Diving Into the Customer Service Survey to Meet All Customer Service Demands

Diving Into the Customer Service Survey to Meet All Customer Service Demands

All businesses must conduct a customer service survey from time to time to ensure their consumers are satisfied with their service and all of its associations.

This is because few other things contribute to the success of your business as much as your customer service.

In fact, 90% of Americans use customer service as a factor to decide whether or not to do business with a company. As such, for the vast majority of American consumers, customer service is a make-or-break aspect that can mean patronizing your company or going to your competitor.

Customers have high expectations when it comes to customer service, as they expect to receive customer service from any channel and device. However, 60% of customers don’t see customer service as becoming easier, as 86% of customers have had to contact customer service multiple times for the same reason.

This signifies that brands don’t take care of customer needs, even when they are told upfront through a Voice of Customer (VoC) program.

This article delves into the customer service survey, its importance, when to use it, how to create one and more.

Understanding the Customer Service Survey

As its name suggests, the customer service survey is a kind of consumer survey that deals with the specific matters, concerns, interests, considerations and other feedback that customers have in regards to the customer service of your organization.

Dealing specifically with the customer service aspect of their customer buying journey, this survey provides your customers with an avenue to express their opinions on all things relating to your customer service.

Customer service refers to the support you offer your customers both before and after they buy and use your products or services. Providing customer service ensures that your customers have an easy and enjoyable customer experience with you.

This is of utmost importance because CX is a combination of all the opinions and experiences customers have and associate with your brand. It can mean the difference between them casting aspersions on your brand, thus going to competitors, or enjoying it, raising their consumer loyalty and Customer Lifetime Value.

To improve your customer service and your overall customer experience, you should use the customer experience survey, as it provides various means for understanding your customer service.

As such, the following lists all the functions and abilities that this kind of customer survey provides for your business:

- To rate your customers’ satisfaction with your customer service

- To explain their grievances

- To file complaints

- To express what they liked

- To give suggestions for improvement and more

- To give insight into their consumer preferences as they relate to your service

- To relay their chosen mode of providing feedback

- To discover gaps in the service

- To help customers achieve a certain goal

- To understand your customers’ own questions about your service

The Importance of Customer Service Survey

The customer service survey is important for a variety of reasons, all of which contribute to the success of your business, whether it is with a particular customer segment, for a certain campaign or otherwise.

Firstly, offering good customer service is an important factor for retaining customers and customer retention is more cost-effective than customer retention. This is because it costs five times more to acquire a new customer than it does to keep an existing one.

Additionally, the success rate of selling to current customers is 60-70%, while only 5-10% when selling to new customers. When you deliver consistently good customer service, you’ll be able to build consumer loyalty and retain customers. The longer you keep your customers, the longer you’ll benefit from customer retention.

Moreover, in today’s competitive marketplace, customer service involves far more than merely a telephone support agent. Customers get support via various channels, such as email, chat, text message, social media, in-person and more.

It is imperative that brands adapt to these customer service methods. In doing so, they’ll need to understand exactly what bothers and satisfies their customers as they receive this service in an omnichannel setting.

This kind of survey is also important to use in self-service scenarios, as many companies provide self-service support for their customers. This method allows customers to access customer support at any time convenient to them, rather than only during business hours.

The customer service survey is also useful, as it provides flexibility. It is apt to send this survey before, during and after a customer receives some sort of customer service. Doing so will grant you complete insight into what customers are experiencing and how they perceive all the customer service your employees provide.

While you may consider your employees to be well-trained and adept at providing customer service, your customers may think otherwise, at least at certain points. Thus, the customer service survey provides you with a clear view of customers’ experience with your customer service when you aren’t there to see or hear it — which is impossible to do all the time, even if your company is small.

Lastly, the customer service survey is a critical tool for improving your brand image and reputation. As such, it can help you augment your brand equity, which is the value your business derives from being recognizable. Most importantly, by surveying customers on their customer service, you’re showing them you care and are open to making adjustments to best serve them.

Utilamely, the customer service survey allows you to carry out these improvements, enabling you to increase your brand trust. This is a crucial concept to maintain for your brand, as high levels of trust spur customer retention and interest in your brand, thereby fostering customer acquisition as well.

When you lure new customers with minimal effort, you’ll also be lowering your customer acquisition cost.

When to Use a Customer Service Survey

As mentioned above, you can deploy a customer service survey at various times, not just after customers received customer service.

In fact, when you distribute surveys before your customers receive any customer support, you’ll know their expectations beforehand, arming you with the knowledge of how to serve them during any support session.

The following provides examples of when you should use the customer service survey:

- After your customers bought from you, whether it is in-store or digitally.

- In this example, you inquire into whether or not they asked or received any help from your employees.

- This will let you know whether your employees asked customers if they need help or if they hadn’t, what stopped the customers from asking for help themselves.

- Before your customers head into your store.

- Whether they chat with your company on the phone or via a chat, make sure to send them a survey prior to their arrival at your store.

- Simply ask them first and then send them the link to your survey.

- This also applies if they received customer service before continuing their online customer journey.

- As your customers are speaking with you.

- You can preface your customer service session by mentioning the survey and asking for their consent.

- You can also mention survey incentives if you offer them to raise your survey completion rates.

- When you scheduled a support session, but customers missed it or opted out.

- Send a survey to understand why they missed the scheduled customer service session.

- If the customers opted out beforehand, send a survey to find out why and what would have made them keep their appointment.

- After a customer complains and before they receive customer service to help resolve their issue.

- This involves times of dissatisfaction, whether it’s with a product, service or experience.

- Send the survey after the customers complain, but before you serve them with follow-up service.

- This way, you’ll know the issue and how to go about providing the best customer service to resolve it.

How to Create a Customer Service Survey

There are many approaches you can take with your customer service survey, as laid out above. If you’re still not sure how to go about creating one or need a few pointers, the following will help you.

The following steps guide you on how to create a customer service survey. Check out how to create customer service survey questions.

- Define the goal of your survey.

- Refer to the above section to help you decide what to accomplish with your customer service survey.

- Decide on the correct online survey platform.

- There are a host of online survey tools but they don’t all offer the same capabilities and speed to insights as does Pollfish.

- In the screener section of the survey, select the demographics, location and other traits with which you're going to qualify who gets to take the survey.

- Use screening questions to select respondents even more granularly, as only those who answer in the way you choose will take the survey.

- Come up with a few key preliminary questions for the questionnaire portion and guide the direction of your survey.

- Choose the survey type you need for your campaign.

- In the questionnaire section, add in your preliminary questions. Choose from a multitude of types of survey questions.

- Use advanced skip logic to route respondents to relevant follow-up questions based on their answers.

- With skip logic, you can ask a quantitative question using multiple choice and follow-up with a qualitative, open-ended question.

- Decide who to send your survey to. This may at times include a broad study with all customers on a mailing list or specific customers who will receive or already experienced a customer service interaction.

- If you’re deploying your survey to a mass network via your online survey platform, decide whether to use your brand name logo and other indicators.

- Always make the survey unique to your brand if you send it to specific people instead of mass-sending it as in Step A.

- Write an effective email invitation if you’re sending your survey to specific customers via email.

- Mention the importance of the survey and that you value your customers’ time.

- You can include incentives.

- Include a call to action (CTA) to an online survey, such as one that exists on a landing page, or post-checkout.

- Be sure it stands out to your respondents.

- Thank your customers for taking your survey with follow-up emails and a “Thank You” on the final page of your online survey.

- Analyze your survey and use it to make changes and key customer service decisions.

Satisfying All Your Customers

Brands should always work towards delighting their customers with amazing customer service. Your customer service is a reflection of how your company treats its customers. No matter the values associated with your brand, if you provide poor customer service, customers will always go elsewhere.

To create an insightful customer service survey study, opt for the proper online survey platform.

Such a platform should run on random device engagement (RDE) sampling, enabling you to reach customers in their natural digital environments, instead of being pre-recruited. This removes social pressures and will cut back on biases.

You should also use a mobile-first platform since mobile dominates the digital space.

Most importantly, the survey platform should allow you to survey anyone. As such, you’ll need a platform with a reach to millions of consumers, along with one that offers the Distribution Link feature.

This feature will allow you to send your survey to specific customers, instead of just deploying them across a network.

When you use an online survey platform with all of these capabilities, you’ll be able to collect key customer service data and outperform on future customer service endeavors.

Gamifying Market Research with Survey Gamification

Gamifying Market Research with Survey Gamification

Survey gamification is one of the most effective ways to enhance the survey experience and increase your survey completion rate — and for good reason, as gamification is a hot topic, with a global market projected to grow from $9.1 billion in 2020 to $30.7 billion by 2025.

Gamification is being applied across a wide range of industries, from education, to HR, to retail and banking. In fact, a Texas bank raised customer acquisition by 700% via gamification. The clothing company Moosejaw implemented a gamified system, which increased sales by 76%.

Given the unmistakable advantages of gamification and the shift from traditional market research to online mobile surveys, it is inevitable that gamification will become coupled with survey research. Many businesses are already adopting this hybrid approach, as should yours to stay competitive.

This article examines survey gamification, including its key examples, utilities, importance and how to establish it in your surveys to augment your market research techniques.

Understanding Survey Gamification

Survey gamification takes the premise of gamification and implements it for market research purposes, in turn creating what is apt to call a gamification survey.

First, it’s key to understand the precise meaning behind gamification before applying it to surveys. Gamification refers to the integration of game mechanics into non-game contexts, such as websites, online communities, SaaS products such as learning management systems, other systems, activities and services.

The aim of gamification is to forge similar experiences to those of playing games in non-leisure environments to motivate and engage users. In today’s competitive business world, it didn't take long for gamification to make its way into the business sphere.

Gamification can be applied to various business practices to engage customers, employees, partners and various other stakeholders. When it comes to market research, researchers can apply this practice and create a gamification survey.

Survey gamification is the practice of using gaming elements and techniques in surveys. This method enhances the survey experience, fostering participation and engagement, which supports respondents completing a survey, as there is no element of boredom.

The goal of survey gamification is to create surveys that are more interactive, engaging, and enjoyable during participation. This enables them to better engage with consumers, employees, partners and all other survey participants.

Examples of Survey Gamification

There are several ways to gamify a survey; this can mean only using a few game elements, or even only one. The following lists some examples of prominent elements and techniques to use for a gamification survey:

- Leaderboards

- This provides an element of personalization as respondents can see their names and the display of their performance levels.

- This also provides the game element of competition, as respondents will be motivated to score higher, which can have different applications in different surveys.

- This will motivate the respondents to finish their survey, provide quality feedback and do whatever else you demand, as they’ll want to score higher to earn a reward.

- Rewards

- Rewards are also known as survey incentives. They can be monetary or non-monetary.

- The reward should correlate with the time and effort that respondents invested.

- High-tier and pricey rewards should be in surveys that mention your brand, as this is key for brand awareness. This tactic will remind respondents of your business and establish a positive brand experience.

- Badges

- This is a kind of reward itself that shows respondents’ level of achievement.

- This can be applied in-survey, or if you use an online survey platform that partners with a mobile game, this badge can be rewarded through the game itself.

- The respondents should receive a badge, at the end of the survey.

- Or, they should receive some points or anything that can then be conveyed through a ranking system.

- A Progress Bar

- This shows respondents how close they are to completing their survey.

- This is far more interesting than a plain survey that gives no visual or other kinds of indication of how far respondents are in the survey.

- This also provides a higher level of transparency, which will motivate respondents to finish the survey, as they won’t be left wondering how much longer they have to go.

- Avatars

- Here, you can allow respondents to create their own avatars for answering your questions.

- Allow your respondents to save these as unique images they can use elsewhere.

- Additionally, the answers to questions themselves can be avatars. This way, rather than expressing themselves in words, your respondents can choose an avatar that reflects their answer.

- Through this element, you’ll have your answers while the respondents get a pleasant survey experience.

- Virtual currencies

- This can be cryptocurrency or survey currency unique to your brand.

- For example, you can provide “currency” that virtually acts as a gift card to your company.

- You can also provide currency to a desktop or in-app game, should the online survey platform you use to deploy your survey to gaming sites and apps.

- Challenges for your respondents

- Include visual and other gaming challenges in your survey, such as solving a puzzle.

- Aside from being engaging, this will show you if your respondents are paying attention.

- You can get creative here, the more interesting you make your challenges, the better it is for your brand visibility.

The Importance of Survey Gamification

The days of dull surveys that left respondents feeling as though they’ve completed a chore are in the past. With survey gamification, your surveys will keep your users engaged throughout the survey.

With this key benefit in mind, you should also understand that a gamification survey has far more importance than merely offering the element of fun into a survey.

Due to gamification, the respondents are more motivated to complete the survey. As such, they are more likely to provide quality answers. This is a major benefit for market researchers, as it results in higher quality data for analysis.

Survey gamification also draws more interest in partaking in a survey to begin with, which increases your survey response rates. In addition, aside from partaking in the survey, survey gamification cuts back on boredom and maintains higher levels of engagement, which in turn, increases the survey completion rate.

When respondents are deeply engaged, they won’t feel bored or discouraged from finishing their survey. As such, a gamification survey plays a major role in reducing survey attrition.

The gamification of surveys is also important, in that games gratify the basic human need of self-fulfillment. Their motivational factor occurs owing to this need. Games also generate the effect of being fully immersed and involved in an activity.

Gamified surveys also feed into the respondents’ sense of developmental growth and accomplishment, which adds to their user experience.

These are the key aspects that all UX designers, app developers and other digital makers seek to create, in order to keep users on their digital properties.

Integrating game mechanics into business processes, marketing campaigns, websites, applications, online communities, or school classes and college courses have proven to be an effective and fun way of encouraging the participation of target audiences.

Aside from influencing and motivating the behavior of your respondents, which is often your target market, if you’re a business, gamified surveys also yield a strong positive effect on your employees. There will be many instances in which you’ll need to gather employee feedback.

Most of the time, these surveys are anonymized, which will deter your employees from answering them. A gamification survey will avoid this lack of interest and motivation in taking a survey and instead make employees more inclined to take it.

If your survey is not anonymized, employees will still enjoy the process of answering the survey more than they would with a traditional survey.

Finally, survey gamification increases consumer loyalty and brand awareness if you explicitly mention your brand in the survey. When respondents are kept interested in the survey through a positive app or survey experience, it improves brand acceptance in general. This is because they’ll associate their positive experience with your brand.

How to Gamify a Survey

You can gamify your survey with the examples from a previous section. But aside from those examples, there is more to gamifying a survey. The steps below offer a guide on how to go about gamifying your survey in various ways, along with some examples.

- Come up with gamified survey questions.

- These tend to be more specific, so that respondents answer with visuals.

- For example, change “What type of sneakers do you like?” to “which sneakers would you buy if you could buy all your favorites?”

- Place a progress bar at the top of the survey, so the respondent clearly sees their progress and how close they are to completion.

- Consider using rating scale questions, which can rate products and intangible things like feelings and opinions with icons, aviators and smileys.

- See the customer satisfaction survey question guide for specific types of numerical and visual rating surveys and question examples.

- Use jump logic to add relevant questions only in the style of the "Choose Your Own Adventure" book collection.

- This allows respondents to access or "jump" directly to a particular page, question or item in your survey based on their response to a previous question.

- The online survey platform you use will need to offer advanced skip logic to add this feature.

- Give scores by assigning values to responses, the time it took to complete the questions, etc.

- Only through scoring will you be able to add a leaderboard (see the section on examples) and reward respondents.

- Allow respondents to share their accomplishments.

- Use social sharing to increase respondents’ competitiveness and gain new respondents, as social sharing can lure in new ones.

- Boost retention by granting respondents quick wins early in their survey progress.

- Give a reward early on to keep them motivated to complete their survey.

Making Strides in All Survey Research

Survey gamification makes gathering accurate consumer data or the data of any audience far more engaging and enjoyable for the respondents and easier for the researchers. As such, businesses are supplied with high-quality insights.

The progress in innovation and convenience in the digital, mobile and market research spheres will lead to more advanced iterations of the gamification of surveys.

To offer the most effective survey gamification, you must first use a strong online survey tool, as this platform will dictate how your surveys will be gamified. Ideally, you would want to have the leeway to include all of the aforementioned survey gamification elements and techniques in your survey.

To do so, you should use an online survey platform that operates on random device engagement (RDE) sampling, which allows you to reach respondents in their natural digital environments, reducing all kinds of survey bias in turn.

You should also opt for an online survey platform that operates via artificial intelligence and machine learning, which disqualifies survey fraud and poor-quality data, along with providing a mobile-first approach design.

An online survey tool with these functionalities will enable you to establish high-quality survey gamification that will allure and retain your survey respondents, resulting in high levels of participation, low attrition and speed to insights.

How Pollfish Clients Use Our Brand Tracker and Polling Trackers to Meet Business Goals

How Pollfish Clients Use Our Brand Tracker and Polling Trackers to Meet Business Goals

![]()

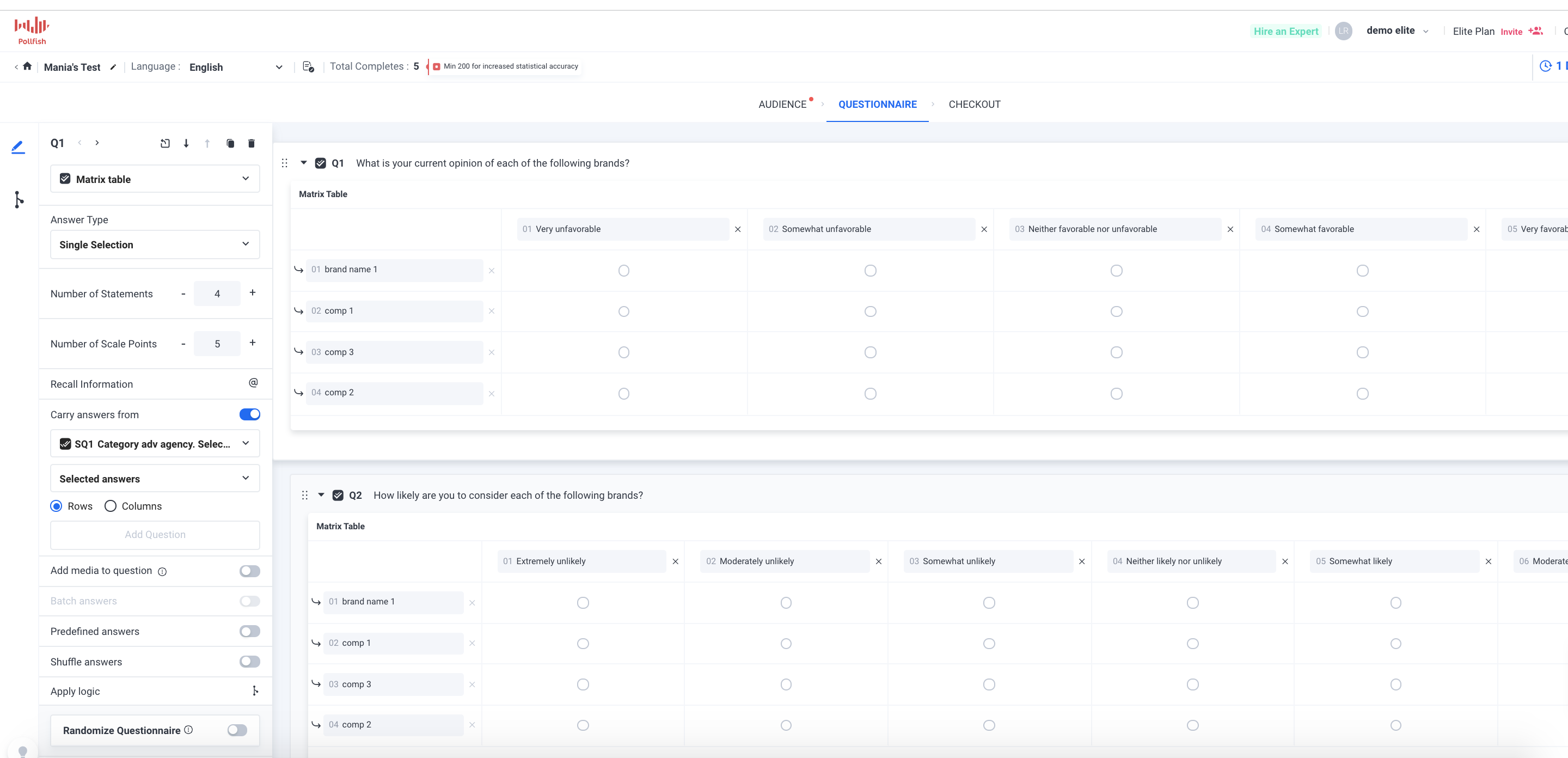

Running a brand tracker and other polling trackers is essential to keeping a constant oversight of the perceptions of your company. Understanding the views of your target market will help you both conceive and execute a variety of business campaigns.

Pollfish clients run trackers throughout the year to track everything from their brand awareness to consumer loyalty and a variety of other matters.

That’s because when it comes conducting market research, understanding your customers is one of the most important benefits, as it helps drive the success of a variety of business goals. Aside from understanding their needs and habits, it is just as crucial to understand how your customers view your brand in particular.

That’s where brand and other polling trackers are especially useful, as they allow you to discover how your target market views various aspects and news of your brand, along with unearthing whether they know about its existence in the first place.

This article provides firsthand information on how clients of the online market research platform Pollfish use brand trackers and other polling trackers to meet their business goals.

Brand Awareness and Usage of a Streaming Platform

One of Pollfish’s major clients is a global audio streaming and media services provider. This platform used Pollfish brand trackers to conduct global market research. The client's intent was to track brand awareness and usage of their platform in five countries.

Specifically, this client sought to uncover trends throughout different days, months and even years and then use those trends to compare with the ads that were being run in specific regions.

The streaming platform used the Pollfish brand trackers on a daily basis, seeking to uncover how well residents of the five countries were aware of the streaming platform and how often they used it.

The company has been running the tracker for half a year as the main instrument in assessing brand awareness and usage.

Brand Awareness and Physical Visitation of an Immersive Arts Production Company

An art production company that creates immersive, multimedia experiences for audiences of all ages, relied on the Pollfish brand tracker to trace both brand awareness and the visitation of its physical exhibitions in different states across the US.

The client has continuously used this tracker to see trends across months, using this information to compare to ad expenditure. As of today, they have run the tracker for one year.

The outcome of using this tracker involved leveraging data on brand awareness to understand how ad expenditure is working in certain locations.

Consumer Behavior and Purchasing Decisions of the Condiment Company Kalsec

Kalsec, a US-based food manufacturer that produces condiments, has been running global trackers on Pollfish since 2019. The company has used polling trackers to observe customer behavior, with a particular analysis on purchasing decisions, as they sought to understand their consumers’ decision-making on the purchase of spices and other flavorings.

Kalsec used our trackers to review year-over-year trends to understand their consumers and aid in their own decision-making processes.

![]()

Running the trackers in 14 countries, Kalsec investigated the awareness of its brand, along with consumer preferences of their products through a global lens. In doing so, the condiment company was able to compare how awareness and preferences panned out across various countries.

The insights that Kalsec derived allowed the business to make key decisions, specifically those that solidify its stance in the industry as experts and leaders on the topic of hot and spicy flavors.

In addition, the company chose to leverage the insights for content creation and lead generation. Furthermore, the brand tracker aided Kalsec in internal business decisions on product ideation and development.

Brand Loyalty of an E-commerce Marketing Brand

An ecommerce marketing platform sought to examine the brand loyalty of various brands using the platform. As such, it utilized the Pollfish brand tracker to do just that. Specifically, the platform conducted a consumer behavior study to unlock market trends and steer content initiatives.

Beginning in 2020, the ecommerce company has been analyzing trends relating to consumer spending, along with brand loyalty to specific brands that use the platform year-over-year.

Running trackers on a yearly basis, the company sought different opportunities to reach its consumers, while it simultaneously measured their loyalty to the platform.

The tracker also provided the ecommerce platform with insights on consumer behavior, in addition to measuring key metrics to align with internal efforts.

The Quorum Leverages The Pollfish Platform To Surface Key Audience Insights Into The Film Business

In late 2020, The Quorum, a film industry research firm, turned to Pollfish to create a survey tracker for the purpose of measuring awareness and interest in upcoming film releases. Key to this research has been measuring changes over time through longitudinal surveys.

The Quorum has been fielding these studies three times a week for the past 18 months. Results of the surveys are available for all to see on The Quorum's website.

![]()

Primarily created as a resource for movie fans, the resulting data has become a valuable resources for the studios and streamers as a way of measuring the health of a film's marketing campaign.

"We are in the field five days a week. In deciding on a data partner, we were looking for a platform that would allow us to maintain complete control over the writing, programming, and fielding of our studies in a frictionless environment. We were immediatley sold once we saw the robust and intuitive Pollfish interface. Eighteen months and hundreds of surveys later, we have no regrets about the decision to work with Pollfish.”

- David Herrin, Founder, The Quorum

This research has resulted in numerous insights into consumer behavior and attitudes about individual films and the theatrical business as a whole. This has proven to be especially valuable in understanding an industry that has seen immense disruption from the pandemic.

The Quorum’s specific objectives with their tracker usage centered on assessing movie awareness over time and determining how the industry has been changing. In addition, the company has been striving to eventually monetize its website by selling its data to studios.

This data is available to the general public, though a market has emerged in licensing the data to studios and streamers. This has become one unexpected monetization model for the tracker.

Brand Awareness and Health of a Condiment Company

Another condiment company has been using the Pollfish brand tracker to keep track of brand health and awareness. Starting in early 2020, the consumer packaged goods company has run a quarterly tracker to track condiment awareness and usage of the products in different cities.

This company has continued relying on the Pollfish tracker, as it allows them to track brand usage and awareness over time in specific, local markets.

Running quarterly, the goals of this tracker include being able to:

- Understand how the company’s brand image stacks up against its competition in its key markets

- Decipher whether its awareness and usage is increasing or decreasing

The tracker has allowed the condiment company to understand the trajectory of its brand perception within its target market and determine how it aligns with other marketing efforts.

Keeping Constant Track of Your Brand

Brand perception shifts with the seasons and the times. What remains constant is the need to satisfy your customers, maintain a healthy brand reputation and grow your brand equity.

As such, you need to keep track of your brand, whether it's for gauging your awareness, reputation, demand or other concerns.

To do so, you’ll need to opt for an online research platform that makes it easy to run polling trackers. This way, you will be able to collect all your necessary data from the right respondents in a short window of time.

As such, choose a survey platform that features artificial intelligence and machine learning to remove low-quality data and offer a broad range of survey and question types.

It should include advanced skip logic to route respondents to relevant follow-up questions based on their previous answers.

Most importantly, it should allow you to survey anyone. As such, you’ll need a platform with a reach to millions of individuals, along with one that offers the Distribution Link feature.

This feature will allow you to send your survey to specific respondents, rather than simply deploying surveys across a network.

With a market research platform that offers all of these capabilities, you’ll be able to survey your audience and run quality trackers whenever you wish.

Managing and Improving Brand Experience with Surveys

Managing and Improving Brand Experience with Surveys

At the heart of every brand lies its brand experience, which not only helps a business obtain its key differentiating factor(s), but is largely responsible for customers’ associations and feelings towards a brand.

This concept also plays a crucial role in brand visibility and brand equity, as it is the experience that shapes visibility and defines a brand’s value for its customers. Experience-driven businesses see a 1.5 times higher YoY growth than other companies.

In addition, brand experience dictates the way customers share their experiences with others. This is important, as customers make both their good and bad experiences publicly known, such as on social media, forums, review sites and via word-of-mouth.

72% of customers will share a positive experience with 6 or more people. Unsatisfied customers, on the other hand, will share their experience with 15 or more people. To satisfy customers, brands must create consistent brand experiences in an omnichannel setting.

This article explains brand experience, its importance, several examples, how it differs from user experience (UX) and how to manage it and improve it with surveys.

Understanding Brand Experience

This concept is defined by the sum of all thoughts, feelings, reactions and sensations that consumers undergo in response to a brand. Brand experience is not exclusive to a particular channel or media type.

Rather, this is the result or the lasting impression that remains with customers after they’ve either encountered or engaged with a brand in any capacity.

Brand experience is a holistic set of conditions that a company creates to influence how customers perceive a particular product or the brand itself. Given that this involves interacting with customers to influence their feelings, it is also considered a kind of experiential marketing.

Companies form their brand experience through a combination of interactions with customers, whether they are digital, physical (such as with products) or in-person (in-store shopping, events, etc). Through different modes of communication, brands can create a positive atmosphere, so that customers establish a tie between the brand and an emotion or need.

As such, brand experience involves creating sensory user experiences so that they can long resonate with customers. This tactic of engagement facilitates brands to convert their brand awareness into brand loyalty.

The Importance of Brand Experience

Brand experience carries plenty of importance for businesses of all sizes and there they're startups or long-established companies. Firstly, this concept deals heavily with creating positive experiences, the kinds that make all members of a target market remain interested in a company, impressed by how it made them feel.

Since brands are competing on experience, a good product or service alone is not enough to retain customers anymore. Thus, brands need to hone in on their brand experience to truly set themselves apart from competitors. This involves forming experiences that can reasonably be seen as superior to competitors’.

Given that a brand is often expressed as a network of associations living within customers’ minds, brands must foster strong brand experiences so that their consumers continuously view them in a positive light. These associations help businesses and market researchers assess customer perceptions, the relevance of their brand, preferences and whether their marketing campaigns are working.

The notion of brand experience also helps brands forge connections with customers, as experiences can humanize a company, show customers that it is more than just a money-making machine and encourage companies to spend more time with their customers. It therefore makes a brand far more present in the lives of its customers than it would have been had it not involved brand experience in its strategy.

A positive brand experience can inspire customers to make changes to their lifestyle and habits, the kinds that involve buying products from a particular brand. A brand experience can inspire customers to create their own content based on their use of a brand’s product or their experience with one. This creates testimonial-like assets for brands, which they can use in their marketing collateral and social media campaigns.

When businesses provide a positive brand experience, this can be the ultimate deciding factor for customers to choose one brand over another. In fact, brands with superior experiences yield 5.7 times more revenue than companies lagging in brand experience.

This should come as no surprise, given that a strong brand experience spurs repeat purchases, one of the underlying aspects of customer retention. When brands retain their customers, those customers in turn, increase their customer lifetime value by bringing more continuous value to a business.

As such, this concept largely affects customer buying behavior, having the power to steer it in one way or another.

Examples of Brand Experience

There are several factors that form brand experience in its entirety. That’s because various aspects of a customer buying journey influence the way customers view a brand.

The following presents common examples of brand experience aspects:

- Customer service can give customers a positive view of their brand experience and make them likely to purchase or return to a brand.

- A strong digital experience allows companies to create their brand’s online presence through their websites, social media, blogs and mobile apps.

- Promotions such as discounts, coupons and customer loyalty programs bring in new customers and create positive experiences.

- Advertisements that target specific customer personas or a broader audience are an extension of a brand’s personality and feelings associated with it.

- Branding aspects like logos, store layouts and signage designed to involve emotions, via emotional marketing like trust, excitement, or dependability.

- Slogans and jingles that are unique to a brand.

- Community participation, such as physical stores, expressing certain views, addressing regional holidays, etc.

- Content marketing campaigns such as blogs, newsletters, resources, infographics, mobile experiences to mold perceptions of a brand.

- Design aspects such as color schemes for ads, web content, and other marketing collateral to stir up desired feelings in customers.

- Product placement and influencer marketing that disseminates products through different media outlets such as social media, film, commercials, etc., to encourage customers to use their brand.

Brand Experience Vs User Experience

Although these terms may be used interchangeably, they are different concepts that therefore have many differences despite their similarities. While both of these concepts entail the sensory, cognitive and behavioral responses that customers face in response to an experience with a company, there are several distinctions between them.

User experience specifically deals with a customer’s takeaway from their interaction with a brand’s products, services, workers, digital experience or other offerings. For example, a good UX occurs when customers have a positive user experience in the following scenarios:

- Receiving fast and effective customer service

- An easy to navigate website

- A smooth checkout process

- A workable product

Brand experience, on the other hand, is all about communicating a vision and feelings to users, which includes catering to them even before they become a user. Therefore, it heavily relies on design and messaging to communicate specific things that make users feel a particular way about a brand.

User experience deals with the experiences that users have already undergone. It also involves the customer journeys that customers must go through to reach their ultimate destination with a brand.

Although these concepts are different and involve using different methods to uphold, you can’t have one without the other. A positive UX helps foster positive brand experiences. Consider this: when a customer has a positive user experience with a brand’s website or app, this experience influences the way they’ll view the brand behind it.

As such, a user experience should implement a consistent brand voice and other branding elements throughout. If it doesn’t, it will be difficult for customers to recognize the brand behind the experience.

Managing and Improving Brand Experience with Surveys

With the diverse makeup of brand experience, it can appear to be difficult to manage, let alone optimize. Surveys are critical tools to use for various market research purposes, along with marketing purposes such as brand experience.

Brands can manage their BX (brand experience) by first being pointedly aware of their customers, which includes a wide swath of considerations, such as: user experience, customer preferences, expectations, desires, aversions, needs, behaviors, opinions and more.

This is because surveys can be used to examine virtually any subject by strategically setting up the questionnaire with the 6 main types of survey questions, depending on the capabilities of the online survey platform they use. They can also incorporate different elements into the questions to maximize respondent engagement, such as videos, GIFs, images and more.

This is because surveys can be used to examine virtually any subject by strategically setting up the questionnaire with the 6 main types of survey questions, depending on the capabilities of the online survey platform they use. They can also incorporate different elements into the questions to maximize respondent engagement, such as videos, GIFs, images and more.

Surveys should therefore be used as a data-driven tool to plan and execute brand experience campaigns. However, they provide even more utility than simply understanding customers to improve BX campaigns.

This is because, when a brand explicitly mentions itself in a survey, this tactic creates a brand experience on its own, raising brand awareness and granting respondents a chance to interact with the brand in a unique way. As such, a brand can improve its brand experience with surveys as another avenue for doing so. To this end, brands can also use multiple question types, add multimedia to questions, personalize the questions, as marketing personalization is key to BX, incentivize the survey and more — all while associating the survey and its positive attributes with a brand.

Going Above and Beyond for Your Brand

Making headway in any branding activity requires being prepared and using a data-driven approach that justifies strategies and a plan of action. After all, no business wants to see their time, resources and efforts go to waste.

That’s why all brands need to conduct market research; survey research in particular, is crucial to implement, as it equips brands with the most relevant and granular insights on their niche and target market. This is because market researchers can set up their surveys in their manner of choice and ask any questions they seek. Best of all, they can acquire answers from the respondents that matter the most — their customers.

Equally important to using surveys if not more so, is choosing the correct online survey platform to create and deploy the surveys. Businesses should choose an online survey platform that allows them to hyper-target their survey respondents, set quotas and use advanced skip logic to route users to the proper follow-up questions.

Additionally, a strong online survey tool allows brands to create quality data checks via artificial intelligence and machine learning, use a wide range of filtering data options, engage respondents in their natural digital environments via random device engagement (RDE) sampling and much more.

A business that uses such survey software is well-adjusted and prepared to tackle a wide range of marketing and market research campaigns, including improving its brand experience.

Buy Survey Responses With a DIY Market Research Platform

Buy Survey Responses With a DIY Market Research Platform

Rather than relying on survey panels or syndicated research, you can buy survey responses and access highly sought insights yourself when you use a DIY market research platform.

Such a platform evades many issues present within the aforementioned research methods, such as panel fatigue, which is found in survey panels and exerting less control over a research project, which occurs in syndicated research.

Additionally, in keeping with the idea that any team member can perform quality market research — very much in tune with data democratization — you can buy a set amount of survey responses for your market research needs. You can do so without breaking your budget.

On the contrary, research firms and various market research platforms don’t offer the ease of performing and sharing market research as does a DIY market research platform. What’s more is that many research projects are expensive and time-consuming. As a matter of fact, brands spend $60,000 and more on market research, with an estimated 6 weeks or more to complete a market research project.

With a DIY research tool, you can buy responses, which is far more cost-effective and quicker.

This article explains what it means to buy survey responses and how to do so on the Pollfish online survey platform.

What it Means to Buy Survey Responses

Relatively speaking, buying survey responses is much like buying a survey sample, which is an exclusive pool of all the respondents that make up your survey. As such, it does not mean you’ll need to reach out to individual respondents or send your survey via an online portal yourself.

So what does buying survey respondents entail? In the context of a DIY market research platform, it means you buy the participation of your target audience based on a particular number of individuals.

Given that you and your team are at the helm of market research study, it is up to your team to decide the number of respondents you would like to partake in your survey. It is key to note that you are not buying for participation in an entire campaign. Rather, you pay for individual respondents’ participation in a specific survey.

By buying survey respondents, you’re allocating all the data you need for any survey; at times, one survey is all you’ll need for a market research campaign, unless you’re seeking out other market research techniques.

Thus, when you pay for individual survey respondents, you’re building the entirety of the subjects that make up a DIY survey.

As such, when you buy responses in a DIY market research platform, you’re hastening the speed to insights and reducing the span of the research project. This is one of the many benefits of buying your responses.

Benefits of Buying Survey Responses

When you buy survey responses on a DIY market research platform, you’re doing more than just opting in research participants. A strong DIY market research platform offers various benefits. These include the following:

- Reaching the exact number of respondents you need

- Obtaining respondents where they naturally exist online

- via RDE sampling or random device engagement

- Market segmentation and targetting

- Quicker insights

- Reaching your particular target market

- Dictating the demographics, psychographics and geolocation of respondents

- All the data you reap is proprietary to you (not the DIY survey platform)

- Being equipped with key data for decision making

- Insights for business decisions

- Steering the direction of a research campaign

How to Buy Survey Responses on Pollfish

Buying respondents is easy and hassle-free — with the right DIY research platform. You can buy individual survey responses on Pollfish.

All respondents are pre-screened and pre-qualified to take part in a survey study. This means, only the respondents you target can take your survey. They will need to tick off all your requirements, from location to demographics and more, depending on how you set up your screener.

To buy responses on Pollfish, you’ll first need to choose a pricing plan. On this page, you have the option of choosing a basic or elite plan. In the basic plan, you can buy survey responses at an individual basis.

Each completed survey, aka, individual survey respondents starts at $0.95. Prices range from $0.95 to $1.25 based on the number of questions in your survey.

Once you choose a pricing plan best suited for you, you can then begin your market research endeavors. The Pollfish dashboard is easy to access and allows you to make your own survey in just 3 steps.

Then, commence targeting your respondents by setting up various qualifications in the screener section of your survey. In Pollfish, this interface is referred to as the Audience section. Here you can also set the exact number of survey completes in your survey. Each complete is done by an individual survey respondent. As such, a survey with 800 survey completes = 800 survey respondents.

You can also create custom quotas to narrow down specific people and see how different groups answer questions. For example, you can create quotas such as: 300 middle-aged men with a salary between $100,000-$250,000.

Constant Access to Any Target Population

All business and non-business entities can conduct their own research via a potent DIY market research platform. Even individuals who seek data on a specific target population can do so at speed when they buy survey respondents.

You should opt for an online research platform that makes buying survey respondents a quick and simple process. This way, you’ll collect all your necessary data from the right respondents in a short space of time.

Opt for a platform that features artificial intelligence and machine learning to remove low-quality data and offer a broad range of survey and question types.

It should include advanced skip logic to route respondents to relevant follow-up questions based on their previous answers.

Most importantly, it should allow you to survey anyone. As such, you’ll need a platform with a reach to millions of individuals, along with one that offers the Distribution Link feature.

This feature will allow you to send your survey to specific customers, instead of just deploying them across a network.

With all of these capabilities, you’ll be able to reach any target audience and run quality research campaigns.

Attracting a Survey Audience the Right Way with Market Research Software

Attracting a Survey Audience the Right Way with Market Research Software

When it comes to attracting a survey audience, you’ll need more than just a well-built questionnaire and an idea of your study’s primary targets. You’ll need to incorporate the proper methods and tools to attract your target market — or your target audience, if you’re not a business.

After all, your target market makes up the core of any market research survey campaign and most notably, the heart of virtually any business matter. You should never lose sight of who comprises your customer base and what their preferences are.

When you attract the proper survey audience to your survey, you’ll glean crucial insights that can help you optimize your entire customer experience. This is a must, as improving customer experience creates up to an 80% increase in revenue for businesses.

Moreover, understanding your target market provides key data for decision-making, the kind that informs a wide breadth of campaigns, from content marketing, to advertising, sales and more.

This article explains how to obtain the proper survey audience and how to do so on the Pollfish online survey platform.

How to Begin: What to Do Before Reaching Out to Your Survey Audience

Before you reach out to your target audience, you’ll need to take a few considerations into account and act on them. You wouldn’t want to end up surveying the wrong people. This will cost you money, create wasted efforts and fail to reach those who are interested in your offerings.

Many companies fail on this front, as 80% of marketing initiatives are aimed at the wrong target audience.

While gaining insights on different segments of a population is important for different research pacticies, when it comes to market research, you should stick to following your specific target market and its different segments and customer personas.

What to Do Before You Attracting Your Survey Audience to Your Survey

As aforementioned in the previous section, here’s what you ought to do before targeting your survey audience:

- Determine the primary needs of your market research campaign.

- Determine the main findings you seek to take away from it.

- For example: do you need insights into customer behavior?

- Or, are you looking to conduct market research for advertising?

- After identifying its primary concerns, create a title and theme of your market research campaign.

- Determine the efforts you’ll need to carry out your campaign.

- This includes choosing various methods to accompany your survey, such as conducting secondary research.

- Then, identify a preliminary amount of survey research you’ll dedicate towards your campaign.

- This includes determining how many surveys you’ll need to conduct, their primary subject matters, their questions and a timeframe.

- Choose a strong online survey platform to host your market research campaign.

- The is a wide range of criteria when it comes to decking on the best survey platform.

- Determine the primary needs of your market research campaign.

How to Choose the Best Survey Platform to Reach Your Target Audience

Piggybacking off of the last point in the previous section, you’ll need to find a potent market research platform before reaching out to your survey audience. That’s because this platform will be the centralized space for all your survey campaigns, which includes attracting the correct audience.

It plays a major role in dealing with your survey subjects throughout the entirety of your research campaign. That’s because you’ll need it prior to reaching out to your survey audience and while you target them, as their responses get filtered out via a cycle of quality checks.

The following explains what to consider when choosing the best survey platform for attracting your desired survey audience:

- A platform that deploys surveys across a wide network of publishers

- Ideally, these are highly trafficked websites, apps and mobile sites

- One that procures respondents where they naturally exist online

- This can be done via RDE sampling or random device engagement.

- One that allows surveys to be formed in a wide variety of languages

- Ideally, one that offers a feature for survey translations

- A platform that quickly gathers all responses

- A strong platform will have turnover rates of no more than 2-3 days maximum.

- Easy to use and create

- One that allows you to make your own survey in 3 easy steps.

- An interface that allows you to screen respondents based on their demographics, psychographics and geolocation.

- All the data you collect is proprietary to you, as opposed to the provider of the market research platform.

- Software that doesn’t charge extra to conduct global market research.

- One that partners with publishers that offer survey incentives.

- A platform that offers a multitude of question types, media files and survey templates to build a custom and engaging questionnaire

- One that offers the option of sending surveys to specific people or via a link you can place anywhere.

- This can be done via the Distribution Link feature.

- A platform that offers 24/7 support, so that you can conduct market research from anywhere, at any time.

How to Reach Your Survey Audience on Pollfish

To reach your survey audience on Pollfish, you’ll first need to decide how you’re going to distribute your surveys. You can opt for the RDE method, in which your surveys will be automatically distributed through our vast network of publishers.

Or, you can use the aforementioned Distribution Link feature, which allows you to send a link to specific individuals who you’ve identified or have the email of. This route also allows you to send surveys to a more narrow scope of respondents.

Usually, these are people who are familiar with your brand, as they will have clicked on your survey through a link via your brand’s web page or social media account. Or, they may have been directly emailed the link, in which case, they’ve provided their email address to your brand.

After you’ve chosen your distribution method, you can then hyper-target your survey audience.

The following provides instructions on how to reach your target audience on Pollfish:

- Create a new project on the survey dashboard by hitting its designated button.

- There, you‘ll be asked: How would you like to collect responses to your survey?

- Choose between the two distribution options of buying responses or send your survey your way.

- Buy responses: This allows you to use the Pollfish global survey network to reach your audience, in which you pay $0.95 per complete response.

- Send your survey your way: This allows you to send your surveys via the Dsitvition Link feature. As such, you can choose whether to send the link via email, social media or a web page.

- If you opt for the latter, offer survey incentives to attract your audience to your study.

- Then, you’ll be taken to the Audience section of the platform.

- Here, you can target your audience as you see fit.

- You have the option of using Multiple Audiences in your survey, or just one.

- Find it on the lefthand panel, which is automatically titled Audience 1.

- You can add another audience by clicking on the + symbol at the bottom of this panel.

- In the lefthand audience panel, you can choose the number of respondents who will partake in the survey/ will be targeted.

- Do so near the pencil icon beside ‘Survey completes.”

- Then, you can select the gender of the audience, along with quotas that dictate how many of each.

- After that, you have the option of adding up to three screening questions and choosing the answers that will disqualify people from your survey.

- This allows you to target respondents via a psychographic and behavioral-based approach.

- Next, add and filter all your demographic, geolocation and device requirements.

- Here, you can be very granular, as each type of criterion allows you to include various subcategories and quotas.

- For example, under the employment category, you can add quotas to a variety of employment types, such as employed for wages, out of work and looking for work, military, retired, etc.

- Review all of your survey respondent requirements.

- Make sure you are targeting the correct audience, ie, your target market.

- In the questionnaire section of the survey, add 1-5 questions.

- Keep your question count short and your questions relevant and interesting to your audience.

- Add different media elements to keep your audience engaged throughout their survey experience.

Constant Access to Any Target Population

With the right online survey platform, you will have instant access to any target population, no matter who it comprises and how far it spans geographically.

To reach the correct survey audience, you’ll need a platform that deploys surveys within a mass network of publishers, ones that account for major websites, apps and mobile sites, along with one that also grants you the ability to send surveys your own way.

A strong market research platform will also attract your survey audience with an appealing digital element that leads to your survey and easily grabs users’ attention. In addition, it will partner with publishers who gamify surveys, allowing respondents to gain incentives while playing a game, making the experience far from boring.

You should also opt for an online research platform that makes buying survey respondents a quick and simple process. This way, you’ll collect all your necessary data from the right respondents in a short space of time.

Additionally, use a platform that features artificial intelligence and machine learning to remove low-quality data and offer a broad range of survey and question types.

It should also include advanced skip logic to route respondents to relevant follow-up questions based on their previous answers.

When you use an online survey platform with all of these capabilities, you’ll be able to reach any survey audience and run quality research campaigns at any time.

What is Conjoint Analysis and Why It’s Crucial for Market Research

What is Conjoint Analysis and Why It’s Crucial for Market Research

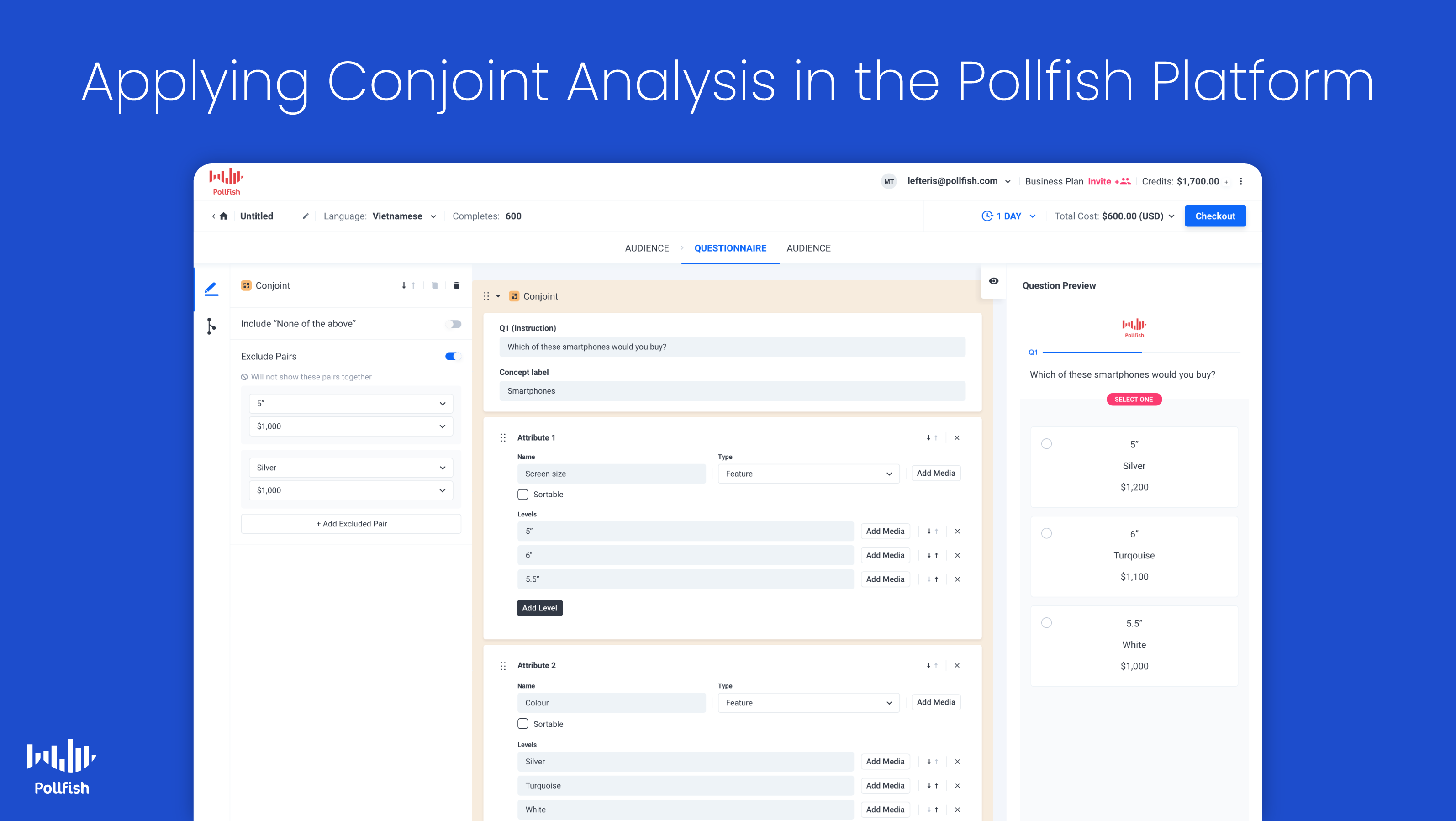

Let’s dive into the market research method called "conjoint analysis," as the Pollfish platform continues expanding its features and capabilities. This is excellent news for researchers, given that they can now apply the conjoint analysis research approach in different survey research endeavors.

One of many market research techniques, this new feature allows researchers to measure the value that consumers place on various aspects of a product or service. By studying how your customers perceive the makeup of your offerings, you’ll understand the distinct advantages and shortcomings within their features.

In addition, by applying this research method, you can uncover your consumer preferences to better innovate, design and price your product or service. That’s because conjoint analysis allows you to understand how consumers make complex choices in real-world scenarios.

This article explains what is conjoint analysis, how it can be applied, its benefits and how to use the conjoint analysis feature in the Pollfish platform. While this research method comes in different varieties, this piece focuses on choice-based conjoint analysis.

What is Conjoint Analysis

Conjoint analysis is a kind of quantitative market research for measuring the value that consumers place on the features of a product or service. A survey-based research method, this commonly used approach merges real-life situations and statistical techniques to understand market decisions.

A kind of statistical analysis, this method helps businesses understand how customers evaluate both components and features of their products and services. This method is based on the principle that any commodity can be broken down into a set of attributes, each of which impacts how users perceive the value of an offering.

Conjoint analysis is especially useful for product and pricing research, as it unearths a wealth of consumer preferences and leverages that information to optimize the products and services in question.

It does so by allowing researchers to make important business decisions concerning their products and services, such as the following:

- Select product features

- Assess consumers’ sensitivity to price

- Forecast market shares

- Understand the demand for certain features or components

- Predict the adoption of new products or services

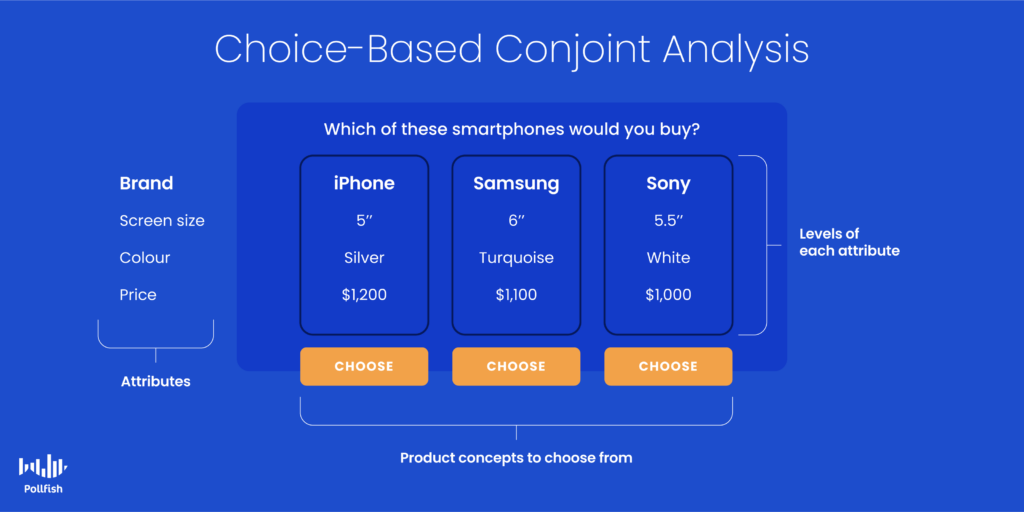

The conjoint analysis method breaks a product or service down by its various components; these are called attributes and levels. Researchers can test different combinations of the components to identify consumer preferences.

The objective of conjoint analysis is to conclude what combination of a limited number of attributes is most influential on respondents’ choice or decision making. A controlled set of products or services is shown to respondents.

Then, researchers analyze how the respondents make choices from these products, which allows them to determine the implicit valuation of the individual components making up the product or service.

These implicit valuations (utilities or part-worths) can be used to create market models for estimating market share, revenue and even profitability of new product designs.

Choice-Based Conjoint Analysis

Currently, Pollfish is offering choice-based conjoint analysis in our online survey platform. You can add this popular form of research to an Elite account.

Other types of conjoint analysis involve asking respondents to rate or rank items. Asking responders to choose a product to buy provides insights specifically on whether they would buy it or not.

As such, choice-based conjoint analysis may be more useful for campaigns that seek to uncover consumer buying preferences, in regard to specific products. The insight you gain can also be used to predict whether consumers will buy from a competitor.

This is how choice-based conjoint analysis works:

Survey respondents are shown a series of options and asked to select the one they are most likely to purchase or use.

A respondent will see alternatives included in choice sets that are repeated.

The Importance of Conjoint Analysis

This kind of analysis is important for a variety of reasons.

First off, its main purpose enables researchers to understand which product or service features their customers prefer over others. As such, you’ll understand the main contributors behind consumer purchasing decisions, as well as the most off-putting attributes that prevent them from buying.

With this information in tow, you can make more informed decisions about pricing, product development, sales and marketing activities. You will be able to optimize your product, its promotional activities, accentuating the proper features and more. You’ll also be made aware of the attributes that repel consumers, which is essential for optimization.

By optimizing your product, its pricing and the marketing activities surrounding it, you’ll increase revenue, foster repeat purchases and strengthen consumer loyalty. All of these outcomes are highly sought-after and necessary for the success of your business.

Conjoint analysis offers the convenience of being able to break down utility to consumers at individual levels, as well as to aggregate all of their responses.

This analysis can also be employed as an exclusive focus on product features and attributes regardless of price or brand name. This allows you to enable the calculation of utility on an individual basis and in regard to specific features that you intend to evaluate.

It can also be used to measure the value of brands in comparison to competing brands, thereby measuring the brand equity of each brand. The information you reap shows you how strong a particular brand is in comparison to a specific product or price.

Consequently, it helps businesses make decisions based on their own brand value in their market. This is important, as having a popular brand is not always enough, as price fluctuations and new features could impact demand.

This research technique also offers straightforward experimentation with varying factors, such as price, capabilities, color and other attributes. As such, it allows you to create a product profile, which you can change to form additional profiles for varying attributes. This is key to do before launching a new product.

Conjoint analysis is also important, as it can be used across different industries for virtually all types of products and services, such as consumer goods, electrical items, insurance plans, housing, luxury goods, and travel.

As a result, you can apply it to different instances if you seek to discover what type of product consumers are most likely to buy, along with what they appreciate the most — and least, about a product. Aside from marketing and advertising campaigns, this is also useful for product management.

Businesses of all sizes can benefit from conducting conjoint analysis, including local establishments, such as grocery stores and restaurants. More importantly, the scope of this kind of analysis is not limited to profit motives only. This means charities and educational institutions can also benefit from conjoint analysis, such as for using it to determine donor preferences.

All in all, conjoint analysis is essential for examining how consumers and other respondents rate and perceive the attributes of a product, service or experience.

Optimizing Product Campaigns and Beyond

Performing a conjoint analysis is critical for optimizing your product and concept campaigns. All brands should conduct it at multiple stages of your product’s life cycle. Conjoint analyses can break down a large number of attributes into smaller bundles for evaluations and comparisons.

As such, you should opt for a strong online survey platform to easily create and deploy conjoint analysis to your target population.

You should use a mobile-first platform since mobile dominates the digital space and no one wants to take surveys in a mobile environment that’s not adept for mobile devices.

Your online survey platform should also offer artificial intelligence and machine learning to remove low-quality data, disqualify low-quality data and offer a broad range of survey and question types.

The survey platform should offer advanced skip logic to route respondents to relevant follow-up questions based on their previous answers.

It should also allow you to survey any employee. As such, you’ll need a platform with a reach to millions of users, along with one that offers the Distribution Link feature. This feature will allow you to send your survey to specific respondents, instead of only deploying them across a vast network.

With an online survey platform with all of these capabilities, you’ll be able to set up an insightful conjoint analysis and understand your consumer, or other key actors’ preferences.

How to Make Your Own Survey in 3 Easy Steps

How to Make Your Own Survey in 3 Easy Steps

As a business, you’ve probably mulled over how to make your own survey for market research purposes. The power of survey research is that it allows you to extract data for a wide array of campaigns, such as marketing, advertising, branding et al., on virtually any focal subject of interest.

Surveys are unique in that they collect data from a pre-defined group of people. Online surveys take this method to the next level, as they only permit qualified respondents to enter the questionnaire portion of a survey.

As such, online survey tools allow you to define the participants allowed to take part in your survey; you can do so by selecting your desired demographics and screening questions.

There’s more to making your survey — but not much, that is, depending on the online survey tool you use.

This article will teach you how to build a survey in just 3 steps, a process that correlates with the Pollfish survey platform.

The Benefits of Using Survey Software

Aside from the above, there is an abundance of benefits to using survey software, which is why it is encouraged to make your survey.

If you are skeptical about employing survey software that allows you to build and launch your survey in just three steps, consider the following. It enumerates the various benefits of using a survey platform; the fact that you can make your survey in just 3 steps is an added benefit.

- Cost-Effective: Although the total cost depends on several factors, such as deployment methods, survey types and the stipulations of your online survey platform provider, online surveys are generally cheap. At Pollfish, they start at only $0.95 per complete.

- Versatile: Software survey often offers versatility in functionality, interface, visuals and more. As such, they allow you to create multiple types of surveys such as multiple-choice, ratings surveys and surveys that focus on different disciplines like customer satisfaction or community feedback. They also allow you to add unique features such as advanced skip logic.

- Respondent Control: A potent survey software grants surveys with the ability to identify each respondent by their IP address, so that no person can take part in the same survey twice to skew results. Therefore, if for example, you set your sampling pool to include 1,000 respondents, you can rest assured that there will be 1,000 unique individuals taking the survey, as no responder will take the survey more than once.

- Quick and Accurate: Online survey tools collect data quickly and accurately. They can gather thousands of survey submissions in a short period, one that is often no longer than a few days long. The entire sampling is accurate to the study you conduct, as screening questions and demographic quotas ensure only the targeted respondents participate in the survey.

- Ease of Analysis: Survey software facilitates the process of analyzing, by allowing you to observe the data in various formats. For example, a strong tool gives you the option of viewing your responses in spreadsheets, graphs, charts and cross-tabulation. This allows you to examine your survey results in a way that suits your preferences best, as some campaigns require specific data formats.

- Easily administered and completed: Online survey tools offer the convenience of administration ease and completion. That is because these tools deploy the surveys for you, meaning that you don’t have to worry about reaching your intended target audience and amount of respondents. The Pollfish platform distributes your survey to a sweeping network of over 140,000 of the most popular websites and apps. It doesn’t finish the process until all respondent quotas are filled.

- Flexible and amendable: Online survey platforms ought to make it easy to control all survey content; that involves adding different media files to questions, skipping questions (skip logic), using a blend of open and close-ended questions and much more. In short, survey software makes survey-building easy to tailor and change.

Make Your Own Survey With a 3-Step Process

Now that we’ve covered the bases of online survey advantages, it’s time to put survey building into action. The following elucidates the three steps, or stages, to make your survey using an online survey platform.

These steps parallel the steps required to take on the Pollfish platform dashboard; they make it easy to jumpstart your survey research campaigns.

Beginning a New Survey Project

When you begin a new survey project, you now have three options. You must select the type most appropriate for your needs. To do so, on your survey dashboard, hover over to "Create project," the big blue button on the upper right side of the screen. Click on it to reveal the two-option dropdown menu. These two options form the basis of your survey campaign type. The two options for creating a new survey project are:

- From Scratch: entails building your survey entirely on your own for custom needs.

- From templates: gives you various templates for building your questionnaire, which you can edit (from moving around the questions, editing the question content, adding new ones, adding media files, etc).

After choosing how you will use the Pollfish platform for your survey project, you will be prompted with the following message:

How would you like to collect responses to your survey?

Here you can choose between buying your responses and sending your survey your way. The latter refers to sending your survey across our vast network of publishers, which includes a bevy of websites, apps and mobile sites. This is part of our random device engagement, a kind of organic sampling in which surveys are distributed randomly to users of different digital spaces. This method allows respondents to take the surveys while they are in their organic environments — cutting back on survey bias.

The latter refers to the Distribution Link feature, in which you can send surveys to specific respondents, rather than through a massive network. Out of the many survey sampling methods, this is a non-probability sampling method. This means it is not random and designed to target people you either know, such as in the case of B2B surveys, or, consumers and other web users who have given you their contact information.

This feature also offers convenience sampling, in that it generates a link you can use at various digital properties to send people to your surveys. Willing respondents can then partake in your survey after coming upon your link on social media, landing pages, site pages, your homepage, etc.