulling demand from your customer experience aside from the product alone.

Targeting Your Most Valuable Consumers

In order for startups and long-standing businesses to survive, they need to have a high product-market fit, which dictates how well a product is in demand in a certain market. Luckily for business owners and market researchers, you can measure and even grow your product-market fit with an online survey platform.

To do so, you’ll need a strong online survey platform to carry out your market research and present it in a way that’s most convenient for you.

You should use an online survey platform that makes it easy to create and deploy consumer surveys. It should offer random device engagement (RDE) sampling to reach customers in their natural digital environments, as opposed to pre-recruiting them.

You should also use a mobile-first platform since mobile dominates the digital space and no one wants to take surveys in a mobile environment that’s not adept for mobile devices.

Your online survey platform should also offer artificial intelligence and machine learning to disqualify low-quality data and offer a broad range of survey and question types.

Additionally, it should also allow you to survey anyone. As such, you’ll need a platform with a reach to millions of consumers, along with one that offers the Distribution Link feature. This feature will allow you to send your survey to specific customers, instead of only deploying them across a vast network.

With an online survey platform that offers all of these capabilities, you’ll be able to quickly extract consumer data and evaluate your product-market fit.

Creating Employee Retention Survey Questions to Improve Your Workplace

Creating Employee Retention Survey Questions to Improve Your Workplace

You’ll need to have a set of pertinent employee retention survey questions to create the necessary insights for your employee retention survey and overall campaign. This will help you take solid action against employee turnover and solidify a good reputation for your business.

While many employees stay at their jobs for a year and more, a considerable portion of them still leave. 31% of employees have quit their job within the first 6 months of working; that’s practically one-third of the workforce.

Employee retention is clearly a prominent challenge that employers and HR departments have to crack; there are a few silver linings, however. For example, 80% of employees feel more engaged when their work is consistent with the core values and mission of their company.

Most importantly, listening to your employees’ concerns plays an influential role in employee retention, that is why it is critical to survey your employees. In fact, 90% of workers are more likely to stay at a company that takes and acts on feedback.

Hence, you’ll need to form relevant questions to power your employee retention survey.

This article contextualizes and provides key examples of employee retention survey questions so that you can reap all the needed insights for retaining your employees.

How to Approach Employee Retention Survey Questions

To approach ideating these questions, you must first put your own employee retention survey and campaign at large into perspective. This means you need to mull over why you are conducting this survey, taking aspects such as the year’s quarter, time and main issues you’d like to address.

This is because the employee retention survey is a kind of employee feedback survey; it can also be labeled as an employee satisfaction survey, as the point of it is to make your employees happy in order to keep them. As such, you’ll need to first identify the priorities of your employees and your HR department.

The Aspects of Employee Retention

There are several key drivers of employee retention that you can prioritize, or at least keep in mind for the future. These include:

- Growth opportunities

- Employees will be hard-pressed to leave if they can grow professionally in your company.

- If employees don’t see a future with your company, they’ll look for opportunities elsewhere.

- Employee fulfillment

- Employees stay in job positions and environments that they love, rather than solely in those that earn them money.

- Employees need to feel that their individual skills are valued.

- Employee trust

- Employees seek to be trusted enough to be autonomous in their tasks.

- They seek to be trusted enough to handle their responsibilities without being micromanaged.

- Ease of collaboration

- A non-hostile workplace is a necessity; such an environment not only decreases employee attrition but stimulates collaboration.

- As humans, employees need some degree of socialization; collaboration provides this, along with helping the company.

- Supporting processes and workflows

- Expectations and processes need to be well-structured and clearly defined so that employees operate correctly and with confidence.

- Employees need to know that their efforts are aligned with their teams’ goals so that they can accomplish their tasks without worry.

As you plan these survey questions and contemplate their priorities, you may come across several issues that need to be addressed. There are two ways to approach this scenario; you can ask questions on multiple topics in each survey, or you can divide the questions into multiple surveys.

In the former approach, your employee retention survey is going to be longer, so you’ll need to provide employees with the approximate time it will take to complete it.

The latter approach involves examining your employees by each survey they take. Given that these will be divided based on the main concern they address, they will be short. Since they all deal with employee retention, you’ll need to send them out in close proximity of each other.

Contextualizing Employee Retention Survey Questions

After you find the main needs and concerns of your survey — or— if you don’t know where to become in terms of ideating, the below list will guide you. This list addresses various key question topics to aid your employee retention survey.

By considering each topic, you’ll be able to contextualize the point of your survey and which survey approach is best for your team.

To approach this survey, consider asking questions in relation to the following concerns:

- Pinpointing the company culture

- Learning how to respond to employee needs in a timely fashion

- Discovering the biggest employee pain points

- Finding whether employees understand the larger goals/roadmap of the company

- Gathering insight into whether there is conflict among team members

- Taking the proper action to make sure everyone is treated well

- Understanding employees’ professional growth goals

- Seeking employees’ issues and desires in terms of their pay

- Detecting instances of burnout or those that lead to employee burnout

- Rewarding employees with employee recognition and acknowledgments of good work

- Identifying the common threads of those who leave the company

- Assuring that all employees understand their goals and objectives

- Minimizing any stress employees may experience

- Allowing employees to feel fulfilled, trust and appreciated

- Understanding general thoughts about the work environment

Discuss these ideas with your HR and/or people team. Some topics will carry much more weight than others, depending on your employee turnover rate, your company’s trajectory, its employee retention issues and more.

Key Examples of Employee Retention Survey Questions

Now that we’ve covered the approach to this survey and prived various topics for formulating your questions, it’s time to focus on the questions themselves.

The following lays out various employee retention question examples (along with follow-up questions) that you can use to fill your survey:

- On the scale of “extremely agree” to “extremely disagree,” how would you rate the following: I have a clear understanding of my objectives and requirements?

- Question Type: Likert scale question

- Employee Retention Survey Topic: Assuring all employees understand their goals and objectives

- On the scale of “extremely agree” to “extremely disagree,” how much do you agree with the following: I feel like I am able to reach my full potential at [company name]?

- Question Type: Likert scale question

- Topic(s): Allowing employees to feel fulfilled, trust and appreciated

- Do you have any thoughts or suggestions about the company culture?

- Question Type: Multiple-selection, multiple-choice and open-ended answer options

- Topic(s): Pinpointing the company culture

- What has been the most difficult aspect of your position?

- Question Type: Multiple-choice and an open-ended answer option

- Topic(s): Discovering the biggest employee pain points

- How can [company name] or your manager minimize any stress you have from your job?

- Question Type: Multiple-selection, multiple-choice and open-ended answer options

- Topic(s): Minimizing any stress employees may experience

- On a scale of 1-10, how would you rate the following?: “I understand the direction and goals this company has in the near future.”

- Question Type: Scaled question

- Finding whether employees understand the larger goals/roadmap of the company

- Have you ever experienced conflict between you and another team member?

- Question Type: Yes or no

- Topic(s): Gathering insight into whether there is conflict among team members

- Follow-up questions:

- Describe the issue. (Open-ended question)

- How did you handle it? (Open-ended question)

- How often have you had this issue? (Numeric answers)

- Do you have everything you need to succeed in your position?

- Question Type: Yes or no

- Topic(s): Learning how to respond to employee needs in a timely fashion

- Follow-up question:

- If no, which of the following do you need most urgently? (Multiple-selection, multiple-choice listing supplies, technical courses, work-life balance, hours, clear expectations, etc.)

- What can [company name] or your manager do to assure you are treated with respect?

- Question Type: Multiple-selection, multiple-choice and open-ended answer options

- Topic(s): Taking the proper action to make sure everyone is treated well

- How satisfied are you with the following?: I am satisfied with my career path and promotion plan.

- Question Type: Matrix question (from very unsatisfied to very satisfied)

- Topic(s): Understanding employees’ professional growth goals

- How satisfied are you with the following?: I am satisfied with my salary/commission/other earnings.

- Question Type: Matrix question (from very unsatisfied to very satisfied)

- Topic(s): Seeking employees’ issues and desires in terms of their pay

- Are you easily irritable or constantly exhausted?

- Question Type: Scaled from “not at all,” to “very much so”

- Topic(s): Detecting instances of burnout or those that lead to employee burnout

- Follow-up question: If answers on the higher portion of the scale are provided, ask: “What would make you less exhausted?” (Multiple-selection, multiple-choice and open-ended answer options)

- Do you feel that you are recognized when going above and beyond?

- Question Type: Yes or no

- Topic(s): Rewarding employees with employee recognition and acknowledgments of good work

- Follow-up question: If “no,” ask: “What can [company] or your manager do to grant you recognition and appreciation?” (Multiple-selection, multiple-choice and open-ended answer options)

- Based on your knowledge and intuition why did past employees leave the company?

- Question Type: Multiple-selection, multiple-choice and open-ended answer options

- Topic(s): Identifying the common threads of those who leave the company

- If you had to do it all over again, would you apply to this position?

- Question Type: Yes or no

- Topic(s): Understanding general thoughts about the work environment

- Follow-up question: Why? (open-ended question)

Avoiding Employee Turnover

It is an absolute necessity to gather employee feedback, as these critical insights help you run your business in a way that’s conducive to employee retention. The more survey research you conduct, the more you’ll be attuned to the needs, desires, pain points and thoughts of your employees.

That way, you can retain your talent, while strengthening the reputation of your business. After all, happy employees who choose to stay at your company are far more likely to give you a high eNPS score on the eNPS survey. In order to collect employee feedback and carry out the eNPS and employee retention survey, you’ll need a strong online survey platform.

Such a platform should make it easy to create and deploy employee surveys. It should offer a mobile-first platform since mobile dominates the digital space and no one wants to take surveys in a poor mobile environment.

The survey platform should also feature advanced skip logic to route respondents to relevant follow-up questions based on their previous answers.

Additionally, it should also allow you to survey anyone. As such, you’ll need a platform with a reach to millions of consumers, along with one that offers the Distribution Link feature. This feature will allow you to send your survey to specific respondents, instead of only deploying them across a vast network.

When you use a survey platform that offers all of these capabilities, you’ll be able to make good use of your employee retention survey questions and foster a positive work environment.

How to Use Various Matrix Questions (Updated)

How to Use Various Matrix Questions (Updated)

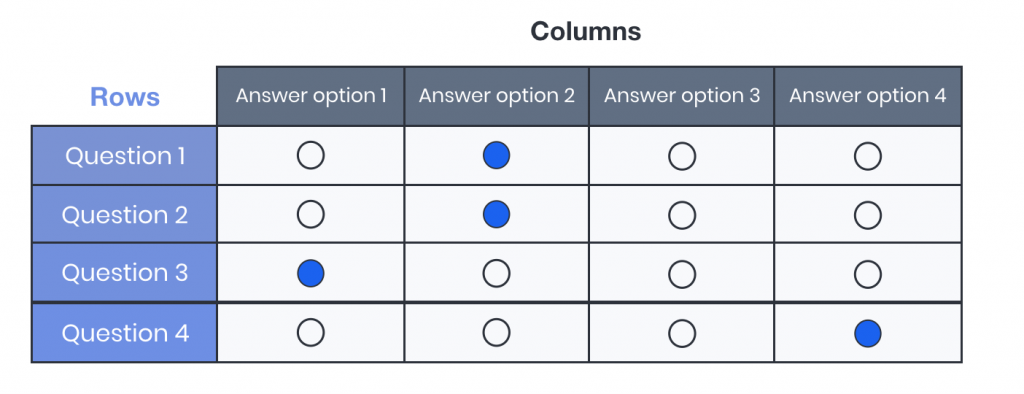

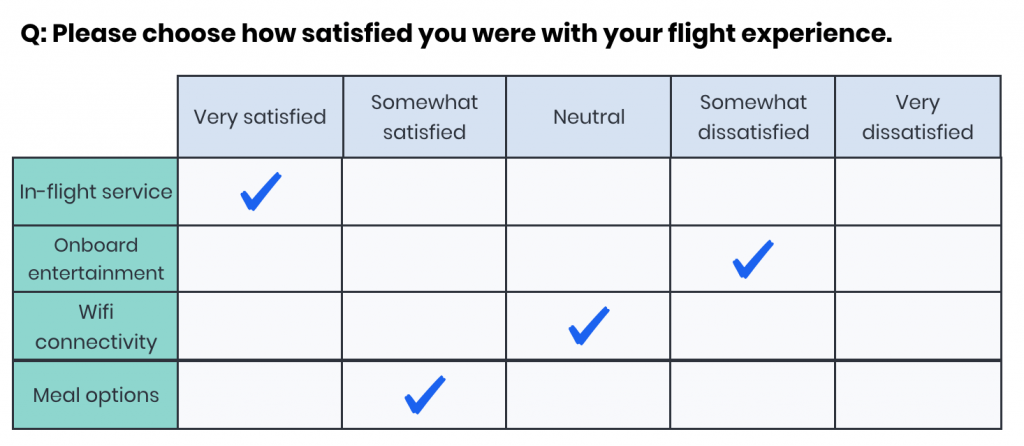

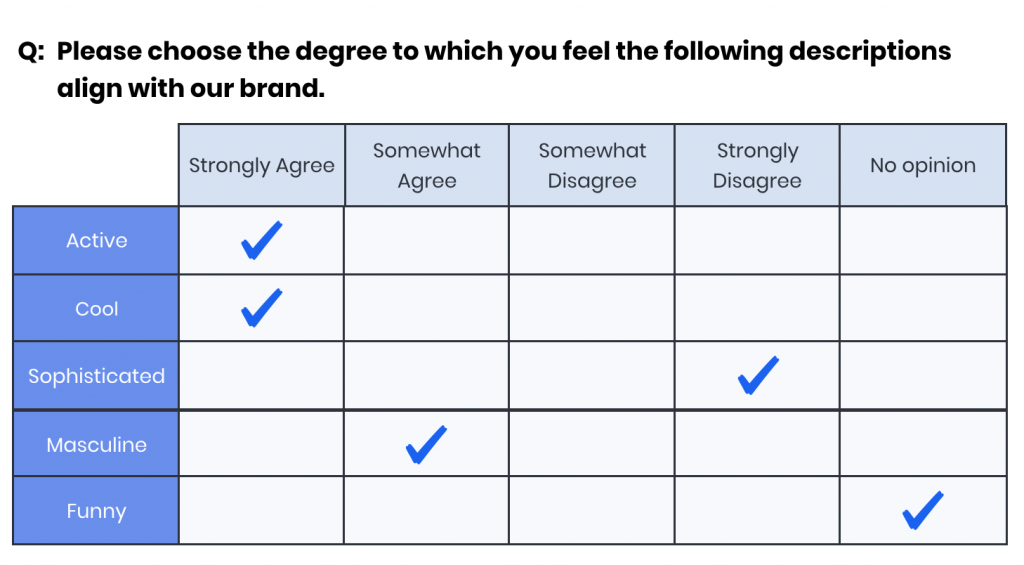

A Matrix question is a group of multiple-choice questions displayed in a grid of rows and columns. The rows present the questions to the respondents, and the columns offer a set of predefined answer choices that apply to each question in the row. Very often the answer choices are on a scale.

When to use Matrix Questions

It is best to use Matrix questions when asking several questions in a scaled format about a similar idea. They can be applied either as a mini-survey on their own or as a single-question type within a larger questionnaire. The closed-ended, predefined answers that apply to a series of questions make Matrix questions great for:

- Customer experience/satisfaction surveys.

- Questions about a subtopic in a larger questionnaire.

- Combining many rating-scale questions in a more digestible format.

Customer experience surveys

Matrix questions are commonly used in customer experience surveys. For example, to ask a respondent about their experience on a flight, the rows might ask the respondent about the service, food, or entertainment while the columns ask them to choose a rating response.

Questions about a subtopic

Oftentimes a questionnaire includes many ideas, but some of them are specific to a subtopic within that survey. Matrix questions are an effective way to cluster these ideas into a format the respondent can easily understand.

For example, in a brand awareness survey, a customer might use a matrix to get more information on brand perception.

Benefits of Matrix Questions

The format and structure of Matrix question types supply some unique benefits. Because it is a series of questions presented as a single table, it appears as a single question on the survey. This has the benefit of saving space (both on paper and in a digital survey) as well as reducing drop-offs from respondents who do not want to answer five nearly identical questions back-to-back.

The grid is easy and intuitive for respondents to follow with closed-ended, predefined answer sets, which means quick responses and a clear, easy-to-analyze dataset as the outcome.

Drawbacks of Matrix Questions

While there are many benefits, there are a few things to keep in mind when using Matrix questions.

The table formatting, while easy for respondents to answer, can also result in activities such as “straight-lining” or other pattern-making within the table.

Another issue can be the addition of too many rows or columns, which may negatively affect the data quality. If there are too many choices, respondents might lose interest (and be more likely to enter insincere answers to move quickly through it). In some cases, this can affect formatting as well, particularly in a digital survey environment such as mobile. If the Matrix question is not designed for an optimal mobile user experience, it can be confusing or frustrating for respondents.

Some survey companies will also charge for each row in the Matrix, as though they are individual questions, which may change the cost of the overall survey. Keep this in mind when building your questionnaire. (Pollfish views Matrix questions as a single question type, so pricing does not vary based on the number of rows and columns included).

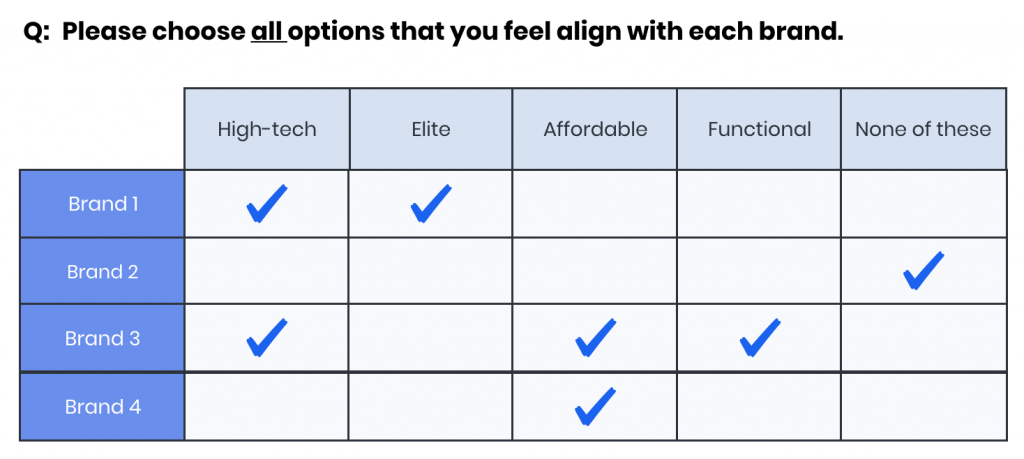

Types of Matrix Questions: Single- Selection vs Multiple-Selection & Multiple Matrices

Matrix questions, like regular multiple-choice questions, can be either single-selection or multiple-selection. This means that a respondent can choose either a single answer choice per row or they could choose multiple answer choices per row.

Competitive analysis surveys might include Matrix questions to better understand how a product or brand is measuring up against competitive offerings.

Exclusive Answers for Multiple Matrices

You can create exclusive answers from the scale points of multiple matrices.

As we realize the need to allow researchers to mark answers as exclusive in a Matrix table, you can do so by using the Multiple Selection question type.

Here's how it works: when a respondent selects a specific scale point as an answer to a statement, all the other scale points become de-selected, much like in the exclusive answers in the Multiple selection question type. Thus, the scale point marked as "exclusive" is an exclusive answer for every statement.

Keep the following in mind: after starting the survey, the respondents cannot modify any exclusive answer flag. You can make multiple scale points become exclusive.

https://www.loom.com/share/99bf9711898e495d88e9ad8da296324c

How Matrix questions differ from a Likert Scale

Many people believe that a matrix question is just a Likert scale, when in fact, it is the other way around.

A Likert Scale is a specific type of Matrix question designed to measure opinions linearly. Using a 5- or 7-point scale to collect user sentiments, a Likert Scale can be used to determine scaling attitudes such as:

- Agreement (Strongly Agree- Strongly Disagree)

- Likelihood (Very Likely- Not very likely)

- Importance (Very Important- Unimportant)

- Frequency (Always- Never)

- Quality (Excellent- Poor)

A Matrix question is a format for the question, meaning it is presented in a grid (or matrix). While Matrix questions often happen to be Likert Scales, Matrix questions can also be applied across a variety of use cases outside of attitudinal measurement, as shown above.

Best practices for writing a good Matrix question

Writing a good Matrix question follows many of the same best practices for writing good survey questions in general. However, due to the grid formatting, there are a few other things to be aware of.

- Limit the number of rows or columns. Keep it around five different options for questions and answers so as not to bore or overwhelm respondents.

- Give respondents a way to opt-out of things they are not familiar with, such as a “no opinion” or “neutral” answer choice.

- Do not make the questions too long. In the table format, long questions create a poor respondent experience.

- Try to group like-concepts. For example, if you want to know about brand perception, keep the questions related to that subtopic.

- As in any closed-ended scaling question type, keep scaling answer choices in order so as not to confuse the respondent.

Matrix question types are available in the "questionnaire" section of the Pollfish survey builder. Sign in or create an account to get started on your next survey.

Frequently asked questions

What is a Matrix question?

A matrix question is a group of multiple-choice questions displayed in a grid of rows and columns. The rows present the questions to the respondents, and the columns offer a set of predefined answer choices that apply to each question in the row. Very often the answer choices are offered in a scale.

When do you need to use Matrix questions?

Matrix questions are best used as to ask several questions about a similar idea when there is a scale involved. They can be used either as a mini-survey on their own, or as a single question type within a larger questionnaire.

What kinds of surveys and contextual questions are Matrix questions good to use for?

Matrix questions are great to use for closed-ended, predefined answers that apply to a series of questions. These are appropriate for customer experience/ satisfaction surveys, questions about a subtopic in a larger questionnaire and for making rating-scale questions more digestible.

Are Matrix questions a type of Likert scale?

It's the other way around. A Likert Scale is a type of matrix question that is designed to measure opinions in a linear fashion. Using a 5 or 7 point scale to collect user sentiments, a Likert Scale can be used to determine scaling attitudes.

What are the two types of Matrix questions?

Matrix questions can be either single-selection or multiple-selection. This means they can either be a single answer choice per row, or they could choose multiple answer choices per row. These might be used in competitive analysis surveys to understand how a product or brand is faring against competitive offerings.

Frequently asked questions

What is a Matrix question?

A matrix question is a group of multiple-choice questions displayed in a grid of rows and columns. The rows present the questions to the respondents, and the columns offer a set of predefined answer choices that apply to each question in the row. Very often the answer choices are offered in a scale.

When do you need to use Matrix questions?

Matrix questions are best used as to ask several questions about a similar idea when there is a scale involved. They can be used either as a mini-survey on their own, or as a single question type within a larger questionnaire.

What kinds of surveys and contextual questions are Matrix questions good to use for?

Matrix questions are great to use for closed-ended, predefined answers that apply to a series of questions. These are appropriate for customer experience/ satisfaction surveys, questions about a subtopic in a larger questionnaire and for making rating-scale questions more digestible.

Are Matrix questions a type of Likert scale?

It's the other way around. A Likert Scale is a type of matrix question that is designed to measure opinions in a linear fashion. Using a 5 or 7 point scale to collect user sentiments, a Likert Scale can be used to determine scaling attitudes.

What are the two types of Matrix questions?

Matrix questions can be either single-selection or multiple-selection. This means they can either be a single answer choice per row, or they could choose multiple answer choices per row. These might be used in competitive analysis surveys to understand how a product or brand is faring against competitive offerings.

How to Get Survey Responses to Complete Your Market Research Needs

How to Get Survey Responses to Complete Your Market Research Needs

When dealing with online surveys, you’ll surely ask yourself how to get survey responses, or at least, how to get more survey responses.

We hear you! Any market research campaign needs a particular amount of surveys for statistical relevance and to lessen the margin of error.

However, survey response rates still tend to be on the lower end of the scale, as the current survey response rates are at about 30%. Thus, there is clearly work that needs to be done to increase this rate so that you can reach a suitable number of survey responses.

However, despite the rather low amount of respondents that take a survey, surveys are still popular — for both researchers and their target audiences.

Online surveys in particular, are a popular route for conducting market research. Both researchers and survey respondents can attest to this.

For example, 71.6% of respondents prefer to answer a survey online. Thus, you should consider updating your market research methods by using online surveys.

This article guides you how to get survey responses so that you get an adequate amount of completed surveys to aid any research campaign.

How to Get Survey Responses Via 2 Survey Distribution Methods

Before we discuss how to increase your survey responses, please note that we are providing this advice for those who use our Distribution link feature.

This feature gives you more freedom when it comes to posting surveys online, as you get to choose where to post the link for people to take your survey, as well as who gets to take your survey, if you’re thinking of sending it to specific people.

This method is one of our major two; the other involves our Random Device Engagement (RDE) method of distributing surveys. With RDE, our platform sends surveys to a massive network of online properties, such as websites and apps.

The surveys target people randomly, given that RDE runs on organic sampling. That means there is no prerecruitment, which you would find in a survey panel. Instead, the platform targets random people who voluntarily exist in a particular digital space.

We target over 250 million people in over 160 countries to gain your respondent pool. Following agile research, this method keeps iterating surveys until the designated amount of respondents have completed their survey.

Thus, you don’t need to worry about getting survey responses via this method. However, if you send surveys your own way, that is, with the Distribution Link feature, you’ll need to have a solid plan on how to get survey responses, especially if you seek a certain number of responses within a certain time.

Fortunately, we provide several tips on how to get more survey responses.

Draw in Responses with a Strong Survey Intro

First responses matter and this applies in survey participation as well. That’s why you’ll need to reel in interest to your survey as soon as you can.

This entails compelling your potential respondents to take your survey as soon as they come upon your survey.

Everyone sets up their survey differently. Yours may exist as a pop-up, while others may position it right below a large image.

Regardless of the form of the call-out you use to grab people’s attention to take your survey, you’ll need to supply it with a strong introduction. This must be interesting, compelling and show respondents why the survey is important and why their participation matters.

As such, use short and snappy survey titles and call-outs.

To ease anyone’s dread, you may want to consider adding the time it takes to complete the survey in your title or introduction.

This is to reassure your respondents from the onset that the survey won’t take much of their time.

It’s also useful to add the purpose of the survey title and introduction, especially when it relates to helping the respondents themselves.

Example text: “Take this quick 3-minute survey to help brands serve you better!”

Create a Survey with Survey Best Practices

You should never just wing it when it comes to producing surveys; instead, apply the best practices for surveys each time you create a survey.

These will ensure you provide a good survey experience for the respondents, as well as receive the key data that you need for your market research campaigns.

While you can’t please everyone, several survey best practices are tried and true. The following provides several best practices you should consider for your surveys:

- Keep your questionnaire short.

- Many are time-poor and no one wants to waste their time.

- Keeping the questioning short will prevent respondents from leaving your survey before completing it. In this way, you’ll prevent or at the very least minimize survey attrition.

- Some respondents won’t even begin your survey if it’s too long.

- Remove any ambiguity from your questions.

- Surveys aren’t a knowledge test for school. As such, your questions should be easy to understand and answer.

- Avoid any confusion and be as direct as possible.

- When questions are difficult to answer, respondents will be bent on leaving the survey or getting bored quickly.

- Mix and match question types to retain interest throughout the survey-taking process.

- You can ward off respondents from getting bored by using a variety of question types and formats.

- Use questions such as: Likert scale questions, Matrix questions, stars and emoji scales, bipolar questions, drill-down questions and more.

- Make sure the survey platform you use allows you to do so.

- Find an adequate time to send your survey.

- This will depend on the lifestyles and habits of your target market.

- You can determine this by conducting a target market analysis to see when your target audience has more time in their day, when they go online, etc.

- Also, there are some general times and moments in the customer journey determined to be the best time to send a survey.

- Thank the respondents and follow up.

- Include a thank you page in your survey to give thanks to respondents for their time and consideration.

- You can also do so in advance by thanking respondents in the intro of the survey.

- Follow up with respondents whose contact information you have. There are many ways to go about this, including with the results of the survey, to thank them and more.

Strengthen Interest with Survey Incentives

Another strong approach to getting survey responses is to reward the respondents with survey incentives.

These incentives can be either monetary or nonmonetary and you can get creative with your incentives to stand apart from your competitors.

This is especially important when your survey states your brand or displays its logo or any other likeness. That’s because using incentives shows generosity and care, thereby positioning your brand in a good light.

After all, your respondents will know which company they are dealing with. Thus, you should consider using incentives to frame your brand in the best possible way. Survey incentives will do this, as they prove to respondents that you truly care about their participation. Otherwise, why would you reward them with incentives?

On the contrary, if respondents see your business on your survey and it doesn’t offer incentives, this will lead to a negative impression of your brand, even if the respondents are longtime customers.

That’d because no one owes you any feedback, regardless of how critical it may be. Thus, use incentives when possible, especially in instances where respondents know your business is running the survey.

Do a Favor for Your Respondents

This is especially useful if you know your respondents or have their contact information.

Doing favors closely ties in with incentives, but it is different in that favors can be anything aside from small benefits (like extra lives on a mobile game that respondents played upon encountering your survey) or gifts.

Favors can consist of doing anything favorable for your respondents. There are many routes you can take with factors, such as the following:

- Promise to give respondents a discount on your products or services.

- Offer a discount on top of an already discounted purchase.

- Enter them into a sweepstake to win a big prize.

- Raise their status if they are in a rewards program.

- Give them a preview of one of your new offerings.

As you can see, there are many kinds of favors you can offer your respondents to lure them into taking your survey.

At times, you may want to give some kind of proof of the favor you promised, such as a coupon that only goes into effect after respondents complete their survey.

Remember that what truly differentiates favors from incentives is that favors are grander and are more long-term-oriented gifts and gestures.

Use Your Content to Motivate Respondents

The content your business puts into the world has various benefits, but did you know that you can use it to encourage people to take your survey?

Not all content assets are easily accessible. That’s where you can use them to incite respondents to take your survey. This is especially true with gated content.

Content that’s gated often involves collecting users’ information in order for them to view it. In this scenario, you can require your users to take your survey to gain access to your gated content.

This is fair, given that both parties will get something in return. In addition, your site visitors won’t have to pay anything or get a membership to view the content they need, they’ll just need to take a survey.

Using gated content is especially useful for B2B matters and campaigns and therefore, B2B surveys.

Aside from granting users entry to gated text-based content, you can also gain more survey responses by giving them access to video content. Videos tend to draw in more views and engagement then text, especially in the era of Tik Tok and short attention spans.

Getting the Right Amount of Survey Participation

Getting the right amount of survey responses is never a feat with the right online survey platform. Such a platform will allow you to research all your targeted respondents in various ways, like the aforementioned RDE method and via the Distribution Link.

With the former, you won’t ever have to worry about survey responses, as the platform will keep sending surveys across the internet until your preset number of completed survey responses is fulfilled.

With the latter option, it’s best to follow our advice on how to get more survey responses. However, even in this method, our survey platform will keep iterating until the requisite number of completed surveys is reached.

Thus, your survey is in good hands regardless of the distribution route you take when you use Pollfish.

You should also consider that a strong survey platform will grant you all the functionalities necessary to build a good survey campaign, one that draws in interest and gets respondents to complete the survey.

Pollfish survey software allows you to create a thorough survey data collection, one you can customize to your liking, view however you please and organize to the max.

In addition, with our vast array of question types, you can create virtually any type of survey to aid your research campaigns.

Researchers can leverage a wide breadth of information on their respondents by accessing a wide pool of insights in their survey results dashboard.

In addition, we also offer the advanced skip logic feature, which routes respondents to relevant follow-up questions based on their answers to a previous question.

Thanks to our advanced market research platform, getting survey responses is highly attainable and easy on Pollfish.

Where Can I Post Surveys Online — and Other Concerns

Where Can I Post Surveys Online — and Other Concerns

Where can I post surveys online? We know you’ve got questions — and not just for your survey target audience. You’re probably brimming with questions on how to use an online survey platform with all of its capabilities, features and methods in the survey process.

Fortunately, we’ve got you covered on things survey and market research-related.

If you haven’t used survey research before, we suggest doing so, as online survey software industry in the US has grown 5.0% per year on average between 2017 and 2022.

And for good reason. Surveys provide an easy and quick method to obtain key insights on those who matter most to your business: your customers.

You should therefore opt for an online survey platform to learn the nitty gritty of all members of your target market — the group of people most likely to buy from your business.

While we can’t address every concern you may have in just one article, we can make certain related topics clear. When it comes to posting surveys online, you’ll need to know how this can be done, namely, the two major methods making this possible.

There are a few other related things you ought to know, which this article will cover.

This article lays out answers to key questions about conducting surveys, such as where can I post surveys online and others.

How Can I Post Surveys Online?

When it comes to posting your surveys online, there are two main methods underpinning this endeavor.

The first gives you less leeway on where your survey will appear, but is one of the most powerful ways of reaching a wide audience across the internet — and the world. That’s because it involves organic sampling, which reaches people randomly on the internet.

Depending on the survey platform you use, you may be able to cast a wide net when it comes to reaching a diverse population, across a multitude of online platforms.

The second method involves more specificity; researchers get to choose which platforms their surveys will be on. That’s because it involves posting a link to the survey in various digital channels that you as the researcher select.

Or, you can send the link to specific people via email, social media or some other means.

Not all survey platforms offer both of these capabilities of posting your survey online. We suggest leveraging a platform that powers your research with both methods.

Random Device Engagement (RDE)

Random Device Engagement is Pollfish’s signature approach to the aforementioned random sampling method. With RDE, surveys are sent to a massive network of over 250 million+ websites and apps, prompting users that exist in their natural digital environments to take the surveys.

As such, you survey will exist in different websites, mobile sites and mobile apps, where consumers are engaged and can be easily incentivized non-monetarily.

This eliminates the survey bias that can occur if you were to use a survey panel.

Professional panelists are not taking a survey in their natural environments online; instead, they are pre-recruited, which means they are not fully anonymous. They can easily feel compelled to answer surveys in a certain way, tainting the accuracy of the survey study.

They are also prone to panel fatigue from constantly having to take surveys. They may also be influenced by certain questions, which then affect how they answer future ones. This is known as panel conditioning.

On the contrary, Random Device Engagement reaches and recruits respondents in the places they naturally frequent online. This means that respondents’ participation is completely voluntary, anonymous and randomized.

As such, respondents are more likely to answer truthfully and are less prone to survey fatigue. After all, respondents’ identities are completely anonymous, since they haven’t been pre-recruited and vetted through a panel recruitment process.

Thanks to RDE, you can reach a wider scope of people and segments in your target market. This is because it is conducted across a wide network of sites and app publishers that deploy your surveys.

Specific Online Channels and Respondents

You can also send surveys to specific people and through specific digital channels, like your homepage, landing pages, emails, newsletters, etc. This requires using the Distribution link feature.

Given that it is our second major method of posting surveys online, it will not work on our network of survey publishers, as does the RDE method. That’s because, in this method, you’ll solely use the Distribution Link to connect potential respondents with your survey.

This feature allows you to create a link for respondents to be able to take your survey online. You are fully in charge of where your surveys will appear. In addition, with the Distribution Link feature, you also have the option to send your survey to specific people.

As such, this method is twofold.

Post surveys to specific channels

Send your survey via your channels of choice to reach a large number of random users, much like you would via organic sampling. The only difference is that the places you survey will exist on won’t be random, as you will choose the channels to place your link.

This method applies agile research, in that it is highly iterative; the platform will continue sending surveys across various digital spaces until a certain number of responses (completed surveys) is collected.

You as the researcher have the power to set your own desired number of completed surveys per campaign. You can also set quotas on different respondent qualifications and add multiple audiences to your survey.

Post surveys to specific people

The second method in the dual approach allows you to send your surveys yourself to specific people. As such, your survey won’t sit in a public digital space like your homepage or a downloadable asset. Instead, you can reach specific people, usually via email.

You can also reach out to customers via social media with the link to your survey.

This method is also agile and iterative.

That’s because, you can set up the feature to reach a certain number of completed surveys as well. Or, you can set a survey to be live until you choose to turn it off. As long as the link is active, respondents can enter your survey.

You can also set the link to be live until a specific date.

How Will My Survey Appear?

Wondering what form your survey will take? We’re referring to the way it will look when your respondents come across it online.

Given that our RDE method sends your survey to various digital platforms and spaces, the survey may take different forms.

This, of course, differs from what your survey will look like when sent via the Distribution Link method. Here’s what you can expect your survey to look like from both:

Via Random Device Engagement

In different digital spaces, your survey can exist as the following:

- A pop-up

- An image

- A button with a call to action that solely contains your survey. You can take this route if you want to cut to the chase quickly.

- A small, visually appealing circle

- Respondents can see this while in-app.

Via the Distribution Link

When you send your survey to specific places or people, it can exist within the following:

- Your homepage

- A static webpage

- Landing pages

- Blog posts

- Downloadable assets

- Content marketing assets

- Gated content

- Social media channels

- Emails

- Contact pages

- FAQ page

- External websites (when backlinked or via a partnership)

In these spaces, you can insert your survey into your website content or even external websites. The survey itself can take the form of the items mentioned under the above RDE approach.

Where Can I Post Surveys Online?

Finally, we land at the crux of the matter, where can you actually post your surveys online?

While this list is as exhaustive as possible, note that with the expansion of the internet and things like VR and the Internet of Things( IoT), there may be more digital spaces that will become available for survey research in the future.

The prior section (How Will My Survey Appear) touched upon some of the digital spaces we dive into in the section. However, here we provide a thorough illustration of where you can post surveys online.

- Website content

- Use various available pages and elements on your website to place the link to your survey. These include:

- Webpages:

- Homepage

- Landing pages

- Static pages

- Contact page

- FAQ page

- Blog

- Evergreen content places

- Page with gated content

- Video content pages

- Event sign-up pages

- Reports and whitepapers

- Other content assets